Funding & Business

Pending home sales tick lower in July as canceled contracts spike

Signed contracts to buy existing homes, known as pending sales, were weaker in July compared with June, and were canceled at the highest rate since at least 2017.

The monthly pending home sales index from the National Association of Realtors dropped 0.4% in July from June, but was still 0.7% higher from July of last year.

Mortgage rates in July were moving slightly higher, which could account for some of the drop. The average rate on the popular 30-year fixed mortgage started July at 6.67% and then moved to 6.85% by the middle of the month and ended July at 6.75%, according to Mortgage News Daily. The rate fell more sharply in August and is now sitting at 6.51%.

“Even with modest improvements in mortgage rates, housing affordability, and inventory, buyers still remain hesitant,” said Lawrence Yun, chief economist for the NAR. “Buying a home is often the most expensive purchase people will make in their lives. This means that going under contract is not a decision homebuyers make quickly.”

Not only are sales moving lower, but buyers are canceling these contracts at a swift pace. Redfin, a real estate brokerage, found 15% of contracts were canceled in July, the highest rate since it began tracking the metric in 2017. This is based on a Redfin analysis of pending-sales data from MLS, a national database of listings.

The report found cancellations most prevalent in Texas and Florida, citing specifically high rates in San Antonio (22.7%), Fort Lauderdale (21.3%) and Tampa (19.5%).

Redfin agents cited “cold feet” as the primary reason buyers are backing out, according to the report. That tracks with the overall uncertainty consumers are feeling about the current state of the economy.

An NAR survey of Realtors found just 16% said they expect an increase in buyer traffic over the next 3 months.

Regionally July sales dropped month-to-month in the Northeast and Midwest, were flat in the South and rose in the West.

“It’s been a ‘Cruel Summer’ overall: buyers remain squeezed by affordability challenges while sellers have been slow to adjust expectations, leaving the housing market stuck in neutral,” said Realtor.com senior economist Jake Krimmel. “Mortgage rates, too, offered little relief in July.”

Funding & Business

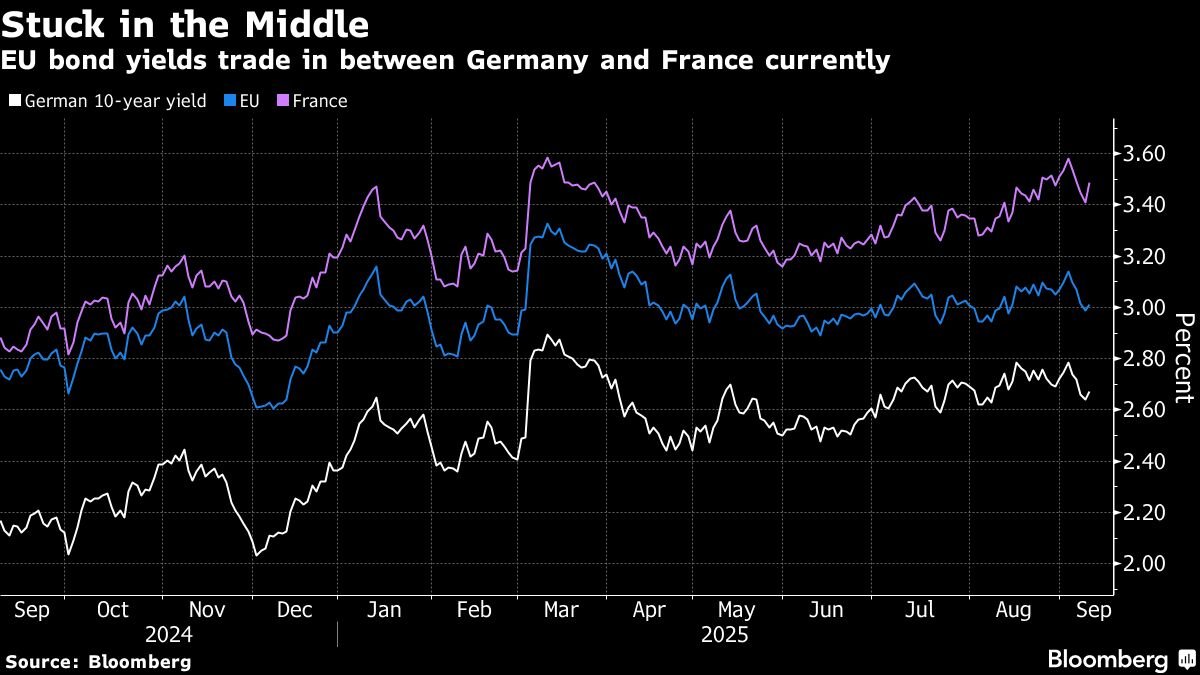

EU Bonds Hit Market Milestone as Eurex Starts Offering Futures

Europe’s largest bond-futures exchange is launching a contract for the European Union’s debt on Wednesday, a move that could help boost trading liquidity and eventually lower the bloc’s borrowing costs.

Source link

Funding & Business

Aramco to Price Second Dollar Bond Sale of 2025 to Fund Projects

Saudi Arabian Oil Co., known as Aramco, is preparing to price new benchmark-sized dollar bonds on Wednesday, extending the oil-rich kingdom’s debt spree as it seeks fresh capital to fund projects.

Source link

Funding & Business

Oil Climbs as Traders Weigh Trump’s Tariff Threats, Doha Strike

Oil rose for a third session after President Donald Trump told European Union officials he’s willing to slap new tariffs on India and China in an effort to get Russia to negotiate with Ukraine.

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi