AI Insights

Artificial intelligence or artificially irritating? | News, Sports, Jobs

There’s plenty to be worried about with modern technology. Social media harassment, deep fakes and artificial intelligence robots who may become smarter than humans are just a few. But there are some positives as well. Readily keeping in touch with friends and relatives is at the top of my list.

Around 1995, I came across my fourth grade class photo. Since I moved from Locust Valley, Long Island to the Finger Lakes midway through sixth grade, I had been in touch with only a couple of my classmates. On a lark, I scanned the photo and emailed it to the only person from Long Island I had talked to in the past 40 years, fellow Cortland alum Doug DeRancy. So, I was surprised when Doug emailed me back and said, “Thanks, that’s great. We have a listserv for Locust Valley High School class members of ’67. I’ll send it out.”

Over the next month I heard from a dozen or so elementary school classmates. I have to admit, I couldn’t remember some of them. But that’s okay though, because some of them didn’t remember me.

Fast forward to this July. Phyliss and I decided to go to Casa Del Sol for dinner. Once a year we take the pontoon boat from Ampersand Bay, down the river, through the locks to Lake Flower for dinner. The return trip in the dark is always a good test of our boating skills.

As is frequently the case, Casa was crowded, but we soon got seats on the verandah. There was a family to our right and a couple about my age to the left. I always look around at Casa to say hi to any local friends who might be dining, but I didn’t see any that night.

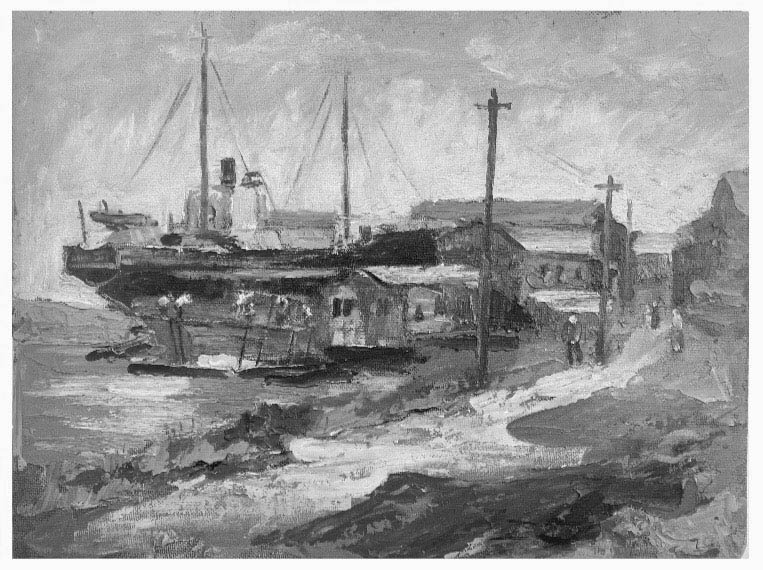

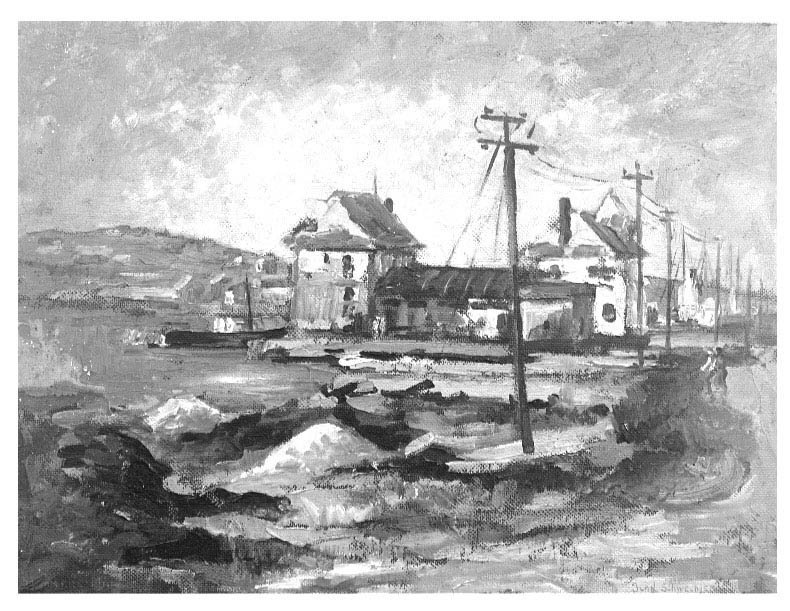

Hester’s grandfather’s artwork

(Provided photo — Jack Drury)

It was a beautiful warm Adirondack evening, and we followed a ritual going back to the 1970s. My mother, who traveled around the globe 40 weekends a year to judge at dog shows, made dinner at Casa her first stop when she got home. I always thought there should be a tiny brass plate in her memory at one of the tables: Kitty Drury dined here 1978-1988. We had some deluxe nachitos in her memory, as well as a couple of margaritas. All too soon, we were done with dinner, paid our bill and were ready to head over to Mountain Mist for ice cream before heading upstream home.

Occasionally, someone I don’t know will recognize me because of this column and compliment me. I’ll admit, I never get tired of it. Fortunately, no one has let me know how much they detest it … yet. When the woman sitting next to us approached, I thought she might be one of my readers. I was taken aback when the woman said, “You’re Jack Drury, I went to elementary school with you in Locust Valley.” I had to immediately stop and think. No, it wasn’t Linda Leydon who in Kindergarten, I kissed in the back of the school bus, nor was it my 6th grade crush Crystal Waters. Somewhere deep in my gray matter came a name. I responded as if I had just seen her yesterday, “You’re Hester Simpson, your mother was Madame Simpson, the French teacher.”

Hester knew I lived in Saranac Lake from the 1995 email. While sitting near us, she said to her husband that she thought the guy at the table next to them might be Jack Drury, her elementary school classmate. She googled my name and in the vast wasteland of the internet found a current photo which confirmed it.

We made plans to get together the next day, and Phyliss and I got to share one of our favorite activities with them: a boat tour of Lower Saranac Lake. Sharing a bit of the cultural and natural history of the lake never gets old. I learned she was a very well-respected visual artist who lives in Manhattan, but we found that we had something else in common other than a Locust Valley childhood — visits to Saint Pierre and Miquelon.

What are Saint Pierre and Miquelon you ask? It’s an archipelago of eight islands located 12 miles off the south coast of Newfoundland with a population of less than 6,000. My family made the journey in 1959 on a memorable vacation across Newfoundland. I have distinct memory of taking a small boat loaded with more sheep than people for the hour-and-a-half journey to the islands. Other memories include a distinct odor while visiting a mink farm and practicing my elementary school French — thanks to Hester’s mother — where they speak European French, not to be mistaken for Canadian French. It was quite an adventure for a 10-year old.

Hester’s grandfather’s artwork

(Provided photo — Jack Drury)

Hester’s reason for visiting Saint Pierre and Miquelon was even more interesting. Saint Pierre and Miquelon is a self-governing territorial collectivity of France with its residents are French citizens. It has a long history of issuing postage stamps, all of them the work of artists. SP-M stamps are in demand around the world to well-informed philatelists. Hester’s grandfather, like Hester, was a well-known artist and had painted several landscapes of the islands. Hester inquired to the local museum to see if they might like them. They did, and Hester and her husband got to hand deliver them. No easy task, considering that there are only two flights a week to the islands or the ferry, with or without the sheep. Not only are the paintings on display in the museum, but they are being considered for commemorative stamps.

We all have items that bring special meaning to our lives because they provide special memories. Of her grandfather, Hester has his paintings that she took to the islands. I, in contrast, have a memento of my trip to Saint Pierre and Miquelon in 1959. It is a miniature toy killick and it has been sitting on my desk for many years. What’s a killick? It is a traditional, homemade anchor consisting of a large stone secured within a wooden frame. While perhaps not as significant as a painting, every time I look at it, it provides a special memory of our family adventure in 1959.

Sure, today’s technology can drive you crazy, and there are some days that I wonder if it portends the end of civilization as we know it. On the other hand, when it provides opportunities as it has for Hester and me, it provides some wonderful memories. And after all, when it’s all said and done, is there anything else?

My souvenir killick

(Provided photo — Jack Drury)

AI Insights

Commanders vs. Packers props, SportsLine Machine Learning Model AI picks, bets: Jordan Love Over 223.5 yards

The NFL Week 2 schedule gets underway with a Thursday Night Football matchup between NFC playoff teams from a year ago. The Washington Commanders battle the Green Bay Packers beginning at 8:15 p.m. ET from Lambeau Field. Second-year quarterback Jayden Daniels led the Commanders to a 21-6 opening-day win over the New York Giants, completing 19 of 30 passes for 233 yards and one touchdown. Jordan Love, meanwhile, helped propel the Packers to a dominating 27-13 win over the Detroit Lions in Week 1. He completed 16 of 22 passes for 188 yards and two touchdowns.

NFL prop bettors will likely target the two young quarterbacks with NFL prop picks, in addition to proven playmakers like Deebo Samuel, Romeo Doubs and Zach Ertz. Green Bay’s Jayden Reed has been dealing with a foot injury, but still managed to haul in a touchdown pass in the opener, while Austin Ekeler (shoulder) does not carry an injury designation for TNF. The Packers enter as a 3-point favorite with Green Bay at -172 on the money line, while the over/under is 49 points. Before betting any Commanders vs. Packers props for Thursday Night Football, you need to see the Commanders vs. Packers prop predictions powered by SportsLine’s Machine Learning Model AI.

Built using cutting-edge artificial intelligence and machine learning techniques by SportsLine’s Data Science team, AI Predictions and AI Ratings are generated for each player prop.

For Packers vs. Commanders NFL betting on Monday Night Football, the Machine Learning Model has evaluated the NFL player prop odds and provided Commanders vs. Packers prop picks. You can only see the Machine Learning Model player prop predictions for Washington vs. Green Bay here.

Top NFL player prop bets for Commanders vs. Packers

After analyzing the Commanders vs. Packers props and examining the dozens of NFL player prop markets, the SportsLine’s Machine Learning Model says Packers quarterback Love goes Over 223.5 passing yards (-112 at FanDuel). Love passed for 224 or more yards in eight games a year ago, despite an injury-filled season. In 15 regular-season games in 2024, he completed 63.1% of his passes for 3,389 yards and 25 touchdowns with 11 interceptions. Additionally, Washington allowed an average of 240.3 passing yards per game on the road last season.

In a 30-13 win over the Seattle Seahawks on Dec. 15, he completed 20 of 27 passes for 229 yards and two touchdowns. Love completed 21 of 28 passes for 274 yards and two scores in a 30-17 victory over the Miami Dolphins on Nov. 28. The model projects Love to pass for 259.5 yards, giving this prop bet a 4.5 rating out of 5. See more NFL props here, and new users can also target the FanDuel promo code, which offers new users $300 in bonus bets if their first $5 bet wins:

How to make NFL player prop bets for Washington vs. Green Bay

In addition, the SportsLine Machine Learning Model says another star sails past his total and has nine additional NFL props that are rated four stars or better. You need to see the Machine Learning Model analysis before making any Commanders vs. Packers prop bets for Thursday Night Football.

Which Commanders vs. Packers prop bets should you target for Thursday Night Football? Visit SportsLine now to see the top Commanders vs. Packers props, all from the SportsLine Machine Learning Model.

AI Insights

Adobe Says Its AI Sales Are Coming in Strong. But Will It Lift the Stock?

Adobe (ADBE) just reported record quarterly revenue driven by artificial intelligence gains. Will it revive confidence in the stock?

The creative software giant late Thursday posted adjusted earnings per share of $5.31 on revenue that jumped 11% year-over-year to a record $5.99 billion in the fiscal third quarter, above analysts’ estimates compiled by Visible Alpha, as AI revenues topped company targets.

CEO Shantanu Narayen said that with the third-quarter’s revenue driven by AI, Adobe has already surpassed its “AI-first” revenue goals for the year, leading the company to boost its outlook. The company said it now anticipates full-year adjusted earnings of $20.80 to $20.85 per share and revenue of $23.65 billion to $23.7 billion, up from adjusted earnings of $20.50 to $20.70 on revenue of $23.50 billion to $23.6 billion previously.

Shares of Adobe were recently rising in late trading. But they’ve had a tough year so far, with the stock down more than 20% for 2025 through Thursday’s close amid worries about the company’s AI progress and growing competition.

Wall Street is optimistic. The shares finished Thursday a bit below $351, and the mean price target as tracked by Visible Alpha, above $461, represents a more than 30% premium. Most of the analysts tracking the stock have “buy” ratings.

But even that target represents a degree of caution in the context of recent highs. The shares were above $600 in February 2024.

AI Insights

First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT): How to Invest

The First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT 1.91%) offers a sophisticated way to track AI companies, with an emphasis on fundamental analysis.

It does so through an advanced index methodology designed to target companies that meet specific artificial intelligence and robotics criteria, rather than simply buying the largest names in the space.

However, with this added complexity comes higher costs. ROBT may not be the most beginner-friendly ETF. Here’s what you need to know to decide if the First Trust Nasdaq Artificial Intelligence and Robotics ETF is worth choosing over its AI-focused competitors.

Image source: Getty Images.

Overview

What is First Trust Nasdaq Artificial Intelligence and Robotics ETF?

The First Trust Nasdaq Artificial Intelligence and Robotics ETF is a thematic ETF that tracks the Nasdaq CTA Artificial Intelligence and Robotics index. It is not a mutual fund.

This benchmark takes a more nuanced approach than most AI ETFs by grouping companies into three categories:

- Enablers, which develop the hardware, software, and infrastructure that form the building blocks of artificial intelligence.

- Engagers, who design, integrate, or deliver AI-driven products and services.

- Enhancers, which offer value-added AI capabilities as part of a broader business model, however, AI and robotics are not their primary focus.

Companies are scored across the three categories based on their level of AI involvement, with the top 30 in each category selected. However, the index is not equally split between these groups.

Engagers receive the highest weighting at 60% of the portfolio because they have the most direct AI exposure. Enablers make up 25%, while Enhancers account for15% to provide balance and diversification. Within each group, holdings are equally weighted.

The portfolio is rebalanced quarterly to reset weights and capture relative performance changes, while a semiannual reconstitution ensures the index remains current with evolving AI and robotics developments.

How to invest

How to invest

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF’s trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you’re willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings

Holdings

First Trust Nasdaq Artificial Intelligence and Robotics ETF has a heavy U.S. weighting at 64%, followed by Japan at 9.2%, then the U.K., Israel, South Korea, France, and Taiwan.

The fund holds 100 companies, with 50% classified as technology sector, 22% as industrials, and 9% as healthcare. The remaining holdings are primarily spread across the consumer discretionary and communications sectors, with small allocations to financials, consumer staples, and energy.

The First Trust Nasdaq Artificial Intelligence and Robotics ETF’s largest holdings as of late August 2025 are:

- Symbotic (SYM 0.29%): 2.92%

- Upstart Holdings (UPST -0.34%): 2.28%

- AeroVironment (AVAV -1.81%): 2.25%

- Ocado Group (OCDO -1.99%): 2.22%

- Palantir Technologies (PLTR -1.39%): 2.14%

- Synopsys (SNPS 13.35%): 2.07%

- Recursion Pharmaceuticals (RXRX 6.72%): 2.00%

- Cadence Design Systems (CDNS 4.95%): 1.91%

- Gentex (GNTX 1.36%): 1.91%

- Ambarella (AMBA -0.28%): 1.85%

The portfolio has a large-cap tilt, with an average market cap of $28 billion. Valuations are elevated, with shares trading around 29x price-to-earnings, 2.75x price to sales, and 17x price to cash flow.

Should I invest?

Should I invest?

Only consider First Trust Nasdaq Artificial Intelligence and Robotics ETF if you specifically believe in its index methodology and the “engagers, enablers, enhancers” classification system, along with the resulting weighting across these groups.

There is no single “right” way to invest in AI. This is simply how ROBT’s benchmark index approaches selection and weighting compared to competing ETFs. It may under or outperform similar funds at various times.

If you appreciate a more complex, rules-based approach, you may find the fund appealing. But if you’re seeking simplicity, this ETF probably isn’t a fit.

Note that the ETF has historically lagged the broader market and has shown greater volatility than diversified index ETFs, like S&P 500 funds. Its relatively narrow portfolio means individual stock positions can have an outsized impact on performance, for better or worse.

Moreover, investing in AI and robotics carries idiosyncratic risk. These companies are often priced for growth, with high valuations that may be vulnerable to pullbacks if earnings don’t keep pace. The sector also tends to lack exposure to defensive, non-cyclical industries, which can leave long-term investors more exposed during market downturns.

Dividends

Does the ETF pay a dividend?

The First Trust Nasdaq Artificial Intelligence and Robotics ETF has a 30-day SEC yield of 0.27% as of August 2025. The ETF pays dividends semiannually in December and June. The yield is low because many AI-focused companies reinvest earnings into growth rather than paying dividends.

Expense ratio

What is the ETF’s expense ratio?

The expense ratio for First Trust Nasdaq Artificial Intelligence and Robotics ETF is 0.65%, or $65 per $10,000 invested annually. This is higher than both sector and broad market ETFs, and even on the pricey side for a thematic ETF, approaching the cost of some actively managed funds due to its more specialized index methodology.

A percentage of mutual fund or ETF assets deducted annually to cover management, operational, and administrative costs.

Historical performance

Historical performance

Since its inception, First Trust Nasdaq Artificial Intelligence and Robotics ETF has generally tracked its benchmark, the Nasdaq CTA Artificial Intelligence and Robotics Index, but has delivered slightly lower returns across most periods due to fee drag.

For example, over the past five years, the fund returned 6.4% annually versus 6.9% for the index.

Where the gap really shows is against the broader market: The S&P 500 has compounded at nearly 16% annually over the same period, far ahead of the ETF.

This underperformance highlights two challenges with thematic funds like this: higher volatility and sector concentration.

While the ETF has at times outpaced the S&P 500 over short stretches, it has struggled to keep up over longer horizons, reflecting the risks of a narrower, more specialized portfolio.

|

1-Year |

3-Year |

5-Year |

|

|

Net Asset Value |

14.38% |

9.54% |

6.35% |

|

Market Price |

14.56% |

9.58% |

6.37% |

Related investing topics

The bottom line

First Trust Nasdaq Artificial Intelligence and Robotics ETF takes a very involved approach to index construction, breaking the AI and robotics universe into three categories and then assigning different portfolio weights to each group.

While this adds a layer of precision that some investors may appreciate, it also introduces complexity that can make the strategy harder to evaluate and follow compared to simpler, market-cap-weighted thematic ETFs.

The 0.65% expense ratio is on the higher side for a passive ETF and approaches the cost of certain actively managed funds in this space, which could make some investors question whether the additional complexity justifies the fee.

Over the long term, higher costs combined with a specialized weighting methodology may influence performance, so this fund may be best-suited for those who specifically want this unique structure rather than a broader, more conventional approach.

FAQ

Investing in First Trust Nasdaq Artificial Intelligence and Robotics ETF FAQ

What is the best way to invest in AI and robotics?

The best way to invest in AI and robotics depends on your investment style. Some investors are more comfortable with diversified thematic ETFs like the First Trust Nasdaq Artificial Intelligence and Robotics ETF, while others prefer to build their own portfolios of individual stocks.

Is ROBT a good investment?

First Trust Nasdaq Artificial Intelligence and Robotics ETF may appeal if you like its complex index approach, but its high fees and convoluted weighting can be drawbacks.

What is the best AI and robotics ETF?

The best AI and robotics ETF varies by investor goals, costs, and desired exposure, so compare options carefully. Some of the top AI and robotics ETFs by market cap include:

- Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ)

- Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ)

- iShares Future AI & Tech ETF (NYSEARCA:ARTY)

- Roundhill Generative AI & Technology ETF (NYSEARCA:CHAT)

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi