AI Research

Is AI a job-killer? Here’s the grim outlook – The Berkshire Eagle

Is AI a job-killer? Here’s the grim outlook The Berkshire Eagle

Source link

AI Research

FactSet Research Systems (FDS) Integrates MarketAxess AI-Powered Data Into Workstation

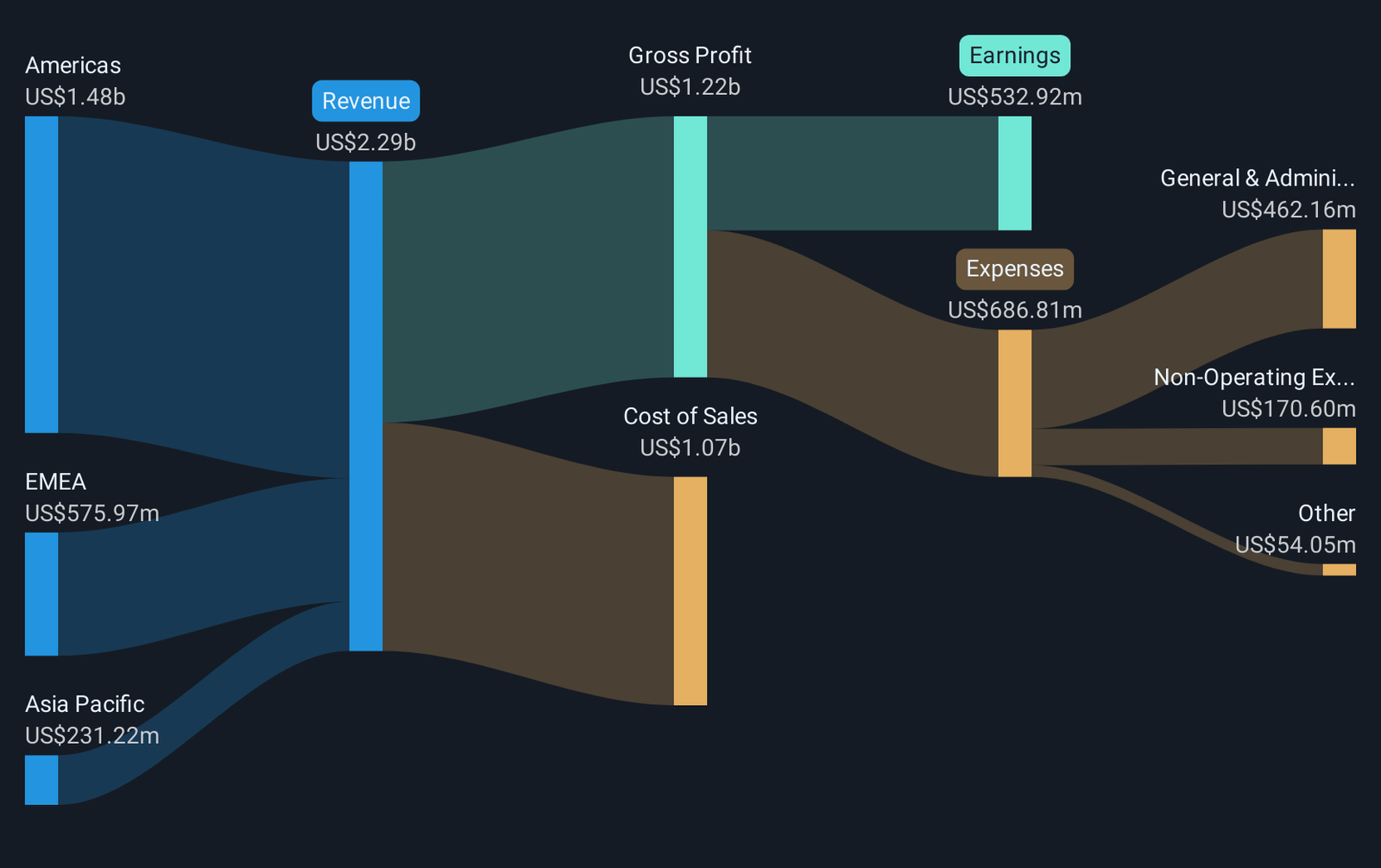

FactSet Research Systems (FDS) has recently integrated MarketAxess’ AI-powered CP+ data into its workstation, making it the sole provider of such capabilities in a terminal desktop environment. This integration is designed to provide users with real-time bond pricing and insights on a vast array of securities, centralizing financial data and enhancing trade execution. Over the past week, FDS saw a 1.08% price increase, aligning with broader market trends as the S&P 500 and Nasdaq reached record highs. FactSet’s addition of cutting-edge features may have added positive weight to its recent price movement amid a generally robust technology sector.

You should learn about the 1 warning sign we’ve spotted with FactSet Research Systems.

The integration of MarketAxess’ AI-powered CP+ data into FactSet’s workstation could significantly enhance the company’s appeal by providing advanced data analytics to its users. This move aligns with FactSet’s strategy of expanding its service offerings through acquisitions and new product launches, potentially boosting revenue and earnings in the future. As FactSet continues to integrate acquisitions and enhance its product lineup, these innovations could strengthen the firm’s position in the competitive financial services market. The recent 1.08% share price increase may partly reflect investor optimism about these enhancements and their potential to drive growth.

Over the last five years, FactSet’s total return, including share price and dividends, was 16.06%. However, the company’s recent performance over the past year fell short of both the broader US market, which achieved a 20.5% return, and the Capital Markets industry, which returned 34.2%. This underperformance could highlight investor concerns regarding rising technology costs and potential challenges in the asset management sector.

The current share price of US$372.86 remains at a discount compared to the consensus analyst price target of US$428.38, suggesting additional upside potential if the company can successfully execute its growth strategies. With revenue forecasted to grow at 5.4% annually, analysts project earnings to rise to US$725.4 million by 2028. To align with these projections, FactSet’s strategic moves in technology and acquisitions will be crucial in achieving the expected revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

AI Research

Researcher Kelly Merrill, Jr. speaks to risks of AI as mental health support

Merrill, who studies the intersection of technology and health communication, was interviewed by Spectrum News to discuss safeguards over AI and health communications.

The interview points out that while Ohio no laws regulating AI in mental health, several states have already acted: Illinois bans AI from being marketed as therapy without licensed oversight, Nevada prohibits AI from presenting itself as a provider, and Utah requires AI chatbots to disclose their nonhuman nature and protect user data.

Merrill urges Ohio lawmakers to follow suit and “protect people over profit.” The assistant professor of health communication and technology in UC’s School of Communication, Film, and Media Studies has spent more than five years researching how digital tools affect well-being, motivated in part by his father’s death from cancer.

His recent study on AI companions found that while about a third of participants reported feeling happier after using them, Merrill cautions that the tools pose risks—including privacy concerns, unrealistic expectations of human relationships, and even dependency. To address these issues, he stresses the importance of “AI literacy,” so users understand what AI can and cannot do.

Merrill also argues that companies should build in safeguards, such as usage reminders and prompts to seek professional help. He supports temporary bans on AI therapy while research catches up, saying the tools should supplement, not replace, overburdened mental health systems.

Watch the interview and read the story.

Feature photo at top iStock photo: AleksandarGeorgiev.

AI Research

LIGO could observe intermediate-mass black holes using artificial intelligence – Physics World

Copyright © 2025 by IOP Publishing Ltd and individual contributors

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi