Tools & Platforms

AI Proteins Appoints James Bowman as Chief Technology Officer

Dr. James Bowman, PhD

AI Proteins, a biotech company pioneering a new class of de novo therapeutic miniproteins designed by artificial intelligence, today announced the appointment of Dr. James Bowman, PhD as its first Chief Technology Officer. In this role, James will drive the expansion of the company’s core technology platform, integrating machine learning, synthetic biology, robotics, and large-scale data analysis to create entirely novel protein therapeutics. He previously served as AI Proteins’ Director of Protein Engineering, where he helped establish the framework that powers the company’s discovery engine.

“Our vision is to bring miniprotein medicines to patients across many diseases. Accomplishing this requires industrializing the design-build-test process for drug discovery,” said Dr. Chris Bahl, CEO of AI Proteins. “James has been pivotal in building our protein engineering approach, and his promotion to CTO underscores both his contributions and our commitment to advancing the technology at the heart of AI Proteins.”

Before joining AI Proteins as a founding team member, James was a Postdoctoral Fellow at the Institute for Protein Innovation, Boston Children’s Hospital and Harvard Medical School, where he engineered novel miniproteins for cancer therapeutics, resulting in multiple patent applications and licenses.

“I’m incredibly excited to take on the role of CTO, and doubly thrilled to be leading our efforts to make our discovery engine even more amazing,” said James Bowman. “We built a rapid, high-throughput approach for creating miniproteins with properties and functions that we pre-define and tailor to each project’s design goals. Miniproteins offer unique advantages over existing modalities, and our platform will allow this modality to reach its full potential in medicine.”

About AI Proteins

Boston-based AI Proteins is a biotech company on a mission to re-imagine protein therapeutics with a novel approach for designing entirely new proteins. Using AI-enabled design and a high-throughput drug discovery platform, AI Proteins creates de novo miniproteins optimized for a variety of therapeutic applications. Partnered with leading biopharmaceutical companies, AI Proteins continues to pursue collaborations across a wide variety of therapeutic areas in addition to advancing its internal pipeline. The AI Proteins platform can dramatically accelerate the development of lead therapeutic candidates ready for IND-enabling studies.

For more information, please visit aiproteins.com

Tools & Platforms

Open-Source AI Rivaling OpenAI and DeepSeek

In a bold move to assert its presence in the global artificial intelligence arena, the United Arab Emirates has unveiled K2 Think, an open-source AI model designed to challenge heavyweights like China’s DeepSeek and OpenAI’s offerings. Developed by the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) in collaboration with the tech firm G42, this model emerges from Abu Dhabi’s Institute of Foundation Models. With just 2.5 billion parameters, K2 Think punches above its weight, delivering reasoning capabilities that rival much larger systems, according to benchmarks cited in recent reports.

The launch, announced earlier this month, underscores the UAE’s strategic pivot away from oil dependency toward tech innovation. Researchers at MBZUAI claim K2 Think achieves competitive scores in key areas such as mathematical reasoning and code generation, often matching or exceeding models like DeepSeek’s V3.1, which has been hailed for its efficiency on Chinese hardware. This development comes amid intensifying competition, where nations vie for AI supremacy through accessible, cost-effective tools.

A Compact Powerhouse in AI Reasoning

What sets K2 Think apart is its emphasis on efficiency. Unlike resource-intensive models from U.S. giants, this Emirati creation runs on modest hardware, making it ideal for deployment in resource-constrained environments. As detailed in a CNBC article published on September 9, the model was trained using a novel approach that optimizes for speed and sustainability, potentially reducing energy costs by up to 70% compared to peers.

Industry experts note that K2 Think’s open-source nature democratizes access, allowing developers worldwide to fine-tune it for specific applications. This contrasts with proprietary systems like OpenAI’s o1-mini, which, while advanced, remain locked behind paywalls. Posts on X, formerly Twitter, from tech influencers have buzzed with excitement, highlighting how the UAE’s entry could accelerate innovation in regions underserved by Western tech.

Strategic Implications for Global AI Dynamics

The UAE’s foray into open-source AI isn’t isolated; it’s part of a broader ecosystem bolstered by investments from Microsoft-backed G42. A report from The National on September 9 emphasizes that K2 Think signals the country’s readiness to compete in a field dominated by the U.S. and China. DeepSeek, for instance, recently announced plans for an AI agent by year’s end, as per a Bloomberg piece dated September 4, intensifying the race.

For industry insiders, the real intrigue lies in K2 Think’s potential to foster AI sovereignty. By releasing the model under an open license, the UAE invites collaboration, potentially sparking a wave of localized adaptations. This mirrors China’s strategy with DeepSeek, which optimized for domestic chips and undercut costs, as noted in a Fortune analysis from August 21.

Challenges and Future Prospects

Yet, challenges remain. Critics point out that while K2 Think excels in reasoning tasks, it may lag in creative or multimodal capabilities compared to larger models. A Slashdot discussion from September 13 highlights community debates on its scalability, with some users questioning long-term support.

Looking ahead, the UAE’s investment in AI education and infrastructure, including MBZUAI’s programs, positions it for sustained growth. As Euronews reported on September 10, this model could redefine low-cost AI, encouraging a multipolar tech world where emerging players like the UAE challenge established powers.

Economic Diversification Through Tech Innovation

Economically, K2 Think aligns with the UAE’s Vision 2031, aiming to build a knowledge-based economy. Partnerships with global firms ensure technology transfer, while open-sourcing mitigates risks of over-reliance on foreign AI. X posts from AI enthusiasts, such as those praising DeepSeek’s cost efficiencies, underscore a sentiment that the UAE’s model could similarly disrupt markets.

In essence, K2 Think represents more than a technical achievement; it’s a geopolitical statement. As nations like China advance with models like DeepSeek’s upcoming agent, per recent Bloomberg insights, the UAE’s agile approach may inspire others to follow suit, fostering a more inclusive AI future.

Tools & Platforms

Larry Ellison Oxford investment: Larry Ellison’s $1.3 billion bet to turn Oxford into the Next Silicon Valley: Inside the tech giant’s vision to revolutionize innovation, AI, and global health with the Ellison Institute of Technology

Central to this ambitious plan is the Ellison Institute of Technology (EIT), a sprawling research campus backed by a £1 billion investment and set to open by 2027.

This initiative is designed to blend advanced science, artificial intelligence, and sustainable innovation with Oxford’s academic excellence, creating an ecosystem where groundbreaking discoveries can thrive and scale.

Ellison’s vision extends beyond traditional philanthropy. By partnering closely with the University of Oxford and dedicating significant funding to joint research and scholarships, the EIT aims to foster a self-sustaining network focused on solving global challenges in healthcare, clean energy, and food security.

Ellison’s projects also include preserving the city’s culture and history. One of the most striking examples is The Eagle and Child pub, known for hosting literary legends like J.R.R. Tolkien and C.S. Lewis.

Ellison plans to restore the pub while integrating it into his broader vision for the city. It will remain a place of history and culture, but also a space where ideas, learning, and innovation meet.This investment will drive significant economic impact, expecting to create around 5,000 jobs, more than doubling the workforce of Bill Gates’s foundation. Ellison has also acquired local landmarks like the Eagle and Child pub, symbolizing his deep-rooted commitment to Oxford’s transformation.

What is the Ellison Institute of Technology?

At the center of Ellison’s vision is the Ellison Institute of Technology, or EIT. This is not just a lab. It’s a $1.3 billion research campus. When it opens in 2027, it will include massive labs, supercomputing facilities, and a medical clinic focused on oncology and preventive care.

The institute aims to tackle big global problems. Health, climate change, food security, and artificial intelligence are the main focus areas. Ellison wants top scientists and researchers to work there. He also plans to fund major collaborations with the University of Oxford. One of the standout projects is a vaccine research program using artificial intelligence. This initiative aims to speed up vaccine development and make treatments more effective, especially for diseases that are difficult to prevent.

The EIT is also designed to be visually striking. It is being built with modern architecture that complements Oxford’s historic cityscape. The campus reflects Ellison’s goal: combine cutting-edge innovation with traditional prestige.

Why is Ellison buying a historic pub?

If building a tech campus wasn’t enough, Ellison is also buying historic sites. One notable example is The Eagle and Child pub. This isn’t just any pub. It’s famous as the meeting place of J.R.R. Tolkien and C.S. Lewis, two of the world’s most beloved authors.

Ellison purchased the pub for a large sum and plans a major renovation. The goal is to preserve the literary history while giving it a new purpose. After the refurbishment, it will serve as a hub for scholars and innovators, blending the old charm of Oxford with a space for modern collaboration.

This move shows that Ellison’s vision is not only about money or technology. It’s about culture, legacy, and creating a city where history and innovation coexist.

Who is Larry Ellison

Larry Ellison is the co-founder of Oracle Corporation, a global leader in database software and cloud computing. He started the company in 1977 with just $2,000, transforming it from a small startup into one of the world’s largest software firms.

Ellison initially served as Oracle’s CEO until 2014 and now holds the positions of chairman and chief technology officer. His vision and leadership have been key to Oracle’s success, including significant acquisitions such as Sun Microsystems that expanded the company’s footprint in the tech industry.

Oracle’s database technology revolutionized how businesses manage data, and under Ellison’s guidance, it evolved into a dominant player in enterprise software and cloud infrastructure.

In 2025, Larry Ellison’s fortune surged dramatically, propelled by a remarkable rise in Oracle’s stock price. This was triggered by soaring demand for Oracle’s cloud computing and artificial intelligence services. A landmark $300 billion cloud deal with OpenAI boosted Oracle’s revenue outlook and sent shares up over 40% in a single day.

This spike added more than $100 billion to Ellison’s net worth, briefly making him the world’s richest person.

FAQs:

Q1: What is Larry Ellison building in Oxford?

A: A $1.3 billion research campus called the Ellison Institute of Technology.

Q2: Why is Ellison buying historic sites like The Eagle and Child pub?

A: To preserve Oxford’s cultural heritage while integrating it into his innovation-focused vision.

Tools & Platforms

Why Micron Technology (MU) Is Up 19.7% After AI-Driven Demand Boosts Analyst Optimism and Data Center Revenue

- In the past week, Micron Technology attracted widespread analyst upgrades and sector optimism due to robust demand for advanced memory chips powering artificial intelligence applications and data centers. Analysts highlighted Micron’s rapidly rising data center revenue and its strengthened position as an essential supplier for AI infrastructure solutions.

- A unique aspect is that Micron’s momentum has been reinforced by major enterprise customers’ commentary, especially Oracle’s, reflecting industry-wide confidence in continued AI-driven demand for memory products through at least 2026.

- We’ll explore how these positive demand signals from large AI customers impact Micron’s investment narrative and growth outlook.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Micron Technology Investment Narrative Recap

To be a Micron Technology shareholder, you need to believe in ongoing strength in AI-driven data center demand that can offset the inherent volatility and competition of the memory chip industry. The latest surge in analyst upgrades and sector optimism has sharpened focus on Micron’s position in the AI supply chain, but it does not eliminate the cyclical risks still present in both DRAM and NAND markets that could impact earnings momentum if demand trends shift unexpectedly.

Among recent announcements, Micron’s raised Q4 2025 earnings guidance stands out as closely linked to the surge in AI-fueled memory demand, reinforcing confidence behind current analyst enthusiasm. The updated outlook, with expected revenue of US$11.2 billion and EPS of US$2.64, reflects tangible benefits from AI, making near-term results a primary market catalyst in the coming weeks.

Yet, despite this tailwind, investors should also consider how quickly competition from other memory giants could…

Read the full narrative on Micron Technology (it’s free!)

Micron Technology’s narrative projects $53.6 billion in revenue and $13.6 billion in earnings by 2028. This requires 16.6% yearly revenue growth and a $7.4 billion earnings increase from $6.2 billion today.

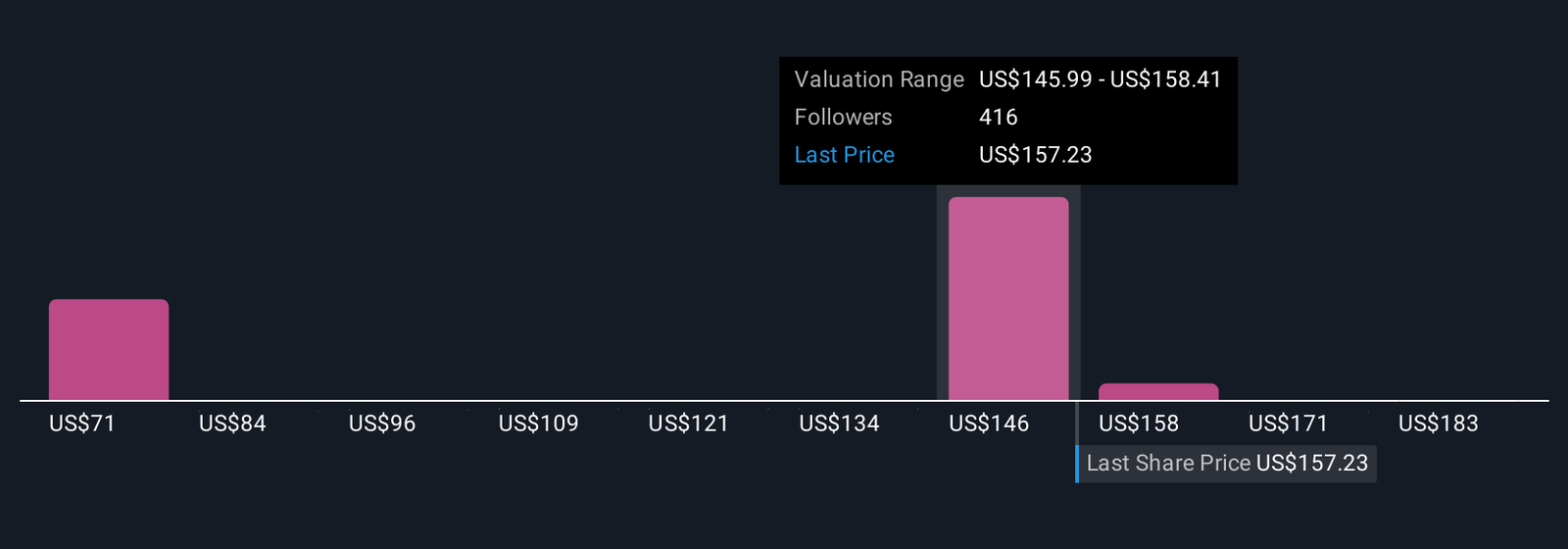

Uncover how Micron Technology’s forecasts yield a $150.57 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Fifty members of the Simply Wall St Community estimate Micron’s fair value between US$71.48 and US$195.67 per share. However, continued robust demand for advanced DRAM and HBM in AI data centers could prove pivotal for future revenue and margin strength, so consider a range of market outlooks.

Explore 50 other fair value estimates on Micron Technology – why the stock might be worth as much as 24% more than the current price!

Build Your Own Micron Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source