Funding & Business

State of Insurtech 2024 Report

In 2024, investors continued to retreat from insurtech.

Just 113 investors made at least 2 equity insurtech investments during the year — a 72% drop from the high of 406 investors in 2021. As a result, insurtech dealmaking dropped to 362 deals, the lowest annual total since 2016.

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

Key takeaways from the report include:

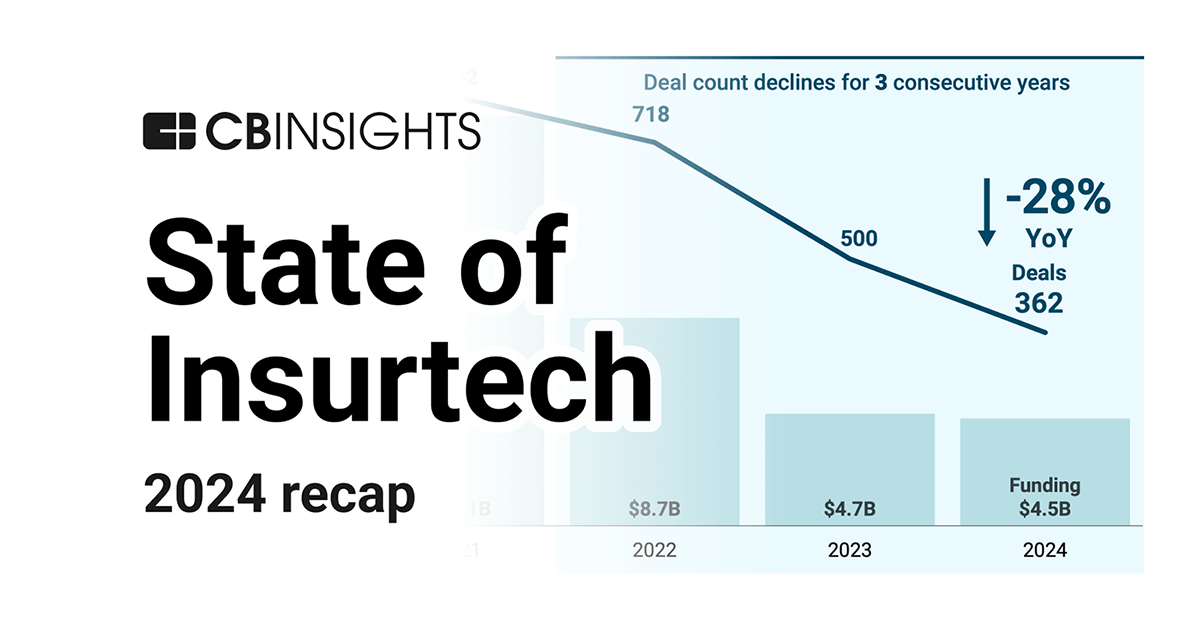

- Insurtech dealmaking and funding continue to decline. Deal count fell 28% year-over-year (YoY) to 362 deals in 2024, while funding dropped 4% to $4.5B. Insurtech deals and funding are both at recent lows.

- Quarterly funding to P&C insurtechs is in the gutter. P&C funding dropped 43% quarter-over-quarter (QoQ) to $0.4B in Q4’24 — a 7-year low — with annual funding also declining to $2.6B. The year’s 2 largest deals in P&C went to AI-focused startups Altana AI and Akur8, highlighting investors’ appetite for specialized AI opportunities.

- Silicon Valley is dethroned as insurtech’s funding capital. Silicon Valley’s share of global insurtech funding dropped dramatically from 20% in 2023 to 10% in 2024, surpassed by New York at 15%. This was the first time since 2018 that Silicon Valley wasn’t No. 1.

- Early-stage insurtechs raise record-high deal sizes. The median early-stage insurtech deal size surged 52% YoY to $3.8M in 2024 — outpacing the broader venture landscape — as investors concentrate on a more selective group of innovators.

- Recently funded insurtechs show stronger business fundamentals and more efficient growth trajectories. Insurtechs that raised funding in 2024 have grown employee headcounts by a median of 20% over the last 12 months, far surpassing the 3% growth among those that raised during the funding boom of 2021.

Insurtech dealmaking and funding continue to decline

Insurtech deal count fell 28% YoY, from 500 deals in 2023 to 362 in 2024. The decline outpaced the broader venture environment, which saw deal count fall 19% YoY. 2024 was the worst year for insurtech dealmaking since 2016 (328 deals).

Deal volume among leading investors has also decreased. The number of investors that made 5 or more equity insurtech investments has fallen from 57 in 2021 to just 7 in 2024. Those that remain active now operate in a more favorable environment due to reduced competition across the marketplace.

Insurtech funding declined in 2024 as well, though by only 4% YoY.

Quarterly funding to P&C insurtechs is in the gutter

Q4’24 marked a 7-year low for P&C insurtech funding, which fell 43% QoQ to $0.4B. The decline caused broader insurtech funding to halve QoQ, from $1.4B in Q3’24 to $0.7B in Q4’24.

P&C deal count also fell 10% QoQ to 45 in Q4’24, the lowest level since Q2’16.

Annual P&C insurtech funding declined to $2.6B in 2024, a 7-year low, underscored by just 2 P&C insurtech startups raising $100M+ mega-round deals: Altana AI, which offers an AI-powered supply chain risk platform, and Akur8, an AI-powered pricing platform. Those deals signal appetite for specialized AI products for the insurance industry, coinciding with a global surge in AI funding to over $100B last year.

Comparatively, life & health insurtech saw an increase in annual funding and dealmaking. Funding increased 64% YoY to $1.8B in 2024, while deals ticked up from 126 in 2023 to 128 in 2024.

Silicon Valley is dethroned as insurtech’s funding capital

The share of global insurtech funding to Silicon Valley-based startups halved YoY, falling from 20% in 2023 to 10% in 2024. Comparatively, New York led the way with 15% of global insurtech funding share in 2024, more than doubling from 7% the year prior.

Silicon Valley is the world’s leading tech ecosystem, and venture-wide funding to the region’s startups soared last year amid a boom in AI investment. Given the ecosystem’s prominence, diminished insurtech activity in Silicon Valley could lead to missed opportunities for insurance-focused AI advancements.

Early-stage insurtechs raise record-high deal sizes

The median insurtech deal size increased from $4.1M in 2023 to $5.2M in 2024.

The increase was fueled by early-stage insurtechs, which saw median deal size surge 52% YoY, from $2.5M in 2023 to $3.8M in 2024. The size and growth rate both beat out the broader venture environment, where early-stage deal size increased 17% YoY to $2.1M.

Combined with the broader decline in dealmaking, larger check sizes indicate that investors are concentrating their investments on fewer bets. For the insurance industry, this dynamic points to a slimmer insurtech landscape with fewer high-growth participants moving forward.

On the other hand, late-stage insurtech deal sizes declined 19% YoY from $40M in 2023 to $32.5M in 2024.

The decline coincides with a restricted exit environment: Insurtech M&A exits fell from 57 in 2023 to 35 in 2024.

Nevertheless, notable exits include CCC Intelligent Solutions’s acquisition of EvolutionIQ in December at a valuation of $730M, as well as Applied’s purchase of Planck in July. Both acquisitions targeted genAI-enabled startups, signaling a broader appetite for genAI insurance offerings.

Recently funded insurtechs show stronger business fundamentals

Insurtechs that raised funding in 2024 are growing headcounts faster than other insurtechs, by a median of 20% over the last 12 months and 40% over the last 24 months.

Comparatively, median headcount growth among insurtechs that raised a funding round at the height of the funding boom in 2021 is marginal — just 3% over the last 12 months.

The higher growth rates of recently funded insurtechs suggest a new breed of companies with stronger fundamentals — they’re not only able to raise capital in a selective market but are also demonstrating more efficient growth than their 2021-funded counterparts.

By the same logic, investors and partners (like established brokers and carriers) should monitor the landscape for outliers that represent organic growth opportunities — such as insurtechs that haven’t raised funding in several years but continue to grow headcount at a steady clip.

MORE INSURTECH RESEARCH FROM CB INSIGHTS

For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

If you aren’t already a client, sign

up for a free trial to learn more about our platform.

Funding & Business

Why Raising Too Much Funding Is Often Fatal

As the bifurcation of the venture market deepens, founders are faced with an important decision: to raise from traditional boutique VCs or from the platform giants?

On the surface, there’s status associated with the big platforms. Their deep pockets means they can pay over the odds, and bigger rounds at higher prices make for more impressive headlines. To founders, who are staring into a void of uncertainty, it might feel like winning the lottery.

Unfortunately, but unsurprisingly, it’s not quite that simple. Consider this quote from veteran investor, Fred Wilson:

“The fact is that the amount of money start-ups raise in their seed and Series A rounds is inversely correlated with success. Yes, I mean that. Less money raised leads to more success. That is the data I stare at all the time.”

Being on the boutique side of this argument, perhaps Wilson just doesn’t want to compete on price against the big platforms? As usual, data can point to the truth of this question, for those who care to look.

Premature scaling

In 2011, Startup Genome released a report on “premature scaling.” In its effort to understand the major drivers of startup failure, one factor kept coming up: Startups that raised large amounts of capital early would try to build their way to success without properly testing assumptions. By sinking money into untested product development or team expansion, they removed the optionality and flexibility that is vital to innovation.

This mirrors advice given to founders by Y Combinator co-founder Paul Graham:

“The more you raise, the more you spend, and spending a lot of money can be disastrous for an early stage startup. Spending a lot makes it harder to become profitable, and perhaps even worse, it makes you more rigid, because the main way to spend money is people, and the more people you have, the harder it is to change directions.”

Today, as the bar for traction in subsequent rounds has risen so steeply, this is an even greater concern for founders. Coming to the conclusion that you need to pivot (which many successful startups will) after you’ve already burned millions of venture dollars may be too late, as the runway to hit the metrics for your next round grows shorter.

Re-risking

The more you spend, the more fragile your vision becomes. This is a process that venture capitalist Rob Go has described as “re-risking.”

“At each funding round, there is a significant re-risking of the startup, to the point that you are not moving meaningfully down the risk curve for a long long time. And even at a late stage, a mega funding round can bring you right back up to the point of maximum risk.”

The lingering question is why the big platform firms would pursue a strategy that amplifies failure. The key is to understand their priority: to be in the leader in any major category, at almost any cost.

This strategy justifies putting options on as many startups as possible in the areas of consensus, and then winnowing that down to a handful of winners. If you crank the “power law” of venture capital up to 11 by injecting ever-larger sums of capital, owning these monstrous outcomes is worth hundreds of small failures. This strategy, while zero-sum in effect, is effective as long as enough of the remaining value accrues to these winners.

So, be careful about the motivation attached to any capital you may raise. Some investors are out there to support you through a journey of exploration, while others just want to pump you with rocket fuel and see what happens.

Dan Gray, a frequent guest author for Crunchbase News, is the head of insights at Equidam, a platform for startup valuation.

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

New Ardian Infrastructure Fund Set to Surpass €10 Billion Target

Ardian is on track to exceed the €10 billion ($11.7 billion) fundraising target for its latest fund, people familiar with the effort said, as investors look for opportunities in the infrastructure segment.

Source link

Funding & Business

Tesla's Door Design Can Trap People Inside

When Tesla car doors lose power, you need to use the manual door release to get out. But riders and drivers can get stuck inside. Emily Chang explains. (Source: Bloomberg)

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi