Funding & Business

Funding Trends, Biggest Exits, and Most Active Investors

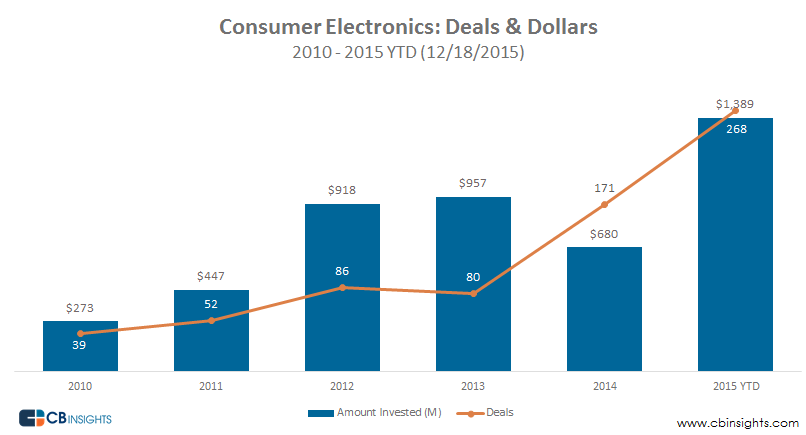

This year has so already seen more than $1.3B invested in consumer electronics startups, the first time in at least 5 years that funding has topped $1B.

The Fitbit IPO showed that despite the capital intensity and scaling difficulties associated with hardware-based businesses, successful consumer electronics companies are able to produce big returns for their investors.

With the annual Consumer Electronics Show coming up this January, we decided to take a look at how funding to consumer electronics companies has fared in the last few years, using CB Insights data.

This year has so far already seen a 57% year-over-year increase in the number of deals and more than $1.3B invested, the first time in at least 5 years that funding has topped $1B. In fact, there have been more consumer electronics deals in 2015 than in the four years between 2010 and 2013 combined. The pace of investment has increased markedly in the last two years, with sensor and electronic part costs falling and wearables picking up steam.

Investment by stage

In recent years, the majority of deals have been at the earlier stages, with Seed and Series A combining for a 36% share of deals in 2010, but a 59% share of deals in 2013, and a 60% share in 2015 year-to-date. Seed in particular has seen an increase jumping from a low of 24% deal share in 2011 to 45% so far in 2015, including fundings of Sproutling, TrackR, and Giroptic.

Deals in the “other” category — which includes deals unattributed to any particular round — have generally commanded the second-highest percentage of deal share.

Active Investors

The most active investor by far into consumer electronics companies was hardware accelerator HAX, which has invested in more than 45 companies since 2010. Several other accelerators populate the list including Y Combinator and TechStars, as well as hardware-dedicated accelerators like Highway1.

Among institutional investors, Intel Capital tops the list investing into portfolio companies including Razer and Skully Helmets. Other non-corporate VCs on the list include Kima Ventures, Foundry Group, and New Enterprise Associates (among others). It should be noted that crowdfunding sites like Kickstarter and Indiegogo are among the most popular initial fun-seeking platforms for consumer electronics companies, and allow them to raise capital for production runs as well as assess demand and prove product-market-fit.

| Rank | Investor | Select Investments |

|---|---|---|

| 1 | HAX | Darma, Aria, Syrmo |

| 2 | Y Combinator | Pebble Technology, ShapeScale, Senic |

| 2 | Intel Capital | Razer, Skully Helmets, Recon Instruments |

| 4 | TechStars | Jewelbots, Revolar, Atlas |

| 5 | Kima Ventures | Sensibo, InSensi, Swivl |

| 6 | Foundry Group | Fitbit, Loop Labs, littleBits Electronics |

| 7 | True Ventures | Fitbit, Sano Intelligence, Soundhawk |

| 7 | Qualcomm Ventures | Pelican Imaging, Fitbit, Zeebo |

| 7 | Highway1 | Construkts, Wink Labs, Shortcut Labs |

| 10 | Samsung Ventures | Vinli, Jibo, Fove |

| 10 | New Enterprise Associates | Lytro, Olio Devices, Cape Productions |

| 10 | Felicis Ventures | InSensi, Sano Intelligence, Fitbit |

| 10 | First Round Capital | Ringly, Electric Objects, Thalmic Labs |

Exit trends

Exits have also been on the upswing, with 2015 reaching a high of 41 exits, more than any of the previous 5 years. Fitbit’s has been the largest exit in the space. The company was valued at $4.1B in its 2015 IPO. GoPro originally held the title, with a $3.1B valuation at the time of it’s IPO in 2014 (though the stock has tumbled in the public markets since then). There have not been many large exits in the space, with less than 30 $100M+ exits happening since 2010. However, as wearables and more IoT products increase in popularity, we can expect to see more exits happening in the future.

*Analysis did not include debt or grant rounds. Analysis was of first exits only.

Want more data on consumer electronics? Check out our venture capital database below.

If you aren’t already a client, sign up for a free trial to learn more about our platform.

Funding & Business

UK Can Get More From Oil, Gas With Faster Tax Change, Lobby Says

The UK can generate almost 25% more in taxes from oil and gas companies through 2050 if the Labour government replaces a contentious windfall levy on North Sea producers as soon as next year rather than waiting, according to an industry lobby group.

“Action is required now,” Offshore Energy UK said in its analysis of the nation’s fiscal policy impacts. The lack of an immediate response risks pushing the sector into “an accelerated decline” that includes a “loss of critical mass” of British oil and gas supply chain capability.

Funding & Business

Stock Market Today: Dow, S&P Live Updates for September 1

Asian investors may tread cautiously on Monday as uncertainty deepens following a U.S. federal appeals court ruling that President Donald Trump’s sweeping trade tariffs were illegal.

The dollar was steady against major peers in early trading while US equity futures edged higher. Contracts indicate losses for Australian and Japanese shares at the open, and gains in Hong Kong. US bond futures nudged lower, with the cash market closed for the Labor Day holiday.

Funding & Business

Tokyo Bourse Pressed for More Disclosure on Management Buyouts

The Tokyo Stock Exchange remains under pressure to do more to protect minority shareholders during management buyouts, just weeks after requiring more disclosures on such deals.

Pacific Industrial Co., a supplier for Toyota Motor Corp., and car-care products maker Soft99 Corp. are among companies that have announced plans to go private in management buyouts, since new rules came into effect on July 22.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Business2 days ago

Business2 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies