AI Insights

A Platform Leader’s Path to Sustained Dominance

This article first appeared on GuruFocus.

Salesforce (NYSE: CRM) offers a compelling long-term opportunity due to its leadership in the customer relationship management (NYSE:CRM) market, expanding AI integration, and growing addressable market. because of its continuous leading position in the customer relationship management (NYSE:CRM) market, the fast-growing adoption of artificial intelligence, and rapidly increasing the total addressable market. The business model that the company provides allows subscriptions and grants profits that are predictable, moreover, the platform-based approach increases the switching costs and provides opportunities to expand within the existing client bases. Thus, theThe business model enables high visibility into recurring revenue and long-term client retention.

Standing at the forefront of the global CRM market, Salesforce has captured nearly a quarter (23%) of the market share, leaving behind formidable adversaries like Microsoft, Oracle, and SAP. The position of being number one provides Salesforce with a multilayer competitive fortifications; thus, it builds a strong economic moat.

Network Effects and Ecosystem Dominance: There are over 4,000 applications on the AppExchange belonging to the Salesforce ecosystem, reinforcing its self-expanding cycle where developers attract customers, and vice versa. This network effect, which grows stronger with the addition of new applications thus the ecosystem expands, creates a barrier to entry that competitors find it almost impossible to duplicate. Independent software vendors (ISVs) devote a large amount of time and energy in creating applications that work with Salesforce, which in turn, makes the customers think that if they switch to another platform they would be missing out on the benefits of the whole partner network.

Data Network Effects: The greater the number of customers availing of Salesforce services, the larger is the amount of the data which is being accumulated by the platform on customer interactions across different sectors and applications. This data facilitates the enhancement of AI models, predictive analytics, and benchmarking capabilities; thus, the platform continues to generate value that compounds over the years and is not easily reproduced by new entrants.

Salesforce’s artificial intelligence strategy is a key component not just because it adds features, Salealos because sforce’s artificial intelligence strategy enhances its platform differentiation and supports operational leverage.. The company introduces the next generation of AI technology and improves the algorithmic base inspiring the organizations to work different with the which they produce and hold about their own customer data.

AI Insights

Artificial intelligence can predict risk of heart attack – mydailyrecord.com

AI Insights

China’s Open-Source Models Are Testing US AI Dominance

While the AI boom seemingly began in Silicon Valley with OpenAI’s ChatGPT three years ago, 2025 has been proof that China is highly competitive in the artificial intelligence field — if not the frontrunner. The Eastern superpower is building its own open-source AI programs that have demonstrated high performance as they put ubiquity and effectiveness over profitability (while still managing to make quite a bit of money), the Wall Street Journal reports.

DeepSeek is probably the most well-known Chinese AI entity in the U.S., whose R1 reasoning model became popular at the start of the year. Being open-source, as opposed to proprietary, means these programs are free and their source code can be downloaded, used and tinkered with by anyone. Qwen, Moonshot, Z.ai and MiniMax are other such programs.

This is in contrast to U.S. offerings like ChatGPT, which, though free to use (up to a certain level of compute), are not made available to be modified or extracted by users. (OpenAI did debut its first open-source model, GPT-OSS, last month.)

American companies like OpenAI are racing to catch up — monopolies and industry-standard technologies are often the ones that are the most accessible and customizable. The Trump administration wagered that open-source models “could become global standards in some areas of business and in academic research” in July.

Want to join the conversation on how the security of information and data is impacting our global power struggle with China? Attend the 2025 Intel Summit on Oct. 2, from Potomac Officers Club. This GovCon-focused event will include a must-attend panel discussion called “Guarding Innovation: Safeguarding Research and IP in the Era of Strategic Competition With China.” Register today!

China’s Tech Progress Has Big Implications

The Intel Summit panel will feature, among other distinguished guests, David Shedd, a highly experienced intel community official who was acting director of the Defense Intelligence Agency (after serving as its deputy director for four years) and deputy director of national intelligence for policy, plans and procedures.

Shedd spoke to GovCon Wire in an exclusive interview about China-U.S. competition ahead of his appearance on the panel. He said that China’s progress in areas like AI should not be taken lightly and could portend greater problems and tension in the future.

“Sensitive IP or technological breakthroughs in things like AI, stealth fighter jets, or chemical formulas lost to an adversary do not happen in a vacuum. They lead, instead, to the very direct and very serious loss of the relative capabilities that define and underpin the balance and symbiosis of relationships within the international system,” Shedd commented.

Open-source models are attractive to organizations, WSJ said, because they can customize the programs and use them internally and protect sensitive data. In their Intel Summit panel session, Shedd and his counterparts will explore how the U.S. might embrace open-source more firmly as a way to stay agile in the realm of research and IP protection.

Who Is Stronger, America or China?

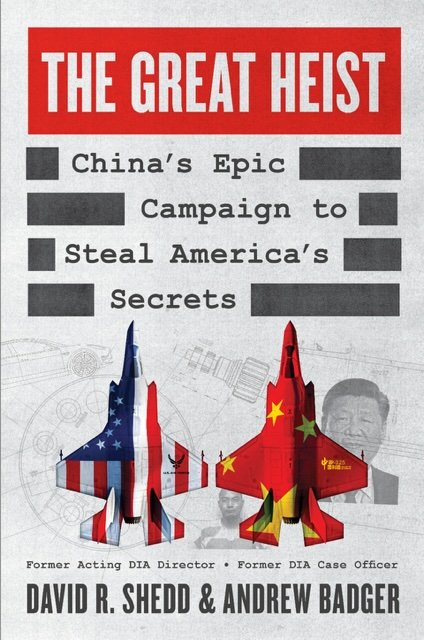

Shedd, along with co-author Andrew Badger, is publishing a book on December 2 entitled “The Great Heist: China’s Epic Campaign to Steal America’s Secrets.” Published through HarperCollins, the volume will focus on the campaign of intellectual property theft the Chinese government is waging against the U.S.

Shedd elaborated for us:

“The PRC/CCP’s unrelenting pursuit of stolen information from the West and the U.S. in particular has propelled China’s economic and military might to heights previously unimaginable. Yet we collectively continue to underestimate the scale of this threat. It’s time for the world to fully comprehend the depth and breadth of China’s predatory behavior.

Our national security depends on how we respond—and whether we finally wake up to the reality that China has already declared an economic war on the West using espionage at the forefront of its campaign. It already has a decades-long head start.”

Don’t miss former DIA Acting Director David Shedd, as well as current IC leaders like Deputy Director of National Intelligence Aaron Lukas and CIA’s AI office Deputy Director Israel Soong at the 2025 Intel Summit on Oct. 2! Save your spot before it’s too late.

AI Insights

Move Over Palantir. This Artificial Intelligence (AI) Stock Just Took Over as the S&P 500’s Best Performer in 2025.

This AI-driven megatrend has sent this stock and its closest competitor rocketing higher in 2025.

Many artificial intelligence (AI) stocks have zoomed higher over the last three years, following the introduction of OpenAI’s ChatGPT. One of the biggest winners, by far, has been Palantir Technologies (PLTR 2.70%). The enterprise software company integrated generative AI into its software in 2023, and it’s seen sales and profits soar ever since. The stock is up a cumulative 2,500% since the start of 2023, including a 120.7% rise in 2025 alone, as of this writing.

Up until last week, that was good enough to make it the best performer in the S&P 500 at the moment. But another stock overtook the market darling’s year-to-date performance at the start of September, boosted by the voracious demand for artificial intelligence. Say hello to the new best-performing stock in the S&P 500.

Image source: Getty Images.

Essential infrastructure for AI data centers

Big tech companies are spending hundreds of billions of dollars on building out data centers and outfitting them with servers. Chipmakers like Nvidia have benefited greatly as demand for graphics processing units (GPUs) and custom AI accelerators continues to climb. But there’s another important component to building out data centers: Storage.

AI training is extremely data-intensive. While some of that data needs to be readily accessible quickly, a lot of it can be held in what’s called “nearline” storage. Nearline storage might take a few seconds to access, but it’s a cheap and effective way to maintain the huge amounts of data needed for large language models.

Hard drive maker Seagate Technology (STX 0.76%) has seen demand for nearline storage explode, helping push its stock to a 121.4% gain so far this year, as of this writing. That’s better than every other stock in the S&P 500, including Palantir.

The company shipped 137 exabytes of capacity to data center customers last quarter, up 14% sequentially and 52% year over year. The financial results are just as impressive. Revenue grew 39% in fiscal 2025. Gross profit margin expanded to 35.2% from 23.4% last year. Fourth-quarter gross margin was even more impressive at 37.4%, as the market remains supply-constrained.

Seagate is one of two major suppliers of hard drives. Western Digital (WDC 0.51%) remains its biggest rival, maintaining a nearly equal share of the market. Unsurprisingly, Western Digital is also a top-performing stock this year, as it benefits from the exact same mega trend as Seagate. While both have made strides in increasing storage capacity per unit, there’s still a limit to how much each can produce. Thus, they’ve both seen strong gross margin expansion.

Tech companies are planning to keep spending on new data centers and the necessary increased storage capacity that comes along with them. Seagate’s management expects data center storage demand to climb from $13 billion in 2024 to $23 billion by 2028. Western Digital shared a similar outlook at its investor day in February. As a result, the current cycle of growth could extend for years to come.

Is it worth the price?

Hard drives are kind of a commodity for data centers. A buyer could use any supplier, and the hard drives will fit into the same exact spot in their data center as any other hard drive would. The only major difference is how much storage capacity each drive has, which makes price per terabyte (TB) the biggest deciding factor for a buyer.

As a result, competition between Seagate and Western Digital has typically kept pricing low and pushed new technology forward relatively quickly. Margin expansion only really happens when there’s a huge demand cycle like we’re currently seeing. When the cycle ends, and it will, both companies will see deterioration in their margins until the next uptick in demand.

Seagate seems to have developed a slight technology lead. Its heat-assisted magnetic recording (HAMR) process is on track to be able to scale production of 40TB hard drives by the second half of fiscal 2026 (early calendar 2026). Western Digital isn’t on track to start mass production of 40TB hard drives — it’s about six months behind. That could open the door for Seagate to take some market share over the next few years and grow slightly faster than its chief rival.

At a forward price-to-earnings (P/E) ratio of 18.5, investors may think Seagate is an absolute bargain compared to most AI stocks. When you compare it with Palantir’s eye-popping 245 times earnings multiple, it seems extremely cheap. But it’s important to put that in context.

While Seagate is growing earnings extremely quickly right now, it’s still in a cyclical industry. Cyclical stocks tend to trade at much more attractive earnings multiples amid upcycles in demand. That’s because they could see a massive drop in earnings power if demand dries up, or even if supply growth starts to outpace demand.

For a point of reference, Western Digital trades for a forward P/E ratio close to 14. While Seagate may deserve a slight premium to Western Digital, both are trading at a premium to their historic pricing over the past year after their recent run to put them at the top of the S&P 500’s best-performers list. At this point, it might be worth waiting for a better price on both stocks before buying into the latest big winner from artificial intelligence spending.

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi