Business

Al Fayed-owned Mayfair penthouse has ‘leaky roofs and noisy lifts’, BBC reveals

BBC

BBCThe owner of a multi-million pound penthouse on Park Lane, central London, has been in an eight-year legal battle with companies owned by the late Mohamed Al Fayed and his family, the BBC has found.

The dispute began as a wrangle over a legal agreement relating to the installation of a new lift more than 20 years ago.

Since then, it has escalated into a row alleging leaky roofs, botched refurbishments and claims that a noisy lift was “maliciously” run at night to disturb the penthouse owner’s sleep.

Lawyers for both parties declined to comment.

The row at the exclusive Mayfair address – documented in High Court filings – shines a light on the way some business dealings were conducted in Mohamed Al Fayed’s empire in the years before he died.

Throughout his life, he was known for his combative approach, frequently resorting to legal action to resolve disagreements.

The luxury penthouse at the centre of this dispute is owned by Alan and Rosaleen Hodson. He is a property developer whose company has built thousands of homes in south-east England.

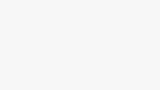

It is on the top floor of 55 Park Lane, known as “Hyde Park Residence”, a large apartment building in a prime spot – right next to the exclusive Dorchester Hotel.

The building’s website promises “an atmosphere of warmth and calm with the best of London living”. A four-bedroom apartment is currently on sale for £8.5m.

In 2003, the Mail on Sunday described the address as having “sensational” views across Hyde Park and a “marble entrance foyer [that] has to be seen to be believed”.

However, walking past the building gives a different impression. Some might consider it a little shabby for such a premium location, with peeling paint and a missing sign above the door.

Hyde Park Residence has been owned by the Fayed family since the 1980s, through Prestige Properties (PP), a company based in Liechtenstein.

This has been “under the control and held for the benefit of” Mohamed Al Fayed’s estate and family since his death in 2023, according to the accounts of a subsidiary company filed in the UK. Al Fayed’s widow Heini Wathen-Fayed is a director of this subsidiary called Hyde Park Residence Ltd, which manages some of the apartments.

Dave M Benett/Getty Images

Dave M Benett/Getty ImagesAl Fayed’s son Dodi, who died in a car crash alongside Princess Diana in 1997, reportedly used to have a flat there.

When Mohamed Al Fayed owned Harrods, he would sometimes let managers and directors live in the block, and the neighbouring building, 60 Park Lane, which he also owned.

In 2024, the BBC spoke to 13 women who said Fayed sexually assaulted them at 60 Park Lane. Four of them said they were raped.

Leaky roofs

The first issue emerged soon after Mr Hodson bought the penthouse in 2004, according to court documents seen by the BBC.

Mr Hodson made extensive improvements to the apartment when he moved in – modifying the kitchen, upgrading the roof terraces, and putting in a new lift so he wouldn’t have to use a flight of stairs to access the property.

An agreement giving him legal ownership of his new lift – by updating his lease – wasn’t honoured by Liechtenstein-based PP, Mr Hodson claimed.

Like many large buildings, the ownership of Hyde Park Residence is complicated.

The freeholder of the building is the Grosvenor Estate, which has extensive landholdings in central London. The Al Fayed family’s company PP has the right to use it for the next 110 years.

This leasehold arrangement, though time-limited, is considered a form of ownership.

Grosvenor should have been asked for permission before these improvements were started. But permission was not requested – although it agreed in 2006 to grant permission retrospectively for a payment of £100,000, which Prestige Properties paid.

Then, in 2014, Mr Hodson began to be bothered by noise from two of the buildings’ lifts. Despite his complaints, the noise grew worse, he argued, until in 2015 the building managers agreed to suspend use of one of the troublesome lifts at night.

And in 2016, the two parties fell out further. PP demanded that Mr Hodson contribute £80,000 towards the money paid to the Grosvenor Estate, some years earlier.

The following year, the Hodson’s took PP and two other Fayed-controlled companies to the High Court asking for a list of grievances to be met and damages paid.

Among the issues, Mr Hodson said that he had wanted to extend the flat, adding a floor. He had spent £180,000 developing a plan, but PP denied him permission to build it, despite initially encouraging the plan – his lawyers claimed.

PP’s lawyers argued the company hadn’t given Mr Hodson permission to extend his property. They said that, as a property developer, he should have known that he wouldn’t get permission without paying PP, as the landlord, millions of pounds.

Mr Hodson said that as a result of this dispute, PP allowed people to start using a noisy lift again, disturbing his sleep, which he thought was a “malicious and deliberate” response to a letter of complaint. He said on one night the lift was used 23 times between midnight and 02:00.

He also complained of poor repair work, which he said left him with a leaky roof and damage to his roof terraces.

The dispute still hasn’t been resolved. In March this year, there was another court filing from Mr Hodson claiming “the roof is still leaking. The lift is still making excessive noise… The corridors and lobby have never been finished following refurbishment.”

Lawyers for PP argue in reply that the noise from the lift is at “acceptable levels” and deny that it was restarted maliciously. They admit water leaked but say their clients have taken all reasonable steps to stop it.

PP is counterclaiming £344,000 in ground rent, plus another £286,000 of interest and costs.

The sums are trivial compared to Mohamed Al Fayed’s wealth, estimated at £1.7bn at the time of his death. And it is remarkable that a dispute of this kind should have dragged on for so long.

But Al Fayed was known for never giving an inch to those he fell out with – and that approach seems to be continuing even after his death.

Alan Hodson, Heini Wathen-Fayed, PP, and Grosvenor Estate declined to comment.

Business

When is the Budget and what might be in it?

Jennifer Clarke & Tom EspinerBBC News

Reuters

ReutersThe Chancellor Rachel Reeves will set out plans for the economy when she delivers the Budget on 26 November.

There have been warnings that she will have to put up taxes or cut spending if she wants to stick to her own rules on government borrowing.

Before the 2024 general election, Labour promised not to increase income tax, National Insurance or VAT for working people.

What is the Budget?

In her Budget statement, the chancellor of the exchequer will outline the government’s plans for raising or lowering taxes.

It will also include big decisions about spending on health, schools, police and other public services.

The statement is made to MPs in the House of Commons.

Alongside the Budget, additional details about the measures and costs will be published by the Treasury, the government’s economic and finance ministry.

The independent Office for Budget Responsibility (OBR), which monitors government spending, will also publish an assessment of the health of the UK economy and a forecast of what it thinks will happen in the future.

What time is the Budget and what happens afterwards?

The Budget speech usually starts at about 12:30 UK time – after Prime Minister’s Questions – and lasts about an hour.

It will be broadcast live on the BBC iPlayer and on the BBC News website.

The Leader of the Opposition, Conservative MP Kemi Badenoch, will respond to the speech in the House of Commons.

MPs debate the measures for four days, before voting on them.

If approved by MPs, tax changes can come into effect immediately. However, the government must pass a finance bill to make them permanent.

What might be in the Budget?

There has been lots of speculation that Reeves might raise taxes in the Budget.

This is because she is expected to need to raise extra money to meet her self-imposed rules for government finances, called fiscal rules.

Reeves has two main rules, which she has said are “non-negotiable”:

- Not to borrow to fund day-to-day public spending by the end of this parliament

- To get government debt falling as a share of national income by the end of this parliament

However, in its last estimate in March, the OBR said the chancellor only had £10bn headroom to meet these rules, which it called a “very small margin”.

Since then the government has U-turned on planned benefit cuts that had aimed to save billions, while the cost of government borrowing has also increased.

Tax thresholds

There has been speculation that if the government wants to raise more tax without increasing income tax, VAT or National Insurance for working people, it could extend the current freeze on income tax thresholds, which is due to end in 2028.

Freezing the thresholds means that, over time as salaries rise, more people reach an income level at which they start paying tax or qualify for higher rates. This is often referred to as a “stealth tax”.

Property taxes

There have also been reports that property taxes will be reformed.

This could include replacing stamp duty – a tax buyers pay on properties above a certain value in England and Northern Ireland – with a property tax.

Landlords could have to pay more taxes, and council tax could be replaced.

One report suggested the government was considering taxing the money people make when they sell their main home in certain circumstances – this would mean changing the capital gains tax rules.

Isa reform

In July, the chancellor ruled out any immediate reform to cash Isas (Individual Savings Accounts). There had been speculation that she wanted to reduce the annual allowance to push people into investing in shares instead, to help boost economic growth.

It is possible that reform could still happen, but other measures to encourage people towards personal investment are considered more likely.

Pension changes

There is often speculation about possible changes to pension rules ahead of the Budget, such as the tax relief available to savers and the level of the tax-free lump sum which can be withdrawn.

However, previous chancellors who have been tempted to change to the higher rate tax relief on pension contributions have not done so. Cutting the relief would save the Treasury money, but may make pension savings less attractive.

Other taxes

The TUC, the umbrella group for trade unions in the UK, has called for higher taxes on online gaming companies and on banks’ profits.

How is the UK economy doing?

The Labour government has repeatedly said that boosting the economy is a key priority.

A growing economy usually means people spend more, extra jobs are created, more tax is paid and workers get better pay rises.

The latest figures show that growth in the UK economy has slowed in recent months. The economy was flat in July, after growing by 0.4% in June.

Looking at the longer term trend, the economy grew by 0.2% in the three months to July, down from the 0.3% growth seen in the three months to June, and from the 0.6% growth seen between March and May.

Meanwhile prices in the shops are still rising faster than wanted.

Inflation – the rate at which prices rise – was 3.8% in the year to July, which is above the Bank of England’s 2% target.

Despite this, in August the Bank cut its key interest rate to 4%, taking the cost of borrowing to the lowest level for more than two years.

The Bank moves interest rates to try to keep inflation on target, and cuts are less likely when price rises are above 2%.

However, the Bank cut rates because of concerns that the jobs market is weakening, with data showing job vacancies are continuing to fall and wage growth is slowing.

Lower interest rates can make loans, credit cards and some mortgages cheaper, but can also mean worse returns for savers.

Business

AI cloud surge: Oracle’s Nvidia moment? What to know about Larry Ellison co-founded firm’s sudden rise

On Wednesday, Oracle stunned Wall Street when its shares surged 36% in a single day, the company’s biggest one-day gain since 1992. The rise followed its announcement of a series of multibillion-dollar deals in artificial intelligence (AI) cloud infrastructure, including a landmark agreement with OpenAI. The rally was so dramatic that Oracle co-founder Larry Ellison briefly overtook Elon Musk as the world’s richest person before market corrections set in.The $300 billion OpenAI deal and moreAt the centre of the surge is Oracle’s $300 billion, five-year agreement with OpenAI, one of the largest cloud computing contracts ever signed. The company will provide computing resources and infrastructure to power OpenAI’s advanced models. Oracle has also struck deals with Nvidia, SoftBank, Meta, and xAI, signalling its transformation into a core provider of AI infrastructure.Backlog signals long-term growthCEO Safra Catz revealed that Oracle’s backlog of finalised contracts has reached $455 billion, four times higher than last year, and is expected to cross $500 billion soon. This backlog offers investors confidence in sustained long-term revenue, even as quarterly results sometimes fall short of projections, as reported by ET.Competing with cloud giantsOracle’s position in AI cloud computing now puts it in direct competition with Amazon Web Services and Microsoft Azure. The company expects revenue from its cloud infrastructure business to rise 77% to $18 billion this year, and reach $144 billion within four years, according to news agency AP.The billionaire shuffleThe surge in Oracle’s stock briefly added around $100 billion to Ellison’s wealth, pushing him past Elon Musk in Bloomberg’s billionaire rankings. Musk, whose fortune is closely tied to Tesla, regained the top spot later in the day. But as AP noted, the episode highlighted how AI-driven optimism is reshaping wealth dynamics among tech leaders.Why it matters for AIOracle’s resurgence positions it as a critical enabler of global AI adoption. By providing high-performance, reliable cloud infrastructure, the company is not just fuelling chatbot development but also supporting applications in robotics, pharmaceuticals, finance, and automation. Or as Ellison himself summed it up during an earnings call: “AI changes everything.”

Business

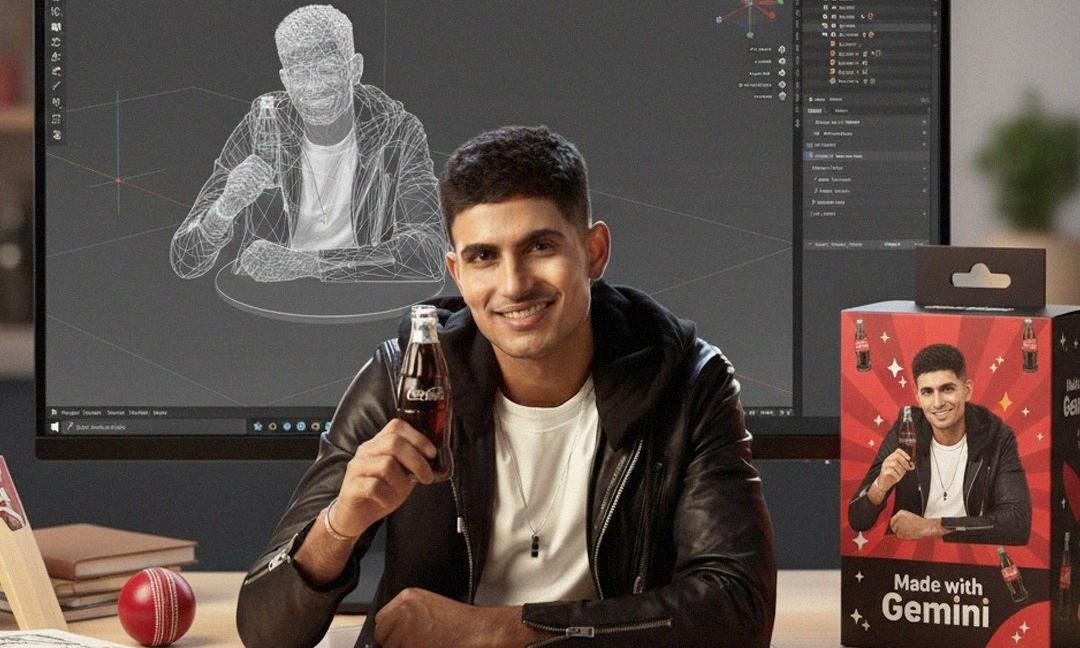

Google’s Gemini Nano Banana AI goes viral, generating 3D Figurines

Nano Banana, the latest image-generating tool of Google’s AI chatbot Gemini, has taken the internet by storm with “gemini nano banana ai 3d figurines” trending on Google.

So, how to use Gemini Nano Banana? Users only have to give simple prompts to Google Gemini to generate realistic figurines of the image uploaded with the prompt. The generated figurine not only looks realistic but can also be put in a setting of the user’s choice.

Steps for using Gemini Nano Banana

First, the user has to open Google Gemini on his or her mobile or computer and log in with their credentials.

Then, the user has to upload an image of their choice that they want to convert into a figurine. However, the image should be clear so the AI can detect it properly. Once the image is uploaded, the user can give a prompt to generate the figurine of his or her choice.

Also Read: OpenAI vs Grok vs Gemini in world’s first AI chess tournament: Guess who won?

How to prompt Gemini Nano Banana

A suitable and easy prompt for the purpose has been shared by Google Gemini on its official X handle. “Create a 1/7 scale commercialised figurine of the characters in the picture, in a realistic style, in a real environment. The figurine is placed on a computer desk,” stated the prompt.

“The figurine has a round transparent acrylic base, with no text on the base. The content on the computer screen is a 3D modelling process of this figurine. Next to the computer screen is a toy packaging box, designed in a style reminiscent of high-quality collectable figures, printed with original artwork. The packaging features two-dimensional flat illustrations,” it added.

Also Read: Eight free AI tools to create Studio Ghibli-style images easily

Other features of Nano Banana

Apart from generating images, Nano Banana can also be used for adding or removing elements in a picture. It can be done with this simple saying: “Using the provided image, please [add/remove/modify] [element] to/from the scene. Ensure the change is [description of how the change should integrate],” reported the Hindustan Times.

Users can also combine multiple images and create a new one. All the user has to do is use this prompt: “Create a new image by combining the elements from the provided images. Take the [element from image 1] and place it with/on the [element from image 2]. The final image should be a [description of the final scene].”

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi