Jobs & Careers

Karnataka Tech Funding Crash-Lands 44%

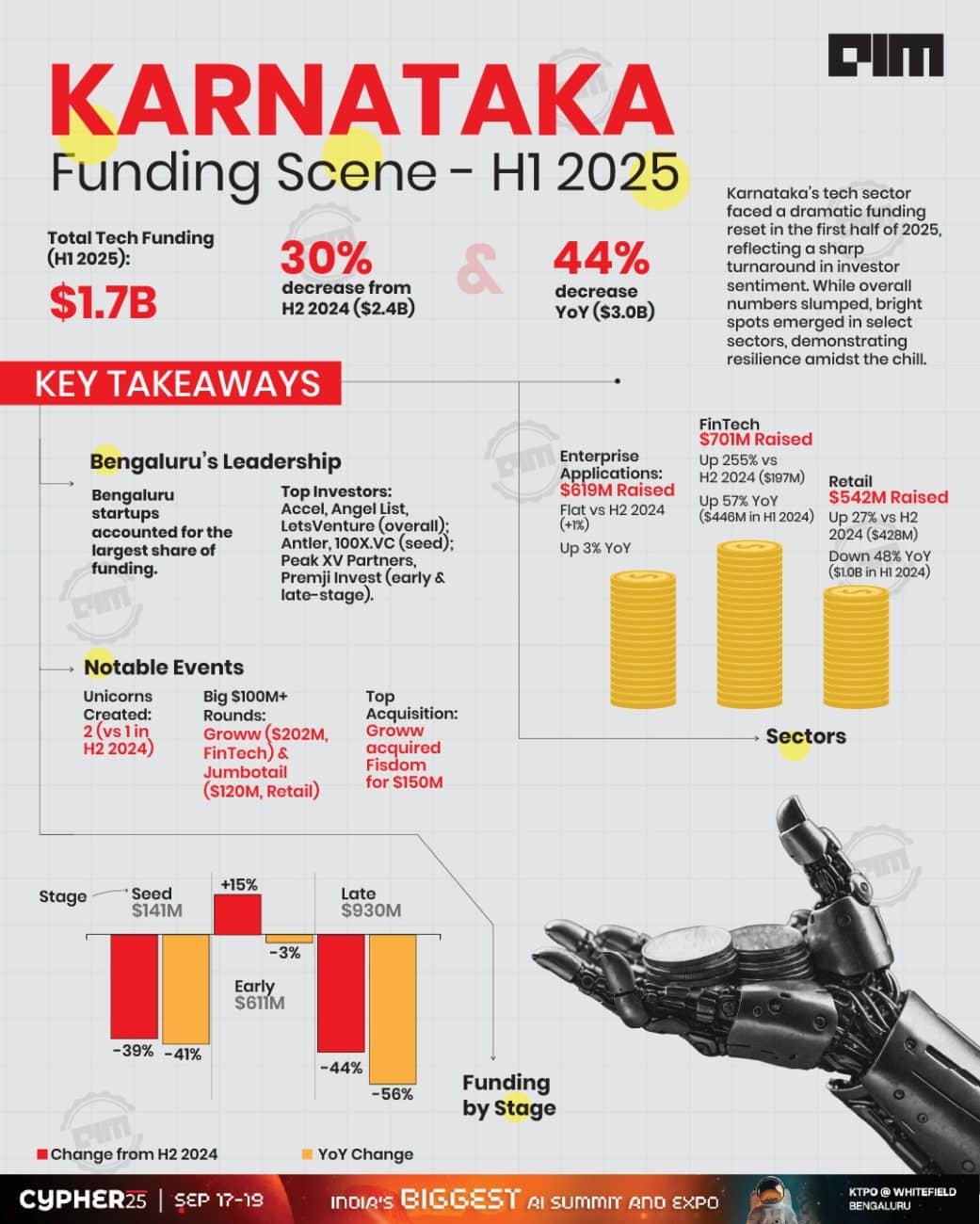

Karnataka saw a total of $1.7 billion in funding during the first half of 2025, a significant decrease of 30% from the $2.4 billion raised in the second half of 2024, and a 44% drop compared to $3.0 billion raised in H1 2024, according to Tracxn’s recent Karnataka Tech H1 2025 Funding Report.

While the report reveals a considerable decline in overall funding levels, Bengaluru continued to dominate as the hub of tech investment within the state.

The decline reflects subdued investor activity across several segments when compared to prior periods, the report stated. However, some verticals, such as fintech and enterprise applications, remained resilient.

Funding Stages

Seed stage saw a total funding of $141 million in H1 2025, a drop of 39% compared to $233 million raised in H2 2024, and a drop of 41% compared to $239 million raised in H1 2024.

The early stage saw a total funding of $611 million in H1 2025, an increase of 15% compared to $531 million raised in H2 2024, and a drop of 3% compared to $630 million raised in H1 2024.

The late stage witnessed a total funding of $930 million in H1 2025, a drop of 44% compared to $1.6 billion raised in H2 2024, and a drop of 56% compared to $2.1 billion raised in H1 2024.

Sectors

Fintech, enterprise applications, and retail were the top-performing sectors in H1 2025.

Fintech sector saw a total funding of $701 million in H1 2025 which is an increase of 255% when compared to $197 million raised in H2 2024 and a rise of 57% when compared to $446 million raised in H1 2024.

Enterprise applications sector saw a total funding of $619 million in H1 2025 which is an

increase of 1% when compared to $611 million raised in H2 2024 and an increase of 3% when compared to $604 million raised in H1 2024.

The retail sector saw a total funding of $542 million in H1 2025 which is an increase of 27% when compared to $428 million raised in H2 2024 and a drop of 48% when compared to $1.0 billion raised in H1 2024.

Companies

H1 2025 has witnessed two $100 million+ funding rounds, four in H2 2024, and five rounds in H1 2024. Companies like Groww and Jumbotail have managed to raise funds above $100 million in this period.

Groww has raised a total of $202 million in a Series F round. Jumbotail has raised a total of $120 million in a Series D round.

A major part of these $100 million+ funding rounds are from fintech and retail sectors. Ather Energy was the only company to go public in H1 2025.

Unicorns & Acquisitions

Two unicorns were created in H1 2025, an increase of 100% compared to 1 in H2 2024, and a drop of 33% compared to 3 created in H1 2024.

Tech companies in Karnataka saw 26 acquisitions in H1 2025, a drop of 4% compared to 27 in H2 2024, and a rise of 24% compared to 21 in H1 2024. Fisdom was acquired by Groww at a price of $150 million. This became the highest valued acquisition in H1 2025 followed by the acquisition of Fintellix by ICRA at a price of $26 million.

Bengaluru & Investors

Bengaluru-based tech firms accounted for the majority of the funding raised by tech companies across Karnataka. Accel, Angel List and LetsVenture were the overall top investors in Karnataka Tech ecosystem. Antler, 100X.VC and Rainmatter were the top seed stage investors in Karnataka Tech ecosystem for H1 2025.

Accel, Alteria Capital and Peak XV Partners were the top early stage investors in

Karnataka Tech ecosystem for H1 2025. Premji Invest, SoftBank Vision Fund and Creaegis were the top late stage investors in Karnataka Tech ecosystem for H1 2025.

Among VCs, United States-based Accel led the most number of investments in H1 2025 with 34 rounds, while India-based fund Z47 added three new companies to its portfolio.

Jobs & Careers

Top Life Sciences Companies Set Up GCCs in India in Last 5 Years, says EY India

India has rapidly become a key hub for life sciences global capability centres (GCCs), with nearly half of the world’s top 50 life sciences companies establishing a presence in the country—most within the past five years, according to a new EY India report.

The report, Reimagining Life Sciences GCCs, highlighted how India’s GCCs have evolved from back-office support centres into strategic engines driving drug discovery, regulatory affairs, and commercial operations.

“This isn’t about cost arbitrage anymore, it’s about India becoming indispensable to the global R&D pipeline,” said Arindam Sen, partner and GCC Sector Lead – technology, media & entertainment and telecommunications, EY India. “Life sciences multinationals are embedding their most strategic, knowledge-intensive work here, making India the epicentre for life sciences innovation, compliance, and future growth.”

According to EY, Indian life sciences GCCs now manage integrated functions across clinical trials, pharmacovigilance, supply chain analytics, biostatistics, and enabling services such as finance, HR, IT, and data analytics.

The study shows that GCCs handle 70% of finance, 75% of HR, 62% of supply chain, and 67% of IT functions for their global firms. Core functions have also grown sharply: 45% in drug discovery, 60% in regulatory affairs, 54% in medical affairs, and 50% in commercial operations.

India’s rise as a GCC hub is driven by four key factors: policy support from central and state governments, a strong talent pool of over 2.7 million life sciences professionals, access to a mature ecosystem including CROs, universities, and startups, and widespread infrastructure with scalable Grade-A office spaces.Looking ahead, the report noted that leading life sciences GCCs are positioning themselves as “twins” of their global headquarters, co-owning innovation and accelerating outcomes. Sen added, “Their evolution will be defined by future capabilities, operating model transformation, and building agile, multi-disciplinary teams skilled in areas like generative AI, bioinformatics, and digital health.”

Jobs & Careers

AI PC Shipments to Hit 77 Million Units This Year: Report

AI PCs will make up 31% of the worldwide PC market by the end of 2025, according to Gartner. Shipments are projected to hit 77.8 million units this year, with adoption accelerating to 55% of the global market in 2026 and becoming the standard by 2029.

“AI PCs are reshaping the market, but their adoption in 2025 is slowing because of tariffs and pauses in PC buying caused by market uncertainty,” said Ranjit Atwal, senior director analyst at Gartner, in a statement. Despite this, users are expected to continue investing in AI PCs to prepare for greater edge AI integration.

AI laptop adoption is projected to outpace desktops, with 36% of laptops expected to be AI-enabled by 2025, compared to 16% of desktops. By 2026, nearly 59% of laptops will fall into this category. Businesses largely favour x86 on Windows, which is expected to represent 71% of the AI business laptop market next year, while Arm-based laptops are anticipated to see more substantial consumer traction.

To support this shift, Gartner predicts that 40% of software vendors will prioritise developing AI features for PCs by 2026, up from just 2% in 2024. Small language models (SLMs) running locally on devices are expected to drive faster, more secure, and energy-efficient AI experiences.

Looking ahead, Gartner notes that vendors must focus on software-defined, customisable AI PCs to build stronger brand loyalty. “The future of AI PCs is in customisation,” Atwal said.

Still, the rapid rise of AI PCs masks an industry-wide “TOPS race.” While Microsoft, AMD, Intel, and Qualcomm position AI PCs as the future, performance claims around neural processing units (NPUs) remain contested.

As industry leaders push for more TOPS, analysts warn that real-world AI performance may hinge less on specifications and more on practical workloads, software maturity, and user adoption.

The post AI PC Shipments to Hit 77 Million Units This Year: Report appeared first on Analytics India Magazine.

Jobs & Careers

Hexaware, Replit Partner to Bring Secure Vibe Coding to Enterprises

Hexaware Technologies has partnered with Replit to accelerate enterprise software development and make it more accessible through secure Vibe Coding. The collaboration combines Hexaware’s digital innovation expertise with Replit’s natural language-powered development platform, allowing both business users and engineers to create secure production-ready applications.

The partnership aims to help companies accelerate digital transformation by enabling teams beyond IT, such as product, design, sales and operations, to develop internal tools and prototypes without relying on traditional coding skills.

Amjad Masad, CEO of Replit, said, “Our mission is to empower entrepreneurial individuals to transform ideas into software—regardless of their coding experience or whether they’re launching a startup or innovating within an enterprise.”

Hexaware said the tie-up will facilitate faster innovation while maintaining security and governance.

Sanjay Salunkhe, president and global head of digital and software services at Hexaware Technologies, noted, “By combining our vibe coding framework with Replit’s natural language interface, we’re giving enterprises the tools to accelerate development cycles while upholding the rigorous standards their stakeholders demand.”

The partnership will enable enterprises to democratise software development by allowing employees across departments to build and deploy secure applications using natural language.

It will provide secure environments with features such as SSO, SOC 2 compliance and role-based access controls, further strengthened by Hexaware’s governance frameworks to meet enterprise IT standards.

Teams will benefit from faster prototyping, with product and design groups able to test and iterate ideas quickly, reducing time-to-market. Sales, marketing and operations functions can also develop custom internal tools tailored to their workflows, avoiding reliance on generic SaaS platforms or long IT queues.

In addition, Replit’s agentic software architecture, combined with Hexaware’s AI expertise, will drive automation of complex backend tasks, enabling users to focus on higher-level logic and business outcomes.

The post Hexaware, Replit Partner to Bring Secure Vibe Coding to Enterprises appeared first on Analytics India Magazine.

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies