For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

Funding & Business

State of Insurtech Q1’25 Report

From a new $1B unicorn to a 9-year low for early-stage funding, we break down the trends reshaping insurtech using CB Insights data.

The insurtech landscape is increasingly competitive. Median deal sizes are down, and early-stage insurtech funding is at a nearly 9-year low, despite a rebound in global insurtech funding to $1.3B in Q1’25.

Insurtech does not exist in a vacuum, and the broader venture environment is centered on AI funding. In Q1’25, OpenAI raised nearly 31 times the total funding of all insurtechs combined, underscoring where capital is flowing.

AI capabilities are poised to reshape the future of insurance — whether through 100-day-old startups or 100-year-old incumbents adapting to a new competitive reality.

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

Key takeaways from the report include:

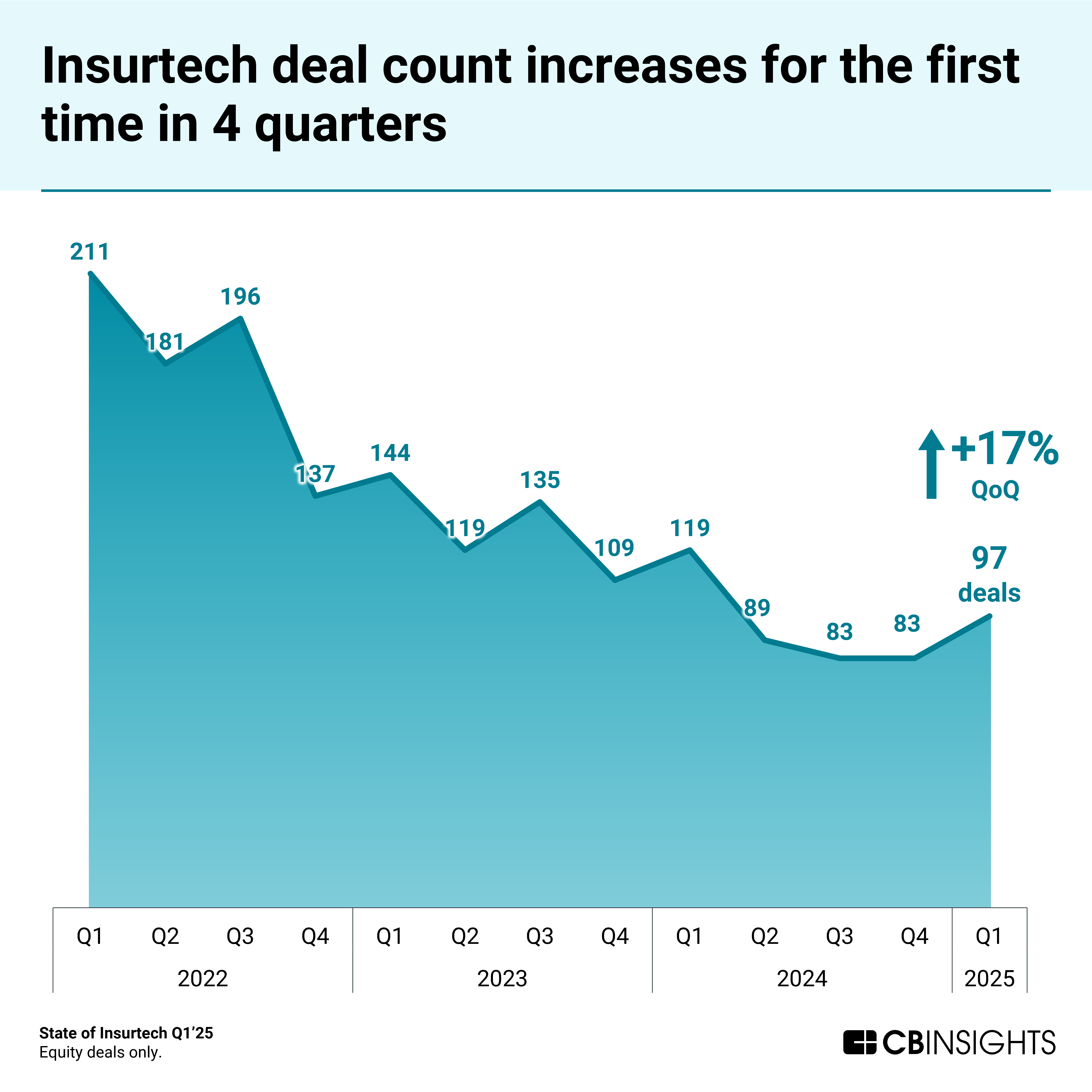

- Insurtech dealmaking increases for the first time in a year. Global insurtech deal count increased 17% quarter-over-quarter (QoQ), from 83 in Q4’24 to 97 in Q1’25. Property & casualty insurtech drove the increase, from just 51 deals — a near 8-year low — in Q4’24 to 70 in Q1’25.

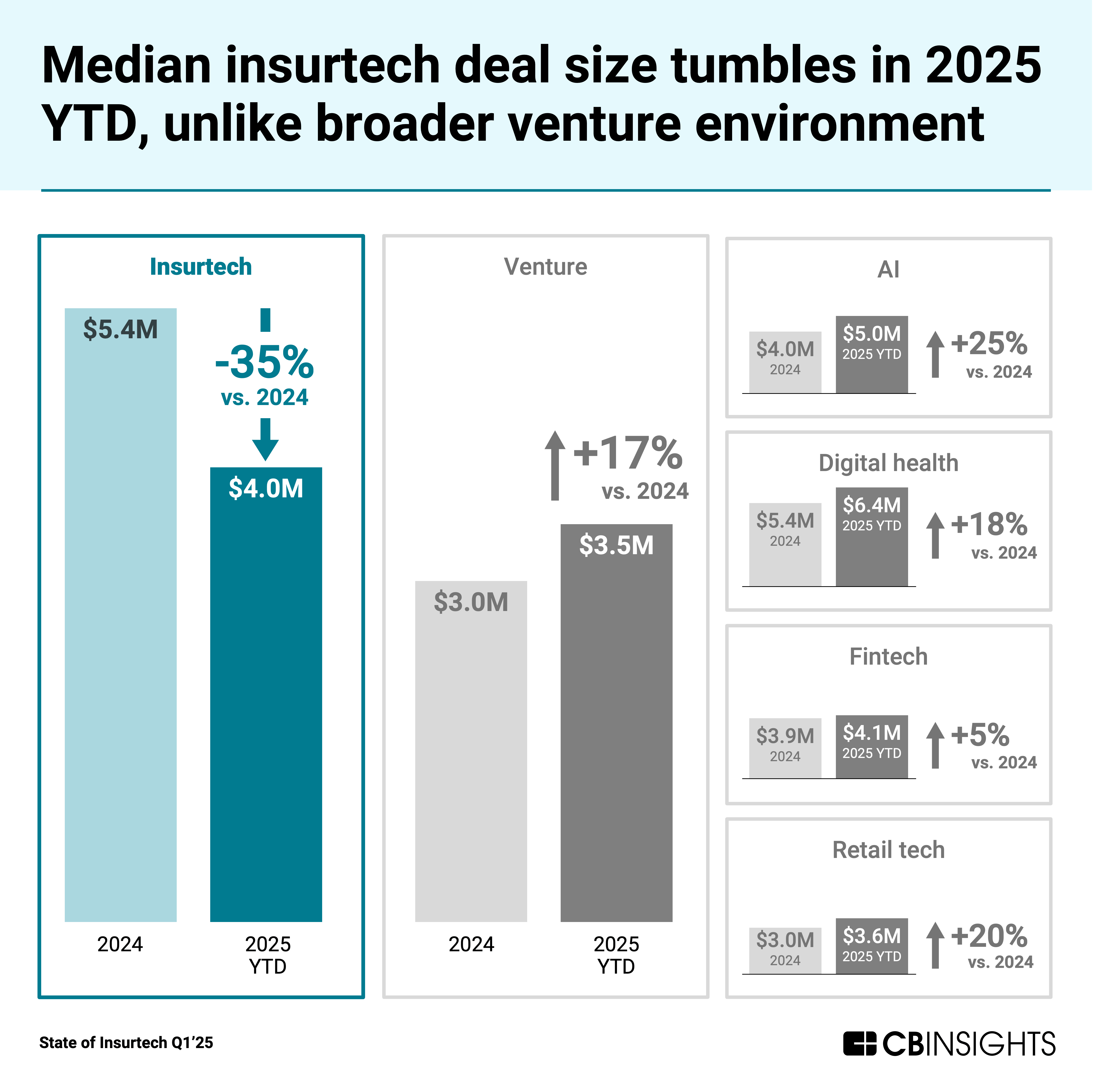

- Median insurtech deal size tumbles 35% in 2025 YTD (year to date) to $4.0M. The median insurtech deal size has not been lower since 2019 ($3.4M). The decline stands out because median deal sizes across the broader venture environment rose 17% YTD to $3.5M, while insurtech’s fell.

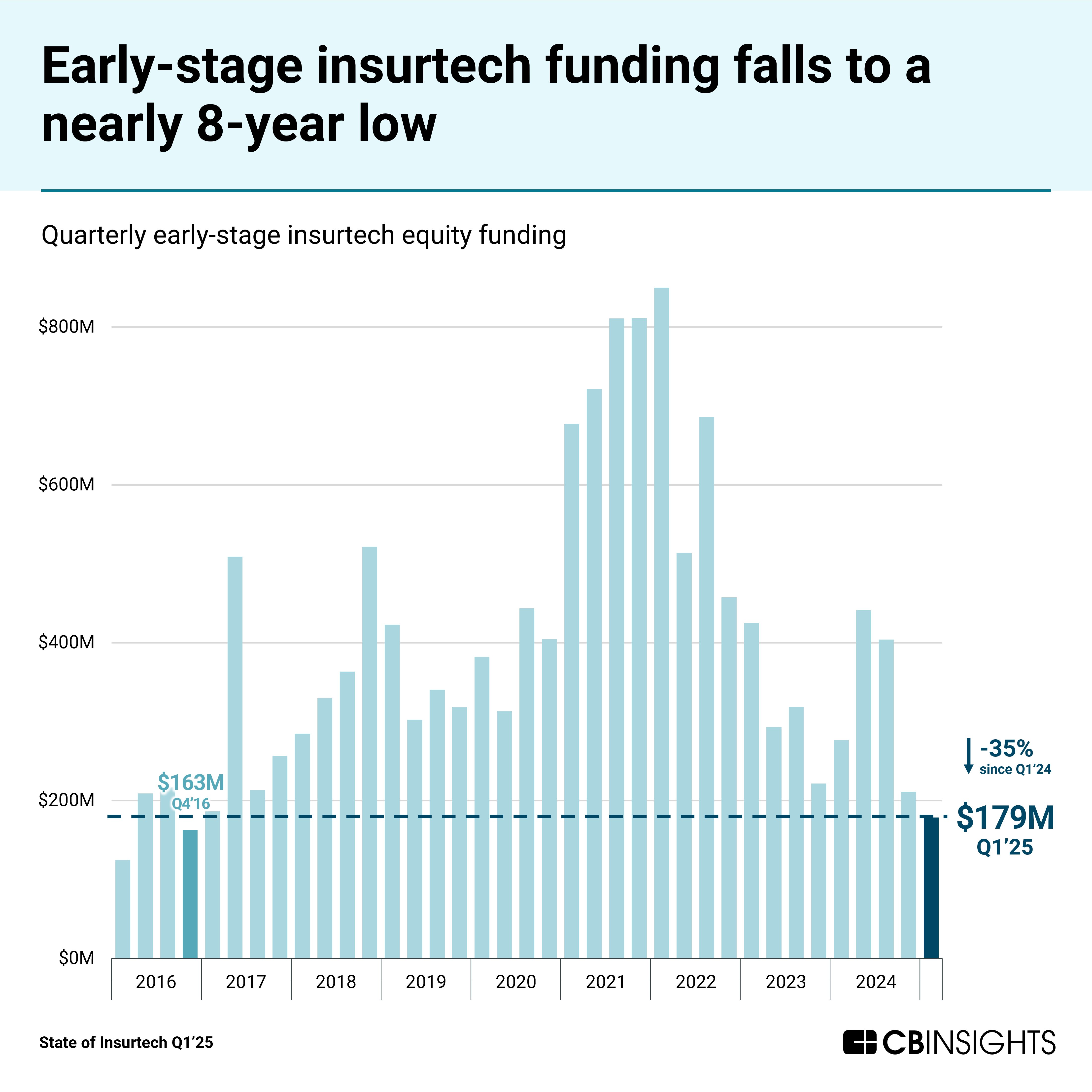

- Early-stage insurtech funding reaches a nearly 8-year low — $179M. Early-stage insurtech funding fell 35% year-over-year (YoY) from $277M in Q1’24.

- Late-stage insurtech dealmaking paints a cautious growth picture. The 7 insurtechs that raised Series D+ deals in Q1’25 saw median headcount growth of just 3% over the past 12 months — far lower than insurtechs raising at earlier stages.

- Silicon Valley sees 1 in 5 global insurtech deals. Silicon Valley’s share of global insurtech equity deals has nearly doubled YoY, from 10.9% in Q1’24 to 21.9% in Q1’25. Funding to Silicon Valley-based insurtech increased to $0.3B — the highest level since Q4’23 ($0.4B).

Insurtech dealmaking increases for the first time in a year

Insurtech deal count increased 17% QoQ, from 83 deals in Q4’24 to 97 in Q1’25 — a reversal of the broader venture trend, where deal count declined 7% over the same period.

The rebound was driven by property & casualty insurtech, which jumped from just 51 deals — a near 8-year low — in Q4’24 to 70 in Q1’25. Meanwhile, life & health insurtech saw deal count dip to 27 in Q1’25.

This increase in activity followed an abnormally weak Q4, when funding had fallen to $0.8B. In Q1’25, insurtech funding surged 63% to $1.3B — slightly above the 10-quarter average of $1.2B. Notably, insurtech was the only fintech vertical to post a funding gain this quarter.

Nearly $400M toward three $100M+ mega-round deals contributed to the broader funding rebound:

- Quantexa, a data management and financial crime prevention platform, raised a $175M Series F deal.

- Openly, a homeowners-focused general agency and program administrator, raised a $123M Series E deal.

- Instabase, an AI platform for unstructured data, raised a $100M Series D deal.

Future implication: These mega-rounds signal investors’ readiness to write large checks for select insurtechs — even in a cautious funding environment. For incumbents, this underscores the importance of tracking well-capitalized startups that could pose competitive threats through 2025.

Median insurtech deal size tumbles in Q1’25

Half of the quarter’s top 10 insurtech deals went to AI-centered startups: Quantexa, Instabase, Nirvana, Taktile, and Naked. But unlike the broader venture market, insurtech lacked the depth of large-dollar AI deals needed to lift the median.

While the average insurtech deal size ticked up 6% to $15.8M in 2025 YTD, the median insurtech deal size tumbled from $5.4M in 2024 to $4.0M — its lowest point since 2019 ($3.4M). This trend diverged from the broader venture environment, where a spike in $100M+ mega-rounds pushed medians higher.

Early-stage insurtech saw a similar dynamic, with median deal sizes declining to $3.0M in 2025 YTD — even as the broader venture landscape saw an increase, from $2.0M in 2024 to $2.8M. Fertility-focused platform Gaia raised the largest early-stage insurtech deal in Q1’25 ($15M Series A).

Future implication: Smaller check sizes could give incumbent insurers an opening to partner with capital-constrained insurtechs — potentially securing more favorable terms and early access to emerging tech that would be harder to land in a hotter market.

Early-stage insurtech funding reaches a nearly 8-year low

Early-stage insurtech startups raised just $178.5M across 56 deals in Q1’25 — the lowest total since Q4’16 ($162.8M). Funding has dropped sharply over the past year, falling 35% from Q1’24.

Early-stage insurtech deal share has also tumbled over the past few years. In 2022, 71% of deals went to early-stage insurtechs, while in 2025 YTD, it was just 58%.

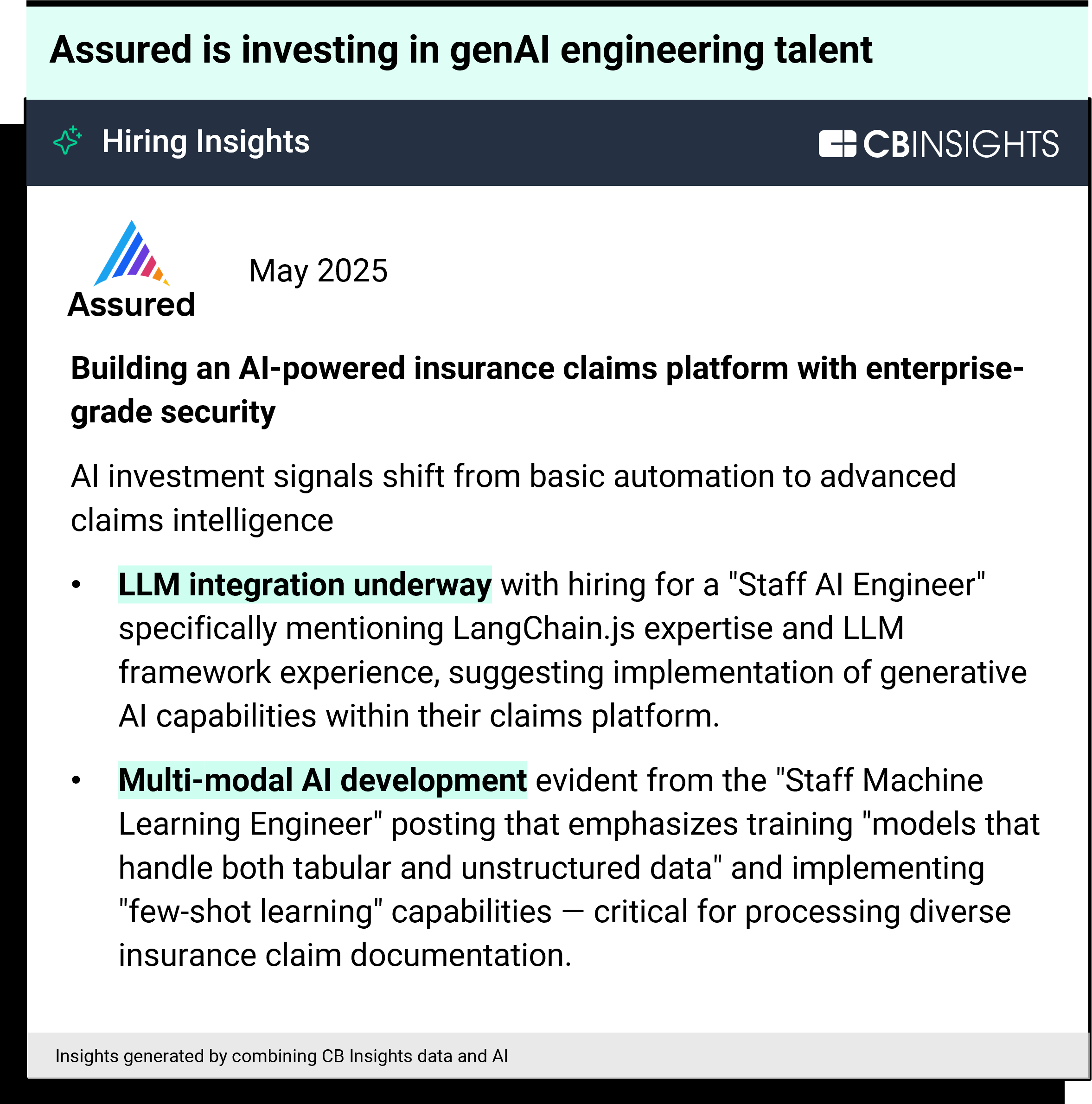

Still, the quarter delivered one notable early-stage highlight: AI claims platform Assured became just the second new insurtech unicorn since Q4’23. The startup raised an undisclosed Series A round at a $1B valuation, backed by ICONIQ Capital and Kleiner Perkins.

Assured also ranks in the global top 4% of companies for hiring momentum and is actively prioritizing genAI-focused hires:

Future implication: The sustained drop in early-stage insurtech funding risks shrinking the industry’s future innovation pipeline. To stay ahead, insurance execs should prioritize identifying and building relationships with promising startups now — before competition for a smaller pool of standouts intensifies.

Late-stage insurtech dealmaking paints a cautious growth picture

The 7 insurtechs that raised Series D+ rounds in Q1’25 posted median 12-month headcount growth of just 3% — significantly lower than their earlier-stage peers. Only one of them — insurance customer communication platform Ushur — saw double-digit growth over the same period.

Ushur is also the only insurtech among the 7 with an above-average M&A probability within the next 2 years. This signals a potential standstill in the late-stage insurtech market, especially as the IPO pipeline remains frozen — just 2 insurtechs have gone public since 2023.

Future implication: With just 3% median headcount growth, late-stage insurtechs are showing signs of stagnation. In a market where public investors expect clear growth momentum, more of these companies may be pushed toward M&A exits — often at compressed valuations.

Silicon Valley sees 1 in 5 global insurtech deals

Silicon Valley has now seen 2 consecutive quarters of elevated insurtech dealmaking. The share of global insurtech deals to Silicon Valley-based startups nearly doubled YoY, rising from 10.9% in Q1’24 to 21.9% in Q1’25. Comparatively, 9% of deals across the broader venture environment went to Silicon Valley-based companies in Q1’25.

2 of the quarter’s top 5 insurtech deals went to Silicon Valley-based insurtechs: Instabase and Nirvana ($80M Series C). As a result, Silicon Valley’s insurtech funding in Q1’25 increased to $0.3B — the highest level since Q4’22 ($0.4B). By comparison, Europe’s insurtech market saw $0.4B in funding across 26 deals in Q1’25, slightly edging out Silicon Valley’s total.

Silicon Valley also saw a major insurtech exit in Q1’25: Munich Re announced its acquisition of Palo Alto-based Next Insurance — one of insurtech’s most-promising startups — at a $2.6B valuation.

Future implication: As the world’s premier tech ecosystem, Silicon Valley remains a leading indicator for insurtech innovation. Insurance executives should track tech talent migration into insurtech as a signal of where future competitive threats may emerge.

MORE INSURTECH RESEARCH FROM CB INSIGHTS

If you aren’t already a client, sign

up for a free trial to learn more about our platform.

Funding & Business

How Capital One built production multi-agent AI workflows to power enterprise use cases

How do you balance risk management and safety with innovation in agentic systems — and how do you grapple with core considerations around data and model selection? In this VB Transform session, Milind Naphade, SVP, technology, of AI Foundations at Capital One, offered best practices and lessons learned from real-world experiments and applications for deploying and scaling an agentic workflow.

Capital One, committed to staying at the forefront of emerging technologies, recently launched a production-grade, state-of-the-art multi-agent AI system to enhance the car-buying experience. In this system, multiple AI agents work together to not only provide information to the car buyer, but to take specific actions based on the customer’s preferences and needs. For example, one agent communicates with the customer. Another creates an action plan based on business rules and the tools it is allowed to use. A third agent evaluates the accuracy of the first two, and a fourth agent explains and validates the action plan with the user. With over 100 million customers using a wide range of other potential Capital One use case applications, the agentic system is built for scale and complexity.

“When we think of improving the customer experience, delighting the customer, we think of, what are the ways in which that can happen?” Naphade said. “Whether you’re opening an account or you want to know your balance or you’re trying to make a reservation to test a vehicle, there are a bunch of things that customers want to do. At the heart of this, very simply, how do you understand what the customer wants? How do you understand the fulfillment mechanisms at your disposal? How do you bring all the rigors of a regulated entity like Capital One, all the policies, all the business rules, all the constraints, regulatory and otherwise?”

Agentic AI was clearly the next step, he said, for internal as well as customer-facing use cases.

Designing an agentic workflow

Financial institutions have particularly stringent requirements when designing any workflow that supports customer journeys. And Capital One’s applications include a number of complex processes as customers raise issues and queries leveraging conversational tools. These two factors made the design process especially complex, requiring a holistic view of the entire journey — including how both customers and human agents respond, react, and reason at every step.

“When we looked at how humans do reasoning, we were struck by a few salient facts,” Naphade said. “We saw that if we designed it using multiple logical agents, we would be able to mimic human reasoning quite well. But then you ask yourself, what exactly do the different agents do? Why do you have four? Why not three? Why not 20?”

They studied customer experiences in the historic data: where those conversations go right, where they go wrong, how long they should take and other salient facts. They learned that it often takes multiple turns of conversation with an agent to understand what the customer wants, and any agentic workflow needs to plan for that, but also be completely grounded in an organization’s systems, available tools, APIs, and organizational policy guardrails.

“The main breakthrough for us was realizing that this had to be dynamic and iterative,” Naphade said. “If you look at how a lot of people are using LLMs, they’re slapping the LLMs as a front end to the same mechanism that used to exist. They’re just using LLMs for classification of intent. But we realized from the beginning that that was not scalable.”

Taking cues from existing workflows

Based on their intuition of how human agents reason while responding to customers, researchers at Capital One developed a framework in which a team of expert AI agents, each with different expertise, come together and solve a problem.

Additionally, Capital One incorporated robust risk frameworks into the development of the agentic system. As a regulated institution, Naphade noted that in addition to its range of internal risk mitigation protocols and frameworks,”Within Capital One, to manage risk, other entities that are independent observe you, evaluate you, question you, audit you,” Naphade said. “We thought that was a good idea for us, to have an AI agent whose entire job was to evaluate what the first two agents do based on Capital One policies and rules.”

The evaluator determines whether the earlier agents were successful, and if not, rejects the plan and requests the planning agent to correct its results based on its judgement of where the problem was. This happens in an iterative process until the appropriate plan is reached. It’s also proven to be a huge boon to the company’s agentic AI approach.

“The evaluator agent is … where we bring a world model. That’s where we simulate what happens if a series of actions were to be actually executed. That kind of rigor, which we need because we are a regulated enterprise – I think that’s actually putting us on a great sustainable and robust trajectory. I expect a lot of enterprises will eventually go to that point.”

The technical challenges of agentic AI

Agentic systems need to work with fulfillment systems across the organization, all with a variety of permissions. Invoking tools and APIs within a variety of contexts while maintaining high accuracy was also challenging — from disambiguating user intent to generating and executing a reliable plan.

“We have multiple iterations of experimentation, testing, evaluation, human-in-the-loop, all the right guardrails that need to happen before we can actually come into the market with something like this,” Naphade said. “But one of the biggest challenges was we didn’t have any precedent. We couldn’t go and say, oh, somebody else did it this way. How did that work out? There was that element of novelty. We were doing it for the first time.”

Model selection and partnering with NVIDIA

In terms of models, Capital One is keenly tracking academic and industry research, presenting at conferences and staying abreast of what’s state of the art. In the present use case, they used open-weights models, rather than closed, because that allowed them significant customization. That’s critical to them, Naphade asserts, because competitive advantage in AI strategy relies on proprietary data.

In the technology stack itself, they use a combination of tools, including in-house technology, open-source tool chains, and NVIDIA inference stack. Working closely with NVIDIA has helped Capital One get the performance they need, and collaborate on industry-specific opportunities in NVIDIA’s library, and prioritize features for the Triton server and their TensoRT LLM.

Agentic AI: Looking ahead

Capital One continues to deploy, scale, and refine AI agents across their business. Their first multi-agentic workflow was Chat Concierge, deployed through the company’s auto business. It was designed to support both auto dealers and customers with the car-buying process. And with rich customer data, dealers are identifying serious leads, which has improved their customer engagement metrics significantly — up to 55% in some cases.

“They’re able to generate much better serious leads through this natural, easier, 24/7 agent working for them,” Naphade said. “We’d like to bring this capability to [more] of our customer-facing engagements. But we want to do it in a well-managed way. It’s a journey.”

Funding & Business

Houthis Say They Hit Red Sea Ship in First Attack This Year

Yemen’s Houthis have claimed responsibility for an attack on a ship sailing through the Red Sea on Sunday, in their first strike on merchant shipping since December.

Source link

Funding & Business

Andrew Left Set to Appear in Court in Push to Toss Fraud Charges

Activist short seller Andrew Left is set to appear in federal court Monday in a securities fraud case that shook the industry a year ago, setting up a battle over investor tips and free speech.

Source link

-

Funding & Business7 days ago

Kayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Jobs & Careers6 days ago

Mumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Mergers & Acquisitions6 days ago

Donald Trump suggests US government review subsidies to Elon Musk’s companies

-

Funding & Business6 days ago

Rethinking Venture Capital’s Talent Pipeline

-

Jobs & Careers6 days ago

Why Agentic AI Isn’t Pure Hype (And What Skeptics Aren’t Seeing Yet)

-

Funding & Business4 days ago

Sakana AI’s TreeQuest: Deploy multi-model teams that outperform individual LLMs by 30%

-

Funding & Business7 days ago

From chatbots to collaborators: How AI agents are reshaping enterprise work

-

Jobs & Careers6 days ago

Astrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle

-

Tools & Platforms6 days ago

Winning with AI – A Playbook for Pest Control Business Leaders to Drive Growth

-

Jobs & Careers4 days ago

Ilya Sutskever Takes Over as CEO of Safe Superintelligence After Daniel Gross’s Exit