Tools & Platforms

Tech stocks head south as investors see that growth in AI is not limitless

- Tech stocks declined in August as investors questioned the limits to growth of AI companies. Nvidia, Marvell Technology, and Super Micro Computer Inc all underperformed the broader market in August. This uncertainty may impact the S&P 500, which is dominated by the “Magnificent 7” tech giants.

The Nasdaq 100 closed down 1.22% on Friday and while U.S. markets are closed today for the Labor Day holiday, futures contracts for the index are not: They’re trading flat this morning, implying that investors are not expecting much from tech stocks once the opening bell rings in New York on Tuesday.

The Nasdaq 100 closed down for the month of August (-0.16%) even though the broader S&P 500 was up 3.56%.

Tech stocks were dogged all month by discussion about whether AI was in a bubble. And a study by MIT suggested that 95% of companies have yet to see a return on their investment in AI.

As Jim Reid and his team of analysts at Deutsche Bank said this morning: “Nvidia (-3.32% on Friday) was a major driver of this softness, losing ground after Marvell Technology’s outlook raised doubts over demand for data-centre equipment and as China’s Alibaba unveiled a new AI Chip. Last Wednesday Nvidia’s results had delivered a modest quarterly beat but saw slowing revenue growth for the data centre division, in part due to a pause in sales of AI chips to China.”

Marvell Technology is based in Santa Clara, California, and makes semiconductor chips. It has a partnership with Nvidia. On its fiscal Q2 2026 earnings call on August 28, CEO Matt Murphy said, “We expect overall data center revenue in the third quarter to be flat sequentially.” Flat is not up, and that sent Marvell’s stock down 19% the next day. (In May, Marvell cancelled its investor day presentations, citing macroeconomic uncertainty.)

That disappointment came after Nvidia’s earnings call the day before. The company reported robust data center revenue growth but it was nonetheless below analyst expectations.

And then there is Super Micro Computer Inc, another chipmaker buoyed by the AI boom. In early August, it reduced its revenue outlook for the year to $33 billion. Back in February, it had estimated $40 billion. On top of that, on August 28 the company said in its annual report, “We have identified material weaknesses in our internal control over financial reporting, which could, if not remediated, adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner.” Its stock fell 5.5% after that and was down 27% for the month.

Shakiness in AI stocks could have consequences for the broader market. The “Magnificent 7” tech companies (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla), which have all placed large bets on AI, are currently worth 34% of the entire market cap of the S&P 500.

Here’s a snapshot of the markets globally this morning:

- S&P 500 futures were up 0.1% this morning. U.S. markets are closed for Labor Day.

- STOXX Europe 600 was up 0.19% in early trading.

- The U.K.’s FTSE 100 was up 0.08% in early trading.

- Japan’s Nikkei 225 was down 1.24%.

- China’s CSI 300 was up 0.6%.

- The South Korea KOSPI was down 1.35%.

- India’s Nifty 50 was up 0.81% before the end of the session.

- Bitcoin fell to $109.3K.

Tools & Platforms

TGA ‘stepping up’ regulation of AI scribes in healthcare | Information Age

Australia’s Therapeutic Goods Administration (TGA) says it is “stepping up its efforts” to regulate digital scribes, including those using artificial intelligence technology, following calls for greater oversight of the software as it becomes increasingly prevalent in healthcare settings.

AI scribes typically use large language models (LLMs) to quickly transcribe and summarise discussions between patients and healthcare practitioners.

Some systems are also able to suggest potential treatments, write referral letters, make follow-up phone calls, propose billing opportunities, and draft healthcare plans.

Experts have called for advanced AI scribes to be regulated as medical devices by the TGA, given the sensitive data they handle and their ability to make medical recommendations, as Information Age reported in August.

The TGA announced on Friday it was reviewing AI scribes amid concerns some systems were introducing features “such as diagnostic and treatment suggestions”, which may need to be considered medical devices and thereby formally regulated before being sold or advertised.

While most AI scribes do not include such features yet, a TGA review published in July found software which did propose diagnoses or treatment options were “potentially being supplied in breach of the [Therapeutic Goods] Act”.

The TGA had begun responding to complaints and reports of non-compliance, it said, while also addressing “unlawful advertising and supply” of some AI scribes.

“We may take targeted action in response to alleged non-compliance,” the regulator said.

The TGA did not comment on how many complaints or reports of non-compliance it had received.

The regulator said it encouraged consumers to report concerns through its website.

Australian firms welcome regulatory scrutiny

Australian companies such as Heidi Health and Lyrebird Health have seen significant success in the AI scribe industry, amid competition from smaller providers such as i-scribe and mAIscribe — all of which were contacted for comment.

Heidi Health co-founder and CEO Dr Thomas Kelly told Information Age his team “welcome the TGA’s sharpened compliance focus”.

While Kelly said Heidi did not currently have features which would render it a medical device under the TGA definition, he said the firm would engage with the regulator “if we ever introduce features that give Heidi a therapeutic purpose”.

“Proportionate, risk‑based enforcement protects patients and ensures a level playing field for responsible developers,” he said.

Australian AI scribe company Heidi Health says its software does not yet meet the definition of a medical device. Image: Heidi Health / YouTube

Akuru, the health tech company behind i-scribe, said while its product also did not meet the definition of a medical device, it welcomed “the regulator’s latest focus on taking targeted action” against unregulated products which provided diagnostic advice or treatment suggestions.

“We know the scribing market is crowded, and unfortunately, some solutions do cross that line,” Akuru medical director Dr Emily Powell said in a statement.

“… We welcome wider regulatory guidance that empowers clinicians to make informed decisions about secure, compliant, and appropriate software.”

Adoption ‘running ahead of governance’

University of Queensland associate professor of business information systems Dr Saeed Akhlaghpour, who has studied the use of AI scribes in healthcare, described the TGA’s focus on such technology as “a positive move” given their increasing use.

“Bringing AI scribes under safety and medical-device rules gives patients greater peace of mind, reduces legal uncertainty for clinicians, and offers vendors a clearer, more predictable path to compliance,” he said.

“The reality is that adoption is already running ahead of governance — industry surveys suggest nearly half of Australian doctors are already using, or planning to use, AI scribes.

“That scale of uptake makes timely guardrails essential now, not later.”

Regulators in the United States, European Union, and United Kingdom were also “moving to treat scribe tools that go beyond transcription as clinical technologies, not just productivity aids”, Akhlaghpour said.

Akuru, the Australian company behind i-scribe, says it welcomes the TGA’s scrutiny of digital scribe software. Image: i-scribe / Supplied

Expert calls for ongoing reviews

Australian AI governance expert Dr Kobi Leins — who last month told Information Age she was turned away from a medical practice after not consenting to its use of an AI scribe — said ongoing industry-wide expert reviews and training were needed to maintain public confidence.

“Where the data goes and how it is collected and stored is critical, as implications may be profound if shared with insurers, employers, or others — and in the case of genetic and family related health, may have implications for family members not present,” she said.

Ongoing reviews of AI scribes needed to be triggered when systems were “modified, connected, or repurposed”, said Leins, who called for such reviews to analyse “cybersecurity, AI, ethical, legal, vulnerability, medical and other lenses … to capture the wide range of risks and legal compliance required”.

“Included in that review needs to be a plan for ongoing training of the medical profession as to how to use the tools effectively, including seeking consent and always providing the option to opt out,” she said.

“Ensure independent deep expertise to review, not vendor reviews … and ensure that vendors — like with cybersecurity — have the responsibility to notify of changes to systems to practitioners.”

Healthcare professionals should “regularly assess” digital scribe software before using it, including when software updates may introduce new functionality or change data protection and privacy safeguards, the TGA said in August.

Aside from complying with the TGA’s rules, AI scribes used in healthcare may also need to uphold obligations under laws such as the Privacy Act, Cyber Security Act, and Australian Consumer Law, the regulator added.

Tools & Platforms

AI Search Engine Market Size

Report Overview

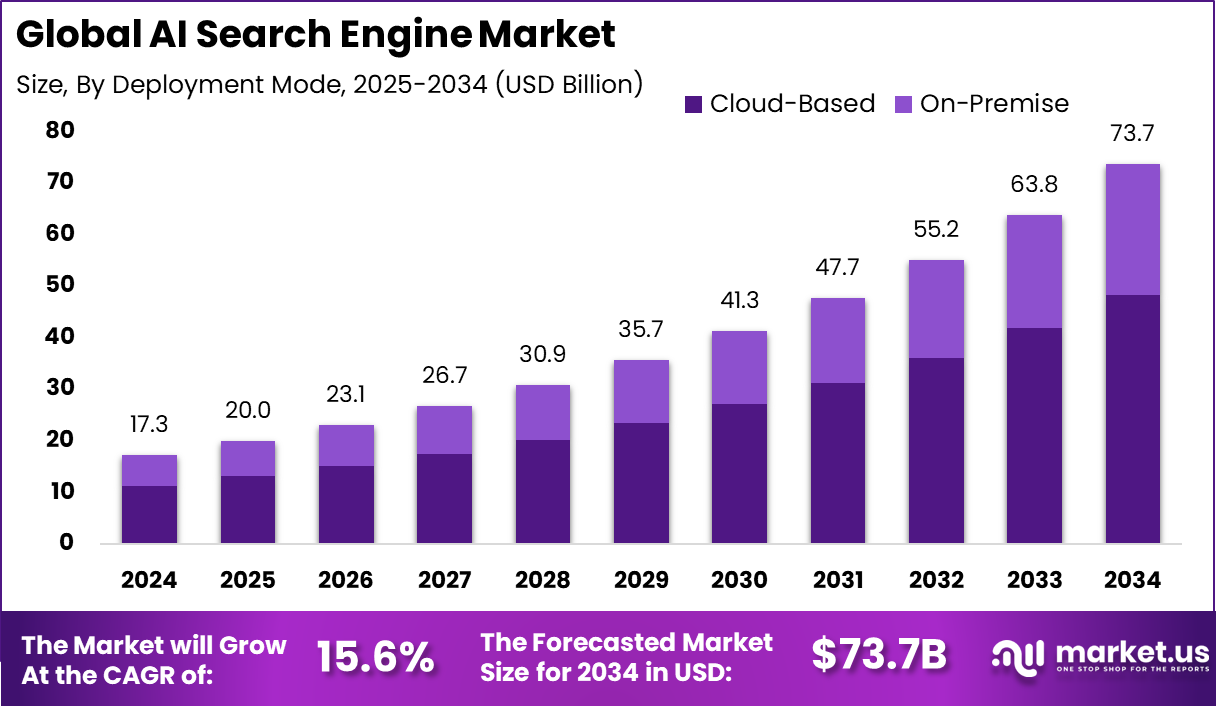

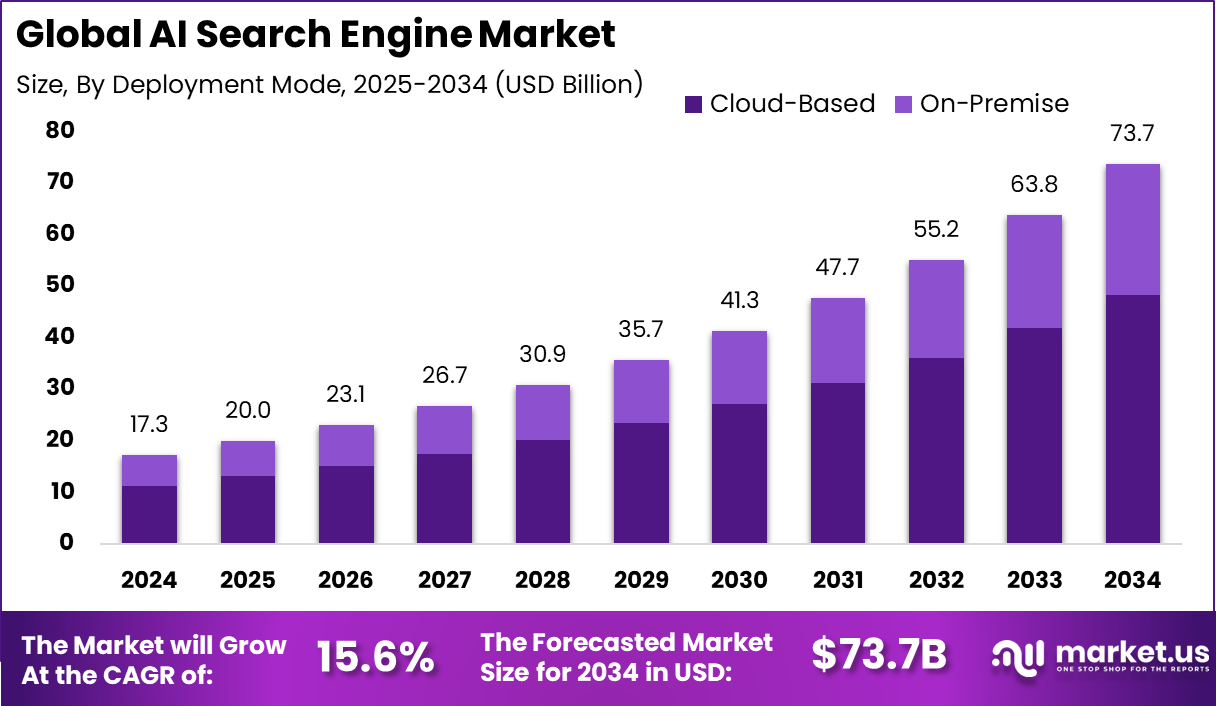

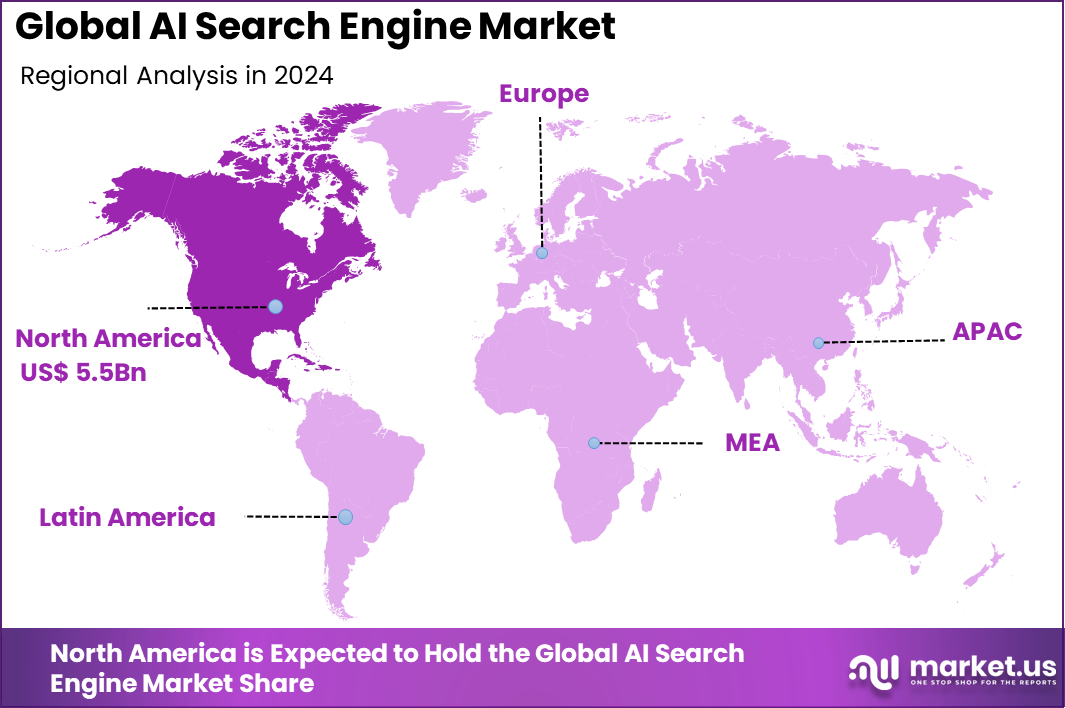

The Global AI Search Engine Market size is expected to be worth around USD 73.7 Billion By 2034, from USD 17.3 billion in 2024, growing at a CAGR of 15.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 31.9% share, holding USD 5.5 Billion revenue.

The AI search engine market is built around technologies that enable users to find information more intelligently and accurately using machine learning and natural language processing. These solutions not only understand the meaning behind queries but also provide personalized answers that adapt to the user’s context. AI-powered search engines are now core tools for fast, intuitive information access, driving both personal productivity and enterprise workflows.

This market is propelled by the increasing need for personalized and context‑aware search experiences. Improvements in language understanding and generative capabilities enable these systems to interpret complex queries and deliver relevant information with greater precision. In parallel, the explosion of digital content and the demands of decision‑making environments in enterprises and consumers are motivating adoption of AI‑driven search technologies.

Key Insight Summary

- Large Enterprises are the top adopters, holding 64.9% share of the market.

- Natural Language Processing (NLP) is the leading technology segment.

- Cloud deployment dominates with a 65.6% share of total adoption.

- retail & e-commerce emerged as the primary end-use sector, driving demand for AI search engines.

Analysts’ Viewpoint

Investment opportunities abound in enterprise-focused AI search products, cloud-based solutions, industry-specific customizations, and privacy-focused platforms. The sector is attracting funds for agentic AI engines and multi-modal interaction models. Regions like North America and Asia Pacific provide dynamic opportunities due to rapid technology adoption, government-backed innovation, and sizable populations of digital users.

Business benefits realized from AI search adoption include better productivity, increased efficiency in knowledge management, reduced cost in handling vast data, and enhanced customer interactions. Intelligent search engines minimize manual effort, automate document indexing, and allow organizations to respond swiftly to evolving market and customer needs.

The regulatory environment varies regionally but is especially shaped by frameworks such as GDPR and CCPA that govern privacy, user consent, and data protection. Compliance requirements in Europe and North America drive innovation toward secure, transparent, and ethically designed AI search solutions. Privacy-oriented development and algorithmic fairness are increasingly seen as non-negotiable standards, influencing adoption and trust in AI-powered platforms.

Regional Insight

In 2024, North America held a dominant market position, capturing more than 31.9% share and generating USD 5.51 billion revenue in the AI search engine market. The region’s leadership is mainly supported by the rapid digital transformation of enterprises and the strong presence of technology innovators.

Businesses across sectors such as e-commerce, finance, and healthcare are increasingly adopting AI-driven search platforms to deliver faster, more relevant, and personalized results. The high demand for intelligent search solutions that can process natural language queries, analyze unstructured data, and improve decision-making has positioned North America at the forefront of this industry.

The leadership of North America is also reinforced by the widespread integration of advanced AI models, including natural language processing and generative AI, into enterprise applications. Strong investment activity in artificial intelligence, combined with robust cloud infrastructure, has accelerated the deployment of AI-powered search solutions across organizations.

Emerging Trends

Growth Factors

Key Market Segments

By Organization Size

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Generative AI

- Computer Vision

- Other

By Deployment

By End Use

- BFSI

- Media & Entertainment

- Healthcare

- IT & Telecom

- Retail & E-commerce

- Travel & Hospitality

- Manufacturing

- Education

- Others

Regional Analysis and Coverage

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top Use Cases

Customer Insight

Driver Factor

Personalization Enhances Relevance

The main driver in the AI search engine sector is their ability to personalize results based on individual user data. AI search engines use advanced techniques like natural language processing and machine learning to understand the intent behind each query, surfacing results that match a user’s habits, location, and search history. For instance, a user asking for restaurant options in their city receives listings tailored precisely to their preferences, time of day, and even dietary restrictions.

Personalized search means users get information that is truly relevant, not just a list of generic results. This shift toward individualized search experiences leads users to rely on AI engines for more complex and ambiguous questions, making these tools an essential part of modern information-seeking behavior.

Restraint Factor

Growing Privacy Concerns

One of the clearest limiting factors for AI search engines comes from mounting privacy concerns. AI-powered systems often require extensive access to user data so they can tailor those responses and improve results. However, handling large sets of personal information raises worries about how data is collected, stored, and used.

Public awareness and new regulations, such as GDPR and CCPA, have created hurdles for providers of AI search engines. These rules mandate strict data security protocols and greater transparency about data use. As a result, some innovations in personalization are held back, and users may hesitate to trust or adopt these new search technologies when privacy feels compromised.

Opportunity Analysis

Expanding into Voice and Visual Search

A standout opportunity in the AI search engine space is expansion into voice and visual search. As technology evolves, users increasingly expect to find information without typing, using voice assistants or taking a quick picture. Incorporating natural language and image recognition allows AI search platforms to understand queries in a more human way, whether spoken or visual.

This new direction offers a richer, more accessible experience for users, making it easier to search and get contextual results in daily life. Companies that invest in multi-modal search – where spoken words, images, or even video can guide search – are positioned to shape the future of user interaction and engagement.

Challenge Analysis

Competing with Established Search Leaders

One of the major challenges for new AI search engines is breaking the dominance of established traditional engines, especially when users are deeply accustomed to platforms like Google. Building brand recognition and user trust takes time, especially when established competitors offer proven reliability and vast resources.

Additionally, creating technically robust systems able to interpret ambiguous or complex queries requires continuous innovation. Gaining a foothold means not only outperforming competitors on accuracy and relevance but also convincing people to try unfamiliar tools. This is compounded by the need for substantial investment in infrastructure and expertise, which further raises the barrier for newcomers.

Competitive Analysis

In the AI search engine market, leading enterprise technology providers such as SAP SE, Amazon Web Services, Salesforce, and Google LLC play a central role. Their focus lies in integrating AI-driven search functions into enterprise systems and cloud platforms. These companies leverage their vast customer base and advanced cloud ecosystems to deliver scalable search solutions.

Another group of influential players includes IBM Corporation, Zeta Global Corp., and Adobe, who emphasize personalization and data-driven decision-making in search technologies. IBM brings expertise in natural language processing and enterprise AI, while Adobe integrates AI search into content management systems. Zeta Global enhances customer engagement by using AI-powered insights.

Additionally, Microsoft, NVIDIA Corporation, and Oracle contribute significantly to market innovation. Microsoft strengthens the market with AI-powered tools within its productivity ecosystem, while NVIDIA accelerates AI search capabilities with its high-performance GPUs. Oracle integrates AI into its database and enterprise applications to support more intelligent information retrieval.

Top Key Players in the Market

- SAP SE

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Google LLC

- IBM Corporation

- Zeta Global Corp.

- Adobe

- Microsoft

- NVIDIA Corporation

- Oracle

Recent Developments

- In July 2025, Google LLC launched AI Mode in the UK, powered by Gemini 2.5. It delivers conversational answers instead of long lists of links, supports complex queries, and keeps context for follow-up questions, making search more natural and precise.

- In March 2025, One 97 Communications Limited partnered with Perplexity AI, Inc. to bring AI-driven search to the Paytm app. The integration improves accessibility in local languages and provides real-time insights, helping users make informed financial decisions and boosting digital inclusion.

- In October 2024, Meta Platforms Inc. started building its own AI-based search engine with a dedicated web crawler. Linked with Meta AI across its platforms, it provides real-time conversational answers and reduces reliance on external search providers, strengthening its independence in the search ecosystem.

Report Scope

Tools & Platforms

AI hiring booms in agencies as tech integration deepens

Of late, beyond major corporations such as Intel, LinkedIn, General Motors, Mastercard, Accenture, PwC, Jindal Power and Steel, S&P, etc., there has been a noticeable uptick among agencies hiring for roles specifically emphasizing artificial intelligence (AI) expertise or AI leadership. Let us examine some examples.

In April, Interpublic Group (IPG) appointed Yaniv Sarig as global head of AI Commerce, and in the same month, Vishal Jacob joined Wavemaker’s data and technology division, Choreograph, as president – AI and digital solutions for India. In his new role, Jacob would lead WPP Media’s AI charter and collaborate closely with digital leadership teams to deliver integrated, impact‑driven digital solutions for clients.

Agency holding companies are also following suit; Stagwell, for instance, appointed John Kahan as its inaugural chief AI officer (CAIO), where he will spearhead the integration and development of AI initiatives across its global network.

Daniel Hulme has served as WPP’s CAIO since 2021, working alongside WPP’s CTO and agency teams to define, identify, curate, and promote AI capabilities and opportunities that benefit both the broader group and society.

In another notable move, Horizon Media—the largest independent media agency in the U.S. as of 2024—appointed Tim Rich as its head of AI solutions. Similarly, IPG’s subsidiary Golin named Jeff Beringer as its first CAIO, and the independent insights-led marketing solutions agency Luckie & Co appointed Mark Unrein Jr as their CAIO.

Anupama Bhimrajka, vice president – marketing, foundit—a jobs platform—attributes the surge in AI-related hiring to growing client demand, the imperative to remain competitive, and AI’s transformative potential across the creative value chain, a momentum that accelerated with the mainstream adoption of generative AI technologies post‑2022.

Source: foundit Insights Tracker

While agencies have long embraced digital skill sets—dating back to the early 2000s with the rise of programmatic advertising, mobile-first strategies, and social media analytics—the current wave represents a fundamental shift in both capability and intent.

According to the foundit Insights Tracker, demand for AI-integrated marketing roles has surged by 32 percent over the past six months, particularly within digital-first and boutique creative agencies.

Bhimrajka notes that today’s clients expect more than exceptional creativity—they want intelligent, data-driven solutions that deliver measurable results. “Consequently, agencies are evolving to offer AI‑powered services such as advanced audience segmentation, predictive campaign analytics, creative automation, and even AI‑driven influencer strategies,” she explains.

Foundit’s Bhimrajka emphasized that AI leaders play a crucial role in defining ethical boundaries, selecting appropriate tools, and integrating AI into workflows in ways that enhance, not replace, human creativity.

“From building AI-assisted ideation engines to automating repetitive production tasks, these leaders are freeing creative teams to focus on high-impact storytelling, strategic thinking, and emotional resonance,” Bhimrajka stated.

Siddharth Verma, head of executive search, Xpheno, a specialist staffing company, concurred: although concept development and copywriting remain predominantly human-driven, the execution of designs, videos, and podcasts increasingly leverages AI to meet client expectations for speed and scale.

“The media and agency space has always embraced tools that elevate output—AI is no exception. Its adoption creates bandwidth for agencies to pursue high-cognitive, high-value creative work,” he explained.

Recent hiring data and project outcomes indicate that agencies with robust AI leadership do more than preserve the creative spark—they amplify it.

“AI leaders ensure these tools are used responsibly, preserving originality, brand voice, and cultural nuance. Ultimately, they bridge the gap between technological efficiency and artistic expression,” Bhimrajka added.

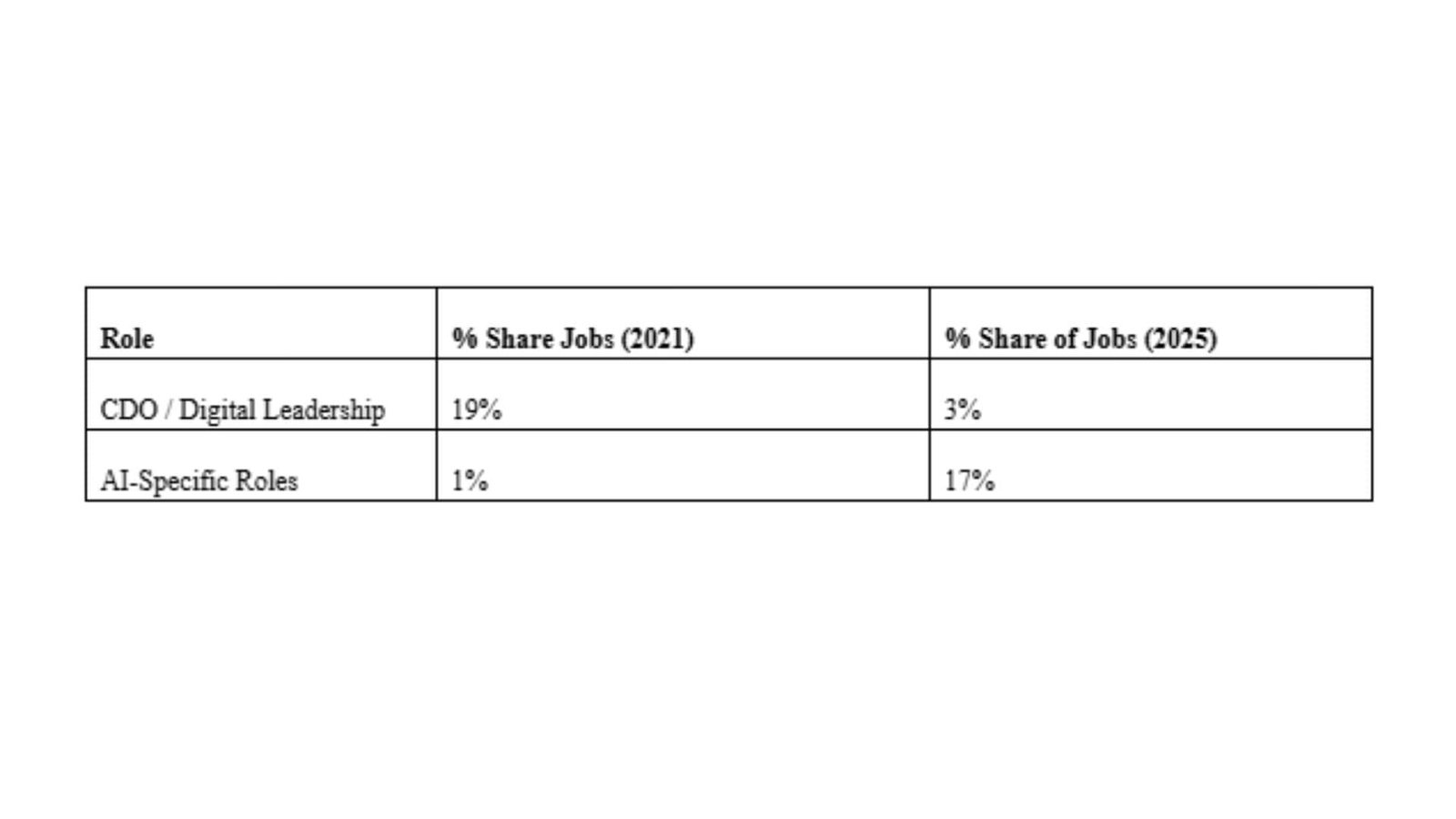

During the digital transformation era, agencies invested heavily in chief digital officers (CDOs) to modernize operations. In 2021, digital leadership roles made up nearly 19 percent of digital/tech hires. By 2025, that share fell sharply to three percent, as digital fluency became widespread.

In stark contrast, AI-specific roles ballooned from one percent in 2021 to 17 percent in 2025—with agencies now actively recruiting AI engineers, prompt designers, machine learning experts, and creative technologists to drive next-gen campaigns.

Leading agency networks such as Dentsu, WPP, and VML (post-merger with Wunderman Thompson in APAC) have launched in-house AI content engines and innovation hubs. Global brands including Coca-Cola, Nike, Cadbury, and KitKat have leveraged generative AI for dynamic content, audience engagement, and real-time iteration.

“These examples signal a strategic pivot from CDO-led transformation to AI-led creative reinvention—the AI hiring boom marks a paradigm shift where technology now powers creativity,” Bhimrajka explained.

AI is no longer seen merely as a support tool—agency leaders now identify it as the primary driver of industry change, with over 70 percent ranking AI as the top force shaping advertising’s future. Agencies are increasingly investing in AI tools and talent.

“AI’s capability to reduce production timelines and costs is allowing agencies to offer services like personalized content at scale, dynamic creative optimization, and virtual content creation—unlocking new revenue streams,” Bhimrajka noted.

Moreover, AI heads are not just tool adopters but strategic integrators—leading AI across creative development, media planning, content personalization, and data-driven storytelling.

“AI heads bridge creative and tech teams, developing proprietary models, prompt libraries, and campaign engines at scale. They uphold ethical AI use, guide internal training, and future-proof client offerings through innovation-led solutions,” she said.

Supporting this, foundit data shows agencies with dedicated AI leadership scale AI initiatives 27 percent faster than those without and are 1.6× more likely to secure client mandates centered on AI-driven solutions.

As AI takes center stage in creativity and campaign execution, the AI head role has become mission-critical—essential for agencies aiming to remain competitive and relevant.

Xpheno’s Verma further added, “An AI head becomes indispensable when tools automate significant operational work. Their mandate is to re-engineer workflows—balancing AI-enabled efficiency with safeguarding high-value human creativity and originality.”

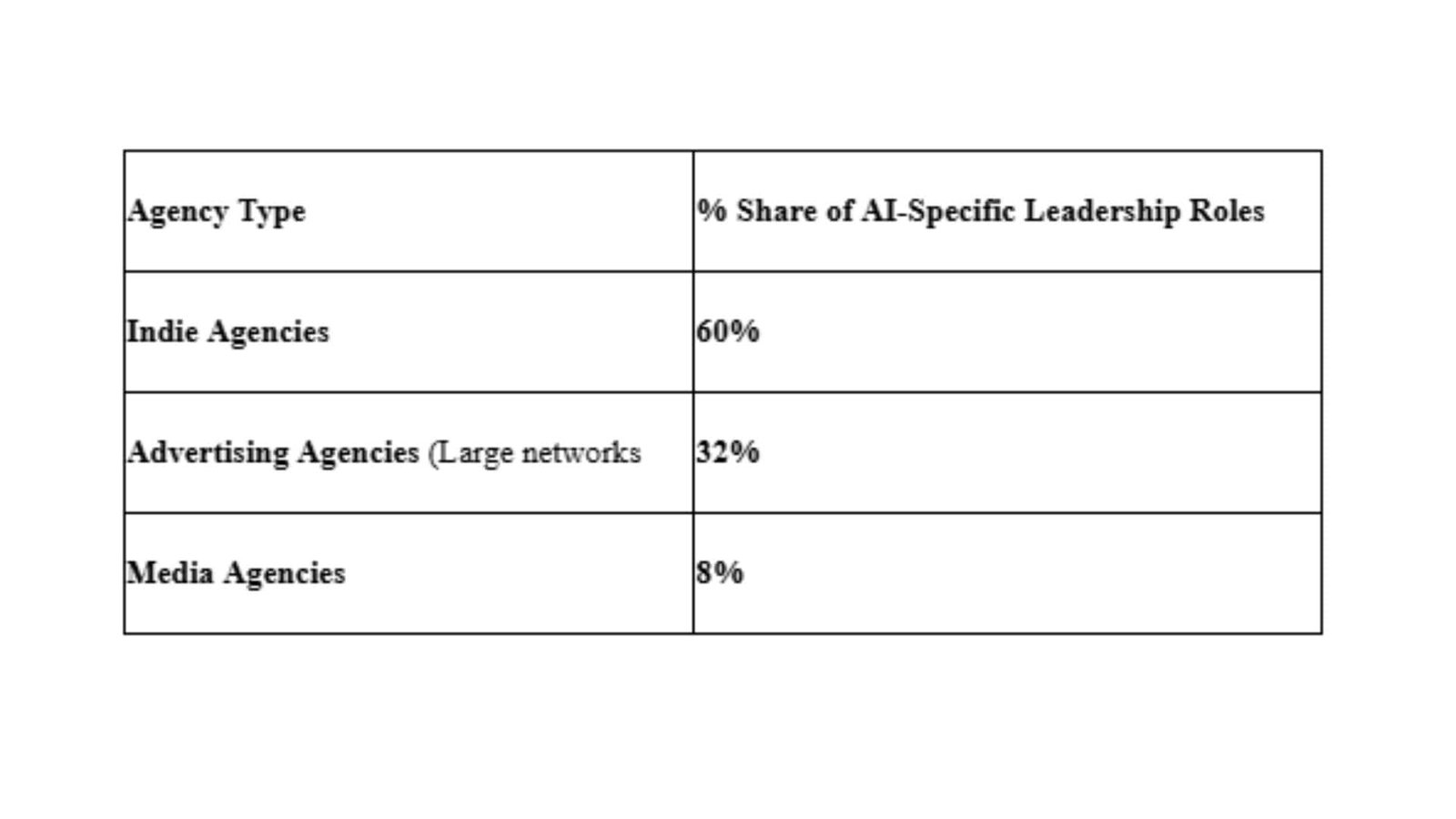

Advertising, media, indie: Rise is high amongst?

According to Bhimrajka, independent agencies are at the forefront of AI hiring—driven by their agility, demand for faster content creation, and receptiveness to experimentation. Their smaller scale allows them to roll out AI tools more swiftly across creative workflows.

Source: foundit Insights Tracker

She explained, “Large advertising agencies are scaling up gradually through centralized innovation teams and structured AI centers, but adoption is slower due to process complexity. Media agencies continue to use AI primarily for performance optimization—such as bidding algorithms and targeting—with fewer standalone AI leadership roles.”

However, Verma noted that for indie agencies, adopting AI remains a substantial investment and implementation challenge. One emerging solution is the use of fractional executives—such as fractional CTOs or AI heads—who provide strategic leadership without the cost of full-time hires. “Despite complexities around privacy and role overlap, the fractional leadership model makes high-level expertise affordable for smaller firms,” he said.

According to Bhimrajka, compensation for AI leadership roles depends heavily on the type of agency. Advertising and media agencies—with global clients and advanced technology infrastructure—tend to offer higher pay than indie firms, thanks to larger budgets and deeper AI integration. “Indie agencies offset lower fixed salaries through flexible arrangements like profit‑sharing or early‑stage innovation bonuses,” she added.

Verma noted that, as an emerging role, AI leadership positions lack standardized job definitions, mandates, or compensation benchmarks. Salaries vary widely depending on the sector, company size, urgency and context of the role, and its scope.

He stated that leadership packages across industries range from Rs 35 LPA to more than Rs 1 crore. “The media and agency landscape hasn’t established a standard pay scale yet, and that gives candidates the leverage to negotiate packages that reflect their role and the brand,” he added.

Bhimrajka clarified that, across Indian advertising, media, and indie agencies, AI heads typically earn between Rs 25 lakh and Rs 50 lakh annually, with most salaries clustering around Rs 30– Rs 45 lakh among established players.

“At the upper end—especially within multinational networks or large holding companies—compensation can exceed Rs 1 crore, although such packages are rare and usually tied to enterprise‑level digital transformation or global AI mandates,” she said.

At indie and boutique agencies, AI leadership salaries start at Rs 24– Rs 30 lakh, often complemented by perks like accelerated career growth, equity options, or performance‑linked bonuses to offset a modest base salary.

“These salaries align broadly with industry norms for AI leadership in India and, in a few elite cases, even surpass them,” Bhimrajka noted.

For context, AI director roles in India average Rs 50 lakh annually (typical range: Rs 47.8–Rs 55.8 lakh), while mid‑sized firms offer head of AI roles in the Rs 18– Rs 26 lakh range, climbing significantly in larger, tech‑savvy organisations.

However, appointing an AI expert or chief will not eliminate all the challenges agencies face—they are still likely to encounter significant hurdles.

Bhimrajka points out that the AI tool ecosystem evolves rapidly, making it difficult to select and maintain the right stack—potentially leading to wasted spending and workflow disruptions. AI heads can mitigate this by conducting small-scale tool pilots, planning for rapid transitions, and securing vendor support for team training.

Talent gaps present another hurdle, driven by the scarcity of professionals who combine technical and creative expertise. “Agencies can address this by partnering with universities and tech incubators, investing in upskilling programs for existing staff, and establishing internal AI communities or centers of excellence to share knowledge,” she said.

Data risks are also mounting as AI handles sensitive information. Leaders must establish clear protocols, remain audit-ready, and maintain transparency with clients regarding decision-making processes and data usage. Bhimrajka emphasized, “This also involves close collaboration with legal and compliance teams to stay ahead of evolving regulations.”

Bhimrajka also cautioned against over-automation, which can stifle originality. Agencies must keep humans in the loop, encouraging creative reviews and cross-functional checks.

Measuring and demonstrating ROI from AI initiatives are additional challenges. “Agencies must define sharp KPIs and demonstrate clear results—to build trust and sustain AI investments,” she added.

As agencies become more AI-enabled, competition intensifies, potentially eroding their creative edge. “If not managed properly, AI can have commercial repercussions on both revenue and costs,” Verma explained.

Looking ahead, industry forecasts suggest marketing and advertising AI budgets in India will grow by 25 percent–30 percent year-on-year through at least 2028, and by 2027, more than 70 percent of mid-to-large advertising and media agencies in India are expected to have dedicated AI leadership roles.

Bhimrajka concluded that the AI head role is no longer optional—it’s becoming central to agency resilience. “From winning new business to transforming creativity and strategy in the AI era, this position is poised to become a C‑suite staple within major agencies,” she stated.

-

Business4 days ago

Business4 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies

-

Education2 months ago

Education2 months agoAERDF highlights the latest PreK-12 discoveries and inventions