Business

AI Gold Rush Breeds Harsh 996 Work Routine In Silicon Valley | Business News

Last Updated:

Silicon Valley tech giants battle for AI dominance, offering huge pay and adopting the 9-9-6 culture in San Francisco startups.

AI Boom, Human Cost: San Francisco Startups Push 9-9-6 Work Schedule

The race for AI heats up, with tech companies in Silicon Valley pouring billions into overpowering others and grabbing the largest pie in the emerging market. Companies have reportedly begun poaching human resources by offering millions of dollars in a pay package. No one wishes to lag behind when things are high at stake. Everyone is ready to pour sweat and blood, literal and metaphorical.

At the center of this heated race, a new culture called 9-9-6 has emerged in the startups of San Francisco, USA.

What Is 9-9-6 Culture?

It means employees of these startups work from 9 in the morning to 9 in the evening, Monday through Saturday. It translates to 72 hours of work weekly, going away from 4 or 5 day work week culture being promoted across Europe, particularly Nordic countries for more leisure time.

An X handle named TBPN in the post said that they checked the receipts and found that the claims are “true” – Saturdays have become a workday. “The great lock-in is in full effect,” it added.

Many San Francisco startups claim they practice 9-9-6, so we checked the receipts.We worked with Ramp to look at the data and it’s true – Saturdays have become a workday.

The great lock-in is in full effect. pic.twitter.com/MbwAICe3Dy

— TBPN (@tbpn) September 8, 2025

AI War Among Tech Titans

Several big tech giants, including Meta, Google, Microsoft and Amazon, have poached the startup founders with a high paycheck to work with their teams building the smartest Large Language Models (LLMs) and improving the hot application-based technology. For instance, Meta shocked the tech industry when it announced to invest a $14.3 billion in data labelling startup Scale AI. As part of the agreement, Meta took a 49% stake in the company, hired its CEO Alexandr Wang to lead a new superintelligence lab and said it would deepen the work it does with Scale.

Since the inception of ChatGPT by OpenAI in late 2020, the official age of AI has begun. Two years after the trailblazing technology, there’s no official winner, but a sudden push to have everything as AI-laced.

A team of writers and reporters decodes vast terms of personal finance and making money matters simpler for you. From latest initial public offerings (IPOs) in the market to best investment options, we cover al…Read More

A team of writers and reporters decodes vast terms of personal finance and making money matters simpler for you. From latest initial public offerings (IPOs) in the market to best investment options, we cover al… Read More

September 10, 2025, 10:22 IST

Read More

Business

Flagship Enterprise Center to hold AI business conference – Herald Bulletin

Business

IREN Stock (IREN) Keeps Climbing as AI Cloud Business Grows, Nvidia GPUs Incoming

IREN Limited’s (IREN) shares have continued to extend their recent rally. The data center infrastructure provider’s stock gained over 15% at the close of trading on Tuesday to emerge as the fifth-biggest gainer of the day. Since the start of the year, the shares have also soared by over 200%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The boost comes a day after Daniel Roberts, the company’s co-founder and co-CEO, noted that the “demand for our AI Cloud is accelerating.” Roberts also said the firm is preparing to receive over 9,000 Blackwell graphics processing units (GPUs) from chipmaker Nvidia (NVDA) over the coming months to expand its artificial intelligence-powered cloud business.

IREN was recently admitted into the Nvidia Preferred Partner Program, giving the company priority access to the chip designer’s latest GPUs. As part of its expansion, the Sydney-based firm plans to install the incoming GPUs at its site in Prince George, British Columbia, Canada, where it is constructing a new facility to install Nvidia’s GB300 NVL72 systems. These systems are Nvidia’s high-end, liquid-cooled AI servers built around the Blackwell GB300 GPU.

IREN Misses Wall Street Estimates

IREN has continued to rally despite missing Wall Street’s revenue projection for its most recent quarter. In its fiscal fourth-quarter 2025 results released in late August, the company, which also mines Bitcoin, generated $187.3 million in revenue, below the estimated $188.91 million.

However, for a company that frequently reports a net loss, IREN reported a net income of $176.9 million during the recent quarter. This is even as the company looks to expand its AI Cloud server business to 10,900 Nvidia GPUs, with over 80% of those from the chipmaker’s Blackwell models.

Furthermore, IREN mined fewer Bitcoins in August, with the number dropping by over 8% from 728 BTC in July to 668 BTC in August. However, the company continues to maintain a positive outlook.

“Following record fiscal year and quarterly earnings, we delivered another month of solid performance, generating $53 million of hardware profit in August despite seasonal curtailment and electricity prices,” said co-CEO Daniel Roberts.

IREN’s brighter prospects for its AI cloud business coincide with the time investors are looking to Oracle’s (ORCL) cloud infrastructure revenue as a key driver for future growth.

Is IREN a Good Stock to Buy?

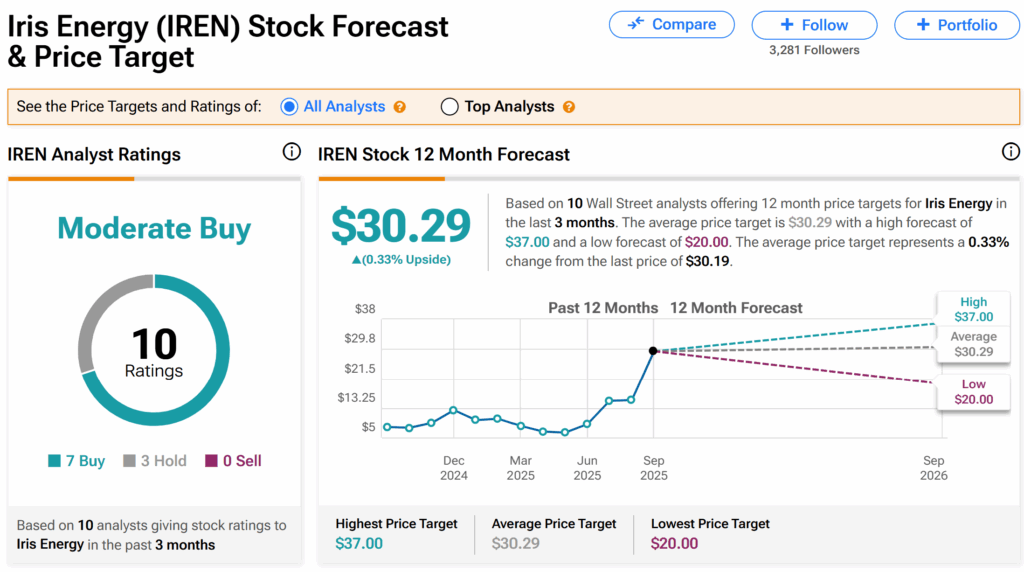

Analysts on Wall Street are generally cautious about IREN’s shares. On TipRanks, the stock has a Moderate Buy consensus recommendation based on seven Buy and three Hold ratings by 10 Wall Street analysts over the last three months.

The average IREN price target is $30.29, which indicates a potential marginal growth of 0.33% from current levels.

Business

Can Artificial Intelligence (AI) Help Turn Opendoor’s Business Around?

Key Points

-

Opendoor recently appointed Shrisha Radhakrishna as its new interim leader.

-

Radhakrishna believes artificial intelligence can help the company in multiple areas of its operations, including pricing and in-home assessments.

-

The company has routinely incurred losses and it’s carrying more than $2 billion in debt on its books.

-

10 stocks we like better than Opendoor Technologies ›

Artificial intelligence (AI) has been transforming businesses across the globe and across all sectors of the economy. While it may not necessarily fix a broken business, it can help add efficiency, unlock new growth opportunities, and drive down costs.

Those are all things that Opendoor Technologies (NASDAQ: OPEN) could benefit from. Many investors and analysts see the iBuying company as nothing more than the latest meme stock, benefiting from a flurry of hype from retail investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Management, however, hopes to solidify its operations and do more with less, due to AI. Is this a great idea that could make Opendoor a better buy, or is this simply too risky of a stock to hold?

Image source: Getty Images.

Can AI fix the company’s biggest struggles?

Opendoor’s new president and interim leader, Shrisha Radhakrishna, who took over last month after Carrie Wheeler stepped down, is eyeing AI as a way to improve the company’s operations. Radhakrishna sees many ways that AI can be a key part of the company’s future growth, helping the business with marketing, pricing, and in-home assessments.

Turning to AI can be a way to improve efficiency, but it’ll take time and money to do so. And even then, it’s questionable how much generative AI can do for Opendoor’s business. Consider that the company’s gross margin is typically in just single digits. The iBuying business involves flipping houses and if there’s not enough of a spread there to make enough of a margin, it’s going to be incredibly difficult for the business to cover its other operating expenses and stay out of the red.

AI may help with pricing, but unless it results in significant margin expansion, it may not necessarily lead to a big payoff for the business and its shareholders.

Many AI projects are falling short of expectations

Excitement around AI has captivated investors, but that doesn’t mean that simply throwing money at AI is going to solve problems. In fact, it may create new ones as Opendoor spends excessively without having much to show for it.

According to a recent report from the Massachusetts Institute of Technology, a staggering 95% of companies haven’t been generating any meaningful revenue or payoff from their investments into AI. While the hyperscalers and big tech companies with massive budgets have undoubtedly grown their businesses due to AI, the study underscores the importance of keeping expectations in check.

As tempting as it may be to assume that AI will improve a company’s operations, that’s by no means a sure thing. And that can be particularly concerning for a business such as Opendoor, which has routinely posted losses and which already has more than $2 billion in debt on its books. Last quarter (which ended June 30), its interest expense totaled $36 million — nearly 3 times the size of its operating loss of $13 million.

Investing into AI likely won’t make Opendoor a better stock

Opendoor’s business needs a lot of work before it can have a realistic path to profitability and be a good investment option. There’s a ton of risk for investors to take on and although the stock has surged more than 300% this year (as of Monday), that doesn’t mean the rally is sustainable or that it will continue.

The volatility that comes with Opendoor’s stock makes it an unsuitable option for the vast majority of investors to consider for their portfolios. With challenging market conditions, poor financials, and many question marks surrounding the long-term viability of Opendoor’s business, this is a stock I’d steer clear of for the foreseeable future. At the very least, you may want to wait until the company actually shows some tangible improvement and payoff from its efforts and AI investments. Otherwise, you could be taking on significant risk. This is a stock that could have a long way to fall given its sharp rally this year and the volatility that comes with it.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $671,288!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,031,659!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi