Funding & Business

FCC approves $8 billion Paramount-Skydance merger

The Paramount Global headquarters in New York, US, on Tuesday, Aug. 27, 2024.

Yuki Iwamura | Bloomberg | Getty Images

The Federal Communications Commission cleared the way Thursday for an $8 billion merger between Paramount and Skydance Media.

The deal, which was announced more than a year ago, includes the CBS broadcast television network, Paramount Pictures and the Nickelodeon channel.

“Americans no longer trust the legacy national news media to report fully, accurately, and fairly,” Brendan Carr, chairman of the FCC, wrote in a statement Thursday. “It is time for a change. That is why I welcome Skydance’s commitment to make significant changes at the once storied CBS broadcast network.”

Carr said Skydance had made written commitments to ensure the new company’s programing would have a diversity of viewpoints across the political and ideological spectrum. Skydance also said it would hire a third-party impartial outsider to report to the president of the new company to evaluate complaints of bias.

The FCC chairman noted that Skydance does not have any DEI programs in place and has agreed not to establish any such initiatives at the new company.

Paramount chair Shari Redstone is set to depart the company’s board once the Skydance merger is complete. Her family’s company National Amusements is selling its controlling stake in Paramount to Skydance.

Skydance is owned by David Ellison, the soun of Oracle founder and billionaire Larry Ellison.

The decision by the FCC to greenlight the merger was not unanimous. Commissioner Anna Gomez, the lone Democrat on the three-person commission, opposed the move, saying she was troubled by Paramount’s recent payment to settle a suit brought by President Donald Trump against CBS’s “60 Minutes.”

“The Paramount payout and this reckless approval have emboldened those who believe the government can — and should-abuse its power to extract financial and ideological concessions, demand favored treatment, and secure positive media coverage,” she wrote in a dissent statement.

The FCC’s ruling comes less than a month after Paramount agreed to pay $16 million to Trump after he sued the company over the editing of a “60 Minutes” interview with former Vice President Kamala Harris. It also occurred a week after CBS announced it was canceling “The Late Show with Stephen Colbert.”

Colbert had called the settlement a “big fat bribe” during one of his monologues last week, referencing the $8.4 billion pending merger between Paramount and Skydance Media, which required the approval of the Trump administration to proceed.

At the time, Paramount and CBS executives released a statement saying the cancellation was “purely a financial decision against the challenging backdrop in late night.”

However, the timing of its decision has been called into question by a number of political figures and Hollywood trade groups.

The Writer’s Guild of America asked New York State Attorney Letitia James to join California and launch an investigation into potential wrongdoing at Paramount.

“Cancelations are part of the business, but a corporation terminating a show in bad faith due to explicit or implicit political pressure is dangerous and unacceptable in a democratic society,” the WGA wrote in a statement last week. “Paramount’s decision comes against a backdrop of relentless attacks on a free press by President Trump, through lawsuits against CBS and ABC, threatened litigation of media organizations with critical coverage, and the unconscionable defunding of PBS and NPR.”

Democratic Senators Adam Schiff, of California, and Elizabeth Warren, of Massachusetts, also questioned the deal.

“Was it a coincidence that CBS canceled Colbert just three days after he spoke out?” Warren wrote in an op-ed for Variety published Wednesday. “Are we sure that this wasn’t part of a wink-wink deal between the president and a giant corporation that needed something from his administration?”

Funding & Business

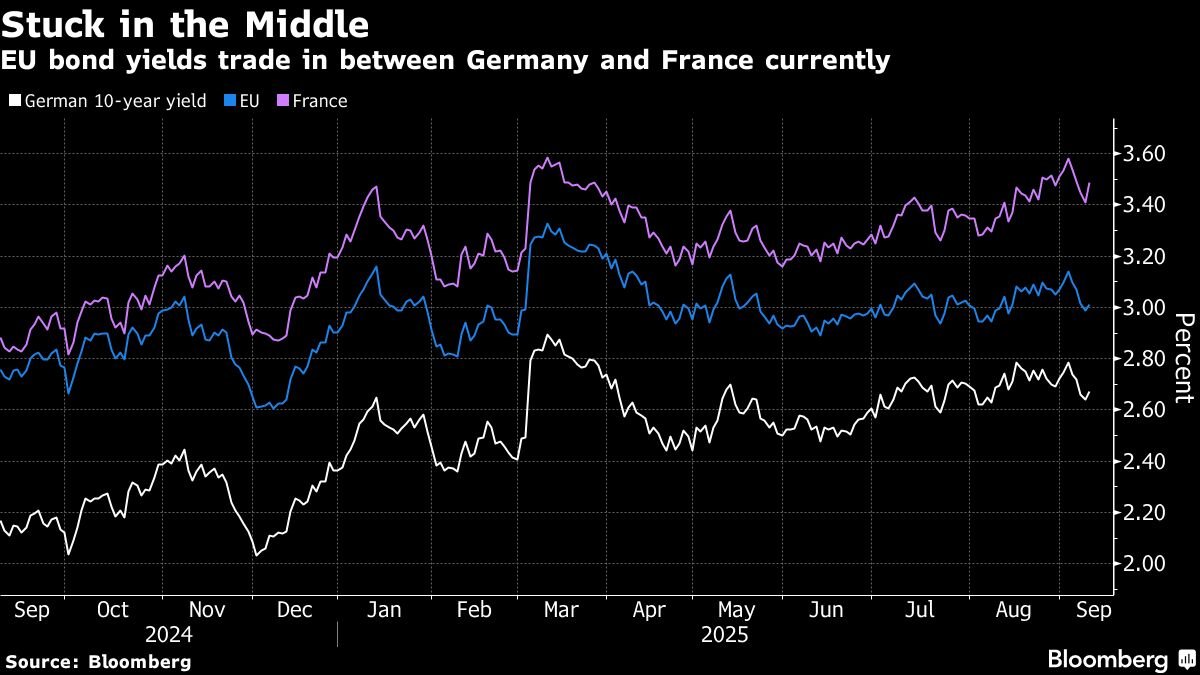

EU Bonds Hit Market Milestone as Eurex Starts Offering Futures

Europe’s largest bond-futures exchange is launching a contract for the European Union’s debt on Wednesday, a move that could help boost trading liquidity and eventually lower the bloc’s borrowing costs.

Source link

Funding & Business

Aramco to Price Second Dollar Bond Sale of 2025 to Fund Projects

Saudi Arabian Oil Co., known as Aramco, is preparing to price new benchmark-sized dollar bonds on Wednesday, extending the oil-rich kingdom’s debt spree as it seeks fresh capital to fund projects.

Source link

Funding & Business

Oil Climbs as Traders Weigh Trump’s Tariff Threats, Doha Strike

Oil rose for a third session after President Donald Trump told European Union officials he’s willing to slap new tariffs on India and China in an effort to get Russia to negotiate with Ukraine.

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi