AI Insights

Apple CEO Tells Staff AI Is ‘Ours to Grab’ in Hourlong Pep Talk

(Bloomberg) — Apple Inc. Chief Executive Officer Tim Cook, holding a rare all-hands meeting following earnings results, rallied employees around the company’s artificial intelligence prospects and an “amazing” pipeline of products.

Most Read from Bloomberg

The executive gathered staff at Apple’s on-campus auditorium Friday in Cupertino, California, telling them that the AI revolution is “as big or bigger” as the internet, smartphones, cloud computing and apps. “Apple must do this. Apple will do this. This is sort of ours to grab,” Cook told employees, according to people aware of the meeting. “We will make the investment to do it.”

The iPhone maker has been late to AI, debuting Apple Intelligence months after OpenAI, Alphabet Inc.’s Google, Microsoft Corp. and others flooded the market with products like ChatGPT. And when Apple finally released its AI tools, they fell flat.

But Cook struck an optimistic tone, noting that Apple is typically late to promising new technologies.

“We’ve rarely been first,” the executive told staffers. “There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before iPod.”

But Apple invented the “modern” versions of those product categories, he said. “This is how I feel about AI.”

An Apple spokesperson declined to comment on the gathering.

The hourlong meeting addressed a range of topics, including the retirement of operating chief Jeff Williams, increasing Apple TV+ viewership and advances in health care with features like the AirPods Pro hearing-aid technology. It also touched on donations and community service by Apple employees, the company’s goal to become carbon neutral by 2030, and the impact of regulations.

“The reality is that Big Tech is under a lot of scrutiny around the world,” Cook said. “We need to continue to push on the intention of the regulation and get them to offer that up, instead of these things that destroy the user experience and user privacy and security.”

Cook often holds town hall-style chats when visiting Apple’s offices around the world, but companywide meetings from the Steve Jobs Theater at headquarters are unusual.

The remarks followed a blockbuster earnings report, with sales growing nearly 10% during the June quarter. That beat Wall Street expectations and eased concerns about iPhone demand and a slowdown in China.

AI Insights

Billionaire Steve Mandel Just Sold Microsoft Stock to Buy This Dominant Artificial Intelligence (AI) Stock Up Nearly 800% Over the Past Decade

Mandel increased his Amazon stake by a sizable amount.

Billionaire Steve Mandel and his hedge fund Lone Pine Capital have been a great one to follow for individual investors. Although some hedge funds have a poor record of underperforming the broader market, Mandel has substantially outperformed the market over the past three years. So, when he makes a move in his portfolio, investors should pay attention.

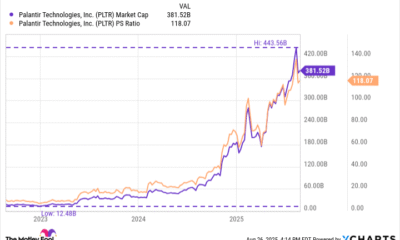

One thing Mandel did during Q2 was sell off some of his Microsoft shares. Although it wasn’t a massive move, the hedge fund reduced its position by about 5%. Then, Mandel used some of those funds to invest in another promising AI stock that has increased in value by nearly 800% over the past decade.

That stock? Amazon (AMZN -1.16%).

Image source: Getty Images.

AWS is the best reason to invest in Amazon right now

Amazon may not be the first company that comes to mind when you think about AI. Instead, it probably seems more like an e-commerce investment. While that sentiment is true for the consumer-facing portion, the reality is that a large chunk of Amazon’s profits comes from AI-related revenue streams.

The biggest is from Amazon Web Services (AWS), its cloud computing arm. Cloud computing firms are having a strong year, thanks to the massive demand generated by AI workloads. Because more companies can’t justify spending millions (or even billions) of dollars on a data center dedicated to training AI models, it’s far more reasonable to rent computing power from a firm that already has the capacity. That’s the idea behind cloud computing, and it has translated into strong growth for the business unit.

In Q2, AWS’s sales rose 17% to $30.9 billion. That’s strong growth, but it is a bit slower than its peers, Microsoft Azure and Google Cloud, which each grew revenue by more than 30% in Q2. However, AWS is much larger than both of these units, so it shouldn’t surprise investors that AWS is growing at a slower rate. AWS accounted for about 18% of Amazon’s total revenue in Q2, but it made up 53% of its operating profit. That’s because AWS has far superior margins compared to its commerce business units, making AWS a critical part of the Amazon investment thesis.

AWS is experiencing a significant boost from AI, making it a strong stock pick in this space.

But Microsoft is also a solid AI pick, so why is Mandel moving from Microsoft to Amazon?

Amazon’s stock looks more promising over the long term

From a valuation perspective, both companies trade at fairly expensive levels for their growth. However, they’re both priced about the same from a forward price-to-earnings (P/E) standpoint.

AMZN PE Ratio (Forward) data by YCharts

One thing Amazon has going for it that Microsoft doesn’t is the steady upward pressure on Amazon’s margins. Thanks to AWS and its advertising service business units being the fastest growing in Amazon, its margins are steadily improving. Although Amazon’s revenue growth rate appears to be somewhat slow, its operating income growth rate is actually quite rapid.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

This trend still has years to unfold, which is a solid reason to transition from Microsoft to Amazon. I believe this will be a winning trade over the long term, as Amazon’s profits are expected to grow at a significantly faster rate than Microsoft’s, resulting in the stock outperforming its peer over the long term due to their similar valuations.

However, both stocks are still solid AI picks, and you can’t go wrong with either one.

Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AI Insights

How Artificial Intelligence is Redefining Business Process Automation

In today’s fast-paced economy, businesses are under constant pressure to operate more efficiently while reducing costs and improving customer experiences. Automation has long been a solution, but traditional methods such as simple scripts or rigid workflows often fall short in terms of adaptability and intelligence. This is where artificial intelligence comes into play. By partnering with an Artificial Intelligence Development Company, organizations can unlock new opportunities for smarter decision-making, streamlined operations, and scalable growth.

The growing interest in AI-driven automation reflects its role as a key enabler of digital transformation. Unlike conventional automation, AI systems can analyze large datasets, learn from patterns, and make predictions that allow businesses to stay competitive in increasingly dynamic markets.

Why AI for Business Process Automation

Traditional automation methods—such as scripts or Robotic Process Automation (RPA)—are useful for handling repetitive, rule-based tasks. However, they lack flexibility and cannot adapt to new or changing conditions without manual intervention. Artificial intelligence takes automation a step further by enabling systems to learn, adapt, and improve over time.

Through machine learning and advanced data analytics, AI can identify hidden patterns, make predictions, and support real-time decision-making. This makes it possible not only to automate processes but also to optimize them dynamically, driving more value than traditional approaches.

Key Areas of Application

Finance

AI enables faster and more secure payment processing, advanced transaction analysis, and fraud detection systems that continuously learn to recognize suspicious patterns.

Marketing and Sales

From demand forecasting and personalized customer experiences to intelligent chatbots, AI helps companies better understand their audience and increase conversion rates.

Manufacturing and Logistics

AI-powered tools streamline supply chain management, predict equipment maintenance needs, and reduce downtime, ensuring smoother operations and higher efficiency.

Human Resources (HR)

Recruitment processes are enhanced through automated resume screening, predictive analysis of employee retention, and data-driven insights for workforce planning.

Advantages of Implementation

The implementation of AI in business processes brings several clear advantages. One of the most significant is cost reduction: by automating repetitive, labor-intensive tasks, companies can cut manual rework and optimize resource allocation, which lowers operating expenses without sacrificing quality. AI also accelerates processes, as models are capable of handling large data streams in near real time.

This speed translates into faster approvals, more efficient routing, more accurate forecasting, and quicker customer responses, all of which shorten cycle times. Another key benefit is error minimization. With advanced pattern recognition and anomaly detection, AI reduces human error, ensures data consistency, and helps stabilize performance metrics across workflows.

Finally, AI offers unmatched flexibility and scalability. Systems continuously learn from new data, allowing them to adapt to changing rules and business volumes, while cloud-native deployments make it possible to scale operations seamlessly as demand increases.

Potential Challenges

Despite these benefits, businesses face certain challenges when adopting AI automation. Costs and timelines are among the first hurdles. The discovery phase, data preparation, model training, and integration require significant upfront investment, and success often depends on a phased delivery approach to manage risk.

Data quality is another critical factor. If the available data is incomplete, biased, or siloed, the outcomes will inevitably suffer. Strong governance, robust cleaning pipelines, and continuous monitoring are necessary to maintain reliable results. Ethical and legal considerations must also be addressed.

Organizations need to ensure that their AI solutions operate with transparency, fairness, and respect for privacy, while remaining fully compliant with regulatory standards and internal policies.

Conclusion

AI-driven automation is now a core lever of competitiveness, improving speed, accuracy, and margins while enabling adaptive operations. Start small, pick a high-impact process, validate with a pilot, then scale iteratively with robust data governance and clear ROI checkpoints.

Do You Want to Know More?

AI Insights

Local Events | coastsidenews.com

We recognize you are attempting to access this website from a country belonging to the European Economic Area (EEA) including the EU which

enforces the General Data Protection Regulation (GDPR) and therefore access cannot be granted at this time.

For any issues, contact customerservice@coastsidenews.com or call (650) 726-4424.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Business2 days ago

Business2 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies