AI Research

Apple Researchers Create an AI Model That Uses Behavioural Data from Wearables to Predict Health Signals

Apple researchers, in collaboration with the University of Southern California, have developed a new artificial intelligence (AI) model that tracks behavioural data over sensor signals. The new research builds on prior work by the Apple Heart and Movement Study (AHMS) and was aimed at understanding if behavioural data, such as sleep pattern and step count, can be a better determinant of a person’s health compared to traditional indices such as heart rate and blood oxygen level. As per the paper, the AI model performed surprisingly well, even if with some caveats.

New Apple Study Shows Benefits of Moving Beyond Traditional Health Data

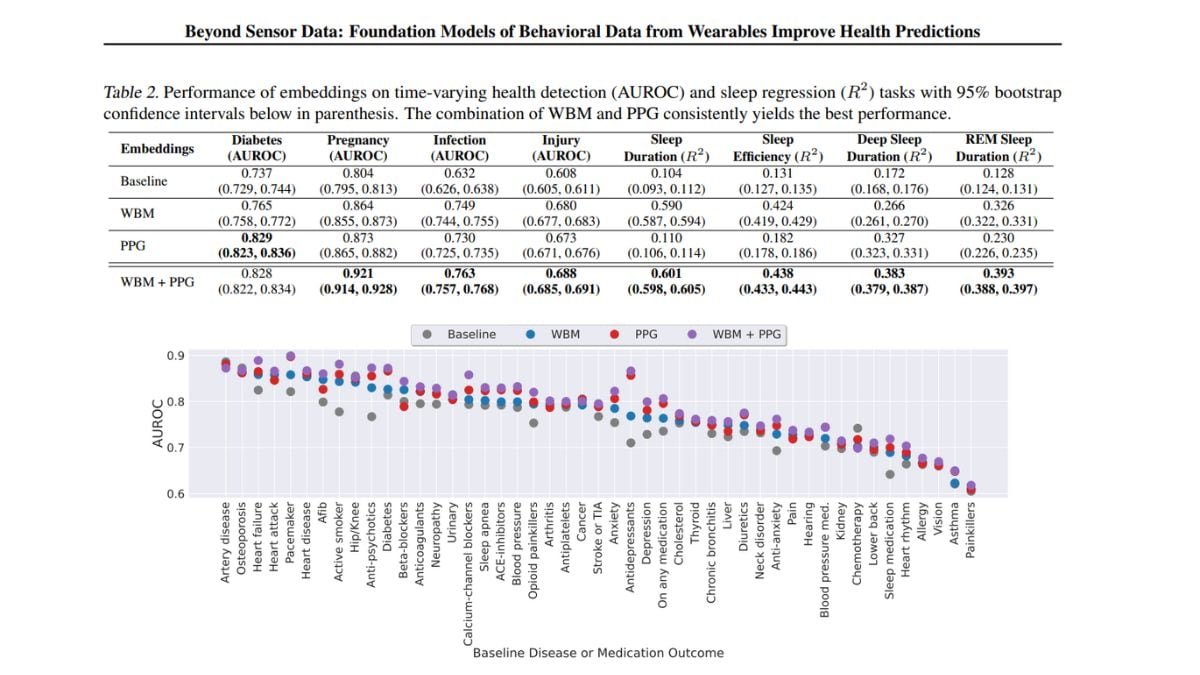

The study, titled “Beyond Sensor Data: Foundation Models of Behavioral Data from Wearables Improve Health Predictions” was published in the pre-print journal arXiv and is yet to be peer reviewed. The researchers set out to develop an AI model, dubbed Wearable Behaviour Model (WBM), that relies on processed behavioural data from wearables such as how long a person sleeps and their REM cycles, daily steps taken and gait, and how their activity pattern changes over the week.

Traditionally, to predict or assess someone’s health, wearable health research has typically focused on raw sensor readings such as continuous heart rate monitoring, blood oxygen levels, and body temperature. The study believes that while this data can be useful at times, it also lacks the full context about the individual and can have inconsistencies.

Regardless, so far, behavioural data, which is also something most wearables process, has not been used in systems as a reliable indicator of a person’s health. There are two main reasons for it, according to the study. First, this data is much more voluminous compared to sensor data, and as a result, it can also be very noisy. Second, creating algorithms and systems that can collect and analyse this data and reliably make health predictions is very challenging.

This is where a large language model (LLM) comes in and solves the analysis problem. To solve the noise in data, researchers fed the model with structured and processed data. The data itself comes from more than 1,62,000 Apple Watch users who participated in the AHMS research, totalling more than 2.5 billion hours of wearable data.

Once trained, the AI model used 27 different behavioural metrics, which were grouped into categories such as activity, cardiovascular health, sleep, and mobility. It was then tested across 57 different health-related tasks, such as finding out if someone had a particular medical condition (diabetes or heart disease) and tracking temporary health changes (recovery from injury or infection). Compared to the baseline accuracy, researchers claimed that WMB outperformed in 39 out of 47 outcomes.

Comparison between performance of the WBM model the test model and the combination of both

Photo Credit: Apple

The findings from the model were then compared with another test model that was only fed raw heart data, also known as photoplethysmogram (PPG) data. Interestingly, when individually compared, there was no clear winner. However, when researchers combined the two models, the accuracy of prediction and health analysis was measured to be higher.

Researchers believe combining traditional sensor data with behavioural data could improve the accuracy in the prediction of health conditions. The study stated that behavioural data metrics are easier of interpret, align better with real-life health outcomes, and are less affected by technical errors.

Notably, the study also highlighted several key limitations. The data was taken from Apple Watch users in the US, and the broader global population was not represented in this. Additionally, due to the high price of wearable devices that accurately collect and store behavioural data, accessibility of preventive healthcare also becomes a challenge.

AI Research

Tories pledge to get ‘all our oil and gas out of the North Sea’

Conservative leader Kemi Badenoch has said her party will remove all net zero requirements on oil and gas companies drilling in the North Sea if elected.

Badenoch is to formally announce the plan to focus solely on “maximising extraction” and to get “all our oil and gas out of the North Sea” in a speech in Aberdeen on Tuesday.

Reform UK has said it wants more fossil fuels extracted from the North Sea.

The Labour government has committed to banning new exploration licences. A spokesperson said a “fair and orderly transition” away from oil and gas would “drive growth”.

Exploring new fields would “not take a penny off bills” or improve energy security and would “only accelerate the worsening climate crisis”, the government spokesperson warned.

Badenoch signalled a significant change in Conservative climate policy when she announced earlier this year that reaching net zero would be “impossible” by 2050.

Successive UK governments have pledged to reach the target by 2050 and it was written into law by Theresa May in 2019. It means the UK must cut carbon emissions until it removes as much as it produces, in line with the 2015 Paris Climate Agreement.

Now Badenoch has said that requirements to work towards net zero are a burden on oil and gas producers in the North Sea which are damaging the economy and which she would remove.

The Tory leader said a Conservative government would scrap the need to reduce emissions or to work on technologies such as carbon storage.

Badenoch said it was “absurd” the UK was leaving “vital resources untapped” while “neighbours like Norway extracted them from the same sea bed”.

In 2023, then Prime Minister Rishi Sunak granted 100 new licences to drill in the North Sea which he said at the time was “entirely consistent” with net zero commitments.

Reform UK has said it will abolish the push for net zero if elected.

The current government said it had made the “biggest ever investment in offshore wind and three first of a kind carbon capture and storage clusters”.

Carbon capture and storage facilities aim to prevent carbon dioxide (CO2) produced from industrial processes and power stations from being released into the atmosphere.

Most of the CO2 produced is captured, transported and then stored deep underground.

It is seen by the likes of the International Energy Agency and the Climate Change Committee as a key element in meeting targets to cut the greenhouse gases driving dangerous climate change.

AI Research

Dogs and drones join forest battle against eight-toothed beetle

Esme Stallard and Justin RowlattClimate and science team

Sean Gallup/Getty Images

Sean Gallup/Getty ImagesIt is smaller than your fingernail, but this hairy beetle is one of the biggest single threats to the UK’s forests.

The bark beetle has been the scourge of Europe, killing millions of spruce trees, yet the government thought it could halt its spread to the UK by checking imported wood products at ports.

But this was not their entry route of choice – they were being carried on winds straight over the English Channel.

Now, UK government scientists have been fighting back, with an unusual arsenal including sniffer dogs, drones and nuclear waste models.

They claim the UK has eradicated the beetle from at risk areas in the east and south east. But climate change could make the job even harder in the future.

The spruce bark beetle, or Ips typographus, has been munching its way through the conifer trees of Europe for decades, leaving behind a trail of destruction.

The beetles rear and feed their young under the bark of spruce trees in complex webs of interweaving tunnels called galleries.

When trees are infested with a few thousand beetles they can cope, using resin to flush the beetles out.

But for a stressed tree its natural defences are reduced and the beetles start to multiply.

“Their populations can build to a point where they can overcome the tree defences – there are millions, billions of beetles,” explained Dr Max Blake, head of tree health at the UK government-funded Forestry Research.

“There are so many the tree cannot deal with them, particularly when it is dry, they don’t have the resin pressure to flush the galleries.”

Since the beetle took hold in Norway over a decade ago it has been able to wipe out 100 million cubic metres of spruce, according to Rothamsted Research.

‘Public enemy number one’

As Sitka spruce is the main tree used for timber in the UK, Dr Blake and his colleagues watched developments on continental Europe with some serious concern.

“We have 725,000 hectares of spruce alone, if this beetle was allowed to get hold of that, the destructive potential means a vast amount of that is at risk,” said Andrea Deol at Forestry Research. “We valued it – and it’s a partial valuation at £2.9bn per year in Great Britain.”

There are more than 1,400 pests and diseases on the government’s plant health risk register, but Ips has been labelled “public enemy number one”.

The number of those diseases has been accelerating, according to Nick Phillips at charity The Woodland Trust.

“Predominantly, the reason for that is global trade, we’re importing wood products, trees for planting, which does sometimes bring ‘hitchhikers’ in terms of pests and disease,” he said.

Forestry Research had been working with border control for years to check such products for Ips, but in 2018 made a shocking discovery in a wood in Kent.

“We found a breeding population that had been there for a few years,” explained Ms Deol.

“Later we started to pick up larger volumes of beetles in [our] traps which seemed to suggest they were arriving by other means. All of the research we have done now has indicated they are being blown over from the continent on the wind,” she added.

Daegan Inward/Forestry Research

Daegan Inward/Forestry ResearchThe team knew they had to act quickly and has been deploying a mixture of techniques that wouldn’t look out of place in a military operation.

Drones are sent up to survey hundreds of hectares of forest, looking for signs of infestation from the sky – as the beetle takes hold, the upper canopy of the tree cannot be fed nutrients and water, and begins to die off.

But next is the painstaking work of entomologists going on foot to inspect the trees themselves.

“They are looking for a needle in a haystack, sometimes looking for single beetles – to get hold of the pioneer species before they are allowed to establish,” Andrea Deol said.

In a single year her team have inspected 4,500 hectares of spruce on the public estate – just shy of 7,000 football pitches.

Such physically-demanding work is difficult to sustain and the team has been looking for some assistance from the natural and tech world alike.

Tony Jolliffe/BBC

Tony Jolliffe/BBCWhen the pioneer Spruce bark beetles find a suitable host tree they release pheromones – chemical signals to attract fellow beetles and establish a colony.

But it is this strong smell, as well as the smell associated with their insect poo – frass – that makes them ideal to be found by sniffer dogs.

Early trials so far have been successful. The dogs are particularly useful for inspecting large timber stacks which can be difficult to inspect visually.

The team is also deploying cameras on their bug traps, which are now able to scan daily for the beetles and identify them in real time.

“We have [created] our own algorithm to identify the insects. We have taken about 20,000 images of Ips, other beetles and debris, which have been formally identified by entomologists, and fed it into the model,” said Dr Blake.

Some of the traps can be in difficult to access areas and previously had only been checked every week by entomologists working on the ground.

The result of this work means that the UK has been confirmed as the first country to have eradicated Ips Typographus in its controlled areas, deemed to be at risk from infestation, and which covers the south east and east England.

“What we are doing is having a positive impact and it is vital that we continue to maintain that effort, if we let our guard down we know we have got those incursion risks year on year,” said Ms Deol.

Tony Jolliffe/BBC

Tony Jolliffe/BBCAnd those risks are rising. Europe has seen populations of Ips increase as they take advantage of trees stressed by the changing climate.

Europe is experiencing more extreme rainfall in winter and milder temperatures meaning there is less freezing, leaving the trees in waterlogged conditions.

This coupled with drier summers leaves them stressed and susceptible to falling in stormy weather, and this is when Ips can take hold.

With larger populations in Europe the risk of Ips colonies being carried to the UK goes up.

The team at Forestry Research has been working hard to accurately predict when these incursions may occur.

“We have been doing modelling with colleagues at the University of Cambridge and the Met Office which have adapted a nuclear atmospheric dispersion model to Ips,” explained Dr Blake. “So, [the model] was originally used to look at nuclear fallout and where the winds take it, instead we are using the model to look at how far Ips goes.”

Nick Phillips at The Woodland Trust is strongly supportive of the government’s work but worries about the loss of ancient woodland – the oldest and most biologically-rich areas of forest.

Commercial spruce have long been planted next to such woods, and every time a tree hosting spruce beetle is found, it and neighbouring, sometimes ancient trees, have to be removed.

“We really want the government to maintain as much of the trees as they can, particularly the ones that aren’t affected, and then also when the trees are removed, supporting landowners to take steps to restore what’s there,” he said. “So that they’re given grants, for example, to be able to recover the woodland sites.”

The government has increased funding for woodlands in recent years but this has been focused on planting new trees.

“If we only have funding and support for the first few years of a tree’s life, but not for those woodlands that are 100 or century years old, then we’re not going to be able to deliver nature recovery and capture carbon,” he said.

Additional reporting Miho Tanaka

AI Research

AI replaces excuses for innovation, not jobs

AI isn’t here to replace jobs, it’s here to eliminate outdated practices and empower entrepreneurs to innovate faster and smarter than ever before.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle