Funding & Business

JLL CEO Ulbrich on the Global Commercial Real Estate Landscape

JLL is a Fortune 200 company and one of the largest consultancies in the world, specializing in real estate and investment management. JLL generates $23.4 billion in annual revenue, with a global workforce of over 112,000 across 80+ countries. The commercial real estate giant has seen office leasing activity worldwide increase both quarterly and year-over-year, with first-half volumes in 2025 reaching their highest level since 2019.

Christian Ulbrich, President and CEO of JLL, discusses the signs of stability and explains why he sees cause for cautious optimism heading toward the end of the year. Christian speaks with Bailey Lipschultz and Katie Greifeld on Bloomberg Businessweek Daily. (Source: Bloomberg)

Source link

Funding & Business

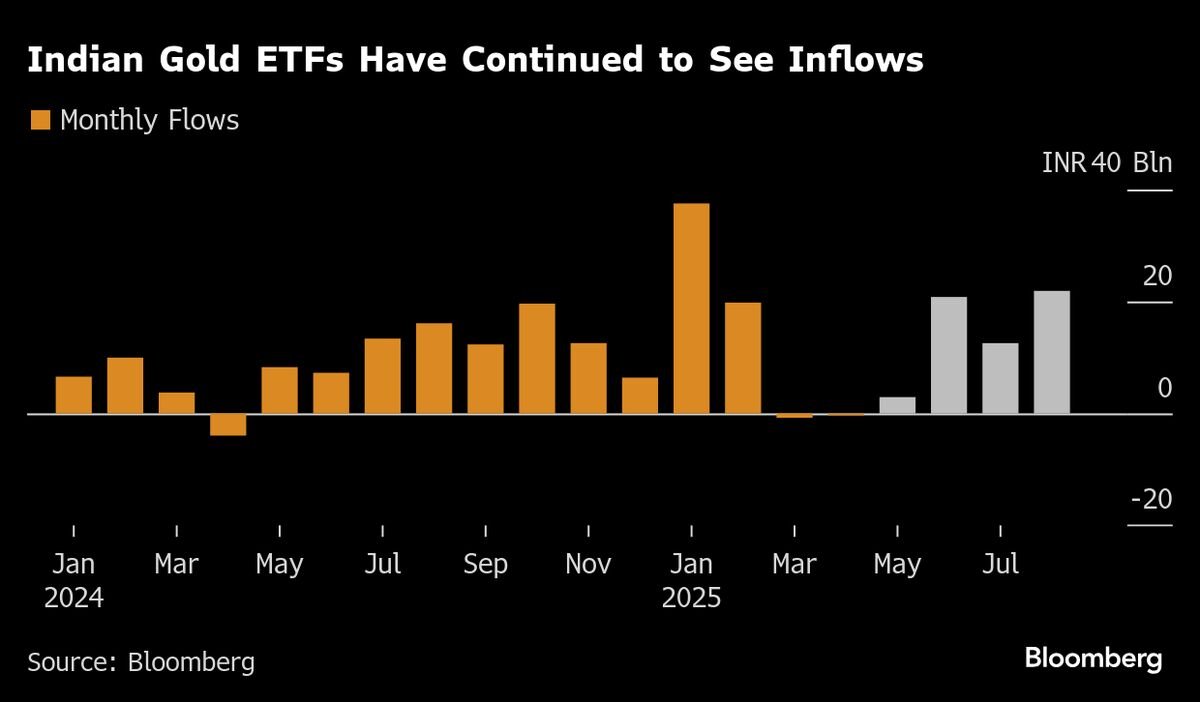

Indian Gold ETFs Continue to Shine on Safe Haven Appeal

Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

Source link

Funding & Business

Top Japan Leaser Orix Plans to Boost Property Fund Size by 33%

Orix Corp.’s real estate investment unit has raised the target size of one of its funds by 33%, reflecting rebounding Japanese institutional investor demand for property market deals.

Source link

Funding & Business

China’s Summer of Economic Weakness Likely Stretched Into August

China’s economy likely endured another month of weakness in August, with a slowdown in industrial output and investment offsetting a slight improvement in retail sales.

Official data due Monday will show factory production increased 5.6% in August from a year earlier, down from a 5.7% gain in the previous month, according to the median forecast in a Bloomberg survey. Retail sales growth is expected to pick up slightly to 3.8% after the weakest gain all year, while fixed-asset investment probably had its slowest expansion in almost half a decade.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi