Business

How AI Is Revolutionizing Cloud Migration and Application Modernization

Cloud migration and application modernization have become make-or-break imperatives for enterprises, yet traditional approaches often stumble under the weight of complexity and legacy systems. Now, agentic AI is revolutionizing this challenge, offering business leaders a faster, smarter path to cloud transformation — and reshaping what’s possible for organizations ready to embrace it.

The Migration Imperative and AI’s Transformative Role

Cloud adoption is on the rise again in 2025, with Foundry reporting that 63% of businesses are accelerating cloud migration plans. AI is a central driver of that growth. This surge reflects a growing recognition that AI capabilities, cloud infrastructure, and application modernization are increasingly interconnected.

However, many organizations find themselves constrained by legacy workloads that are ill-suited for cloud environments. The struggle is that these same workloads contain critical applications and data that should be at the core of any AI strategy.

“Agentic AI represents a paradigm shift in how we approach enterprise IT transformation,” says Swami Sivasubramanian, VP of agentic AI at Amazon Web Services (AWS). “It’s not just about automating repetitive tasks. It’s about having an AI system that can understand the nuances of your application landscape, make intelligent decisions, and execute migrations with minimal human intervention.”

These AI systems create an entirely new migration experience by using advanced foundation models, LLMs, machine learning, graph neural networks, and automated reasoning.

Agentic AI: Your Team’s New Transformation Assistant

AWS Transform, the first agentic AI service developed to accelerate enterprise modernization of .NET, VMware, and mainframe workloads, is revolutionizing cloud migration by automating manual processes while keeping IT teams in control. The service’s AI agents act as transformation assistants, collaborating with customers and partners to tailor migration projects to specific needs.

The power of these agents lies in their ability to automate complex tasks that once required weeks and months of manual effort and multiple specialized teams. Where IT staff previously spent countless hours manually discovering workloads, mapping complex dependencies, and analyzing infrastructure requirements, AI agents now handle these tasks automatically and generate customized migration and modernization strategies. These strategies include precise recommendations for rightsizing, financial modeling, and cost optimization. During execution, these AI agents can autonomously migrate workloads, convert legacy code, and modernize database structures, significantly accelerating the entire process.

The results are dramatic: assessment tasks that typically take weeks are now completed in minutes, enabling data-driven decisions from day one. For .NET applications, organizations are modernizing applications up to 4x faster while achieving up to 40% reduction in licensing costs. VMware migration planning is reduced from weeks to minutes, with network translations being completed up to 80 times faster. Mainframe modernization of IBM z/OS applications is accelerated from years to months, including automated documentation generation.

“We were spending too much time upgrading old code manually. It was slowing us down and competing with our road map. Other cloud providers’ tooling helped, but wasn’t designed to modernize at scale or harness generative AI. We needed a leap, not just an incremental fix,” explained Matt Dimich, VP, Platform Engineering Enablement, Thomson Reuters. “AWS Transform felt like an extension of our team— constantly learning, optimizing, and helping us move faster.”

Experience Meets AI: Powering Transformation at Scale

An AI system is only as good as the knowledge that powers it. In enterprise transformation, decades of migration experience, industry expertise, and proven methodologies form the critical building blocks that help AI agents make informed decisions about complex workloads. This deep domain knowledge enables AI to understand not just what to migrate, but how to preserve business logic, maintain compliance, and optimize costs throughout the process.

“This shift from scripts and disconnected tools to intelligent, self-learning, automated workflows help enterprises modernize their most complex workloads with speed and confidence,” explains Dr. Asa Kalavade, VP of AWS Transform. AWS brings two decades of cloud migration expertise to this challenge, incorporating lessons learned from thousands of successful migrations across Microsoft, VMware, SAP, and mainframe workloads.

The power of this approach multiplies through partner collaboration. Global leaders can embed their domain expertise directly into transformation workflows, creating what Sivasubramanian calls “a powerful force multiplier” that “allows organizations to tackle even the most complex migrations with confidence.” Partners like Accenture, Capgemini, CAST Software, IBM Consulting, and Mission Cloud bring industry-specific knowledge that enhances the AI’s ability to handle unique business requirements and compliance needs.

Beyond Migration: Powering the AI-Driven Enterprise

AI-powered migration is more than a move to the cloud—it’s a springboard for future innovation. By modernizing applications and infrastructure with cloud-native technologies, organizations create a foundation for advanced AI and machine learning initiatives. As Sivasubramanian notes, “We’re just scratching the surface of what’s possible. The organizations that embrace this technology now will be best positioned to lead in the AI-driven future.”

For business and technology leaders, the message is clear: AI-powered cloud migration and modernization is a transformative approach that will redefine enterprise operations in the digital age. Early adopters stand to gain significant competitive advantages in an increasingly AI-powered world.

The future of business is in the cloud, powered by AI. Are you ready to lead?

To learn how AI can accelerate your cloud journey, visit https://aws.amazon.com/ai/generative-ai/

This post was created by AWS with Insider Studios.

Business

Spending without thinking is a risk with unlimited contactless cards

Kevin PeacheyCost of living correspondent and

Tommy LumbyBusiness data journalist

Getty Images

Getty ImagesSpontaneous spending is likely to rise if the limit on contactless cards is increased or scrapped entirely, academics say.

At present, the need to press a four-digit PIN for purchases over £100 gives people a timely prompt about how much they are paying, lowering the risk of debt-fuelled purchases.

Earlier this week, the UK’s financial regulator proposed that banks and card providers set their own limits, or are allowed to remove them entirely. That would make entering a PIN even more of a rarity.

Banks, and some BBC readers, say consumers should be able to set their own contactless limits, as debate on the issue picks up ahead of a final decision later in the year.

Reckless or over-regulated?

Contactless payments have become part of everyday life for millions of people across the world.

When they were introduced in the UK in 2007, the transaction limit was set at £10. Increases in the threshold since then included relatively big jumps around the time of the pandemic, to £45 in 2020, then to £100 in October 2021.

They prompted surges in the average contactless spend.

Clearly, the average would rise because more, higher value, purchases could be made via contactless, without a PIN.

But what is much harder to quantify is whether people were spending more frequently, and larger amounts, than would have been the case if they had needed to enter a PIN.

Richard Whittle, an economist at Salford Business School, says the extra convenience for consumers can come at a cost.

“If this ease of payment leads to consumers spending without thinking, they may be more likely to buy what they don’t really want or need,” he says.

He says this could be a particular issue with credit cards, when people are spending borrowed money and accumulating debt. He believes regulators should consider whether to have different rules for contactless credit cards than for contactless debit cards.

Stuart Mills, a lecturer in economics at the University of Leeds, says cash gives “visible and immediate feedback” on how much money you have, while a PIN is an “important friction point” for controlling spending.

“Removing such frictions, while offering some convenience benefits, is also likely to see many more people realising they’ve spent an awful lot more than they ever planned to,” he says.

Both these academics have raised this concern before, but this is not solely a theoretical argument.

In the Kent market town of Sevenoaks, shopper Robert Ryan told the BBC that entering a PIN “does give me a bit of a prompt to make sure I’m not overspending on my tap-and-go”.

However, the reality for many people is that, under pressure from the cost of living, they are rarely spending more than £100 in one go anyway, so contactless has become the norm.

Research by Barclays suggests nearly 95% of all eligible in-store card transactions were contactless in 2024.

Terezai Takacs, who works in a florists in Sevenoaks, says that over the last couple of years people were cutting back on spending, such as asking for smaller bouquets.

Technology takeover

Ms Takacs also points out that the majority of customers now pay via the digital wallet on their smartphone.

Paying this way already has an unlimited payment limit, owing to the in-built extra security features such as thumbprints or face ID.

Dr Whittle says that is likely to dilute the impact of raising the contactless card limit on spontaneous, or reckless, spending – because young people, in particular, are paying by phone.

Some say scrapping the contactless card limit is overdue, because it is far less relevant when people are accustomed to PIN-free spending on a phone.

“Regulators are finally catching up with how people actually pay,” says Hannah Fitzsimons, chief executive at fintech company Cashflow.

“Digital wallets on smartphones face no limits, so why should cards be stuck in the past?”

If the contactless card limit were to increase or be scrapped, then it would push the UK further on than much of Europe, and more in line with rules in other advanced economies.

In Canada, the industry sets the level rather than regulators, and it is set by providers in the US and Singapore – a model which the Financial Conduct Authority (FCA) wants to replicate in the UK.

Banks agree with the regulator, although UK Finance – the industry trade body – says “any changes will be made thoughtfully with security at the core”.

Personal choice

Banks and card providers that do change limits will be encouraged to allow customers to set their own thresholds, or turn off contactless entirely on their cards.

Gabby Collins, payments director at Lloyds Banking Group – the UK’s biggest bank, says: “Lloyds, Halifax and Bank of Scotland customers can already set their own contactless payment limits in our apps – in £5 steps, up to £100 – and we’re absolutely committed to keeping that flexibility.”

That option has support among some BBC readers, viewers and listeners who contacted us on this topic through Your Voice, Your BBC News.

Ben, aged 36, from London, told us: “The most important principle here is personal choice. I would like to set my own personal limit.

“It is my card and my choice based on convenience and risk tolerance. Some banks do not allow for this. This option has to be provided to everyone.”

Others have concerns over security, saying that unlimited contactless cards would become more of a temptation to thieves and fraudsters.

‘Limitless abuse’

Charities warn that not everyone has the digital skills to set their own limits. In other circumstances, it can have an extremely serious impact on people’s lives.

Sam Smethers, chief executive of Surviving Economic Abuse, says unlimited contactless cards give controlling partners the opportunity for limitless economic abuse.

“Unlimited contactless spending could give abusers free access to drain a survivor’s bank account with no checks or alerts,” she says.

“This could leave a survivor without the money they need to flee and reach safety, while pushing them even further into debt.”

She warns that it could also hasten the shift towards a cashless society.

Cash is a lifeline to many survivors because it was the only way to escape abusers who can monitor online transactions, withhold bank cards and close down bank accounts, she says.

Additional reporting by Andree Massiah

Business

Elon Musk calls for dissolution of parliament at far-right rally in London | Elon Musk

Elon Musk has called for a “dissolution of parliament” and a “change of government” in the UK while addressing a crowd attending a “unite the kingdom” rally in London, organised by the far-right activist Stephen Yaxley-Lennon, known as Tommy Robinson.

Musk, the owner of X, who dialled in via a video link and spoke to Robinson while thousands watched and listened, also railed against the “woke mind virus” and told the crowd that “violence is coming” and that “you either fight back or you die”.

He said: “I really think that there’s got to be a change of government in Britain. You can’t – we don’t have another four years, or whenever the next election is, it’s too long.

“Something’s got to be done. There’s got to be a dissolution of parliament and a new vote held.”

This is not the first time Musk has involved himself in British politics. He started a war of words with the UK government over grooming gangs and also criticised 2023’s Online Safety Act, calling the legislation a threat to free speech.

He had a warm relationship with Nigel Farage, and there were even rumours he could channel a donation to his party before the Tesla boss called for the Reform UK leader to be replaced during a dispute over his support for Robinson.

Musk told the crowd in central London: “My appeal is to British common sense, which is to look carefully around you and say: ‘If this continues, what world will you be living in?’

“This is a message to the reasonable centre, the people who ordinarily wouldn’t get involved in politics, who just want to live their lives. They don’t want that, they’re quiet, they just go about their business.

“My message is to them: if this continues, that violence is going to come to you, you will have no choice. You’re in a fundamental situation here.

“Whether you choose violence or not, violence is coming to you. You either fight back or you die, that’s the truth, I think.”

Musk also told the crowd “the left are the party of murder”, referring to the death of Charlie Kirk.

He said: “There’s so much violence on the left, with our friend Charlie Kirk getting murdered in cold blood this week and people on the left celebrating it openly. The left is the party of murder and celebrating murder. I mean, let that sink in for a minute, that’s who we’re dealing with here.”

He also criticised what he called the woke mind virus and said decisions for advancement should be on merit rather than “discrimination on the basis of sex, or religion or any race or anything else”.

He said: “A lot of the woke stuff is actually super-racist, it’s super-sexist and often it’s anti-religion, but only anti-Christian, like why anti-Christian? That’s unfair … that should be all that matters, the woke mind virus, that I call it, is against all that.”

More than 110,000 people were estimated to have taken part in the far-right street rally, in what is thought to be one of the largest nationalist events in decades. The marchers were faced by about 5,000 anti-racist counter-protesters.

In addition to Musk, figures including Katie Hopkins and French far-right politician Éric Zemmour were invited to speak at the event.

PA Media contributed to this report

Business

Can Veritone’s (VERI) Expanding Government AI Focus Reshape Its Long-Term Business Model?

- In the past week, Veritone completed a US$25 million follow-on equity offering and presented at the H.C. Wainwright Global Investment Conference, showcasing its AI-driven solutions for government and law enforcement sectors as well as a promising Veritone Data Refinery pipeline.

- An interesting insight is Veritone’s focus on securing direct government contracts and progressing toward a pure AI-centric model, supported by validation from early proof-of-concept contracts with agencies such as the U.S. Navy.

- We’ll examine how Veritone’s accelerated push into government AI and recent contract validation influences the company’s investment outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Veritone Investment Narrative Recap

Investors in Veritone need conviction in the company’s ability to grow its AI and Data Refinery offerings, particularly through pipeline momentum and government contracts, while the threat of continued net losses and cash needs looms large. The recent US$25 million equity raise bolsters short-term liquidity and reduces near-term capital constraints, but it is not a fundamental game changer, persistent operating losses and the need for future fundraising remain the most pressing risk for shareholders.

Among the recent developments, completion of the US$25 million follow-on equity offering stands out as the most directly relevant. This fundraising, together with revised credit covenants, helps support operational runway as Veritone works to convert government and enterprise pipeline into revenue. However, the increased share count introduces further dilution, reinforcing the importance of achieving sustainable, profitable growth as a key catalyst.

By contrast, sustained access to capital is not guaranteed for any loss-making company for long, making it critical that investors pay close attention to…

Read the full narrative on Veritone (it’s free!)

Veritone’s narrative projects $158.0 million revenue and $20.7 million earnings by 2028. This requires 20.2% yearly revenue growth and a $114.1 million increase in earnings from -$93.4 million today.

Uncover how Veritone’s forecasts yield a $5.25 fair value, a 41% upside to its current price.

Exploring Other Perspectives

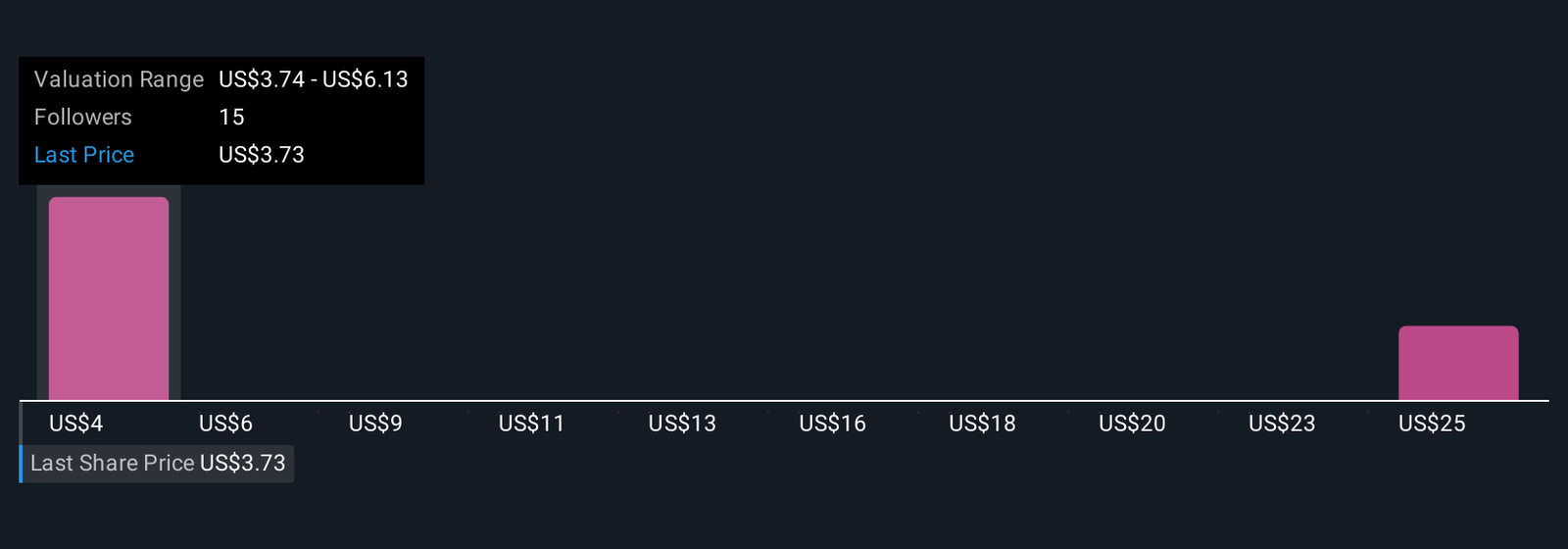

Six fair value estimates in the Simply Wall St Community span from US$3.74 to US$27.68, revealing sharply conflicting outlooks. With persistent net losses still a critical challenge, you can see why opinions differ so widely on Veritone’s future, explore how these diverse perspectives could shape your own view.

Explore 6 other fair value estimates on Veritone – why the stock might be worth just $3.74!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries