By Amy Miller ( September 15, 2025, 23:52 GMT | Insight) — The deep-pocketed tech industry has proven once again that it can block efforts to regulate artificial intelligence, even in California. Even though California legislators approved more than a dozen bills aimed at regulating AI, from chatbot safety, to transparency, to data centers, several proposals attempting to put guardrails around AI died after facing concerted opposition, including the closely watched Automated Decisions Safety Act, which would have set new rules for AI systems that make consequential decisions about individuals.The deep-pocketed tech industry has proven once again that it can block efforts to regulate artificial intelligence, even in California….

AI Insights

Better Artificial Intelligence (AI) Stock: Nvidia vs. Broadcom

Both chipmakers dominate their respective niches in the AI semiconductor market and are growing at an impressive pace.

Nvidia (NVDA 0.41%) and Broadcom (AVGO 0.12%) have stamped their dominance on the artificial intelligence (AI) semiconductor market. Both chip designers are the dominant players in their respective AI chip niches, and that explains why they have been clocking solid growth.

The latest quarterly reports of Nvidia and Broadcom make it clear that the two companies are head and shoulders above their peers, such as Advanced Micro Devices and Intel, in AI chips. But if you have to buy one of these two semiconductor stocks right now to capitalize on the fast-growing AI chip market, which one should it be?

Let’s find out.

Image source: Getty Images.

The case for Nvidia

Nvidia dominates the market for AI graphics processing units (GPUs) used in data centers for tackling AI workloads. Its graphics cards play an instrumental role in training large language models (LLMs), and the company’s chips are now being deployed for AI inference applications as well. Jon Peddie Research estimates that Nvidia controlled a whopping 94% of the global GPU market at the end of the previous quarter. Nvidia’s terrific grip over this market can be attributed to two factors.

First, the company has a technological advantage over its rivals. It shot into the limelight by providing its A100 GPUs for training ChatGPT three years ago, and it has regularly updated its offerings since then. The A100 was manufactured on the company’s 7-nanometer (nm) Ampere platform. It then launched the H100 Hopper GPU based on a 5nm node, and it became a runaway hit for handling AI workloads.

And now, its latest-generation Blackwell processors are said to be 2.5 times faster than the Hopper processors. Rival AMD has been playing catch-up, but it has been unable to make a significant dent in Nvidia’s position so far.

This brings us to the second reason behind Nvidia’s AI dominance. Its foundry partner TSMC allocates the largest chunk of its manufacturing capacity to Nvidia. TSMC manufactures chips for all the leading AI chip designers, including Broadcom, but third-party reports indicate that the foundry giant has reserved 70% of its advanced chipmaking capacity for Nvidia.

So, Nvidia is in a terrific position to cater to the massive AI chip market that’s expected to generate $3.1 trillion in incremental revenue through 2030. Importantly, Nvidia’s dominance is translating into impressive financial growth. The company generated $90.8 billion in revenue in the first six months of the current fiscal year, up by 62% from the year-ago period.

Analysts expect Nvidia to end fiscal 2026 with $206 billion in revenue, which would be a 58% jump from last year. The good part is that it can sustain its healthy growth levels in the long run, considering the multitrillion-dollar opportunity in the AI chip market as well as the company’s ability to maintain its healthy share of this space. All this suggests that Nvidia can remain a top AI stock for a long time to come.

The case for Broadcom

Apart from GPUs, application-specific integrated circuits (ASICs) are also gaining solid traction in AI data centers. These chips can be customized to perform specific tasks, as opposed to GPUs, which are general-purpose computing chips. The custom nature of ASICs is the reason why they can perform the tasks they are programmed for with higher efficiency and power.

Major cloud computing and AI companies are now investing significantly in custom AI processors to lower their operating costs, and most of them are tapping Broadcom to help them design these chips. Broadcom reportedly controls 70% of the ASIC market. This explains why its growth has been fantastic.

The company’s AI revenue shot up 63% year over year in the previous quarter to $5.2 billion. This drove its overall revenue up by 22% year over year to $16 billion. Broadcom is on track to finish the current fiscal year with $20 billion in AI revenue, up from $12.2 billion in the previous year. Next year, its AI revenue is expected to more than double as per Wall Street analysts, and that won’t be surprising, as it has started shipping its custom AI chips to a fourth customer.

OpenAI is touted to be Broadcom’s latest customer for custom AI processors, placing a $10 billion order last quarter. Given that the company is engaged with another three cloud hyperscale customers for developing AI ASICs, there is massive room for Broadcom to grow its AI revenue in the long run.

After all, management pointed out earlier this year that its serviceable addressable market (SAM) from its first three hyperscale customers alone is going to be worth $60 billion to $90 billion in the next three years. The potential addition of new customers could increase that addressable opportunity and help Broadcom significantly multiply its AI revenue in the long run, considering its solid share of this space.

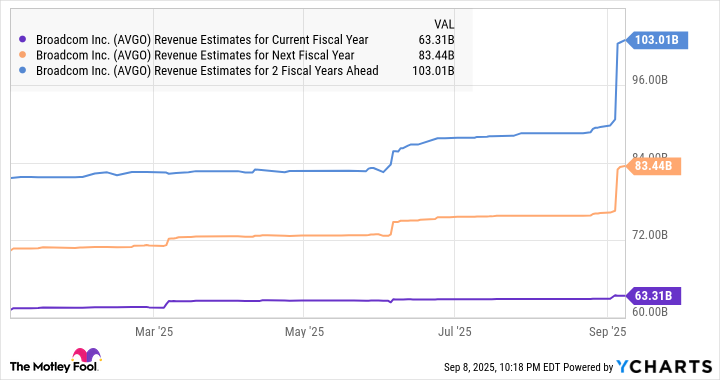

Not surprisingly, analysts have significantly bumped their revenue growth expectations.

Data by YCharts.

The verdict

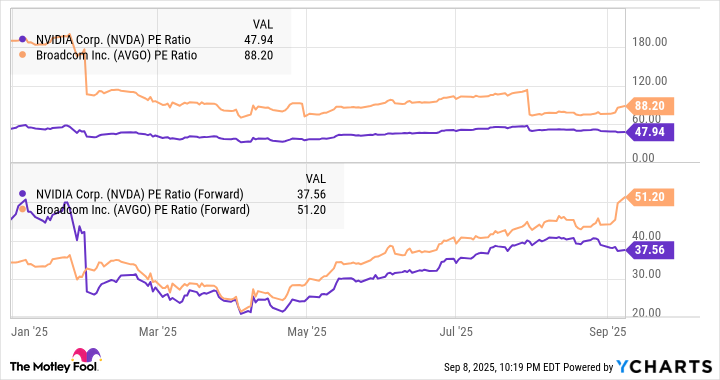

Both Broadcom and Nvidia control a solid share of their respective AI chip niches, and that’s why they are on track to clock remarkable growth. However, one of these two stocks is significantly cheaper than the other one.

Data by YCharts.

Nvidia’s earnings multiples are lower than Broadcom’s, and that’s despite the fact that Nvidia’s bottom line is growing at a much faster pace. Nvidia reported a 54% year-over-year increase in its earnings last quarter, much higher than the 36% growth reported by Broadcom. So, investors looking for a mix of value and growth could consider buying Nvidia right now.

But at the same time, Broadcom’s healthy AI revenue pipeline could allow it to justify the premium it is trading at, which is why investors with a higher appetite for risk can consider adding this growth stock to their portfolios as well.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: short August 2025 $24 calls on Intel and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

AI Insights

This Artificial Intelligence (AI) ETF Has Outperformed the Market By 2.4X Since Inception and Only Holds Profitable Companies

For well under $100, you can buy one share of this under-the-radar AI exchange-traded fund (ETF) that looks poised to continue to outperform the market.

For this article, I asked myself: Where would I start investing if I had less than $100 to invest?

Image source: Getty Images.

An AI ETF that’s concentrated and full of leading and profitable companies

This answer to my question popped into my head: I’d want a concentrated exchange-traded fund (ETF) focused on leading and profitable companies heavily involved in artificial intelligence (AI), but with enough differences among themselves.

Why an ETF? Because I’d not want to put all my (investing) eggs in one basket.

Why AI? Because it’s poised to be the biggest secular trend in many decades or even generations.

Why concentrated? Because I believe if investors are going to buy a very diversified ETF, they might as well buy the entire market, so to speak, and buy an S&P 500 index ETF. Indeed, buying an S&P 500 index fund is a good idea for many investors, and recommended by investing legend Warren Buffett. That said, over the long run, I think an AI ETF full of only leading and profitable companies will beat the S&P 500 index.

Roundhill Magnificent Seven ETF (MAGS): Overview

And bingo! There is such an ETF — the Roundhill Magnificent Seven ETF (MAGS 1.92%). It has seven holdings — the so-called “Magnificent Seven” stocks: Alphabet (GOOG 4.38%) (GOOGL 4.53%), Amazon (AMZN 1.42%), Apple (AAPL 1.06%), Meta Platforms (META 1.18%), Microsoft (MSFT 1.01%), Nvidia (NVDA -0.10%), and Tesla (TSLA 3.54%). This ETF closed at $62.93 per share on Friday, Sept. 12.

These megacap stocks (stocks with market caps over $200 billion) were given the Magnificent Seven name a couple of years ago by a Wall Street analyst due to their strong growth and large influence on the overall market. The name comes from the title of a 1960 Western film.

Two other main traits I like about this ETF:

- Its expense ratio is reasonable at 0.29%.

- It provides equal-weight exposure to the seven stocks. At each quarterly rebalancing, the stocks will be reset to an equal weighting of about 14.28% (100% divided by 7).

Since its inception in April 2023 (almost 2.5 years), the Roundhill Magnificent Seven ETF has returned 160% — 2.4 times the S&P 500’s 65.9% return.

Roundhill Magnificent Seven ETF (MAGS): All stock holdings

Stocks are listed in order of current weight in portfolio. Keep in mind the ETF is rebalanced quarterly to make stocks equally weighted.

|

Holding No. |

Company |

Market Cap |

Wall Street’s Projected Annualized EPS Growth Over Next 5 Years |

Weight (% of Portfolio) |

1 Year/ 10-Year Returns |

|---|---|---|---|---|---|

|

1 |

Alphabet | $2.9 trillion | 14.7% | 17.72% | 55.9% / 677% |

|

2 |

Nvidia | $4.3 trillion | 34.9% | 15.00% | 49.3% / 32,210% |

|

3 |

Apple | $3.5 trillion | 8.8% | 14.13% | 5.6% / 812% |

|

4 |

Tesla | $1.3 trillion | 13.4% | 13.81% | 72.3% / 2,270% |

|

5 |

Amazon | $2.4 trillion | 18.6% | 13.30% | 22% / 762% |

| 6 | Meta Platforms | $1.9 trillion | 12.9% | 13.16% | 44.3% / 725% |

| 7 | Microsoft | $3.8 trillion | 16.6% | 12.76% | 20.3% / 1,250% |

|

Overall ETF |

N/A |

Total net assets of $2.86 billion |

N/A |

100% |

40.5% / N/A |

|

N/A |

S&P 500 |

N/A |

N/A |

N/A |

19.2% / 300% |

Data sources: Roundhill Magnificent Seven ETF, finviz.com, and YCharts. EPS = earnings per share. Data as of Sept. 12, 2025.

All these companies are profitable leaders in their core markets, and heavily involved in AI. Nvidia produces AI tech that enables others to use AI, while the other companies mainly use AI to improve their existing products and develop new ones.

Alphabet’s Google is the world leader in internet search. Its cloud computing business is No. 3 in the world, behind Amazon Web Services (AWS) and Microsoft Azure. The company also has other businesses, notably its driverless vehicle subsidiary, Waymo. (You can read here why I believe Nvidia is the best driverless vehicle stock.)

Nvidia is often described as the world’s leading maker of AI chips — and that it is. But it’s much more. It’s the world leader in supplying technology infrastructure for enabling AI. It’s also the global leader in graphics processing units (GPUs) for computer gaming.

Apple’s iPhone holds the No. 2 spot in the global smartphone market, behind Samsung. However, it dominates the U.S. market. The company’s services business is attractive, as it consists of recurring revenue and has been steadily growing.

Amazon operates the world’s No. 1 e-commerce business and the world’s No. 1 cloud computing business. It also has many other businesses, notably its Fresh and Amazon Prime Now (Whole Foods) grocery delivery operations.

Meta Platforms operates the world’s leading social media site, Facebook, as well as Instagram, Threads, and messaging app WhatsApp.

Microsoft’s Word has long been the world’s leading word processing software. Word is part of Microsoft Office, a suite of popular software for personal computers (PCs). Its Azure is the world’s second-largest cloud computing business.

Tesla remains the No. 1 electric vehicle (EV) maker, by far, in the U.S. despite struggling recently. In the first half of 2025, China’s BYD surpassed Tesla as the world’s leader in all-electric vehicles by number of units sold. CEO Elon Musk touts that the company’s robotaxi and Optimus humanoid robot businesses will eventually be larger than its EV sales business.

In short, the Roundhill Magnificent Seven ETF is poised to continue to benefit from the growth of artificial intelligence. Technically, it doesn’t have a long-term history. But if it had existed many years ago, it’s easy to tell that its long-term performance would be very strong because the long-term performances of all its holdings have been anywhere from great to spectacular.

Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends BYD Company and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AI Insights

Tech industry successfully blocks ambitious California AI bill | MLex

Prepare for tomorrow’s regulatory change, today

MLex identifies risk to business wherever it emerges, with specialist reporters across the globe providing exclusive news and deep-dive analysis on the proposals, probes, enforcement actions and rulings that matter to your organization and clients, now and in the longer term.

Know what others in the room don’t, with features including:

- Daily newsletters for Antitrust, M&A, Trade, Data Privacy & Security, Technology, AI and more

- Custom alerts on specific filters including geographies, industries, topics and companies to suit your practice needs

- Predictive analysis from expert journalists across North America, the UK and Europe, Latin America and Asia-Pacific

- Curated case files bringing together news, analysis and source documents in a single timeline

Experience MLex today with a 14-day free trial.

AI Insights

These fields could see job cuts because of artificial intelligence, federal data says

Artificial intelligence has some excited and others scared, as the rapidly evolving technology impacts the job market.

Lucas Shriver is working hard at LEMA in St. Paul. A solar-powered battery station can now be used as a power source in a desert. It’s a project and a job that’s been a long time coming.

“I think I was about 7 years old when I built a tree house by myself,” Shriver said.

He earned his engineering degree from the University of St. Thomas in June. As a full-time employee, he is one of the lucky ones.

“In my own searching for jobs and my friends, the job market right now is quite difficult, and it does seem like people are looking for someone with five years of experience,” Shriver said.

His professor, John Abraham, agrees.

“The jobs at the bottom rung of a ladder for people to climb up to a corporation. Those are going away in the last two years,” Abraham said. “There’s 35% fewer entry-level, you’re a recent college graduate and you’re looking for a job, you’re up a creek, you’re up a creek.”

Federal data suggests three fields that will feel potential cuts because of AI: Insurance adjusting, credit analysis and paralegals. The data also suggests growth could come in the software, personal finance and engineering fields.

For job seekers of any age or field, Abraham suggests learning how to use artificial intelligence.

“This is a tool that increases effectiveness so much, you just have to know it if you’re going to compete,” he said.

And Shriver has the job to prove it.

“I have no idea where this is going, but as for today, I am gonna use AI,” he said.

Abraham says jobs with empathy, like counseling and health care may be safer from AI; he also says the trades will likely still be in demand.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers3 months ago

Jobs & Careers3 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education3 months ago

Education3 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business3 months ago

Funding & Business3 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries