AI Research

Biennale Architettura 2025 | Artificial Intelligence takes center stage at the Biennale Architettura 2025

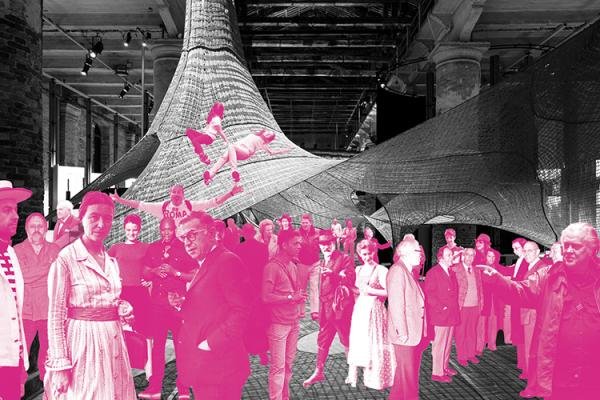

Artificial intelligence takes center stage at the 19th International Architecture Exhibition – Intelligens. Natural. Artificial. Collective. – curated by Carlo Ratti and organized by La Biennale di Venezia, chaired by Pietrangelo Buttafuoco, open to the public until Sunday November 23, 2025, at the Giardini, Arsenale and Forte Marghera. To the rich calendar of the Exhibition’s GENS Public Programme — aimed at engaging the public and creating connections between various disciplines through an experiential exploration of the Exhibition’s themes (full program available at www.labiennale.org) — two new digital companions are now being added. Spatial Intelligens is developed by sub, the transdisciplinary architecture and design studio led by Niklas Bildstein Zaar, also behind the Exhibition’s spatial design; In Other Words is designed by VOLUME, one of the featured participants. The new tools extend this year’s curatorial theme into infrastructure, inviting visitors to inhabit architectural ideas presented by the partecipants, while also raising broader questions about how knowledge is organized, circulated, and contested within cultural institutions.

Artificial Intelligence at Work

Throughout the preparation of this year’s Biennale Architettura, AI has been used to summarize texts, generate captions, and assist with wayfinding. What began as logistical support now shifts into a more public and experimental space. These new tools mark a move from static presentation to active engagement, positioning the Exhibition itself as a responsive system.

“The Biennale becomes a living lab,” says curator Carlo Ratti, “a place not for displaying answers, but for asking new questions”.

AI Research

Researchers ‘polarised’ over use of AI in peer review

Researchers appear to be becoming more divided over whether generative artificial intelligence should be used in peer review, with a survey showing entrenched views on either side.

A poll by IOP Publishing found that there has been a big increase in the number of scholars who are positive about the potential impact of new technologies on the process, which is often criticised for being slow and overly burdensome for those involved.

A total of 41 per cent of respondents now see the benefits of AI, up from 12 per cent from a similar survey carried out last year. But this is almost equal to the proportion with negative opinions which stands at 37 per cent after a 2 per cent year-on-year increase.

This leaves only 22 per cent of researchers neutral or unsure about the issue, down from 36 per cent, which IOP said indicates a “growing polarisation in views” as AI use becomes more commonplace.

Women tended to have more negative views about the impact of AI compared with men while junior researchers tended to have a more positive view than their more senior colleagues.

Nearly a third (32 per cent) of those surveyed say they already used AI tools to support them with peer reviews in some form.

Half of these say they apply it in more than one way with the most common use being to assist with editing grammar and improving the flow of text.

A minority used it in more questionable ways such as the 13 per cent who asked the AI to summarise an article they were reviewing – despite confidentiality and data privacy concerns – and the 2 per cent who admitted to uploading an entire manuscript into a chatbot so it could generate a review on their behalf.

IOP – which currently does not allow AI use in peer reviews – said the survey showed a growing recognition that the technology has the potential to “support, rather than replace, the peer review process”.

But publishers must fund ways to “reconcile” the two opposing viewpoints, the publisher added.

A solution could be developing tools that can operate within peer review software, it said, which could support reviewers without positing security or integrity risks.

Publishers should also be more explicit and transparent about why chatbots “are not suitable tools for fully authoring peer review reports”, IOP said.

“These findings highlight the need for clearer community standards and transparency around the use of generative AI in scholarly publishing. As the technology continues to evolve, so too must the frameworks that support ethical and trustworthy peer review,” Laura Feetham-Walker, reviewer engagement manager at IOP and lead author of the study, said.

AI Research

Amazon Employing AI to Help Shoppers Comb Reviews

Amazon earlier this year began rolling out artificial intelligence-voiced product descriptions for select customers and products.

AI Research

Nubank To Continue Leveraging AI To Enhance Digital Financial Services In Latin America

Nubank (NYSE: NU) is reportedly millions of customers across Latin America. Recently, the company’s Chief Technology Officer, Eric Young, shared his vision for leveraging artificial intelligence to fuel Nubank’s global expansion and improve financial services.

During a recent discussion, Young outlined how AI is not just a tool but a cornerstone for operational efficiency, customer-centric growth, and democratizing access to personalized finance.

With a career that includes work at Amazon in the early 2000s, Young brings a philosophy of prioritizing customer experience.

At Amazon, he witnessed firsthand how technology could transform user experiences, a mindset he now applies to Nubank’s mission. “If not us, then who?”

Young posed rhetorically during the videocast, underscoring Nubank’s unique position to disrupt traditional banking.

Founded in Brazil in 2013, Nubank has positively impacted the financial sector by prioritizing financial inclusion and superior customer service, challenging legacy banks with its digital-first approach.

Under Young’s leadership, Nubank’s priorities are clear: enhance agility, expand internationally, and harness AI to serve customers better.

He emphasized the need for cross-functional collaboration, particularly with the product and design teams.

This includes partnering with Nubank’s recently appointed Chief Design Officer (CDO), Ethan Eismann, to iterate quickly on new features.

By fostering a culture of testing and learning, Young aims to deliver products that not only meet but exceed user expectations, ultimately capturing a larger market share.

This involves deepening engagement with existing users, attracting new ones, and venturing into underserved markets where financial services remain inaccessible.

Central to Young’s strategy is AI’s transformative potential.

Nubank’s 2024 acquisition of Hyperplane, an AI-focused startup, marks a pivotal step in this direction.

Young highlighted how advanced language models—such as those powering ChatGPT and Google Gemini—can bridge the gap between everyday users and elite financial advisory services.

These models excel at processing vast amounts of data, including transaction histories, to offer hyper-personalized recommendations.

Imagine an AI that automates budgeting, predicts spending patterns, and suggests investment opportunities tailored to an individual’s financial profile, all without the hefty fees of traditional private banking.

Young drew a parallel to the exclusivity of high-end services.

Historically, AI-driven private banking was reserved for the ultra-wealthy, but Nubank’s vision is to make it ubiquitous.

“We’re democratizing access to hyper-personalized financial experiences.”

By analyzing user data ethically and securely, AI can empower customers from all segments—whether a small business owner in Mexico or a young professional in Colombia—to manage their finances with the precision once afforded only to elites.

This aligns with Nubank’s core ethos of inclusion, ensuring that technology serves as an equalizer rather than a divider.

Looking ahead, Young sees AI as the engine for Nubank’s platformization efforts, enabling scalable solutions that support international growth.

As Nubank eyes further expansion beyond Brazil, Mexico, and Colombia, AI will streamline operations, from fraud detection to customer support chatbots, reducing costs while enhancing reliability.

Yet, Young cautioned that success hinges on responsible implementation—prioritizing privacy, transparency, and human oversight to build trust.

In an era where fintechs aggressively compete for market share, Eric Young’s insights position Nubank not just as a bank, but as a key player in AI-powered financial services.

By blending technological prowess with a focus on the customer, Nubank is set to transform money management, making various services more accessible to consumers.

As Young basically put it, the question isn’t whether AI will change finance—it’s how Nubank will aim to make a positive impact.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers3 months ago

Jobs & Careers3 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education3 months ago

Education3 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business3 months ago

Funding & Business3 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries