AI Insights

3 Top Artificial Intelligence (AI) Stocks to Buy Not Named Nvidia – July 1, 2025

Key Takeaways

- It’s time to buy digital infrastructure and Nvidia partner Vertiv stock.

- Why chip maker Taiwan Semi is an all-encompassing tech investment across AI and beyond.

- Buy electric construction stock MYRG for the AI infrastructure boom.

Wall Street bulls pushed the stock market to new all-time highs to end June, as investors bet on a cease-fire deal in the Middle East. The strong end to the second quarter capped off a historic rebound from the early April lows.

The Nasdaq soared over 33% since April 8, driven by mouth-watering gains from Nvidia and other growth stocks benefiting from the artificial intelligence revolution.

The market might face some near-term selling pressure and volatility in the coming weeks. Still, the combination of trade deals, cooling inflation, and strong earnings growth expectations provide a bullish launching pad for stocks in the second half. The S&P 500 has also posted a positive July for 10 straight years.

Let’s dive into three highly-ranked Zacks stocks benefiting directly from the artificial intelligence spending boom to consider buying in July.

Buy Picks-and-Shovels AI Stock Vertiv Now and Hold

Behind-the-scenes technology stock Vertiv ((VRT – Free Report) ) soared1,445% in the past three years to outclimb AI chip powerhouse Nvidia’s 990% charge. The digital infrastructure and continuity solutions company is poised to benefit from the AI spending boom and become a long-term AI winner no matter who commercializes artificial intelligence and which AI hyperscalers gain the largest market share.

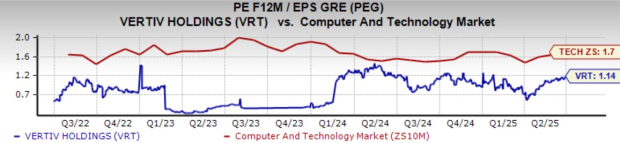

Image Source: Zacks Investment Research

Vertiv’s hardware, software, analytics, and ongoing services portfolio is focused on power, cooling, and IT infrastructure, operating across AI data centers, communication networks, and commercial/industrial environments. The Ohio-based firm’s growing portfolio helps make sure the high-density computing power that drives technological innovation and the economy runs as smoothly as possible 24/7.

VRT, which has partnered with Nvidia ((NVDA – Free Report) ) to help solve critical AI challenges such as cooling, averaged 16% revenue growth in the past four years.

“We continue to see accelerated scaling of AI deployments across the data center market, with strong demand signals reinforcing both our near- and long-term growth outlook… Our partnership with NVIDIA and our reference designs for their GB200 and GB300 NVL72 platforms position Vertiv at the forefront of AI factory deployment at industrial scale,” CEO Giordano Albertazzi said in prepared remarks last quarter.

Image Source: Zacks Investment Research

Vertiv is projected to grow its revenue by 19% in 2025 and 14% next year to $10.87 billion—double its 2021 total. The soaring tech company is expected to boost its adjusted earnings by 25% and 24%, respectively, following 60% growth in 2024 and 236% in 2023. VRT reaffirmed its 2025 outlook in late May, and its upbeat EPS revisions earn it a Zacks Rank #2 (Buy).

Wall Street loves the dividend-paying AI stock, with 15 of the 19 brokerage recommendations we have at “Strong Buys.” Despite its Nvidia-beating run over the past three years, VRT trades 16% below its highs and it’s on the verge of completing the bullish golden cross where the shorter-dated 50-day moving average climbs above the 200-day.

Image Source: Zacks Investment Research

Vertiv trades at a 30% discount to its highs at 32.1X forward 12-month earnings. Its strong longer-term earnings growth outlook helps the stock trade at a 33% discount to Tech, even though VRT has crushed the sector over the past five years.

TSMC is One of the Best AI Tech Stocks to Buy for the Next Decade

Physically building the most complex, cutting-edge semiconductors in the world makes Taiwan Semiconductor Manufacturing Co. ((TSM – Free Report) ) a straightforward, all-encompassing tech investment across AI, electronics, and future tech innovations.

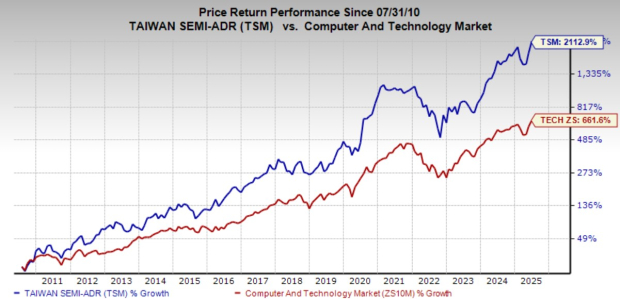

Taiwan Semi’s foundry-only model slowly transformed it into one of the only games in town for semiconductor manufacturing, especially at the bleeding edge. This backdrop is why TSM stock has skyrocketed 2,600% over the past 20 years, more than tripling the Tech sector’s performance.

Taiwan Semi reportedly holds a roughly 60% share of the entire foundry market and 90% of advanced chip manufacturing, boasting Apple and other tech titans as key clients. Nvidia’s massive AI expansion likely wouldn’t be possible without TSMC.

Image Source: Zacks Investment Research

TSMC is also critically addressing its geopolitical fears by expanding its manufacturing footprint outside Taiwan into Japan and the U.S. Taiwan Semi pays a dividend, and its balance sheet is solid.

Taiwan Semi is boosting its industry-leading 3-nanometer production, fueled by demand from AI chip companies Nvidia and AMD. The pure-play foundry company said 3nm chips accounted for 22% of total wafer revenue in the first quarter of 2025, up from 9% in the year-ago period, with advanced technologies accounting for 73%.

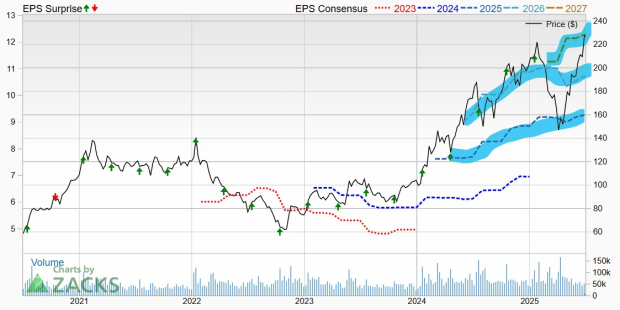

Image Source: Zacks Investment Research

TSMC is projected to grow its revenue by 29% in FY25 and 17% in FY26 (following a 25% expansion last year) to surge from $90 billion in 2024 to $137 billion in 2026. Taiwan Semi is projected to grow its adjusted earnings by 32% in FY25 and 16% next year.

The company’s recent positive earnings revisions earn it a Zacks Rank #2 (Buy) and extend its stretch of improving, AI-boosted earnings growth. And TSMC has topped our estimates for nearly five years running.

Taiwan Semi stock might be a little overheated from a technical standpoint after its massive rally saw it hit new highs at the end of June alongside Nvidia and other tech standouts. That said, TSMC still trades at a 33% discount to its highs and 18% below Tech at 22.6X forward 12-month earnings.

Image Source: Zacks Investment Research

Any pullback to its 21-day or 50-day moving averages could represent a more enticing buying opportunity. Others might want to wait for its second-quarter earnings release on July 17. Long-term investors might avoid the market timing game and buy TSMC now.

Buy Under the Radar MYRG Stock for the AI Infrastructure Boom

MYR Group Inc. (MYRG – Free Report) is a U.S.-based specialty contractor that builds and maintains electrical infrastructure, such as power lines and substations, for utilities, renewable energy projects, and beyond.

The electric construction firm’s growth outlook is stellar. MYR Group is set to ride the massive energy and electrification infrastructure spending boom that’s just kicking off due to soaring AI energy demand and decades of underspending on critical energy infrastructure.

Image Source: Zacks Investment Research

MYRG’s Transmission and Distribution segment focuses on electric transmission lines, distribution networks, substations, clean energy projects, EV charging infrastructure, and much more for utilities and developers.

MYR Group’s Commercial and Industrial unit provides electrical wiring, maintenance, and repair services for a diverse range of facilities, including airports, hospitals, AI data centers, industrial plants, as well as clean energy infrastructure.

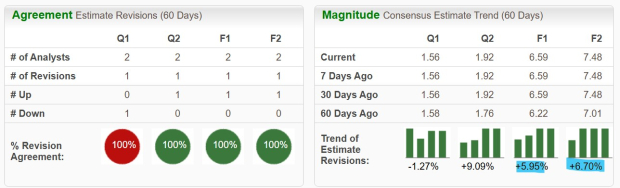

Image Source: Zacks Investment Research

MYR Group went on a massive run between 2017 and 2023, before facing short-term setbacks in 2024, driven by project delays, cost overruns in clean energy contracts, and more. MYRG’s beat-and-raise first quarter helps it earn a Zacks Rank #1 (Strong Buy).

Its backlog jumped 8% YoY in Q1 to $2.43 billion. MYRG is projected to grow its revenue by 3% and 6%, respectively, in 2025 and 2026. Better yet, its earnings are expected to bounce back massively after a rough 2024 to the tune of 260% growth in 2025 and 14% next year to reach $7.48 a share, blowing away its previous 2023 record of $5.42 a share.

Image Source: Zacks Investment Research

The electric construction stock climbed 960% in the past 15 years, crushing the Utilities sector’s 45% and the S&P 500’s 480%, including a 450% surge in the past five years. MYR Group recently broke out to new all-time highs. Yet, MYRG trades at a 20% discount to its highs at 25.8X forward 12-month earnings.

AI Insights

Real or AI: Band confirms use of artificial intelligence for its music on Spotify

The Velvet Sundown, a four-person band, or so it seems, has garnered a lot of attention on Spotify. It started posting music on the platform in early June and has since released two full albums with a few more singles and another album coming soon. Naturally, listeners started to accuse the band of being an AI-generated project, which as it now turns out, is true.

The band or music project called The Velvet Sundown has over a million monthly listeners on Spotify. That’s an impressive debut considering their first album called “Floating on Echoes” hit the music streaming platform on June 4. Then, on June 19, their second album called “Dust and Silence” was added to the library. Next week, July 14, will mark the release of the third album called “Paper Sun Rebellion.” Since their debut, listeners have accused the band of being an AI-generated project and now, the owners of the project have updated the Spotify bio and called it a “synthetic music project guided by human creative direction, and composed, voiced, and visualized with the support of artificial intelligence.”

It goes on to state that this project challenges the boundaries of “authorship, identity, and the future of music itself in the age of AI.” The owners claim that the characters, stories, music, voices, and lyrics are “original creations generated with the assistance of artificial intelligence tools,” but it is unclear to what extent AI was involved in the development process.

The band art shows four individuals suggesting they are owners of the project, but the images are likely AI-generated as well. Interestingly, Andrew Frelon (pseudonym) claimed to be the owner of the AI band initially, but then confirmed that was untrue and that he pretended to run their Twitter because he wanted to insert an “extra layer of weird into this story,” of this AI band.

As it stands now, The Velvet Sundown’s music is available on Spotify with the new album releasing next week. Now, whether this unveiling causes a spike or a decline in monthly listeners, remains to be seen.

I have always been passionate about gaming and technology, which drove me towards pursuing a career in the tech writing industry. I have spent over 7 years in the tech space and about a decade in content writing. I hope to continue to use this passion and generate informative, entertaining, and accurate content for readers.

AI Insights

How to Choose Between Deploying an AI Chatbot or Agent

In artificial intelligence, the trend du jour is AI agents, or algorithmic bots that can autonomously retrieve data and act on it.

AI Insights

Do AI systems socially interact the same way as living beings?

Key takeaways

- A new study that compares biological brains with artificial intelligence systems analyzed the neural network patterns that emerged during social and non-social tasks in mice and programmed artificial intelligence agents.

- UCLA researchers identified high-dimensional “shared” and “unique” neural subspaces when mice interact socially, as well as when AI agents engaged in social behaviors.

- Findings could help advance understanding of human social disorders and develop AI that can understand and engage in social interactions.

As AI systems are increasingly integrated into from virtual assistants and customer service agents to counseling and AI companions, an understanding of social neural dynamics is essential for both scientific and technological progress. A new study from UCLA researchers shows biological brains and AI systems develop remarkably similar neural patterns during social interaction.

The study, recently published in the journal Nature, reveals that when mice interact socially, specific brain cell types create synchronize in “shared neural spaces,” and artificial intelligence agents develop analogous patterns when engaging in social behaviors.

The new research represents a striking convergence of neuroscience and artificial intelligence, two of today’s most rapidly advancing fields. By directly comparing how biological brains and AI systems process social information, scientists can now better understand fundamental principles that govern social cognition across different types of intelligent systems. The findings could advance understanding of social disorders like autism while simultaneously informing the development of more sophisticated, socially aware AI systems.

This work was supported in part by , the National Science Foundation, the Packard Foundation, Vallee Foundation, Mallinckrodt Foundation and the Brain and Behavior Research Foundation.

Examining AI agents’ social behavior

A multidisciplinary team from UCLA’s departments of neurobiology, biological chemistry, bioengineering, electrical and computer engineering, and computer science across the David Geffen School of Medicine and UCLA Samueli School of Engineering used advanced brain imaging techniques to record activity from molecularly defined neurons in the dorsomedial prefrontal cortex of mice during social interactions. The researchers developed a novel computational framework to identify high-dimensional “shared” and “unique” neural subspaces across interacting individuals. The team then trained artificial intelligence agents to interact socially and applied the same analytical framework to examine neural network patterns in AI systems that emerged during social versus non-social tasks.

The research revealed striking parallels between biological and artificial systems during social interaction. In both mice and AI systems, neural activity could be partitioned into two distinct components: a “shared neural subspace” containing synchronized patterns between interacting entities, and a “unique neural subspace” containing activity specific to each individual.

Remarkably, GABAergic neurons — inhibitory brain cells that regulate neural activity —showed significantly larger shared neural spaces compared with glutamatergic neurons, which are the brain’s primary excitatory cells. This represents the first investigation of inter-brain neural dynamics in molecularly defined cell types, revealing previously unknown differences in how specific neuron types contribute to social synchronization.

When the same analytical framework was applied to AI agents, shared neural dynamics emerged as the artificial systems developed social interaction capabilities. Most importantly, when researchers selectively disrupted these shared neural components in artificial systems, social behaviors were substantially reduced, providing the direct evidence that synchronized neural patterns causally drive social interactions.

The study also revealed that shared neural dynamics don’t simply reflect coordinated behaviors between individuals, but emerge from representations of each other’s unique behavioral actions during social interaction.

“This discovery fundamentally changes how we think about social behavior across all intelligent systems,” said Weizhe Hong, professor of neurobiology, biological chemistry and bioengineering at UCLA and lead author of the new work. “We’ve shown for the first time that the neural mechanisms driving social interaction are remarkably similar between biological brains and artificial intelligence systems. This suggests we’ve identified a fundamental principle of how any intelligent system — whether biological or artificial — processes social information. The implications are significant for both understanding human social disorders and developing AI that can truly understand and engage in social interactions.”

Continuing research for treating social disorders and training AI

The research team plans to further investigate shared neural dynamics in different and potentially more complex social interactions. They also aim to explore how disruptions in shared neural space might contribute to social disorders and whether therapeutic interventions could restore healthy patterns of inter-brain synchronization. The artificial intelligence framework may serve as a platform for testing hypotheses about social neural mechanisms that are difficult to examine directly in biological systems. They also aim to develop methods to train socially intelligent AI.

The study was led by UCLA’s Hong and Jonathan Kao, associate professor of electrical and computer engineering. Co-first authors Xingjian Zhang and Nguyen Phi, along with collaborators Qin Li, Ryan Gorzek, Niklas Zwingenberger, Shan Huang, John Zhou, Lyle Kingsbury, Tara Raam, Ye Emily Wu and Don Wei contributed to the research.

-

Funding & Business7 days ago

Kayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Jobs & Careers7 days ago

Mumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Mergers & Acquisitions6 days ago

Donald Trump suggests US government review subsidies to Elon Musk’s companies

-

Funding & Business6 days ago

Rethinking Venture Capital’s Talent Pipeline

-

Jobs & Careers6 days ago

Why Agentic AI Isn’t Pure Hype (And What Skeptics Aren’t Seeing Yet)

-

Funding & Business4 days ago

Sakana AI’s TreeQuest: Deploy multi-model teams that outperform individual LLMs by 30%

-

Jobs & Careers6 days ago

Astrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle

-

Funding & Business7 days ago

From chatbots to collaborators: How AI agents are reshaping enterprise work

-

Funding & Business4 days ago

HOLY SMOKES! A new, 200% faster DeepSeek R1-0528 variant appears from German lab TNG Technology Consulting GmbH

-

Tools & Platforms6 days ago

Winning with AI – A Playbook for Pest Control Business Leaders to Drive Growth