AI Research

After a 700% Rally Over the Last 3 Years, This Magnificent Artificial Intelligence (AI) Stock Looks Poised For Even More Monster Gains

Meta stock is up by more than 700% after its $89 low three years ago.

Three years ago, shares of Meta Platforms (META -2.29%) hit a low around $89 as the company’s ambitious plans to conquer the metaverse appeared to be rooted more in fantasy than reality. To add some perspective, Meta stock had not traded anywhere near those levels for almost a decade.

The precipitous decline in Meta stock was a clear signal from Wall Street and retail investors that sentiment hadn’t just soured, but that enthusiasm surrounding the company’s future was nearly non-existent.

Nevertheless, Meta’s CEO, Mark Zuckerberg, did what many successful entrepreneurs before him have done. He remained grounded, worked collaboratively with a supporting cast of executives, and developed a path forward to win over investors again.

Spoiler alert: His plan has worked (so far). Over the last three years, Meta stock has climbed from $89 per share to roughly $718 as of this writing (July 25). While a 700% return might suggest that Meta’s best days are behind it, I think the ride is just getting started.

Let’s dive into how Meta turned around its situation, and explore why the company’s pivot from the metaverse to artificial intelligence (AI) should have investors more excited than ever.

Meta’s turnaround is nothing short of remarkable

The chart below illustrates trends across Meta’s operating expenses, capital expenditures (capex), and cash flow from operations per employee over the last several years.

META Total Operating Expenses (Annual) data by YCharts.

Throughout 2021 and 2022, operating expenses ballooned as Meta invested aggressively in its Reality Labs division. These investments included new lines of wearable glasses, and upgrades to the company’s virtual reality headset, Meta Quest.

While these new products garnered some interest at first, overall enthusiasm eventually waned. Reality Labs is a non-profitable segment within Meta’s overall business and is often perceived as a cash strain on the company’s high-margin advertising empire.

In 2023, Meta’s management declared a “year of efficiency” during which the company made dramatic cost reductions. As the company cut the excess from an inflated cost profile, Meta reallocated its savings into a new area of focus: AI.

As the chart above illustrates, Meta has remained disciplined in its approach to spending since its reductions over the last couple of years. Although capex has been rising, these investments in AI infrastructure could be seen as much higher-margin than prior moonshots on the metaverse.

Strong unit economics in the form of rising cash flow per employee suggest that Meta’s investments in the AI realm have (so far) helped drive more productivity and efficiency from employees and provided the company with robust operating leverage.

Image source: Getty Images.

Wall Street is bullish on Meta

I think the current price action surrounding Meta stock reflects a feeling of validation around the company’s cost-cutting efforts and strategic pivot to AI. With that said, I am not convinced that Meta stock is priced to perfection just yet.

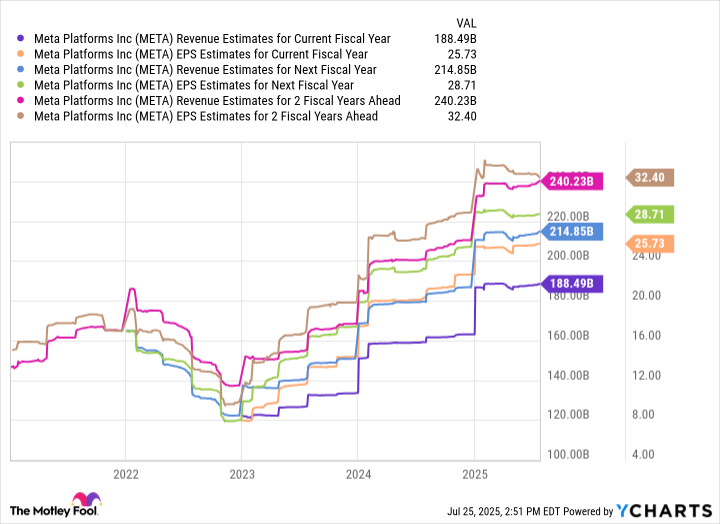

Per the estimates below, it’s clear that Wall Street is calling for even further revenue acceleration and profit margin expansion for Meta over the next few years as the company unlocks new sources of AI-driven growth.

META Revenue Estimates for Current Fiscal Year data by YCharts.

Since the company’s investment in Scale AI and the subsequent creation of Meta Superintelligence Labs (MSL) are yet to bear fruit, I’m cautiously optimistic that the estimates above may wind up being conservative in hindsight. In other words, I do not think the forecast above fully (or accurately) captures the accretive effect that Scale AI or MSL could have on Meta’s business at scale.

For these reasons, I think Meta remains a compelling buy-and-hold opportunity for investors with a long-term time horizon.

Adam Spatacco has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

AI Research

Artificial Intelligence Stocks Rally as Nvidia, TSMC Gain on Oracle Growth Forecast

This article first appeared on GuruFocus.

Sep 11 – Oracle (ORCL, Financial) projected its cloud infrastructure revenue will surge to $114 billion by fiscal 2030, a forecast that triggered strong gains across artificial intelligence-related stocks.

The company also outlined plans to spend $35 billion in capital expenditures by fiscal 2026 to expand its data center capacity.

Shares of Oracle soared 36% on Wednesday on the outlook, as investors bet on rising demand for GPU-based cloud services. Nvidia (NASDAQ:NVDA), which supplies most of the chips and systems for AI data centers, climbed 4%. Broadcom (NASDAQ:AVGO), a key networking and custom chip supplier, gained 10%.

Other chipmakers also advanced. Advanced Micro Devices (AMD,) added 2%, while Micron Technology (MU, Financial) increased 4% on expectations for higher memory demand in AI servers. Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), which produces chips for Nvidia and other AI players, rose more than 4% after reporting a 34% jump in August sales.

Server makers Super Micro Computer (SMCI, Financial) and Dell Technologies (DELL) each rose 2%, supported by their role in assembling Nvidia-powered systems. CoreWeave (CRWV), an Oracle rival in the neo-cloud segment, advanced 17% as investors continued to bet on accelerating AI compute demand.

AI Research

Oracle Health Deploys AI to Tackle $200B Administrative Challenge

Oracle Health introduced tools aimed at easing administrative healthcare burdens and costs.

AI Research

California Lawmakers Advance Suite of AI Bills

As the California Legislature’s 2025 session draws to a close, lawmakers have advanced over a dozen AI bills to the final stages of the legislative process, setting the stage for a potential showdown with Governor Gavin Newsom (D). The AI bills, some of which have already passed both chambers, reflect recent trends in state AI regulation nationwide, including AI consumer protection frameworks, guardrails for the use of AI in employment and healthcare, frontier model safety requirements, and chatbot safeguards.

AI Consumer Protection. California lawmakers are advancing several bills that would impose disclosure, testing, documentation, and other governance requirements for AI systems used to make or assist in decisions that impact consumers. Like 2024’s Colorado AI Act, California’s Automated Decisions Safety Act (AB 1018) would adopt a cross-sector approach, imposing duties and requirements on developers and deployers of “automated decision systems” (“ADS”) used to make or facilitate employment, education, housing, healthcare, or other “consequential decisions” affecting natural persons. The bill would require ADS developers and deployers to conduct impact assessments and third-party audits and comply with various disclosure and documentation requirements, and would establish consumer notice, correction, and appeal rights.

Employment and Healthcare. SB 7 would establish worker notice, access, and correction rights, prohibited uses, and human oversight requirements for employers that use ADS for employment-related decisions. Other bills would impose similar restrictions on AI used in healthcare contexts. AB 489, which passed both chambers on September 8, would prohibit representations that indicate that an AI system possesses a healthcare license or can provide professional healthcare advice.

Frontier Model Safety. Following the 2024 passage—and Governor Newsom’s subsequent veto—of the Safe & Secure Innovation for Frontier AI Models Act (SB 1047), State Senator Scott Wiener (D-San Francisco) has led a renewed push for frontier model safety with his Transparency in Frontier AI Act (SB 53). SB 53 would require large developers of frontier models to implement and publish a “frontier AI framework” to mitigate potential public safety harms arising from frontier model development, in addition to transparency reports and incident reporting requirements. Unlike SB 1047, SB 53 would not require developers to implement a “full shutdown” capability for frontier models, conduct third-party audits, or meet a duty of reasonable care to prevent public safety harms. Moreover, while SB 1047 would have established civil penalties of up to 10 percent of the cost of computing power used to train any developer’s frontier model, SB 53 would establish a uniform penalty of up to $1 million per violation of any of its frontier AI transparency provisions and would only apply to developers with annual revenues above $500 million. Although its likelihood of passage remains uncertain, SB 53 builds on several recent state efforts to establish frontier model safeguards, including the passage of the Responsible AI Safety & Education (“RAISE”) Act in New York in May and the release of a final report on frontier AI policy by California’s Frontier AI Working Group in June.

Chatbots. Various other California bills would establish safeguards for individuals, and particularly children, that interact with AI chatbots or generative AI systems. The Leading Ethical AI Development (“LEAD”) for Kids Act (AB 1064), which passed the Senate on September 10 and could receive a vote in the Assembly as soon as this week, would prohibit individuals or businesses from providing “companion chatbots”—generative AI systems that simulate sustained humanlike relationships through personalization, unprompted questions, and ongoing dialogue with users—to children if the companion chatbot is “foreseeably capable” of engaging in certain activities, including encouraging a child to engage in self-harm, violence, or illegal activity, offering unlicensed mental health therapy to a child, or prioritizing user validation and engagement over child safety, among other prohibited capabilities. Another AI chatbot safety bill, SB 243, passed the Assembly on September 10 and awaits final passage in the Senate. SB 243 would require companion chatbot operators to issue recurring disclosures to minor users, implement protocols to prevent the generation of content related to suicide or self-harm, and disclose companion chatbot protocols and other information to the state.

The bills above reflect only some of the AI legislation pending before California lawmakers ahead of their September 12 deadline for passage. Other AI bills have already passed both chambers and now head to the Governor, including AB 316, which would prohibit AI developers or deployers from asserting that AI “autonomously” caused harm as a legal defense, and California SB 524, which would establish restrictions on the use of AI by law enforcement agencies. Governor Newsom will have until October 12 to sign or veto these and any other AI bills that reach his desk.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi