AI Research

AI scammer posing as US Secretary of State Marco Rubio targets foreign ministers, US politicians

An impostor has used artificial intelligence to impersonate the voice of US Secretary of State Marco Rubio in contacts with three foreign ministers and two US politicians, according to a diplomatic cable seen by multiple news outlets.

The person used a voice generator in contacts with the ministers, a US governor and a member of Congress via the Signal messaging app.

Voicemails were left in two instances and a text message in a third instance invited the targeted person to communicate on Signal, the cable said.

The perpetrator copied a fake “@state.gov” email address on the messages as well as logos and branding used by State’s Bureau of Diplomatic Technology, it said.

Loading…

“The actor likely aimed to manipulate targeted individuals using AI-generated text and voice messages, with the goal of gaining access to information or accounts,” the cable said.

The State Department cable, dated July 3, was sent to all diplomatic and consular posts and suggests that staff warn external partners about fake accounts and impersonations.

“There is no direct cyber threat to the department from this campaign, but information shared with a third party could be exposed if targeted individuals are compromised,” it said.

Responding to an AFP request for comment, the State Department said it was aware of the incident and was “currently investigating the matter.”

“The Department takes seriously its responsibility to safeguard its information and continuously takes steps to improve the department’s cybersecurity posture to prevent future incidents,” said a senior State Department official.

Escalating risk

The cable referred to a second effort in April that was attributed to a Russia-linked hacker who conducted a spear phishing campaign targeting think tanks, Eastern European activists and dissidents and former State Department officials.

“The actor demonstrated extensive knowledge of the department’s naming conventions and internal documentation,” it said.

In that campaign, the person posed as a State Department official in messages sent to private Gmail accounts.

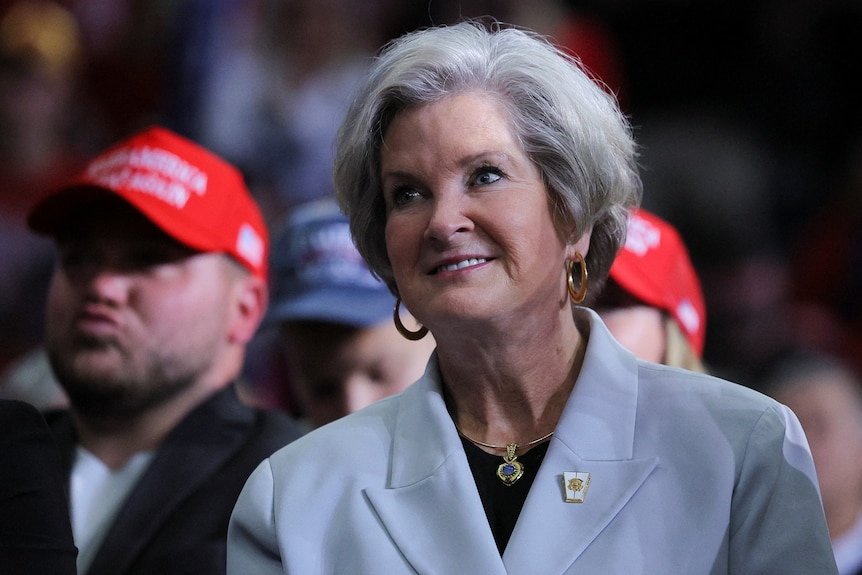

An impersonator managed to breach the phone of White House chief of staff Susie Wiles earlier this year, according to the Wall Street Journal. (Reuters: Brian Snyder)

The State Department said industry partners attributed that campaign to a cyber actor associated with the Russian Foreign Intelligence Service.

The FBI has previously warned that since April, “malicious actors” have impersonated senior US officials to target their contacts, including current and former federal or state government officials.

“The malicious actors have sent text messages and AI-generated voice messages — techniques known as smishing and vishing, respectively — that claim to come from a senior US official in an effort to establish rapport before gaining access to personal accounts,” the FBI said in May.

In May, President Donald Trump said an impersonator breached the phone of White House Chief of Staff Susie Wiles. US senators, governors and business executives received text messages and phone calls from someone claiming to be Wiles, the Wall Street Journal reported.

Reuters/AFP

AI Research

Trends in patent filing for artificial intelligence-assisted medical technologies | Smart & Biggar

[co-authors: Jessica Lee, Noam Amitay and Sarah McLaughlin]

Medical technologies incorporating artificial intelligence (AI) are an emerging area of innovation with the potential to transform healthcare. Employing techniques such as machine learning, deep learning and natural language processing,1 AI enables machine-based systems that can make predictions, recommendations or decisions that influence real or virtual environments based on a given set of objectives.2 For example, AI-based medical systems can collect medical data, analyze medical data and assist in medical treatment, or provide informed recommendations or decisions.3 According to the U.S. Food and Drug Administration (FDA), some key areas in which AI are applied in medical devices include: 4

- Image acquisition and processing

- Diagnosis, prognosis, and risk assessment

- Early disease detection

- Identification of new patterns in human physiology and disease progression

- Development of personalized diagnostics

- Therapeutic treatment response monitoring

Patent filing data related to these application areas can help us see emerging trends.

Table of contents

Analysis strategy

We identified nine subcategories of interest:

- Image acquisition and processing

- Medical image acquisition

- Pre-processing of medical imaging

- Pattern recognition and classification for image-based diagnosis

- Diagnosis, prognosis and risk management

- Early disease detection

- Identification of new patterns in physiology and disease

- Development of personalized diagnostics and medicine

- Therapeutic treatment response monitoring

- Clinical workflow management

- Surgical planning/implants

We searched patent filings in each subcategory from 2001 to 2023. In the results below, the number of patent filings are based on patent families, each patent family being a collection of patent documents covering the same technology, which have at least one priority document in common.5

What has been filed over the years?

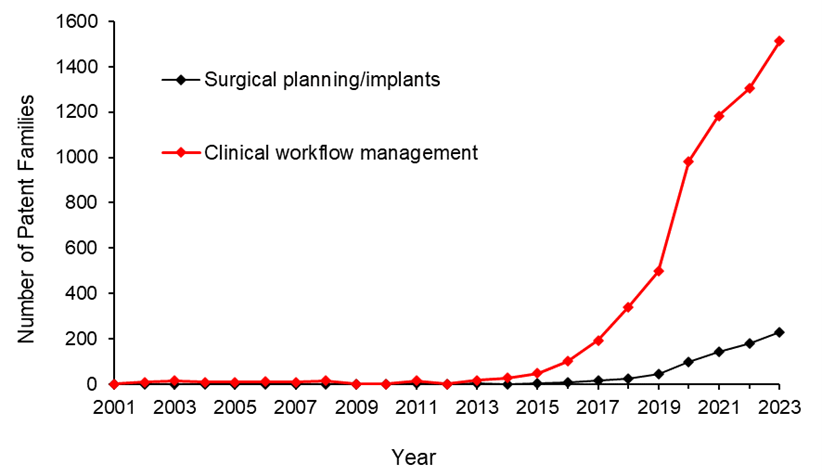

The number of patents filed in each subcategory of AI-assisted applications for medical technologies from 2001 to 2023 is shown below.

We see that patenting activities are concentrating in the areas of treatment response monitoring, identification of new patterns in physiology and disease, clinical workflow management, pattern recognition and classification for image-based diagnosis, and development of personalized diagnostics and medicine. This suggests that research and development efforts are focused on these areas.

What do the annual numbers tell us?

Let’s look at the annual number of patent filings for the categories and subcategories listed above. The following four graphs show the global patent filing trends over time for the categories of AI-assisted medical technologies related to: image acquisition and processing; diagnosis, prognosis and risk management; treatment response monitoring; and workflow management.

When looking at the patent filings on an annual basis, the numbers confirm the expected significant uptick in patenting activities in recent years for all categories searched. They also show that, within the four categories, the subcategories showing the fastest rate of growth were: pattern recognition and classification for image-based diagnosis, identification of new patterns in human physiology and disease, treatment response monitoring, and clinical workflow management.

Above: Global patent filing trends over time for categories of AI-assisted medical technologies related to image acquisition and processing.

Above: Global patent filing trends over time for categories of AI-assisted medical technologies related to more accurate diagnosis, prognosis and risk management.

Above: Global patent filing trends over time for AI-assisted medical technologies related to treatment response monitoring.

Above: Global patent filing trends over time for categories of AI-assisted medical technologies related to workflow management.

Where is R&D happening?

By looking at where the inventors are located, we can see where R&D activities are occurring. We found that the two most frequent inventor locations are the United States (50.3%) and China (26.2%). Both Australia and Canada are amongst the ten most frequent inventor locations, with Canada ranking seventh and Australia ranking ninth in the five subcategories that have the highest patenting activities from 2001-2023.

Where are the destination markets?

The filing destinations provide a clue as to the intended markets or locations of commercial partnerships. The United States (30.6%) and China (29.4%) again are the pace leaders. Canada is the seventh most frequent destination jurisdiction with 3.2% of patent filings. Australia is the eighth most frequent destination jurisdiction with 3.1% of patent filings.

Takeaways

Our analysis found that the leading subcategories of AI-assisted medical technology patent applications from 2001 to 2023 include treatment response monitoring, identification of new patterns in human physiology and disease, clinical workflow management, pattern recognition and classification for image-based diagnosis as well as development of personalized diagnostics and medicine.

In more recent years, we found the fastest growth in the areas of pattern recognition and classification for image-based diagnosis, identification of new patterns in human physiology and disease, treatment response monitoring, and clinical workflow management, suggesting that R&D efforts are being concentrated in these areas.

We saw that patent filings in the areas of early disease detection and surgical/implant monitoring increased later than the other categories, suggesting these may be emerging areas of growth.

Although, as expected, the United States and China are consistently the leading jurisdictions in both inventor location and destination patent offices, Canada and Australia are frequently in the top ten.

Patent intelligence provides powerful tools for decision makers in looking at what might be shaping our future. With recent geopolitical changes and policy updates in key primary markets, as well as shifts in trade relationships, patent filings give us insight into how these aspects impact innovation. For everyone, it provides exciting clues as to what emerging technologies may shape our lives.

References

1. Alowais et.al., Revolutionizing healthcare: the role of artificial intelligence in clinical practice (2023), BMC Medical Education, 23:689.

2. U.S. Food and Drug Administration (FDA), Artificial Intelligence and Machine Learning in Software as a Medical Device.

3. Bitkina et.al., Application of artificial intelligence in medical technologies: a systematic review of main trends (2023), Digital Health, 9:1-15.

4. Artificial Intelligence Program: Research on AI/ML-Based Medical Devices | FDA.

5. INPADOC extended patent family.

[View source.]

AI Research

SupplySide Global 2025 to Spotlight Transformative Industry Trends in Artificial Intelligence, Natural Colors, GLP-1 Innovations and Global Trade Impacts

LAS VEGAS, NV / ACCESS Newswire / September 4, 2025 / SupplySide Global, the premier gathering for the dietary supplement, food and beverage, personal care, pet health and sports nutrition industries, announces its dedicated content covering groundbreaking developments across four critical sectors, from technological advancements to regulatory changes. Product innovation and the evolution of global dynamics are top of mind at the industry’s most valuable annual tentpole event, October 27-30, 2025, at Mandalay Bay in Las Vegas.

“SupplySide Global represents a pivotal moment for the health and nutrition industries as we navigate technological advancements, evolving consumer demands for cleaner ingredients, delivery format breakthroughs and shifting global supply chain dynamics,” shares Danica Cullins, Executive Vice President of Health and Nutrition at Informa Markets. “Comprehensive programming addresses these transformative forces head-on, empowering industry professionals to connect, collaborate and create the future of wellness. SupplySide Global continues to be the catalyst for nutrition innovation by addressing both immediate challenges and long-term industry transformation.”

Artificial Intelligence (AI) Revolutionizing Product Development

SupplySide Global 2025 will feature a focus on AI applications throughout the nutrition supply chain. From predictive formulation tools to consumer preference modeling, attendees will discover how machine learning and advanced algorithms accelerate innovation cycles and create competitive advantages.

“Smarter, faster, cleaner: How AI is reshaping supplement innovation”, will explore how AI-powered predictive modeling is used to optimize bioavailability, forecast efficacy and accelerate formulation decisions. Industry experts will discuss how companies are using AI to unlock the potential of complex compounds such as terpenes, peptides and fungi, and will provide a practical look at how AI is quickly becoming a cornerstone of innovation strategy in supplements.

“Recipe for success: How AI is shaping the future of food and beverage”, will discuss real-world case studies that show the measurable impact of AI across the industry. Operational efficiency, supply chain strategy and innovation will be covered, with takeaways of actionable insights and a clear road map for how AI is shaping the future of food and beverage.

The AI Innovation Zone, part of the New Exhibitor Zone, will also showcase cutting-edge technologies that optimize everything from ingredient sourcing to personalized nutrition solutions.

Natural Colors: Meeting Clean Label Demands

SupplySide Global will showcase breakthrough natural coloring solutions that meet growing consumer demand for clean labels while delivering visual appeal and functional benefits. A dedicated Guided Tour, led by Jenna Troyli, will connect attendees with leading suppliers including California Natural Color, CapsCanada, Colorcon, IFC Solutions, Lycored Corp and Vivify, who will demonstrate plant-based pigments and clean-label technologies in time for the FDA’s (Food and Drug Administration) 2026 deadline to remove artificial colors from the food supply.

A dedicated session, “Colors & flavors in food and beverage face a new challenge, and new opportunities“, invites exhibiting companies to highlight formulation solutions and market leadership in designing products with colors and flavors that meet changing regulatory standards while appealing to consumers taste preferences and visual expectations.

GLP-1 Impact on Nutrition Markets

Nutrition Business Journal estimates the weight management category at $7.2 billion including meal replacements, prebiotics and weight-loss ingredients as a subset of the nutrition industry.

SupplySide Global will address the nutrition industry’s response to the explosive growth of GLP-1 receptor agonists for weight management through dedicated sessions on complementary supplement formulations and nutritional considerations for users. The feature session, “The GLP-1 effect: Developing healthy solutions to fill nutrition and metabolic wellness gaps,” will deliver a concise market opportunity overview followed by industry presentations and a moderated discussion with SupplySide leadership.

Navigating Global Tariffs and Supply Chain Challenges

With international trade policies in flux, SupplySide Global will provide essential guidance on mitigating tariff impacts and ensuring supply chain resilience. Expert panels and presentations will address strategies for ingredient sourcing diversification, regulatory compliance across borders and cost management amid shifting trade relationships.

“Supply chain challenges: Finding consistency through tariffs, AI, diversification and politics”, will discuss ways to assess vulnerabilities, mitigate risk, establish diverse supply chains and stay on top of regulatory changes that may come without warning.

“Navigating the regulatory reset”, will examine how industry can strategically navigate changing policies, identify emerging opportunities and effectively influence the evolving regulatory landscape through significant shifts at federal and state levels.

“Tariffs and turbulence: Overcoming food and beverage supply chain challenges”, will focus on navigating issues such as ingredient shortages, transparency and the political landscape, and ideas on how to diversify the supply chain within the context of a trade war.

“Our content reflects what matters to our industry. We poll our audience, advisory board and partners, evaluate hundreds of expert proposals and analyze engagement data across our platforms”, adds Sandy Almendarez, Vice President of Content at SupplySide. “Our new Session Select initiative puts programming decisions directly in our audience’s hands, generating nearly 1,000 votes. This data-driven approach ensures we deliver the content our community needs most.”

SupplySide Global has the largest selection of learning opportunities spanning breakfast and lunch briefs, GMP Training sessions, Guided Tours, Knowledge & Networking sessions and Elevate & Innovate sessions, Learning Power Hours and a Professional Development Workshop, as well as three specialized knowledge hubs which complement SupplySide’s versatile educational formats designed for every developmental need.

New pass types and group discounts are available for registration. The Explorer and Experience Pass options provide premium event and conference access to both new and returning professionals. Special group rates have also been introduced, making collaborative attendance more accessible. For complete details, please visit www.supplysideglobal.com.

For more information about exhibiting, sponsoring or attending, visit www.supplysideglobal.com.

About SupplySide Global

SupplySide Global, organized by Informa Markets, is the premier business-to-business trade show where supplement, food, and beverage industry professionals make powerful connections. Consumer product decision-makers, suppliers and manufacturers develop partnerships that bring innovative products to life and to market. The supply chain connects at this global exhibition where ingredient and technology companies debut the latest breakthroughs, nutrition scientists find solutions to formulation challenges, and consumer brands source ideas and ingredients that accelerate product development and business growth. A must-attend event, SupplySide Global is more than a trade show, it is the catalyst for nutrition innovation. The SupplySide Portfolio also includes SupplySide Connect New Jersey and publications SupplySide Supplement Journal and SupplySide Food & Beverage Journal.

About Informa Markets

Informa Markets, a subsidiary of Informa plc (LON:INF), creates platforms for industries and specialist markets to trade, innovate and grow. Our portfolio comprises more than 550 international B2B events and brands in markets including Engineering, Healthcare & Pharmaceuticals, Infrastructure, Construction & Real Estate, Fashion & Apparel, Hospitality, Food & Beverage, and Health & Nutrition, among others. We provide customers and partners around the globe with opportunities to engage, experience and do business through face-to-face exhibitions, specialist digital content and actionable data solutions. As the world’s leading exhibitions organizer, we bring a diverse range of specialist markets to life, unlocking opportunities and helping them to thrive 365 days of the year. For more information, visit www.informamarkets.com.

Media Contact

SupplySide PR

SupplySidePR@informa.com

SOURCE: SupplySide

View the original press release on ACCESS Newswire

AI Research

Angelo State launches new Artificial Intelligence Center of Excellence

Angelo State University has launched a new Artificial Intelligence Center of Excellence, according to a news release.

The goal of the new center is to integrate and infuse AI across every academic discipline and operational unit on campus. The AI-COE will be in The Nexus at Angelo State facility.

“Its development is supported by $5 million in non-formula funding recently approved by the Texas Legislature, to be split over the next two fiscal years,” the release stated.

The funding will allow the center to expand its auspices beyond just the Computer Science Department to initially also include Information Technology, the Innovation and Research Hub, and the College of Graduate Studies and Research.

“Eventually, it will involve faculty and staff from across campus, as well as local business owners and outside researchers, who are looking at potential uses of AI in many different areas,” the release stated.

The AI-COE will also serve as a collaborative hub for ASU students, faculty and staff across all academic disciplines where they will explore how AI can enhance learning, solve problems and drive economic development.

“Artificial intelligence is reshaping every aspect of our world — from how we learn and teach to how we work and live,” ASU President Ronnie Hawkins said. “Angelo State is committed to preparing our students, faculty and community to thrive in this new era with innovation, integrity and purpose.

“Our vision is to provide world-class instruction and equipment to lead West Texas in AI education and industry collaboration. But as we embrace the promise of AI, we must also proceed with caution and care. Ethics, transparency and community engagement will be the cornerstones of our approach.”

The university’s AI academic programs will also benefit from AI-COE development, officials said in the news release. ASU recently added new bachelor’s and master’s degrees in AI that can be completed 100% online, as well as an online certificate in AI policy and ethics. More details are available online at angelo.edu/computer-science.

“Much like AI itself, Angelo State’s AI-COE will also continuously evolve,” officials said in the release.

-

Business6 days ago

Business6 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics