Funding & Business

CRE hurricane resilience is leveraging drones and AI

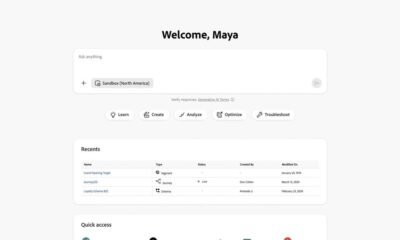

A screenshot of Site Technologies’ commercial real estate risk assessment tools.

Courtesy of Site Technologies

A version of this article first appeared in the CNBC Property Play newsletter with Diana Olick. Property Play covers new and evolving opportunities for the real estate investor, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large public companies. Sign up to receive future editions, straight to your inbox.

The first hurricane of the 2025 Atlantic season is spinning off the East Coast, and there are sure to be more in its wake. As season after season produces more intense storms resulting in increasingly costly damage, facilities managers in commercial real estate are making property resilience a priority.

One of the ways to do that is through technology. Strides have already been made in combating wildfire risk: Companies like Pano AI, Satelytics and AiDash are incorporating satellite technology with artificial intelligence to pinpoint particular fire hazards, with major electric companies as clients.

And similar advancements are working to reduce the risk of hurricane damage: Site Technologies employs drones to help commercial real estate facilities managers see where the vulnerabilities are in their properties and address them before those storms hit. Site was originally a construction company.

“We teamed up with our team of experts and engineers in pavements and roofs and facades and landscaping, and we started to figure out how we need to be able to capture data from facilities to be able to do engineering work and review of the current conditions of the properties,” said Austin Rabine, Site CEO.

Site doesn’t have its own drones, but uses freelancers across the country. Rabine says the company has surveyed roughly 13,000 properties in 15 different countries and deploys drones on an annual basis for large customers that have hundreds or thousands of facilities.

The images, once captured, can be fed into Site’s artificial intelligence platform that incorporates expertise from its own staff and analyzes the properties, providing condition and risk reports for the exterior of each facility.

“We also identify how they should be spending their money over the next three to five years to make sure that their facility is in good condition,” said Rabine. “So we create the scopes of work and condition reports using AI, and then we have a lot of dashboarding features that allow them to sort by their worst properties or their highest-risk properties for them to be able to focus their attention on their highest needs.”

This predictive maintenance allows property and facilities managers to see the issues before they become liabilities. That’s everything from clogged drains to overgrown trees to weak roofs.

For existing customers, Site offers to fly drones over the properties after any kind of destructive event occurs. The images can then be used as before and after assessments for insurance claims.

Site’s customers include Prologis, a major warehouse real estate investment trust, as well as Link Logistics and large national retailers. Most clients will have at least 100 properties, as companies with smaller real estate footprints can use human surveyors more easily.

“When you have hundreds or thousands of properties, it was never really a viable option to be able to get a snapshot, on an annual basis, of your facilities until technology like this,” said Rabine.

Funding & Business

Klarna Shares Pop In Long-Awaited Public Market Entry

Shares of Klarna opened about 30% higher in first-day trading, at $52, on Wednesday in the company’s long-awaited initial public offering, proving that there’s investor appetite for yet another public fintech company.

The Stockholm-based company, which has evolved its model to offer more than just buy now, pay later plans, had set a price range for its IPO of $35 to $37 per share. But as of late Tuesday, reports indicated the company had increased the price of its shares to $40 due to “better-than-expected demand.”

Klarna trades on the New York Stock Exchange under the ticker symbol KLAR.

The new price range gives the company an initial valuation of $15.1 billion, and means that Klarna raised $1.37 billion from the initial public offering.

Klarna had filed a draft registration statement with the U.S. Securities and Exchange Commission last November, and in March made its F-1 prospectus public. But by early April, Klarna seemed to be hitting an indefinite pause on its IPO plans after President Trump announced sweeping tariffs.

At its peak as a private company, Klarna was valued at $45.6 billion. More recently, it was valued at $14.6 billion.

Since its 2005 inception, the company has raised nearly $6.2 billion in funding from investors including Sequoia Capital, General Atlantic and Silver Lake, with Santander adding $1.63 billion to that total in a debt financing just last week. Unlike many other fintechs, Klarna is profitable and turned net income of $21 million in 2024.

The open IPO market

Its IPO follows a string of well-received venture-backed debuts, including the blockbuster market entry by design software provider Figma, which saw shares triple in first-day trading (although they have come back down to earth since).

Klarna’s IPO also comes amid renewed interest in investment in fintech startups, with multiple rounds above $100 million closing this year.

Overall, the IPO dam in fintech finally seems to have broken in 2025.

Since the beginning of the year, several companies in the fintech space have either gone public or filed to do so.

- In early June, shares of Circle closed up 168% at $83.29 in their first day of trading on the New York Stock Exchange, minting the stablecoin issuer with a market cap of around $16.7 billion and renewing hopes for an IPO market rebound. More recently, shares have traded in the $118 range.

- Digital bank Chime went public on June 12, and came out swinging. Chime’s shares shot up 37% in first-day trading on Nasdaq, closing at $37. Shares have traded around $23 in recent days.

Meanwhile, digital wealth management startup Wealthfront filed confidentially for a U.S. initial public offering on June 23. And in early June, crypto exchange Gemini confidentially filed its own plans for a U.S. IPO. Expense management firm Navan (formerly TripActions) also filed confidentially for a U.S. IPO in June. And, blockchain lender Figure is set to make its public debut on Sept. 11.

Related Crunchbase query:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

Gucci Owner Kering Gets More Time to Buy the Rest of Valentino

Kering SA is getting more time to exercise an option to buy the rest of fashion house Valentino, as the French group focuses on reducing its debt levels.

Source link

Funding & Business

Brookfield's Flatt on Insurance, Private Markets and AI

Brookfield Asset Management CEO Bruce Flatt discusses the company’s push into insurance annuities, the state of private credit markets and the opportunities in AI infrastructure with Dani Burger on “Bloomberg Markets.” (Source: Bloomberg)

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi