Funding & Business

A Slow Start to Amazon's Prime Day

Amazon’s Prime Day kicks off to a slower than expected start as early spending drops 14% compared to 2024. Bloomberg’s Spencer Soper joins Caroline Hyde on “Bloomberg Tech” to discuss the tariff impact on retailers and shoppers. (Source: Bloomberg)

Source link

Funding & Business

Argentine Pulp Maker Blames Milei as It Seeks Bankruptcy Protection

Pulp and paper manufacturer Celulosa Argentina SA filed for bankruptcy protection Monday, blaming the government of President Javier Milei for creating a bad business environment for local industry.

Source link

Funding & Business

Nigeria Cuts Oil Firms’ Cost-Recovery Cap to Boost Budget Income

Nigeria has set a lower threshold by which oil companies can recover their expenses as it seeks to boost government revenue amid lower crude oil prices threatening to widen the budget deficit in the West African nation.

Source link

Funding & Business

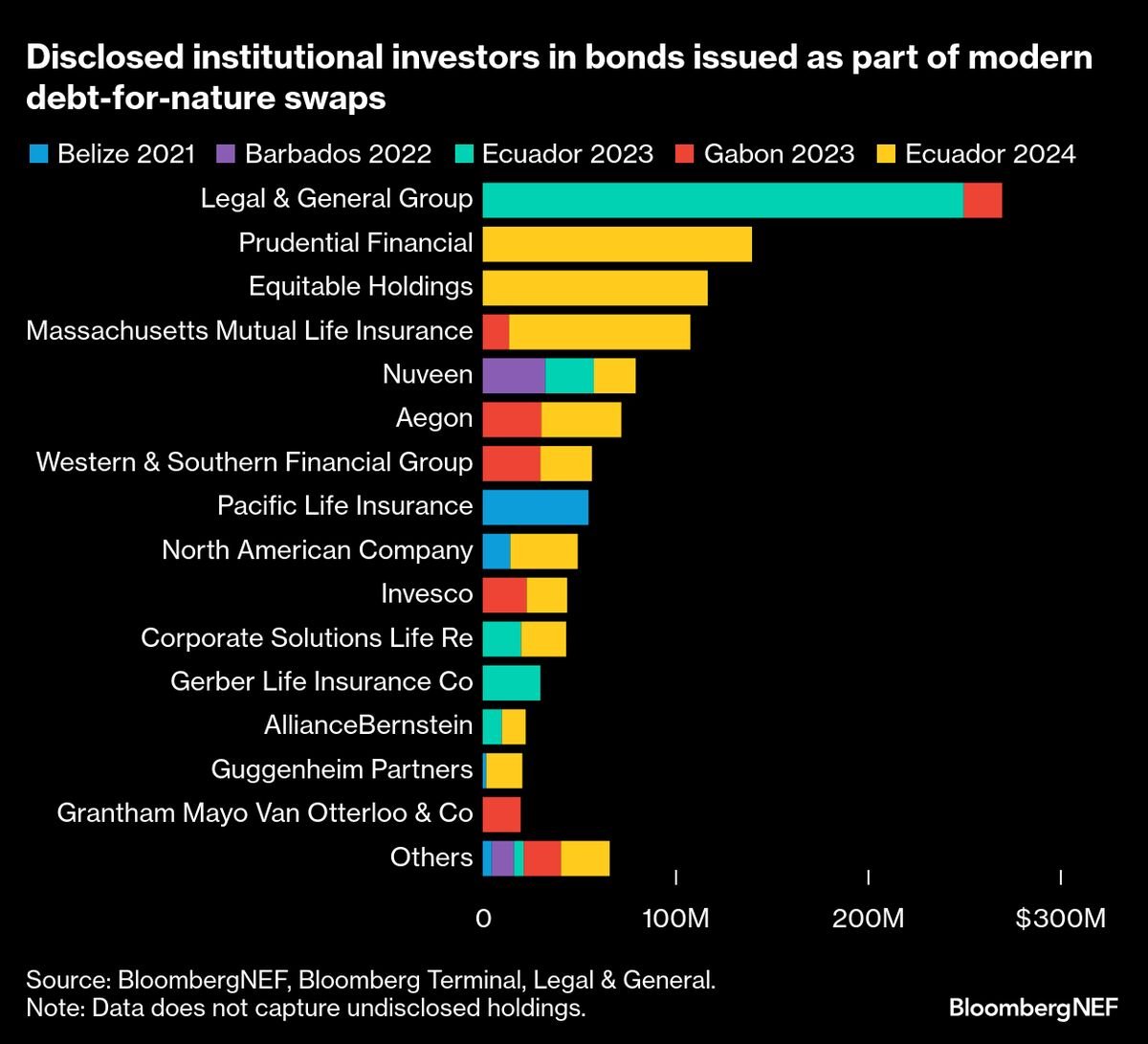

Swaps Pioneered by Credit Suisse Take On New Life in Age of War

Debt swaps pioneered by Credit Suisse to fund nature conservation are enjoying a second life, as bankers see an opportunity to apply the model to everything from post-war reconstruction to energy security.

Source link

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi