Funding & Business

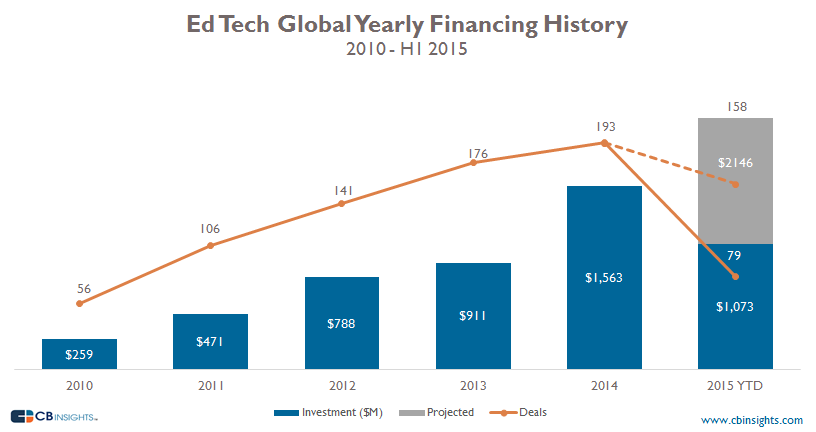

Funding To VC-Backed Education Technology Startups Grows 503% over 5 Years

Investments in education technology totaled $641M in Q1’15 alone.

Funding to education-technology companies is booming. Overall, the period from 2010 to 2014 saw more than a 503% growth in investment dollars.

The pace has held high even in recent quarters. Financing grew from $911M in 2013 to over $1.5B in 2014, a 71% increase year-over-year. In the last four quarters, including Q2’15, ed tech startups attracted $1.9B, a jump of 68% compared to the previous four quarters.

Meanwhile, deal count has carried along steadily. There were 193 deals in 2014, up from 176 in 2013. However, at the current run rate 2015 will see a deal count of 158, well below that of previous years which indicates that deals are becoming fewer yet larger. Note: This data only includes funding to VC-backed companies in the Ed Tech space.

Quarterly deals and dollars

The quarterly breakdown below reveals the recent surge in ed tech funding and deals. Q1’15 set a new high for ed tech financing, with a total of $641M in funding (equal to about 41% of the dollars going to ed tech in all of 2014).

The largest round in Q2’15 was a $100M investment in China-based education app developer Changingedu by Sequoia Capital China, among other investors. The biggest Q1’15 deal was $186M in growth equity to education and training site Lynda.com, in a round that included Accel Partners, Meritech Capital Partners, Spectrum Equity Investors, and TPG Growth. Lynda.com was later acquired by LinkedIn in Q2’15 for $1.5B.

Deals by investment stage

Looking at ed tech funding by investment stage we see a trend toward early-stage investments. The deal share of early-stage deals ramped up from 41% in 2011, to 69% in 2013. Since then, it’s held relatively high; in the first six months of 2015 early-stage deal share was 21%. Meanwhile, mid-stage investments have accounted for a growing share of deals, going from a 20% share in 2012, to 24% in 2014. Late-stage dollar share has also grown slowly, from 4% in 2011, to 7% in 2014, and up to 13% in the first half of 2015.

The dollar share breakdown by investment stage is far more variable. Early-stage deals represented a range of 23% to 40% of dollars invested from 2010 to 2014. In that time, middle stage dollars slid from from 58% to 51% of dollars invested. And late-stage deals saw a range of 10% to 35%, currently accounting for 28% of dollars in the first half of 2015.

Most active investors

The most active ed tech investor is NewSchools Venture Fund with investments in over 35 unique companies. NewSchools’ largest deal was their participation in a $23.5M Series D funding to electronic school-transcript company Parchment in 2012. NewSchools has also invested in Teachscape and Kidaptive. Second on the active ed tech investor list is 500 Startups, followed by Kapor Capital and Learn Capital.

500 Startups is the most active early-stage VC, with a majority of its investments going to early-stage companies. 500 Startups’ largest early-stage investments include seed deals to online learning companies Tynker and Colingo. NewSchools Venture Fund and Kapor Capital are tied for second most active.

Pluralsight, an online course company, is the most well-funded with a total of $203.5M invested by backers including Felicis Ventures and Insight Venture Partners. Learning platform Desire2Learn is second with $165M invested by Silicon Valley Bank, among others.

Looking for the most comprehensive set of private company Ed Tech financing and exit data? Check out the CB Insights Venture Capital Database. Sign up free below.

If you aren’t already a client, sign up for a free trial to learn more about our platform.

Funding & Business

China Factory Activity Slump Continues Despite US Tariff Relief

China’s factory activity remained stuck in contraction in August, as a government crackdown on price wars holds back production offset the boost for manufacturers of the US’ extended trade truce.

Source link

Funding & Business

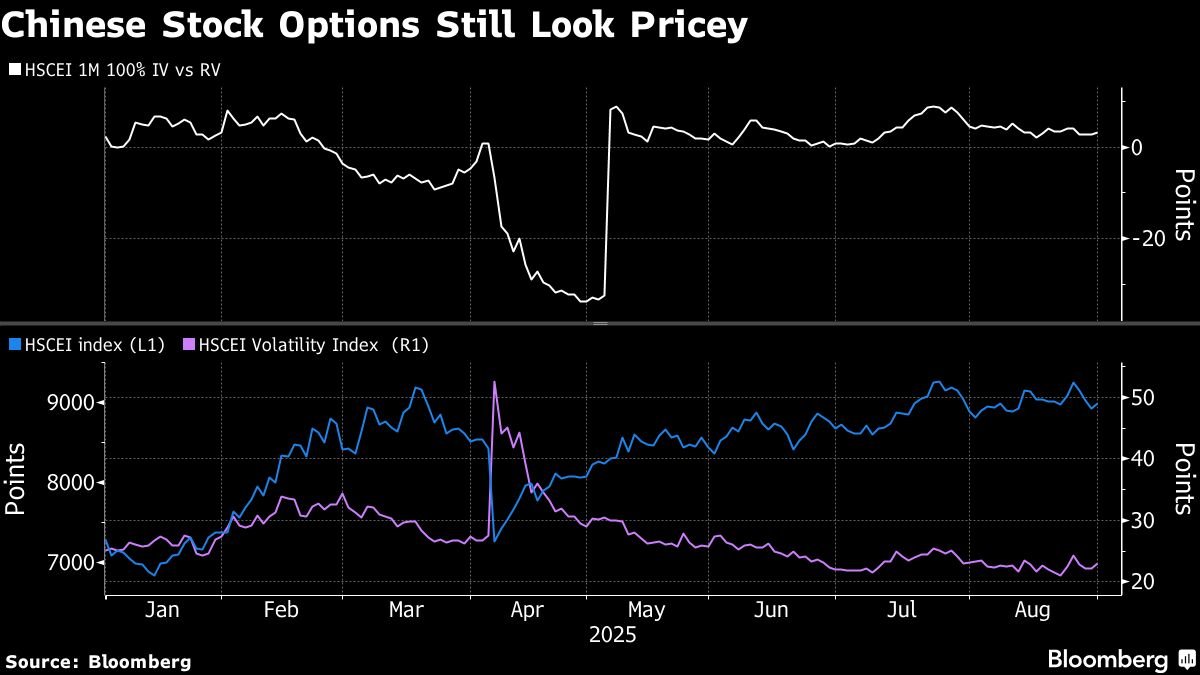

China’s Stock Rally Is Met With Skepticism in Options Market

While Chinese stocks traded in Hong Kong climbed for a fourth straight month, derivatives wagers show investors are skeptical about the market.

Source link

Funding & Business

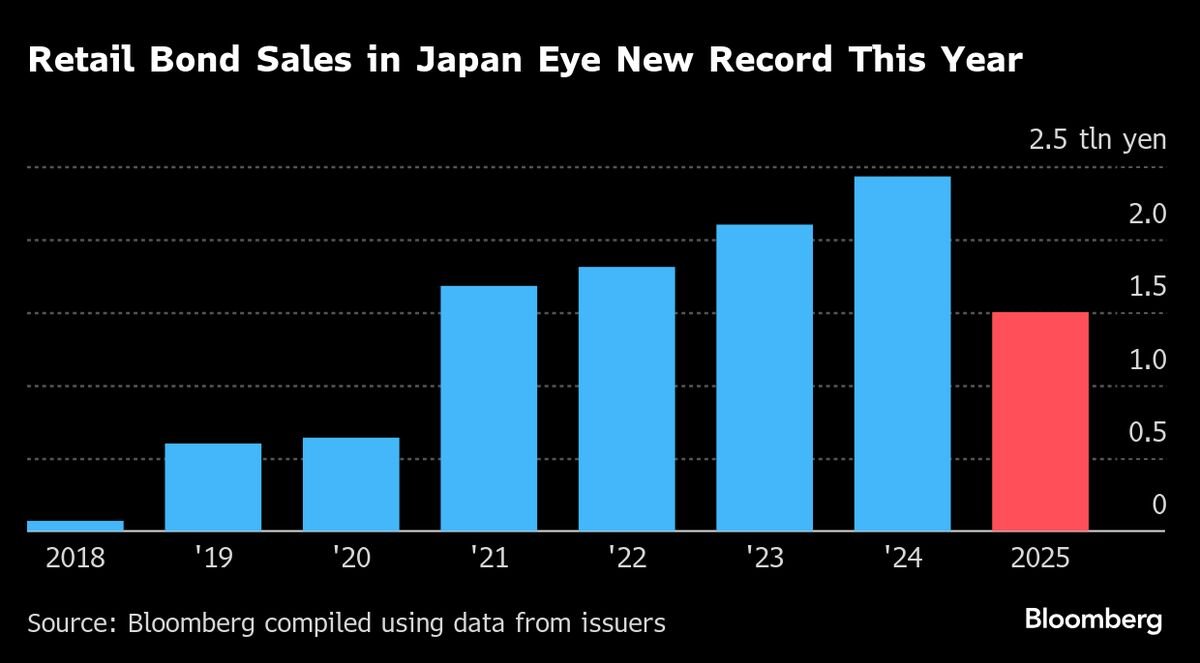

SoftBank, Rakuten Tap Japan’s Booming Retail Demand for Bonds

Sales of corporate bonds to Japan’s mom and pop investors are booming, on track to surpass last year’s record as bigger returns draw buyers looking to protect their savings from inflation.

Well-known names such as railway operator Keio Corp. and supermarket giant Aeon Co. are among those tapping the retail bond market, with the latter selling its debut retail bond on Friday.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle