Tools & Platforms

A thinking cap? This AI-powered cap can transform thoughts into text

Published on

ADVERTISEMENT

Imagine texting your friends and family by controlling your phone with just your thoughts. This idea was once the stuff of science fiction.

Today, the idea of connecting the human brain to computers is moving closer to becoming a reality thanks to the rapid development of artificial intelligence (AI).

So far, technologies that allow transforming thoughts into text have often required a brain implant.

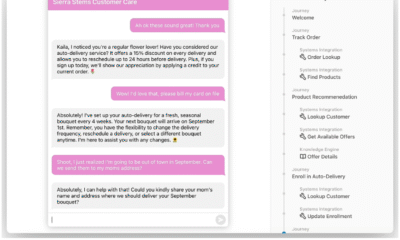

Now, scientists at the University of Technology Sydney are using a cap-like device to explore how AI can interpret brain activity.

The AI-powered cap monitors the brainwave patterns of a person wearing it and converts their thoughts into written language.

The team behind the decoder says the system relies on two distinct types of AI to interpret brainwave signals.

“At first, we use the deep learning model to translate the brain signals into the intended words,” Chin-Teng Lin, a researcher at the University of Technology Sydney, said.

“And then, we use the large language model to make the match of the decoded words and make up for the errors in EEG decoding,” he added.

The results are close, but not flawless, with about 75 per cent accuracy. The team says it is working toward a goal of 90 per cent accuracy.

Could help stroke patients

Other language decoding systems in development, so far, have required subjects to have surgical implants, or go throughfunctional magnetic resonance imaging (fMRI) scanning.

In 2023, a study about a stroke patient being able to communicate again thanks to a brain-computer interface and an AI voice generator made headlines.

Last year, Elon Musk’s brain chip Neuralink was first implanted in a human skull.

Specialists say it could play a role in helping stroke patients recover.

“As scientists, we look at a medical condition and we look at what function has been affected by that medical condition. What is the need of the patient?” Mohit Shivdasani, a researcher at the University of NSW bioelectronics, said.

“We then address that unmet need through technology to restore that function back to what it was. After that, the sky’s the limit,” Shivdasani added.

For more on this story, watch the video in the media player above.

Video editor • Roselyne Min

Tools & Platforms

Grant Thornton Advisors to Sink $1 Billion Over Three Years on AI

Top 10 accounting firm Grant Thornton announced on Sept. 4 that Grant Thornton Advisors is investing $1 billion over three years to provide artificial intelligence tools and technology to the entire workforce at its multinational professional services platform, which stretches from the Americas across Europe to the Middle East.

The firm said the investment will help the platform deliver innovative and high-quality accounting, tax, and advisory services based on a people-centric model powered by AI. As a result, the multinational platform will be able to deliver a better end-to-end digital experience for both its professionals and its clients.

Grant Thornton Advisors established its multinational, mutidisciplinary platform in January 2025, with backing from private equity firm New Mountain Capital, which acquired a significant stake in Grant Thornton US in June 2024.

As a result, Grant Thornton now operates in an alternative practice structure: Grant Thornton LLP, a licensed CPA firm, provides attest services, and Grant Thornton Advisors LLC provides business advisory and non-attest services.

To date, Grant Thornton US sister firms from Ireland, the United Arab Emirates, Switzerland/Liechtenstein, the Netherlands, Luxembourg, the Cayman Islands, and the Channel Islands have joined the multinational platform.

As part of its AI investment, Grant Thornton Advisors is providing the more than 13,500 platform professionals in 60 multinational offices with access to Microsoft 365 Copilot. The rollout complements an earlier pilot project that saw Grant Thornton Advisors provide Microsoft’s AI tool to a 400-person cohort of professionals, generating significant productivity gains, the firm said.

“This isn’t just about investing in AI and technology, it’s about investing in our people,” Grant Thornton Advisors CEO Jim Peko said in a statement. “We’re giving every professional across our multinational platform—from Chicago to Dubai—the kinds of tools they need to work smarter, faster, and in keeping with their individual styles. The result is something that is uniquely Grant Thornton: People who are empowered do their best work so clients benefit from the quality and results they need.”

Mike Kempe, chief information officer for Grant Thornton Advisors, added, “This investment is a big step as we ensure that every person at the Grant Thornton Advisors platform has AI and technology resources at the ready—from our newest hires to our most seasoned professionals. The Microsoft 365 Copilot rollout, for example, will help our people save time, balance their workloads, and make more insightful decisions. This means they’ll be able to efficiently provide our clients with personalized high-quality services.”

Tom Puthiyamadam, Grant Thornton Advisors’ managing partner for advisory services in the U.S., stresses that the Copilot rollout is one of many moves that will help the firm deliver quality services powered by AI and grounded in human insights.

“We’re building a full-service platform amplified by AI and advanced technologies,” he said. “Investing in tools such as Copilot is a critical next step in this effort and part of a steady cadence of innovations that will help us provide clients with novel solutions to whatever challenges lie ahead.”

Over the past year, Grant Thornton Advisors has made progress implementing a phased AI maturity model across its platform. In May, it launched CompliAI, a proprietary AI solution that uses advanced capabilities and a custom-trained large-language model, to help clients control and assess risks.

In addition, Grant Thornton Advisors recently acquired Auxis, a U.S.-based leader in outsourcing and business modernization services. And last month, it added Stax, a strategy consulting firm specializing in commercial due-diligence, value-creation, and exit-planning services for private equity firms, as well as their portfolio companies and advisors.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more…

Subscribe

Already registered? Log In

Need more information? Read the FAQs

Tools & Platforms

AI’s Double-Edged Sword: Powering Tech Surges While Raising Investor Hurdles

The relentless march of Artificial Intelligence (AI) continues to reshape the financial landscape, injecting unprecedented energy into technology stocks and driving significant market rallies. While some players, like Broadcom (NASDAQ: AVGO), bask in a surge fueled by insatiable AI demand, industry titans such as Nvidia (NASDAQ: NVDA) face the increasingly difficult task of satisfying ever-higher investor expectations. This dynamic has created a complex market environment where groundbreaking growth can still lead to muted stock reactions, prompting critical questions about the sustainability and inherent risks of the AI-driven boom.

This article delves into the ongoing influence of AI on the technology sector, examining recent performances, the escalating challenges for market leaders, and the broader implications for investors navigating this transformative era. As AI’s potential continues to unfold, understanding its impact on public companies and the wider market becomes paramount.

The AI Gold Rush: Why It Matters and Who’s Leading the Charge

The current fervor around AI is more than just hype; it’s rooted in tangible demand for the infrastructure that underpins this technological revolution. Companies providing the specialized chips, networking equipment, and data center solutions are experiencing a bonanza. This demand is not merely for general computing power but for highly specific, high-performance components crucial for training and deploying advanced AI models.

Broadcom (NASDAQ: AVGO) stands out as a prime beneficiary of this AI-driven surge. In its fiscal third quarter of 2025, the company reported a staggering 63% year-over-year jump in AI revenue, reaching $5.2 billion, with projections climbing to $6.2 billion for the fourth quarter. A significant new $10 billion custom-chip order, widely speculated to be from OpenAI, further underscores Broadcom’s pivotal role in the AI infrastructure market. This AI momentum has been crucial in offsetting weaker performances in its non-AI segments, such as enterprise networking and storage. Broadcom’s success is largely attributable to its dominance in essential components like Ethernet switch chips and application-specific integrated circuits (ASICs) vital for high-speed data transfers and advanced AI workloads in massive data centers.

However, the AI gold rush presents a unique challenge for even the most dominant players. Nvidia (NASDAQ: NVDA), the undisputed leader in AI chips, continues to post impressive financial results, including a 56% year-over-year revenue increase in its second quarter of fiscal 2025 and a 54% surge in adjusted earnings per share. Yet, despite these stellar figures and CEO Jensen Huang’s ambitious forecast of global AI infrastructure spending soaring to $3 trillion to $4 trillion by 2030, Nvidia’s stock reactions have sometimes been surprisingly subdued, with shares occasionally slipping post-earnings. This phenomenon indicates a “new phase” in the AI sector where investors are now demanding even faster growth to justify increasingly high valuations. What was once considered extraordinary growth is now viewed by some as merely meeting expectations, raising the bar significantly for Nvidia to consistently exceed these lofty benchmarks.

Winners and Those Facing Uphill Battles in the AI Arena

The AI revolution is creating distinct winners, primarily companies embedded deeply in the AI infrastructure supply chain, while simultaneously posing unique challenges for others, even market leaders, grappling with investor expectations and market dynamics.

On the winning side, companies like Broadcom (NASDAQ: AVGO) are exemplifying the direct benefits of the AI buildout. Their specialized chips and networking solutions are indispensable for large-scale AI data centers, translating directly into robust revenue growth and strong stock performance. Broadcom’s ability to secure massive custom-chip orders positions it as a critical enabler of foundational AI technologies, suggesting continued strong performance as AI adoption expands across industries. Similarly, other semiconductor companies providing components for AI accelerators, high-bandwidth memory (HBM), and advanced packaging are also experiencing significant tailwinds.

Conversely, companies like Nvidia (NASDAQ: NVDA), despite their overwhelming dominance and continued record-breaking performance, find themselves in a peculiar position. The very success that propelled them to the forefront of the AI boom has created a challenge of managing investor expectations. While their revenue growth remains astronomical, the market has already priced in such extraordinary performance, demanding perfection and even greater acceleration. This means that even impressive growth figures, which would delight investors in almost any other sector, can lead to a muted or even negative stock reaction if they merely meet, rather than dramatically exceed, analysts’ already elevated forecasts. Furthermore, Nvidia faces potential risks from revenue concentration in its data center segment and the ongoing geopolitical tensions, particularly U.S.-China trade restrictions, which complicate its sales outlook in critical markets. Executive and board member stock sales have also been noted, which can sometimes signal caution to investors.

Beyond the hardware providers, hyperscale cloud providers such as Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN) (through AWS), and Alphabet (NASDAQ: GOOGL) (through Google Cloud) are also significant winners. They are investing billions in AI infrastructure to offer AI services, foundational models, and development platforms to enterprises worldwide, leveraging their extensive data centers and existing customer bases. These companies benefit from the increasing compute demands of AI, both from their own internal development and from external customers utilizing their cloud services.

However, the narrative isn’t uniform. Companies that are slower to integrate AI into their offerings or those whose traditional businesses are being disrupted by AI-powered solutions might find themselves on the losing end. The massive capital expenditure required for AI development and deployment also puts smaller players at a disadvantage, consolidating power among well-capitalized tech giants. The “winner-take-most” nature of some AI markets further intensifies competition and could lead to market share erosion for less agile companies.

Industry Impact and Broader Implications: A New Technological Frontier

The AI-driven rally is not merely a cyclical upswing; it represents a fundamental shift in the technological landscape with far-reaching implications across industries, regulatory frameworks, and historical market precedents. This event fits into a broader industry trend of rapid digital transformation, but with AI acting as an accelerant, pushing the boundaries of what’s possible in automation, data analysis, and predictive capabilities.

The ripple effects are profound. Competitors and partners across the technology ecosystem are being forced to adapt at an unprecedented pace. Traditional software companies are scrambling to embed AI into their products, while hardware manufacturers are retooling supply chains to meet the demand for specialized AI components. The sheer scale of investment in AI infrastructure, estimated to reach trillions by 2030, suggests a prolonged period of growth for the semiconductor and cloud computing sectors, while simultaneously creating intense pressure on other industries to leverage AI for efficiency and innovation or risk obsolescence.

Regulatory and policy implications are rapidly emerging as a critical consideration. Governments worldwide are grappling with the ethical, societal, and economic impacts of AI. Discussions around data privacy, algorithmic bias, intellectual property, and the potential for job displacement are leading to calls for new regulations. The nascent nature of AI technology means that regulatory frameworks are still evolving, and any sudden policy changes or restrictions could significantly impact market sentiment, R&D investments, and the speed of AI adoption. Geopolitical tensions, particularly regarding the supply chain for advanced AI chips and technologies, also loom large, potentially leading to trade restrictions that could fragment global markets and affect profitability for multinational corporations.

Historically, this AI boom draws parallels to previous transformative technological eras, such as the internet revolution or the dot-com bubble of the late 1990s. While some analysts, including OpenAI CEO Sam Altman, acknowledge elements of “irrational exuberance,” many believe the underlying value proposition of AI is far more robust and pervasive than previous speculative booms. AI is expected to inject an astonishing $13 trillion to $16 trillion in value into the stock market, with an annual net benefit of nearly $1 trillion for S&P 500 companies by as early as 2026. This potential for tangible, widespread value creation across diverse sectors differentiates it. However, a significant risk remains in the market’s current concentration, where a few tech giants disproportionately drive returns. This concentration could lead to market vulnerability if these dominant players falter, reminiscent of the over-reliance on a few “blue-chip” tech stocks during the dot-com era. The crucial difference lies in AI’s demonstrated capacity for practical application and economic impact, which, if realized, could underpin a more sustainable, albeit volatile, long-term growth trajectory.

What Comes Next: Navigating the AI Frontier

The immediate future of AI in technology stocks will likely be characterized by continued high investment in infrastructure, intense competition, and a constant re-evaluation of valuation metrics. In the short term, the demand for AI-enabling hardware – particularly advanced GPUs, ASICs, and high-speed networking components – is expected to remain robust. This will continue to benefit key players like Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), alongside their respective supply chains. Companies that can scale their production efficiently and innovate rapidly to meet evolving AI compute needs will thrive. However, investors will be increasingly scrutinizing not just revenue growth, but also the profitability and return on investment from these massive capital expenditures.

Longer-term, the industry will see a strategic pivot towards broader AI integration across all sectors. This means that AI’s influence will extend beyond semiconductor pure-plays to companies that effectively leverage AI to transform their operations, product offerings, and customer experiences. We can expect to see more consolidation within the AI software and services space, as larger tech companies acquire innovative startups to bolster their AI capabilities. Furthermore, ethical AI development, responsible deployment, and robust regulatory compliance will become critical competitive advantages, influencing public trust and market adoption.

Market opportunities will emerge not only in foundational AI technologies but also in specialized applications within industries like healthcare, finance, and manufacturing, where AI can drive significant efficiencies and create new revenue streams. Challenges will include managing the escalating costs of AI R&D, overcoming the “cold start” problem for new AI models (requiring vast amounts of data), and addressing the widening skills gap for AI talent. Companies will need to strategically adapt by fostering internal AI expertise, forming key partnerships, and continuously investing in R&D to stay ahead of the curve. Potential scenarios include a sustained, albeit volatile, growth period driven by real-world AI applications, or a more pronounced market correction if profitability fails to materialize as quickly as investment. The trajectory will largely depend on the tangible economic benefits AI delivers versus the escalating cost of its development and deployment.

Conclusion: Sustaining the AI Momentum Amidst High Stakes

The ongoing influence of Artificial Intelligence on technology stocks represents one of the most significant market shifts of our generation. The surge in demand for AI-enabling hardware and software has propelled companies like Broadcom (NASDAQ: AVGO) to new heights, demonstrating the immense value being created by this technological paradigm. Yet, this era also brings heightened scrutiny, as evidenced by the challenges faced by even market leaders like Nvidia (NASDAQ: NVDA) in consistently exceeding increasingly ambitious investor expectations. The key takeaway is clear: AI is not merely a buzzword; it is a foundational technology driving tangible, albeit concentrated, economic value.

Moving forward, the market will increasingly differentiate between genuine AI value creation and speculative exuberance. While the potential for AI to inject trillions into the global economy is undeniable, investors must remain vigilant regarding the sustainability of current rallies. Concerns about market concentration, potential overvaluation in certain segments, and the long-term profitability of massive AI investments are valid. A July 2025 MIT report highlighting that 95% of organizations achieved “zero returns” on AI investments underscores the complexity of translating AI adoption into tangible financial gains. This suggests that while investment is rampant, effective monetization remains a hurdle for many.

Ultimately, the lasting impact of AI will hinge on its ability to transcend infrastructure and deliver widespread, demonstrable improvements in productivity, innovation, and economic efficiency across diverse sectors. Investors should watch for several critical indicators in the coming months: the actualization of AI-driven revenue streams that justify current valuations, the emergence of clear profitability from substantial AI investments, the evolution of regulatory frameworks, and signs of diversified market leadership beyond a select few tech giants. The AI revolution is here to stay, but its journey will be marked by both unprecedented opportunities and inherent risks that demand careful and informed navigation.

Tools & Platforms

AWS to Show New Generative AI, News Distribution Innovations

AWS will be at stand 5.C90 in Hall 5 at the RAI during exhibit hours and in sessions throughout the week offering engaging demos, in-depth guidance, and thoughtful discussions.

At the stand (5.C90)

The AWS stand will feature 56 AWS Partners across various demos that showcase the technologies and top use cases shaping the future of the Media & Entertainment (M&E) industry. We are demonstrating the latest cloud and AI technologies that help customers across broadcast, streaming, media supply chain, and monetization. This includes a Builder Zone and Generative AI Zone for more technical deep dives.

Throughout the AWS stand, attendees will learn how M&E companies can adapt to a shifting entertainment environment, at scale and within budget, by using the latest generative AI and cloud-based tools from AWS and its Partners.

For example, global news organization Reuters will join AWS in demonstrating live content captured from the floor of the United Kingdom (UK) Parliament—replicated in near real-time to multiple news organizations simultaneously. They will be using the open-source Time-Addressable Media Store (TAMS) API specification and AWS services including Amazon Simple Storage Service (Amazon S3), AWS Elemental MediaConvert, and AWS Step Functions. Reuters and AWS will show how cloud-native collaboration and interoperability can transform the way news is created, exchanged and monetized. AWS will also show how TAMS can be integrated with Amazon Bedrock and the TwelveLabs video understanding models to enable embedding of news content.

M&E companies want to leverage generative AI to unlock revenue from their existing content libraries and IP, reducing operational costs, while enhancing viewing experiences. AWS will feature demos showing practical use of generative AI workloads, including examples of how to use services like Amazon Bedrock, featuring Amazon Nova foundation models, and Amazon Connect.

AI agents are also helping M&E companies support new engagement features, streamline operations, and enhance advertising and monetization opportunities. The AWS booth will include more agentic AI demos than ever before, showcasing capabilities like Amazon Bedrock AgentCore, Amazon Q, and Kiro to support M&E use cases. This includes demos featuring the latest update to the Guidance for a Media Lake on AWS, which has added agentic AI capabilities from AWS Partners MASV and Nomad Media.

Attendees can explore how AWS services can support their unique needs alongside experts in the Builder Zone. This includes learning to deploy infrastructure across multiple availability zones and regions using Amazon CloudFront, and capturing detailed video quality metrics for every frame in your output with AWS Elemental MediaConvert. Explore monetizing live video while offering digital video recorder (DVR) features with AWS Elemental MediaTailor. Reimagine search and discoverability within media libraries with Cloud Storage on AWS and Amazon S3 Vectors, along with streamlining business operations with Amazon Q.

New this year, the Builder Zone will also feature experts who can discuss Digital Sovereignty at AWS. This includes the AWS European Sovereign Cloud, the first fully featured, independently operated sovereign cloud backed by strong technical controls, sovereign assurances, and legal protections required by European governments and enterprises. Anticipated to launch at the end of 2025, the AWS European Sovereign Cloud will be entirely located within the EU, physically and logically separate from other AWS Regions.

Celebrating a decade of AWS Elemental

September 3, 2025 marks 10 years since AWS acquired Elemental Technologies, now known as AWS Elemental. In many ways, the acquisition marked the beginning of a new journey for AWS in M&E, and IBC provides the ideal forum to celebrate with the customers and partners who have helped shape that journey.

Today, AWS Elemental services support innovative new streaming platforms, live digital broadcast techniques, cloud production workflows, and more. These services help customers like BBC, FOX, Netflix, PBS, and Prime Video create, transform, and deliver high-quality digital content. For example, using AWS Elemental Media Services, Tubi delivered the most-streamed Super Bowl in history to 15.5 million peak concurrent streaming viewers. Formula 1 debuted its new F1 TV Premium streaming subscription tier, and NBCUniversal delivered personalized ads across 5,000 hours of 2024 Paris Olympics content on Peacock.

The AWS stand will feature a dynamic timeline mapping out a decade of milestones and industry breakthroughs. It will give attendees a look back on the hundreds of features released since the acquisition, supporting over 1,500 customers worldwide. IBC attendees can also meet with AWS Elemental experts at the stand.

You can visit the AWS Elemental 10-year anniversary page to learn more about all of the activities planned for IBC.

Speaking sessions and more

AWS has also teamed up with NVIDIA to sponsor the Future Tech Hall (Hall 14, Stand 14.A13). Join us to learn from AWS technical leaders, AWS Partner Network (APN) partners, and customers to hear how they are accelerating the implementation of AWS for media workloads.

AWS will participate in ten sessions during IBC2025, including seven sessions on the AWS and NVIDIA Innovation Stage in the Future of Tech Hall (Hall 14) and two sessions on the Future Tech Stage. Sessions include:

- Thursday (9/11)

- 1:35 PM – World Skills Café, stand E102 – Is the Lack of Skills Holding Companies Back? (Featuring: Nina Walsh, Global Leader, Industry Business Development, AWS)

- Friday (9/12)

- 1:45 PM – Future Tech Stage – Pushing the Limits: AI Innovation in Live Sports with Formula 1 (Featuring: Ruth Buscombe, Lead race strategist at Formula 1; Sepi Motamedi, Sr. Product Manager of Live Media Solutions, NVIDIA; Chris Blandy, Director of Media & Entertainment, Games, and Sports Business Development, AWS)

- Saturday (9/13)

- 11:15 AM – AWS and NVIDIA Innovation Stage – The 2025 Club World Cup as the Engine of Innovation: How Cloud Technology Reshaped Sports Rights and Delivery (Featuring: James Pearce, SVP broadcast and streaming at DAZN; Andy Wilson, CTO at M2A Media; Paul Devlin, Global Strategy Leader for Betting, Gaming & Sports at AWS; Larissa Gorner-Meeus, CTO at Proximus Media)

- 12:00 PM – AWS and NVIDIA Innovation Stage – Future Fit Media Supply Chains (Featuring: Adam Jakubowski, VP Technical Operations at BBC Studios)

- 1:00 PM – Future Tech Stage – How Prime Video Is Changing Production with ‘Last One Laughing’ in the cloud (Featuring: Tim Bock, Head of Production, Innovation – International Originals at Amazon MGM Studios; Greg Young, Worldwide Production and Post Technology at Prime Video)

- 3:45 PM – From Rights to Revenue: Unlocking Content Value in a Digital-First World (Featuring: Richard Clarke and Damien Viel from Banijay; Kathleen Barrett, CEO at Backlight; Alex Buchanan, Director of Programs at Base)

- 4:30 PM – AWS and NVIDIA Innovation Stage – AI-Driven Media Transformation: Redefining audience experiences(Featuring: Sebastien Westerduin, CEO, Amplify; Lewis Smithingham, EVP of Strategic Industries – Media, Entertainment, Gaming & Sports, Monks; Joeri Lambert, SVP of Growth, Platforms & Tech Services EMEA, Monks; Stuart Lepkowsky – Global Head of Telco, Media & Entertainment, Games, and Sports Partner Strategy, AWS)

- Sunday (9/14)

- 12:45 PM – AWS and NVIDIA Innovation Stage – Breaking News: Next-generation workflows in News and Sports(Featuring: Sam Ross, Executive Product Manager for Shortform Production and Publication at BBC; Rebecca Light, Group Head of Content Management and Quality Control at Sky)

- 2:15 PM – AWS and NVIDIA Innovation Stage – 10 Years of Video Innovation with AWS Elemental: How it Started, How it’s Going, and What’s Next (Featuring: Eric Orme, VP Live Sports Product & Engineering at Prime Video; Alan Robinson, Executive Product Manager, BBC; Greg Truax, Director of Engineering, AWS Elemental)

- 4:30 PM – AWS and NVIDIA Innovation Stage – MovieLabs: Broadcasting the vision (Featuring: Rich Burger, CEO at MovieLabs; Tom Sharma, CTO at Avid; Raf Soltanovich, VP of Technology at Prime Video)

Additionally, IBC attendees can join AWS, AWS Partners, and other industry peers at one of our ancillary events throughout the week. This includes:

-

Business1 week ago

Business1 week agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics