AI Research

How Leading Enterprises Really Measure Gen AI ROI

Everything you always wanted to know about how to measure the return on investment of generative AI (and agentic AI) comes down to one anecdote: The Soviet Nail Factory.

AI Research

Driving Innovation in Learning and Research at Chula through AI – Chulalongkorn University

On September 5, 2025, the Social Research Institute of Chulalongkorn University organized an international public lecture titled “AI in Higher Education for Innovation in Learning & Research”, delivered by Dr. Muthu Kumar Chandrasekaran, an expert in artificial intelligence and computer technology and former Applied Science Manager at Amazon AI, at Chula Narumit House. The event was officially opened by Professor Dr. Wilert Puriwat, President of Chulalongkorn University, with Associate Professor Dr. Unruan Leknoi, Director of the Social Research Institute, delivering the welcoming remarks. A panel discussion followed, featuring Dr. Philip Soung Soo Cho, a researcher at Chula’s Social Research Institute.

President, Chulalongkorn University

Director, Social Research Institute, Chulalongkorn University

Expert in Artificial Intelligence and Computer Technology and former Applied Science Manager, Amazon AI

Objectives of the Lecture

The lecture aimed to create a platform for knowledge exchange on Artificial Intelligence (AI) between international experts and Thai academics. It also sought to provide guidance on enhancing the quality of teaching and research in Thai universities to meet global standards.

Elevating Thai Universities to the Global Stage:

The session shared best practices for applying AI to improve teaching and research. The evolution began during the MOOC era (2012–2020), with platforms such as Coursera, Canvas Network, Diversity, and Udacity.

In the pre-Generative AI era, AI applications focused on:

- Automated grading systems

- Assessing participation in online classrooms

- Scripted intelligent tutoring systems

In the current era of Generative AI and Agentic AI, developments have become more personalized, enabling the creation of personal AI tutors and positioning AI as a key tool for future learning.

Building International Networks:

The event brought about greater opportunities for collaboration between Chulalongkorn University and global academic and tech experts, reinforcing Thailand’s role in the international AI discourse.

Empowering Thai Society:

The lecture emphasized the need to equip the new generation with AI literacy, ensuring sustainable innovation. It also stressed the importance of:

- Developing inclusive AI policies

- Investing in technology and education

- Ensuring equitable access to AI tools and infrastructure

Despite AI’s potential to disrupt future labor markets and the growing concern over job displacement, it also presents new career opportunities. To adapt, reskilling and upskilling of the workforce remain essential, as people are the core driving force behind national progress. Sustainable investment in data centers was also highlighted as a key factor.

AI Research

This 30-year-old CEO says his AI negotiator can successfully haggle down the price of a car by thousands of dollars

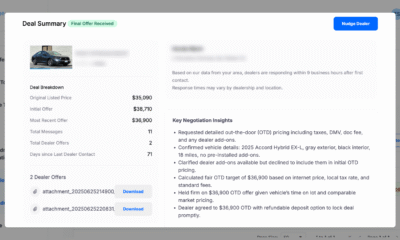

Zach Shefska claims his artificial intelligence can negotiate better car deals than most humans ever could. The 30-year-old chief executive of CarEdge, which he founded with his father Ray in July 2020, says his company’s AI negotiator has saved customers thousands of dollars by handling the back-and-forth haggling that typically makes car buying such a dreaded experience.

Shefska told Fortune the AI negotiator took about four months to develop. “We launched it on July 17th and have helped over 2,000 paying customers,” he said. The system is built on top of existing large language models but enhanced with CarEdge’s proprietary market insights and negotiation training. “CarEdge creates instances of AI agents that are deployed on behalf of users. The agents have proprietary market insights and negotiation training from CarEdge. Each agent creates a unique email and phone number and contacts dealers on behalf of customers,” Shefska told Fortune.

The idea emerged from a simple frustration. “Consumers don’t want to get screwed,” Shefska told PYMNTS in an interview. “And it’s not even necessarily about getting the best price; it’s just not wanting to be taken advantage of.”

CarEdge’s AI negotiator works simply: Customers specify exactly what vehicle they want, and the AI creates anonymous email addresses and phone numbers to contact dealerships directly. The artificial intelligence then handles all the price negotiations while keeping the buyer’s personal information completely private.

Notably, the service isn’t free. Customers pay $40 for a month of access without auto-renewal. “Customers pay because we do not want car dealers to be flooded with users who are simply testing the tech,” Shefska told Fortune. “The goal is for only those who are highly qualified and serious shoppers to leverage the agent to help save them time and money.”

According to CarEdge, though, the results speak for themselves. In one example cited by the company, CarEdge’s AI negotiated a Toyota RAV4 from an initial dealer quote of $37,356 down to $35,600—a savings of nearly $1,800. Customer testimonials published on CarEdge’s website show even bigger wins, with the company claiming that one man, Brian G., reported CarEdge helped him get a 2023 Chrysler Pacifica Hybrid for “$4,000 under MSRP after fees.” Another customer testimonial on the site, attributed to Wes S., says he secured a 2023 Corvette C8 for $5,000 under sticker price.

“On average the agent saves users over $1,000 and ~5 hours of back and forth with dealers via email and text,” Shefska told Fortune. CarEdge says the AI negotiator has been deployed over 10,000 times since launching, collecting pricing data from thousands of dealerships across the country.

CarEdge

The negotiation advantage

What gives the AI such an edge? Unlike consumers who buy cars every three to five years, the artificial intelligence negotiates deals constantly, learning from each interaction. CarEdge has fed the system six years of pricing data from hundreds of thousands of car transactions, giving it deep insights into what constitutes a fair deal.

The AI also eliminates the emotional and psychological pressures that often derail human negotiations. It doesn’t get flustered by high-pressure sales tactics or feel rushed to make a decision. Instead, it methodically compares offers, identifies hidden fees, and pushes for better terms with the persistence of a seasoned negotiator.

According to CarEdge, one customer looking for a Honda Accord got to experience the benefits firsthand when the AI negotiator managed 13 back-and-forth messages with a dealer and ultimately saved him $1,280 off the original out-the-door price.

Beyond the financial savings, the AI negotiator addresses another major pain point in car shopping: privacy invasion. Traditional car shopping websites often expose buyers to a barrage of spam calls and emails from multiple dealerships. CarEdge’s system flips this dynamic entirely: The AI absorbs all the dealer communications while the customer stays anonymous until they’re ready to make a purchase.

This approach has resonated with consumers increasingly concerned about data privacy. The AI uses what CarEdge calls “protected alias” contact information, ensuring that dealers never get access to the buyer’s real phone number or email address during negotiations.

Buying cars in the future

CarEdge’s AI negotiator represents part of a larger transformation in how high-value transactions are conducted. Just as real estate has buyer’s agents, Shefska envisions a future where AI agents routinely handle complex negotiations on behalf of consumers.

As artificial intelligence becomes more sophisticated and car buying remains one of consumers’ most stressful retail experiences, tools like CarEdge’s AI negotiator may become standard practice. For an industry built on information asymmetry and adversarial relationships, that change can’t come soon enough.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

AI Research

2 Artificial Intelligence (AI) Leaders

Key Points

-

Companies can’t get enough AI chips, and that spells more growth for Taiwan Semiconductor Manufacturing.

-

Apple has competitive advantages that could make it a sleeper AI stock to buy right now.

-

10 stocks we like better than Taiwan Semiconductor Manufacturing ›

The artificial intelligence (AI) market is expected to add trillions to the global economy, and investors looking for rewarding buy-and-hold investments in the field don’t need to take high risks. Investing in companies that are supplying the computing hardware to power AI technology, as well as those that could benefit from growing adoption of AI-powered consumer products, could earn satisfactory returns. Here are two stocks to consider buying for the long term.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

1. Taiwan Semiconductor Manufacturing

AI doesn’t work without the right chips to train computers to think for themselves. While Nvidia and Broadcom report strong growth, Taiwan Semiconductor Manufacturing (NYSE: TSM) is the one making the chips for these semiconductor companies. TSMC controls over 65% of the chip foundry market, according to Counterpoint, making it the default chip factory for smartphones, computers, and AI.

TSMC manufactures chips that are used in several other markets, including automotive and smart devices. This means that when one market is weak, such as automotive, strength from another (high-performance computing and AI, for example) can pick up the slack.

TSMC’s manufacturing capacity is immense. It can make 17 million 12-inch equivalent silicon wafers every year.

Its massive scale and expertise at making the most advanced chips in the world put it in a lucrative position. Over the last year, it earned $45 billion in net income on $106 billion of revenue. It has delivered double-digit annualized revenue growth over the last few decades, and management expects this growth to continue.

In the second quarter, revenue grew 44% year over year. This growth has pushed the stock up 51% over the past year. Management expects AI chip revenue to grow at an annualized rate in the mid-40s range over the next five years, which is a catalyst for long-term investors.

With Wall Street analysts expecting the company’s earnings per share to grow at an annualized rate of 21% in the coming years, the stock should continue to hit new highs, as it still trades at a reasonable forward price-to-earnings ratio (P/E) of 24.

2. Apple

Apple (NASDAQ: AAPL) hasn’t made a huge splash in AI yet. Apple Intelligence brought some useful features to its devices, such as AI summaries and image creation, but it’s not as robust as customers were expecting. However, investors shouldn’t count the most valuable consumer brand out just yet. Apple has a large installed base of active devices, and millions of customers trust Apple with their personal data, which could put it in a strong position to benefit from AI over the long term.

Apple previously partnered with OpenAI for ChatGPT integration across its products, but with OpenAI now positioning itself as a competitor after bringing in Apple’s former product designer Jony Ive, Apple is rumored to be exploring a partnership with Alphabet‘s Google’s Gemini to power its Siri voice assistant.

Apple appears to be a sleeping giant in AI. Millions of people are walking around with a device that Apple can turn into a super-intelligent assistant with a single software update. Its large installed base of over 2.35 billion active devices is a major advantage that shouldn’t be underestimated.

But Apple has another important advantage that other tech companies can’t match: consumer trust. Apple has built its brand around protecting user privacy, whereas Alphabet’s Google and Meta Platforms have profited off their users’ data to grow their advertising revenue. A partnership with Google for AI would not comprise Apple’s position on user privacy, since Google would need to provide a custom model that runs on Apple’s private cloud.

For these reasons, Apple is well-positioned to be a leader in AI, making its stock a solid buy-and-hold investment. It says a lot about its growth potential that analysts still expect earnings to grow 10% per year despite the fact that the company is lagging behind in AI. The stock’s forward P/E of 32 is on the high side, but that also reflects investor optimism about its long-term prospects.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $671,288!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,031,659!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

John Ballard has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi