Top Stories

Trump claims tariff deal with Indonesia

US President Donald Trump said he has settled on another tariff deal – this time with Indonesia.

Trump said he had agreed to lower tariffs he had threatened on goods entering the US from Indonesia to 19%, in exchange for what he called “full access” for American firms.

Terms of the deal were not immediately confirmed by Indonesia but the country’s President Prabowo Subianto said it marked a “new era of mutual benefit” with Washington.

The pact is the latest to emerge after the White House unveiled a barrage of tariffs this spring, kicking off a flurry of trade talks over the duties.

After suspending his most aggressive tariff plans from earlier this year, Trump this month renewed his threats, sending warning letters to dozens of countries that he intended to start charging high tariffs from 1 August.

His targets included all of America’s biggest trade partners, including the European Union, Canada, Mexico, Japan and South Korea.

Indonesia also received a letter from Trump last week outlining plans for a 32% tariff on its goods, reportedly bewildering officials who had thought an agreement was close.

Trump said on Tuesday he had reduced that rate after a phone call with the president of Indonesia.

He said as part of the deal, Indonesia had agreed to lower its trade tariffs for products from the US, which America has complained were high for many agricultural products as well as certain manufactured goods.

“They are going to pay 19% and we are going to pay nothing… we will have full access into Indonesia,” he said.

The country has also agreed to purchase $15bn (£11.2bn) worth in US energy, $4.5bn in American agricultural products and 50 Boeing jets, he later wrote on social media.

Those figures are lower than those outlined in a trade deal Reuters had reported earlier this month was expected to be signed.

“I had a very good call with President Donald Trump. Together, we agreed and concluded to take trade relations between Indonesia and the United States into a new era of mutual benefit,” President Prabowo wrote in an Instagram post, without providing details of the deal.

He is expected to hold a news conference later in the day after he arrives back in Indonesia after visiting France.

Indonesia ranks as one of America’s top 25 trade partners, sending about $28bn to the US last year, including clothing, footwear and palm oil.

Stephen Marks, economics professor at Pomona College in California, said the benefits of the deal to Indonesia “are more political than economic”.

“Certainly, [the US does] have some major imports categories from Indonesia – electronics, apparel, footwear, palm oil products which are used in cosmetics,” he said.

“Relative to total trade, the US is a significant importer from Indonesia, though not as great as some of its Asian trading partners.”

As well as Indonesia, the administration has announced agreements with just the UK, China and Vietnam. In all three of those cases, the deals left high US tariffs in place while key issues and terms went unconfirmed or unresolved.

Everett Eissenstat, a partner at Squire Patton Boggs whose served as an economic adviser during the first Trump administration, said he expected the White House to unveil more deals in the coming weeks, while noting that many countries appeared to have lowered their expectations of what they hope to achieve.

He pointed to recent comments on Tuesday by Canadian Prime Minister Mark Carney, which raised the possibility that the country might accept tariffs at levels once considered unthinkable.

“The tone is changing a lot,” he said, adding that he thought a deal was better than no deal.

“For governments, I think it’s best to be at the negotiating table rather than to walk away,” he added.

Top Stories

Metroid Prime 4: Beyond finally gets release date, plus Samus on a motorbike

Metroid Prime 4: Beyond has finally received a release date from Nintendo, following months of speculation.

As revealed at today’s Nintendo Direct livestream, Metroid Prime 4 will release on 4th December across both Switch and Switch 2.

The announcement came with a fresh look at the game, including Samus on a motorbike. Yes, you read that correctly.

Back in June, an advertisement for the game was seen on the London Underground stating the game was “out now”, though this was swiftly debunked by Nintendo.

Still, while the game officially had a 2025 launch window, rumours of a delay intensified over the summer, though Nintendo remained committed to a release this year.

In July the game popped up on the Korean ratings board and then, a month later, was rated by the ESRB. As such, a proper release date has been hotly anticipated.

Metroid Prime 4 is the long-awaited latest entry in Nintendo’s sci-fi series, that once again follows bounty hunter Samus Aran in first-person. This time, though, she’s got psychic powers.

I went hands-on with Metroid Prime 4 at Nintendo’s Switch 2 launch event, but wasn’t completely convinced by its mouse controls.

This is a news-in-brief story. This is part of our vision to bring you all the big news as part of a daily live report.

Love Eurogamer? Make us a Preferred Source on Google and catch more of our coverage in your feeds.

Top Stories

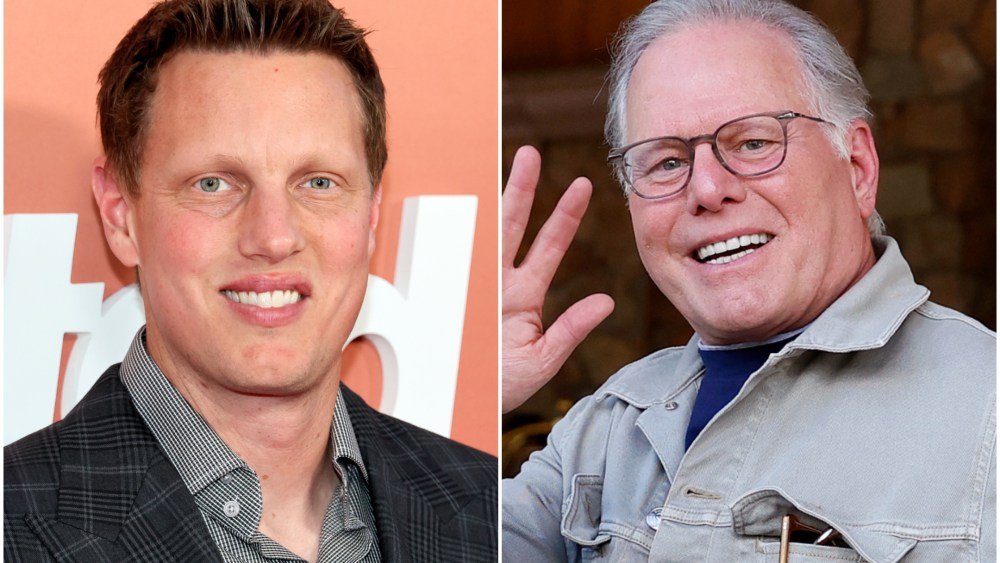

Why Ellison Wants Paramount to Acquire Warner Bros. Discovery Pre-Split

David Ellison‘s Skydance Media just completed the $8 billion takeover of Paramount Global five weeks ago. Now, before Ellison and his team have even finished the work of laying off upwards of 2,000 employees at the newly merged Paramount Skydance to slash costs, the son of tech multibillionaire Larry Ellison is mulling what would currently be a $70 billion-plus deal to acquire Warner Bros. Discovery in its entirety.

The question is: Why now?

Wouldn’t it make more sense to wait until WBD splits in half — to form Warner Bros. (HBO Max and studios) and Discovery Global (TV networks) — a transaction CEO David Zaslav says is on track to be done in April 2026? The WBD separation is designed to boost the value of its streaming and studios businesses by carving off the declining TV arm. Paramount Skydance could make a play for the standalone Warner Bros. without assuming the baggage (including the lion’s share of WBD debt) of the entity that will house CNN, TNT, TBS, Discovery and other nets. And through a deal for standalone Warner Bros., Paramount Skydance would still get its hands on the key growth driver going forward: HBO Max. (The mind reels at what a fused HBO Max-Paramount+ might be rebranded.)

One possibility is that a Larry Ellison-backed M&A play for WBD has been part of the Skydance strategy all along. The idea would be “to consolidate media assets during a period of industry-wide instability and build a conglomerate with a streaming-first focus wrapped with TV and film studios and potentially a larger linear television portfolio,” MoffettNathanson analyst Robert Fishman wrote in a research note Thursday.

And the advantage of moving now is that it could “preempt a potential bidding war for only the Warner Bros. Streaming & Studios assets post-split,” Fishman noted. “By acting now, [Paramount Skydance] positions itself to secure the entire company before rivals can cherry-pick the most attractive assets.”

Indeed, prior to news of Paramount Skydance’s prepping a bid for WBD, which was first reported by the Wall Street Journal, Wells Fargo media analyst Steven Cahall issued a note that pegged the future standalone Warner Bros. as “an attractive M&A candidate” — with Netflix “the most compelling buyer,” and other potential suitors including Amazon, Apple, Comcast, Sony and Paramount Skydance.

Regarding the separated Warner Bros. streaming and studios biz, Cahall wrote, “This will be the only large IP asset for sale at a time when most studios/streamers have big aspirations.” The analyst acknowledged that Netflix has not historically made any big M&A deals. But he opined a Netflix takeover of Warner Bros. had a number of benefits, including being able to “kickstart” a theatrical strategy for the streamer, help it scale video games and “most importantly [provide] premium content to members.” Cahall calculated the value of standalone Warner Bros. at around $65 billion.

To be sure, any Paramount Skydance offer for Warner Bros. Discovery would face big financial and regulatory obstacles — arguably much greater than Skydance-Paramount merger.

After Warner Bros. Discovery shares zoomed up 29% on the potential Paramount bid, WBD now has a market value of $40 billion. When adding in debt (minus cash and equivalents), the enterprise value of Warner Bros. Discovery is now about $71 billion. And that is a far bigger price than the Ellisons paid to swing Skydance-Paramount.

“We think the high debt leverage of WBD is an impediment to a high bid for WBD’s shares,” Kenneth Leon, director of industry and equity research at CFRA Research, said in a Sept. 11 note. He suggested that, even if Paramount Skydance wins a deal for Warner Bros. Discovery as a whole, it may “be only interested in the businesses that will become Warner Bros. and not see meaningful value creation from the Discovery Global media portfolio.”

But MoffettNathanson’s Fishman speculated that Paramount Skydance could see big benefits by pooling its TV business with WBD’s. “Overall, we would expect material cost synergies from the overlapping cable networks,” he wrote — i.e., layoffs. Fishman added there there are “presumably a high level of synergies from combining CBS News with CNN plus the long-term existing partnership between CBS and Turner with the NCAA’s March Madness Final Four.”

Then there’s the question of whether a Paramount-WBD tie-up could get regulatory approval, as it represents a more horizontal combination of two media giants than Skydance-Paramount. Skydance was largely a production company, with limited overlap with Paramount Global.

Already coming out against the notion of a combined Paramount-Warner Bros. Discovery was Sen. Elizabeth Warren (D-Massachusetts), who wrote in a post on X Thursday that such a media merger “must be blocked as a dangerous concentration of power.”

The Trump administration OK’d the Skydance-Paramount merger, after Skydance made key concessions to the FCC including hiring a CBS News ombudsman to vet complaints of “bias” and promising to never bring back diversity, equity and inclusion (DEI) initiatives at the company. But Warren and others have alleged Paramount Global’s $16 million payment to Trump to settle his lawsuit (alleging CBS News’ “60 Minutes” deceptively edited an interview with then-VP Kamala Harris) was a “bribe” to get Trump’s blessing on their deal while Warren also called out Trump’s claim that the new owners of Paramount promised $20 million worth of free advertising. “Remember when Trump announced a multimillion-dollar secret deal with CEO David Ellison? And then — shocker — Trump approved Ellison buying CBS/Paramount,” Warren wrote in the post. “Now, Ellison wants to take over CNN/Warner Bros.” (Skydance and Paramount said they complied with all U.S. laws throughout the merger process, including antibribery laws.)

Whatever scenario ultimately unfolds, Zaslav for one seemingly will see his wish for media biz consolidation realized.

After Trump was elected to a second term in November 2024, Zaslav expressed optimism the new administration would facilitate industry M&A. Trump 2.0, Zaslav said, “may offer a pace of change and an opportunity for consolidation that may be quite different” and that it may “provide a real positive and accelerated impact on this industry that’s needed.”

Top Stories

Trump says he’s sending the National Guard into Memphis to ‘fix’ crime like D.C.

President Donald Trump said Friday that he’s planning to send federal law enforcement and the National Guard into Memphis, Tennessee, to lower crime in the city following his surge into Washington, D.C., over the last month.

“We’re going to Memphis. Memphis is deeply troubled,” Trump said in an interview on Fox News’ “Fox and Friends” in New York. “The mayor is happy. He’s a Democrat. And the governor of Tennessee, the governor is happy. We’re gonna fix that just like we did Washington.”

The president then raised the issue of lowering crime in Chicago, a frequent talking point of his, saying, “I would’ve preferred going to Chicago,” and criticizing Democratic officials in the city for opposing the move.

Trump said he decided on Memphis after speaking with someone he knows on the board of Fedex who brought up the crime rate in the city.

“We’re going to Memphis.” Trump said. “I’m just announcing that now, and we’ll straighten that out — National Guard and anybody else we need. And by the way, we’ll bring in the military, too, if we need it.”

FBI data shows that violent crimes have hovered at around 15,000 to 16,000 a year in Memphis in the last five years, marking an increase of several thousand from a decade ago.

The offices of Memphis Mayor Paul Young and Republican Gov. Bill Lee didn’t immediately respond to NBC News’ requests for comment.

Trump acknowledged that he has “more power” in D.C., whose officials share authority with the federal government, and said the administration has had a positive relationship with Democratic Mayor Muriel Bowser.

“We’ve had a great relationship,” Trump said. “Everybody’s happy, and the mayor was not in favor of it at first … and then she saw the results, and everyone’s going up and thanking her. We have no crime anymore.”

Trump’s emergency order authorizing a federal takeover of the D.C. police force for 30 days expired this week, and would have required Congress to extend it further under a law that grants the city some autonomy.

Bowser said federal law enforcement personnel would remain in the nation’s capital, but the Metropolitan Police Department would stop transporting people detained by U.S. Immigration and Customs Enforcement agents.

While the city would return to the “status quo,” she said, “federal police officers are going to be in the district … federal police officers can enhance the public safety mission of MPD.”

Bowser said last month that the increase of federal forces in the nation’s capital did lead to a drop in crime.

“We greatly appreciate the surge of officers that enhance what MPD has been able to do in this city,” she said. In the first 20 days of the federal takeover, there had been an 87% drop in carjackings compared with the same period last year. The data cited also showed a 45% decrease in violent crime and a 15% fall in crime overall in the district from the same period last year.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi