Funding & Business

Ex-Sequoia Partner On Track To Raise New $400M+ Venture Fund To Invest In Europe

Former Sequoia Capital partner Matt Miller is nearing the close of a new $400 million venture fund to invest in European startups, the Financial Times reported.

Miller has already secured $355 million in commitments from institutional investors for the new London-based fund, the report said, and plans to focus on European AI and B2B startups at Series B.

Moving to London in 2021 to lead Sequoia’s European expansion, Miller left the firm in December last year after a 12-year stint with the company, following a boardroom dispute at Sweden-based portfolio company Klarna.

While at Sequoia, he led the firm’s investment in enterprise cloud provider Confluent, which went public at a valuation of $11 billion in June 2021 — a deal that helped secure his presence on Forbes’ Midas List Europe. He also led investments in U.K.-based semiconductor company Graphcore and Berlin-based workflow automation startup n8n, among others.

“I have made the decision to start my own fund focused on the great founders of Europe,” Miller wrote last year when he announced his decision to start his own fund. “It has been a dream of mine to be an entrepreneur again and I am excited to build something specific for this region that I love.”

His new fund comes amid a sluggish period for European venture funding. Around 1,200 startups based in the continent altogether raised roughly $12.6 billion last quarter, Crunchbase data shows — flat quarter over quarter and down 24% year over year.

The region’s leading countries also shifted in Q2. For the first time since 2012, Germany-based startups led the region’s funding totals, leapfrogging the U.K.

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

Trump Files to Cancel Approval of Maryland Offshore Wind Farm

The Trump administration asked a federal court to cancel the approval of a $6 billion wind project planned off the coast of Maryland as part of a wider effort to halt the development of the offshore clean- energy resource.

Source link

Funding & Business

Australian Treasurer Calls ANZ CEO Over Job Cuts, The Australian Says

Australian Treasurer Jim Chalmers spoke to ANZ Group Holdings Ltd.’s boss Nuno Matos on Tuesday about the bank’s plan to cut thousands of jobs, the Australian reported.

Source link

Funding & Business

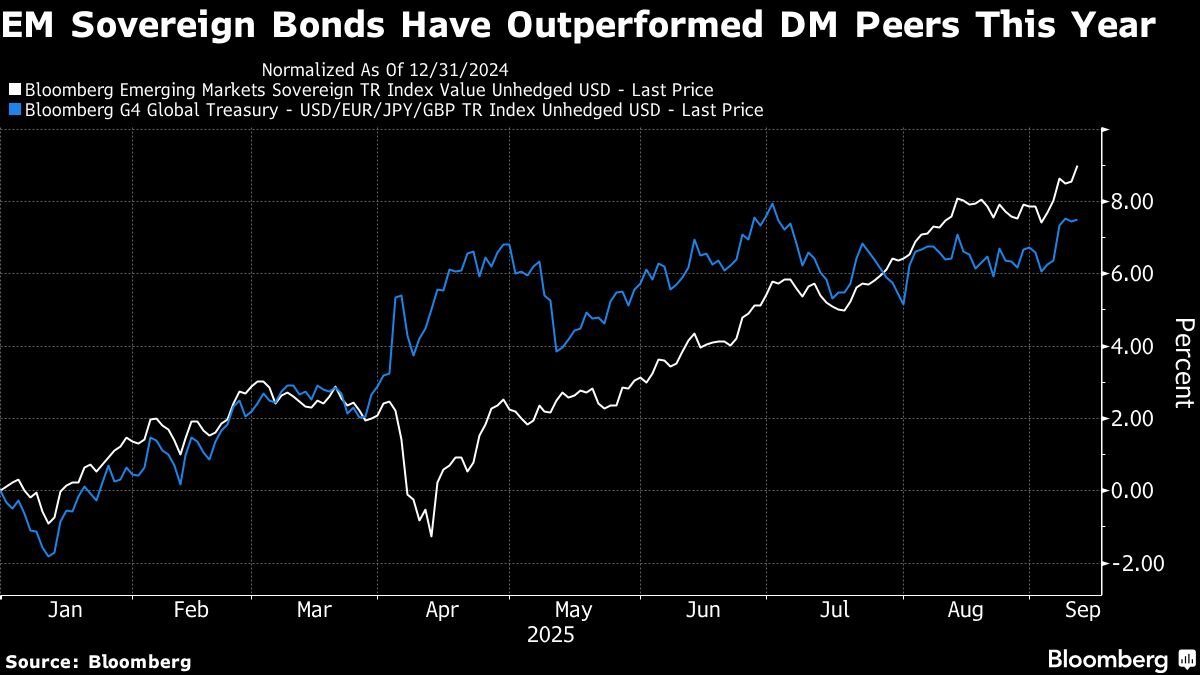

Emerging-Market Investor Inflows Are a 2026 Story, BofA Says

Emerging markets are likely to receive heavier inflows early next year as more evidence on the resilience of these economies fuels a further shift from US assets, according to Bank of America Corp.

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi