Funding & Business

AI Startup Lovable Could Be Valued at $1.5 Billion in New Round From Accel

Accel, the storied venture firm that invested early in Facebook and Slack, is set to lead a new funding round in the Swedish “vibe coding” startup Lovable at a valuation of at least $1.5 billion, according to multiple sources familiar with the deal.

Vibe coding, which allows novices with limited programming expertise to create code using AI, has been all the rage lately. Market leader Cursor’s parent company, Anysphere, which is also backed by Accel, is reportedly in talks for a $9.9 billion valuation and now could be deployed internally by Amazon, Business Insider previously reported.

Other competitors include Cognition AI, Microsoft’s GitHub Copilot, and Windsurf, which was recently acquired by OpenAI.

Lovable, founded by Anton Osika and Fabian Hedin, aims to make coding even more user-friendly, enabling non-engineers to make software and applications.

It has the kind of hockey stick growth that enamors tech investors, going from zero to $17 million in annual recurring revenue in its first three months with 30,000 paying customers.

Lovable declined to comment on the funding round, which is still not finalized and could change. Bloomberg previously reported the valuation of the round.

Only a few months ago, Lovable raised $15 million in pre-series A funding led by Creandum, a European early-stage firm. Other investors included Charlie Songhurst, who sits on the Meta board, as well as Thomas Wolf, cofounder of Hugging Face.

The US has dominated funding for AI startups, something Lovable aims to change.

In a blog post, the company said it “may be Europe’s fastest-growing AI startup” and that it was “proving that world-class AI companies can emerge from Europe—and win on the global stage.”

Funding & Business

Watch Cantor’s Brandon and Kyle Lutnick on 9/11, SPACs, Crypto

Funding & Business

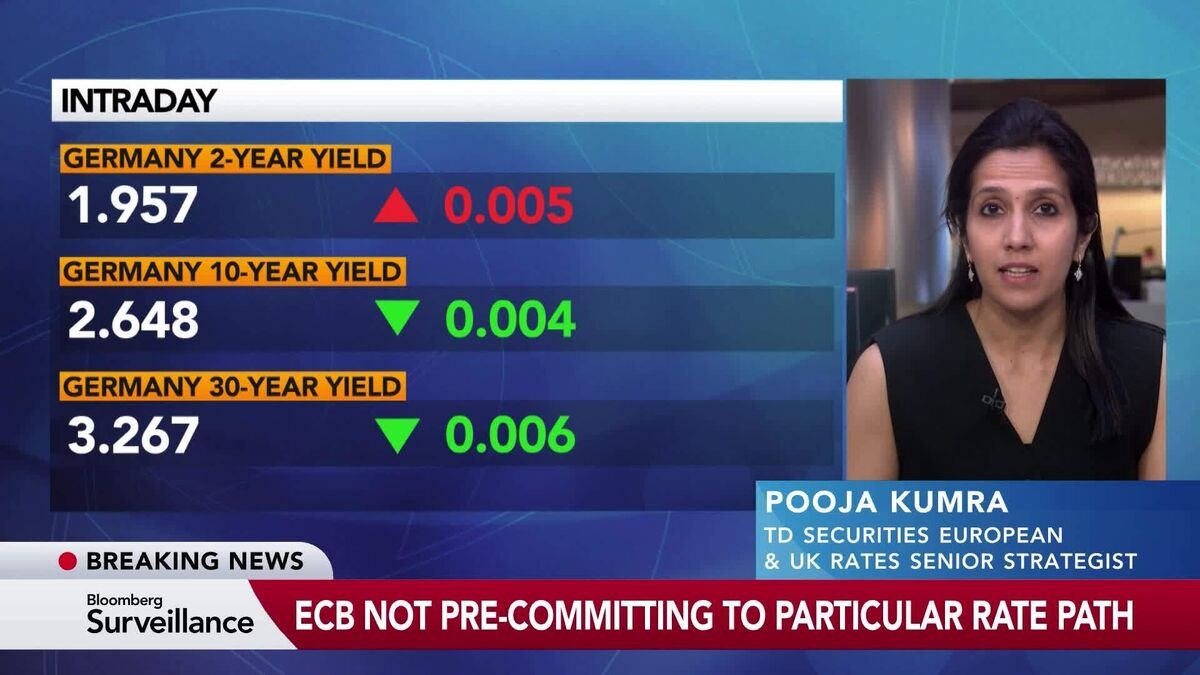

ECB to Weigh Global Uncertainty, Europe Resilience: Kumra

Pooja Kumra, European and UK Rates Senior Strategist at TD Securities, says the uncertain global outlook will now be a focus for the ECB rather the disinflation process in Europe. She speaks to Bloomberg’s Jonathan Ferro and Lisa Abramowicz on ‘Surveillance.’ (Source: Bloomberg)

Source link

Funding & Business

See Near-Term Flattening of Curve: Hornby

Lisa Hornby, Head of US Fixed Income at Schroeder Investment Management, sees a near-term slowdown in the economy and reacceleration in the medium term. She speaks to Bloomberg’s Jonathan Ferro, Lisa Abramowicz and Annmarie Hordern on ‘Surveillance.’ (Source: Bloomberg)

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi