Business

Al Fayed-owned Mayfair penthouse has ‘leaky roofs and noisy lifts’, BBC reveals

BBC

BBCThe owner of a multi-million pound penthouse on Park Lane, central London, has been in an eight-year legal battle with companies owned by the late Mohamed Al Fayed and his family, the BBC has found.

The dispute began as a wrangle over a legal agreement relating to the installation of a new lift more than 20 years ago.

Since then, it has escalated into a row alleging leaky roofs, botched refurbishments and claims that a noisy lift was “maliciously” run at night to disturb the penthouse owner’s sleep.

Lawyers for both parties declined to comment.

The row at the exclusive Mayfair address – documented in High Court filings – shines a light on the way some business dealings were conducted in Mohamed Al Fayed’s empire in the years before he died.

Throughout his life, he was known for his combative approach, frequently resorting to legal action to resolve disagreements.

The luxury penthouse at the centre of this dispute is owned by Alan and Rosaleen Hodson. He is a property developer whose company has built thousands of homes in south-east England.

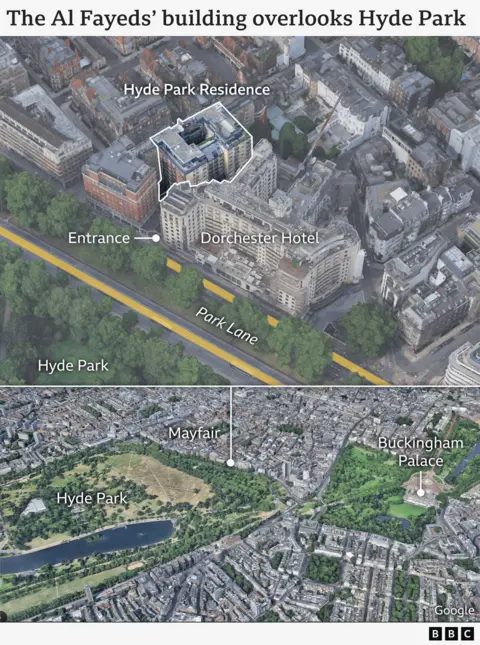

It is on the top floor of 55 Park Lane, known as “Hyde Park Residence”, a large apartment building in a prime spot – right next to the exclusive Dorchester Hotel.

The building’s website promises “an atmosphere of warmth and calm with the best of London living”. A four-bedroom apartment is currently on sale for £8.5m.

In 2003, the Mail on Sunday described the address as having “sensational” views across Hyde Park and a “marble entrance foyer [that] has to be seen to be believed”.

However, walking past the building gives a different impression. Some might consider it a little shabby for such a premium location, with peeling paint and a missing sign above the door.

Hyde Park Residence has been owned by the Fayed family since the 1980s, through Prestige Properties (PP), a company based in Liechtenstein.

This has been “under the control and held for the benefit of” Mohamed Al Fayed’s estate and family since his death in 2023, according to the accounts of a subsidiary company filed in the UK. Al Fayed’s widow Heini Wathen-Fayed is a director of this subsidiary called Hyde Park Residence Ltd, which manages some of the apartments.

Dave M Benett/Getty Images

Dave M Benett/Getty ImagesAl Fayed’s son Dodi, who died in a car crash alongside Princess Diana in 1997, reportedly used to have a flat there.

When Mohamed Al Fayed owned Harrods, he would sometimes let managers and directors live in the block, and the neighbouring building, 60 Park Lane, which he also owned.

In 2024, the BBC spoke to 13 women who said Fayed sexually assaulted them at 60 Park Lane. Four of them said they were raped.

Leaky roofs

The first issue emerged soon after Mr Hodson bought the penthouse in 2004, according to court documents seen by the BBC.

Mr Hodson made extensive improvements to the apartment when he moved in – modifying the kitchen, upgrading the roof terraces, and putting in a new lift so he wouldn’t have to use a flight of stairs to access the property.

An agreement giving him legal ownership of his new lift – by updating his lease – wasn’t honoured by Liechtenstein-based PP, Mr Hodson claimed.

Like many large buildings, the ownership of Hyde Park Residence is complicated.

The freeholder of the building is the Grosvenor Estate, which has extensive landholdings in central London. The Al Fayed family’s company PP has the right to use it for the next 110 years.

This leasehold arrangement, though time-limited, is considered a form of ownership.

Grosvenor should have been asked for permission before these improvements were started. But permission was not requested – although it agreed in 2006 to grant permission retrospectively for a payment of £100,000, which Prestige Properties paid.

Then, in 2014, Mr Hodson began to be bothered by noise from two of the buildings’ lifts. Despite his complaints, the noise grew worse, he argued, until in 2015 the building managers agreed to suspend use of one of the troublesome lifts at night.

And in 2016, the two parties fell out further. PP demanded that Mr Hodson contribute £80,000 towards the money paid to the Grosvenor Estate, some years earlier.

The following year, the Hodson’s took PP and two other Fayed-controlled companies to the High Court asking for a list of grievances to be met and damages paid.

Among the issues, Mr Hodson said that he had wanted to extend the flat, adding a floor. He had spent £180,000 developing a plan, but PP denied him permission to build it, despite initially encouraging the plan – his lawyers claimed.

PP’s lawyers argued the company hadn’t given Mr Hodson permission to extend his property. They said that, as a property developer, he should have known that he wouldn’t get permission without paying PP, as the landlord, millions of pounds.

Mr Hodson said that as a result of this dispute, PP allowed people to start using a noisy lift again, disturbing his sleep, which he thought was a “malicious and deliberate” response to a letter of complaint. He said on one night the lift was used 23 times between midnight and 02:00.

He also complained of poor repair work, which he said left him with a leaky roof and damage to his roof terraces.

The dispute still hasn’t been resolved. In March this year, there was another court filing from Mr Hodson claiming “the roof is still leaking. The lift is still making excessive noise… The corridors and lobby have never been finished following refurbishment.”

Lawyers for PP argue in reply that the noise from the lift is at “acceptable levels” and deny that it was restarted maliciously. They admit water leaked but say their clients have taken all reasonable steps to stop it.

PP is counterclaiming £344,000 in ground rent, plus another £286,000 of interest and costs.

The sums are trivial compared to Mohamed Al Fayed’s wealth, estimated at £1.7bn at the time of his death. And it is remarkable that a dispute of this kind should have dragged on for so long.

But Al Fayed was known for never giving an inch to those he fell out with – and that approach seems to be continuing even after his death.

Alan Hodson, Heini Wathen-Fayed, PP, and Grosvenor Estate declined to comment.

Business

Databricks AI Chief to Exit, Launch a New Computer Startup

(Bloomberg) — Naveen Rao, the head of artificial intelligence at the $100 billion startup Databricks Inc., is planning to leave his position to launch a new venture making a novel type of computer, according to a person familiar with the matter.

A spokesperson for Databricks confirmed that Rao is transitioning to an advisory role at the company, and said that Databricks is planning to invest in his new startup. The spokesperson declined to disclose the size of the investment.

Rao has also held early talks with other investors about backing the new company, which would focus on building a next-generation computer to address the rising costs of AI computing power, said the person familiar with the conversations, who asked not to be named discussing private information.

Rao declined to comment on his plans for the new company.

Rao is a serial entrepreneur who sold his data and AI analytics startup MosaicML to Databricks in 2023 for $1.3 billion. MosaicML had raised about $30 million from investors including Maverick Ventures, Lux Capital and DCVC. Before that, Rao co-founded Nervana Systems, a machine intelligence platform, which was acquired by Intel Corp. in 2016 for about $350 million.

Given Rao’s track record, the new venture could attract significant investor interest at a lofty valuation. He would also join a wave of prominent tech executives who’ve launched startups, including former OpenAI Chief Technology Officer Mira Murati, whose company Thinking Machine Labs was last valued at $10 billion, and ex-Salesforce co-CEO Bret Taylor, whose two-year-old AI startup Sierra was also recently valued at $10 billion.

Databricks recently raised $1 billion in a funding round that made it one of the country’s most valuable startups. The round was co-led by Andreessen Horowitz, Insight Partners, MGX, Thrive Capital and WCM Investment Management.

More stories like this are available on bloomberg.com

Business

Rent the Runway Adds AI Enhancements Amid Transformation

Rent the Runway is continuing to roll out new personalized recommendations and artificial intelligence (AI)-powered enhancements as part of a wide-ranging transformation of its fashion subscription, rental and resale platform.

Business

OpenAI nonprofit gains $100B stake while retaining control of AI company

NVIDIA CEO and co-founder Jensen Huang commends President Donald Trump’s A.I. agenda and outlines what the country’s job future will look like on ‘Special Report.’

Artificial intelligence giant OpenAI on Thursday announced its nonprofit parent will retain control of the company while also gaining an equity stake worth more than $100 billion.

The move will allow OpenAI to raise new capital while also making its nonprofit parent company “one of the most well-resourced philanthropic organizations in the world,” according to Bret Taylor, chairman of OpenAI’s board.

OPENAI TEAMS UP WITH WALMART TO TRAIN MILLIONS OF WORKERS IN ARTIFICIAL INTELLIGENCE

“This recapitalization would also enable us to raise the capital required to accomplish our mission — and ensure that as OpenAI’s [public benefit corporation] grows, so will the nonprofit’s resources, allowing us to bring it to historic levels of community impact,” Taylor said in a statement.

In this photo illustration, the OpenAI logo is seen displayed on a smartphone screen. (Thomas Fuller/SOPA Images/LightRocket via Getty Images / Getty Images)

OpenAI and Microsoft also said in a joint statement on Thursday that they signed a non-binding memorandum of understanding (MOU) to shape their next phase of partnership and are actively working to finalize a definitive deal. The companies said they are focused on building “the best” artificial intelligence tools that are also safe.

OPENAI CEO SAM ALTMAN WARNS OF AI FRAUD CRISIS ‘VERY SOON’

“OpenAI and Microsoft have signed a non-binding memorandum of understanding (MOU) for the next phase of our partnership,” the two companies said in a joint statement Thursday afternoon. “We are actively working to finalize contractual terms in a definitive agreement. Together, we remain focused on delivering the best AI tools for everyone, grounded in our shared commitment to safety.”

The Microsoft headquarters campus in Redmond, Washington. (iStock / iStock)

Microsoft has reportedly invested around $13 billion in the ChatGPT creator since 2019.

A MAJORITY OF SMALL BUSINESSES ARE USING ARTIFICIAL INTELLIGENCE

In May, OpenAI announced it was scuttling its plan to move the company away from a nonprofit structure to becoming a for-profit company. The ChatGPT-maker created a for-profit limited liability company (LLC), which it converted into a public benefit corporation that considers the interests of shareholders as well as OpenAI’s mission. The tech giant announced at the time that OpenAI’s nonprofit would have operational control over the public benefit corporation and would be a large shareholder in it.

Sam Altman, co-founder and CEO of OpenAI, speaks during a panel discussion titled “The Age of AI” at the Technical University of Berlin on February 07, 2025, in Berlin, Germany. (Sean Gallup/Getty Images / Getty Images)

OpenAI CEO Sam Altman, who prompted the company’s exploration of moving to a for-profit structure to make it easier for the company to raise the large amounts of money for investments he thinks will be needed to achieve artificial general intelligence (AGI), sent a letter to employees at the time explaining the decision and what it means for the company.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“OpenAI was founded as a nonprofit, is today a nonprofit that oversees and controls the for-profit, and going forward will remain a nonprofit that oversees and controls the for-profit. That will not change,” Altman wrote in May.

FOX Business’ Eric Revell contributed to this report.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi