Top Stories

RIP to the Macintosh HD hard drive icon, 2000–2025

That version of the icon persisted through the Apple Silicon-era Big Sur redesign and was still with us in the first public beta build for macOS 26 Tahoe that Apple released last week. The new beta also updates the icons for external drives (orange, with a USB-C connector on top), network shares (blue, with a globe on top), and removable disk images (white, with an arrow on top).

All of the system’s disk icons get an update in the latest macOS 26 Tahoe developer beta.

Credit:

Apple/Andrew Cunningham

Other icons that reused or riffed on the old hard drive icon have also been changed. Disk Utility now looks like a wrench tightening an Apple-branded white bolt, for some reason, and drive icons within Disk Utility also have the new SSD-esque icon. Installer apps use the new icon instead of the old one. Navigate to the /System/Library/CoreServices folder where many of the built-in operating system icons live, and you can see a bunch of others that exchange the old HDD icon for the new SSD.

Apple first offered a Mac with an SSD in 2008, when the original MacBook Air came out. By the time “Retina” Macs began arriving in the early 2010s, SSDs had become the primary boot disk for most of them; laptops tended to be all-SSD, while desktops could be configured with an SSD or a hybrid Fusion Drive that used an SSD as boot media and an HDD for mass storage. Apple stopped shipping spinning hard drives entirely when the last of the Intel iMacs went away.

This doesn’t actually matter much. The old icon didn’t look much like the SSD in your Mac, and the new one doesn’t really look like the SSD in your Mac either. But we didn’t want to let the old icon’s passing go unremarked. So, thanks for the memories, Macintosh HD hard drive icon! Keep on spinning, wherever you are.

Top Stories

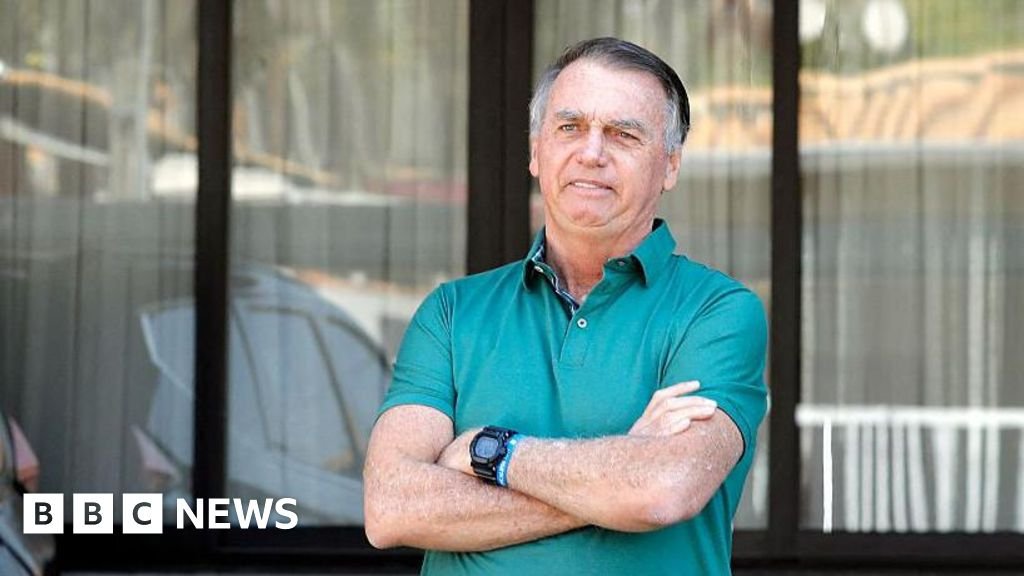

Brazil’s former president Bolsonaro found guilty of coup plot

The former president of Brazil, Jair Bolsonaro, has been convicted of plotting a military coup.

Three out of five Supreme Court justices found the 70-year-old guilty of leading a conspiracy aimed at keeping him in power after he lost the 2022 election to his left-wing rival, Luiz Inácio Lula da Silva.

While the plot failed to enlist enough support from the military to go ahead, it did culminate in the storming of government buildings by Bolsonaro’s supporters on 8 January 2023, the justices found.

One justice acquitted Bolsonaro and a final one is yet to vote, but the simple majority is enough to convict the former president, who could now face decades in jail. He will be sentenced on Friday.

The former president’s fate was sealed on Thursday when Justice Carmén Lúcia cast her vote.

She found him guilty on all the five charges: attempting to stage a coup, leading an armed criminal organisation, attempted violent abolition of the democratic rule of law, and two more charges related to the damage of property during the storming of buildings in Brasília on 8 January 2023.

Top Stories

Rising inflation and a deteriorating job market puts the Fed and Americans in a difficult spot

WASHINGTON (AP) — Inflation rose last month as the price of gas, groceries and airfares jumped while new data showed applications for unemployment aid soared, putting the Federal Reserve in an increasingly tough spot as it prepares to cut rates at its meeting next week despite persistent price pressures.

Consumer prices increased 2.9% in August from a year earlier, the Labor Department said Thursday, up from 2.7% the previous month and the biggest jump since January. Excluding the volatile food and energy categories, core prices rose 3.1%, the same as in July. Both figures are above the Federal Reserve’s 2% target.

A separate government report Thursday showed that weekly applications for unemployment aid jumped 27,000 to 263,000, the highest in nearly four years. Requests for jobless benefits are a proxy for layoffs. Recent reports have also showed that hiring has weakened dramatically this year and was lower than previously estimated last year.

The data raises the specter of “stagflation,” a trend that last bedeviled the U.S. economy in the 1970s. The term refers to a period of slower growth, higher unemployment along with rising inflation. It is unusual because a weak economy typically keeps inflation in check.

Such a scenario could create major headaches for the Fed as it prepares for a meeting next week, when policymakers are widely expected to cut their short-term rate to about 4.1% from 4.3%. The Fed is under relentless pressure from President Donald Trump to cut rates. At the same time, stubborn inflation while the job market is weakening is difficult for the central bank because they are diverging trends that require polar reactions from Fed policymakers to address.

Typically the Fed would cut its key rate when unemployment rises to spur more spending and growth. Yet it would do the opposite and raise rates — or at least keep them unchanged — in the face of rising inflation.

Last month, Chair Jerome Powell signaled that Fed officials are increasingly concerned about weaker hiring, setting the stage for a rate cut next week. Wall Street investors think there is an 85% chance the Fed will cut twice more after that, according to futures pricing tracked by CME Fedwatch.

“Consumer inflation came in mildly hotter than forecast, but not nearly high enough to prevent the Fed from starting to cut rates next week,” Kathy Bostjancic, chief economist for Nationwide, said. “The labor market is losing steam and reinforces that the Fed needs to start cutting rates next week and that it will be the start of a series of rate reductions.”

Where inflation heads next is a key question for the Fed. While Thursday’s report showed inflation picked up, data released Wednesday suggested prices at the wholesale level are cooling. Economists also noted that a separate measure of inflation that the Fed prefers, which will be released in about two weeks, should come in lower than Thursday’s figures and paint a more benign picture of prices.

On a monthly basis, overall inflation accelerated, rising 0.4% from July to August, faster than the 0.2% pace the previous month. Core prices rose 0.3% for the second straight month.

Many economists and some key members of the Fed think that the current pickup in inflation reflects one-time increases from Trump’s sweeping tariffs and won’t lead to a lasting inflationary trend. They argue that a weaker job market will hold down wages and force companies to keep prices in check.

Subadra Rajappa, head of U.S. rates strategy at Societe Generale, said that while inflation was elevated last month, there were also signs that the cost of services moderated, suggesting that outside of tariffs, prices are cooling.

Yet Joe Brusuelas, chief economist at RSM, a tax and consulting firm, says that higher-income households are still spending sufficiently to push some prices higher, such as hotel and airfare costs, which leapt last month. Such spending could keep inflation stubbornly high even in a weak job market, he said.

“The Fed’s getting ready to cut into a sustained increase in prices,” he said. “Very unusual spot. … we can see tariff induced inflation in a slow, steady and methodical manner.”

Goods prices picked up last month, a sign Trump’s sweeping tariffs are pushing up costs. Gas prices jumped 1.9% just from July to August, the biggest monthly increase since a 4% rise in December. Grocery prices climbed 0.6%, pushed higher by more expensive tomatoes, apples, and beef. Rental costs also increased, rising 0.4%, faster than the previous month.

Clothing costs rose 0.5% just last month, though they are still just slightly more expensive than a year ago. Furniture costs rose 0.3% and are 4.7% higher than a year earlier.

Some restaurant owners have boosted prices to offset the rising costs of food. Cheetie Kumar, who owns Mediterranean eatery Ajja in Raleigh, North Carolina, said she’s facing higher costs on everything ranging from spices she imports from India, coffee and chocolate she gets from Brazil, and soy she gets from Canada.

“Those are things that I cannot source locally, we do source a lot of produce and meat and everything else from local farmers, but I don’t know any nutmeg growers in North Carolina,” she said.

Her overall costs are up about 10% from a year ago, with beef costs up 7%, and much bigger increases for things like coffee, chocolate (300%) and spices (100%).

She’s raised prices on some of her menu items by $1 or $2, but said she’s at the limit of how much she can do so before demand wanes and she stops earning a profit.

Bigger companies are also feeling the pinch.

E.L.F. Cosmetics said this spring that it was raising prices by $1. Last month, however, CFO Mandy Fields said it is no longer certain whether the $1 price increases will be enough to offset rising tariff costs.

Shoppers have yet to feel the big sting that economists had predicted earlier in the year. Many retailers ordered goods ahead of tariffs and have also absorbed a big chunk of the costs rather than passing them along to consumers, who’ve grown increasingly leery of price increases.

But Walmart and other big chains have warned of costs increases as they replenish their inventories, with the full impact of tariffs in effect.

___

AP Business Writer Anne D’Innocenzio contributed from New York. AP Business Writer Mae Anderson contributed from Nashville.

Top Stories

Home mortgage demand surges as rates drop to 6.35% : NPR

There has been a spike in mortgage applications as interest rates have dropped to the lowest level since October 2024. Here, a home for sale in Alhambra, Calif., last month.

Frederic J. Brown/AFP via Getty Images

hide caption

toggle caption

Frederic J. Brown/AFP via Getty Images

Mortgage rates are finally falling, and just saw their biggest weekly drop in the past year. The average interest rate for a 30-year fixed-rate mortgage in the past week was 6.35%, according to Freddie Mac, down from 6.5% a week earlier.

That’s the lowest average since last October. Rates have been above 6.5% for most of the last year, climbing above 7% in January.

“Mortgage rates are headed in the right direction and homebuyers have noticed, as purchase applications reached the highest year-over-year growth rate in more than four years,” said Sam Khater, Freddie Mac’s chief economist.

As rates dropped, borrower demand surged. Applications to buy a home and to refinance were both up on a weekly and annual basis, according to the Mortgage Bankers Association.

Refinances made up nearly half of those applications, as those who bought homes at higher rates jumped at the chance to lower their monthly mortgage payments. Purchase applications, meanwhile, rose to their highest level since July.

Why are rates dropping now?

The Treasury yields that affect mortgage rates moved lower with the data that the labor market is weakening. The jobs report last week showed that U.S. employers added just 22,000 jobs in August, and a revised report on Tuesday showed that hiring for the last 12 months ending in March was much lower than initially tallied.

The Federal Reserve is expected to cut the fed funds rate at its meeting next week, despite fresh data showing that inflation inched higher last month — with prices on consumer goods up 2.9% from a year ago. But a rate cut may not mean a drop in mortgage rates, as the expectation of a cut is already likely priced into current rates.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi