AI Insights

In creating an ad, using AI for scenes – but not people – may retain consumer trust – VCU News

Image-generative artificial intelligence makes ad creation faster and cheaper — but there’s an intriguing hook to the look, according to new research from Virginia Commonwealth University. Trust can plummet when AI-generated visuals depict service providers in industries where relationships matter.

So, how can AI help service marketers without compromising trust?

A study coauthored by César Zamudio, Ph.D., associate professor of marketing in the VCU School of Business, determined that selective AI use in ad creation is key.

“When tangible elements — like a doctor’s office environment — are AI-generated, but the service provider’s image is a real picture, trust and ad effectiveness are restored,” Zamudio said. “The takeaway? Use AI where it counts, and let the human element shine.”

This balance is crucial for small businesses as they market themselves. The smart move is to use AI to generate backgrounds, office settings or equipment — but keep real people in their ads. This way, businesses can still benefit from AI’s speed and cost savings without losing consumer confidence.

“Our research offers a simple, actionable strategy: Use AI for settings, not people,” Zamudio said. “This approach can help you cut ad costs without cutting credibility, giving you a real edge to beat bigger brands.”

The research is also relevant to consumers, who can use it to help navigate AI-driven marketing.

“Not all AI ads are misleading,” Zamudio said, “but knowing what’s real — and what’s not — can shape your trust in a brand. … Our study reveals how AI in advertising shapes trust, helping you stay informed, skeptical and aware in today’s digital marketing landscape.”

Smart AI use is key, he said. “Brands can harness AI’s efficiency without losing credibility by keeping real people front and center in service ads. Marketers can use this research to successfully walk the tightrope between innovation and consumer confidence.”

This is especially important for services, where ads help make intangible offerings feel real and trustworthy. With AI disclosures becoming more common due to government and industry pressures, businesses need to know how to design AI-driven ads that maintain consumer trust.

Zamudio’s study, “Service Ads in the Era of Generative AI: Disclosures, Trust and Intangibility,” was co-authored with colleagues from Missouri State University and Longwood University and was published recently in the Journal of Retailing and Consumer Services.

Subscribe to VCU News

Subscribe to VCU News at newsletter.vcu.edu and receive a selection of stories, videos, photos, news clips and event listings in your inbox.

AI Insights

Quantum machine learning: patent strategy promise, pitfalls and practicalities

Shutterstock/Phonlamai Photo

As quantum machine learning edges closer to practical relevance, IP professionals face both unprecedented opportunities and new challenges in patenting algorithms and hardware. Here’s what you need to know

Register for limited access

Register to receive our newsletter and gain limited access to subscriber content.

Subscribe to unlock unlimited access

Get news, unique commentary, expert analysis and essential resources from the IAM experts.

Already have access? Login below

AI Insights

Artificial intelligence is straining the nation's power supply. Here's how oil-field service companies are responding – WCNC

AI Insights

Meet the Artificial Intelligence (AI) Stock That’s Crushing Nvidia on the Market in 2025

This cybersecurity company’s improving revenue pipeline points toward more stock price upside.

The fast-growing adoption of artificial intelligence (AI) technology in the past three years has been a tailwind for Nvidia (NVDA). The company enjoyed an early-mover advantage in this market thanks to its graphics processing units (GPUs), which have played a central role in the training of popular AI models.

However, it looks like investors’ appetite for Nvidia stock may be fading. It has appreciated just 32% so far in 2025 despite sustaining healthy growth levels. Factors such as restrictions on sales of its chips to China and the potential impact of tariffs on Nvidia’s business seem to be weighing on the stock. So, if you’re looking for an alternative to capitalize on the fast-growing adoption of AI, now would be a good time to take a closer look at this cybersecurity specialist that has outperformed Nvidia so far this year.

Image source: Getty Images.

The proliferation of AI in the cybersecurity market is turning out to be a tailwind for this company

Zscaler (ZS 2.82%), a cloud-based cybersecurity company, has witnessed a 59% jump in its stock price in 2025. It is primarily known for providing zero-trust security solutions that help its customers verify the identity of users or devices accessing their networks. The zero-trust security market is projected to grow at an annual pace of almost 17% through 2030, generating more than $92 billion in annual revenue at the end of the decade, according to Grand View Research.

The good part is that Zscaler is growing at a faster pace than the zero-trust security market. Its revenue in the recently concluded fiscal year 2025 (which ended on July 31) increased by 23% to $2.7 billion. Looking ahead, Zscaler could keep growing at a faster pace than the zero trust security market thanks to its strategy of offering cybersecurity tools to customers to protect AI apps, ensure secure access to AI apps, and protect large language models (LLMs), among other tools.

Additionally, Zscaler is also offering agentic AI cybersecurity solutions to speed up the process of identifying the reasons behind IT outages, undertake corrective measures, and improve troubleshooting. The important thing to note here is that Zscaler’s agentic AI security offerings are growing at a nice pace. The annual recurring revenue (ARR) of its agentic security operations increased by an impressive 85% year over year, while its agentic AI operations grew by 58% last year.

With the adoption of agentic AI in cybersecurity expected to clock a compound annual growth rate (CAGR) of 34% through 2033, hitting an annual revenue of $322 billion at the end of the forecast period, Zscaler seems to be in a solid position to accelerate its growth in the long run.

Even better, the company is already building a healthy long-term revenue pipeline thanks to its focus on fast-growing niches such as AI. This is evident from the 31% spike in its remaining performance obligations (RPO) last quarter to $5.8 billion. That’s more than double the revenue it generated in the latest fiscal year.

As RPO refers to the value of a company’s contracted backlog, the faster growth in this metric when compared to the 21% increase in its quarterly revenue suggests that Zscaler is winning new business at a faster pace than it can fulfill.

That’s the reason why there is a good chance that its growth rate could pick up in the future, which is why it makes sense to buy this stock while it is trading at a relatively attractive valuation.

Zscaler’s growth could exceed Wall Street’s expectations

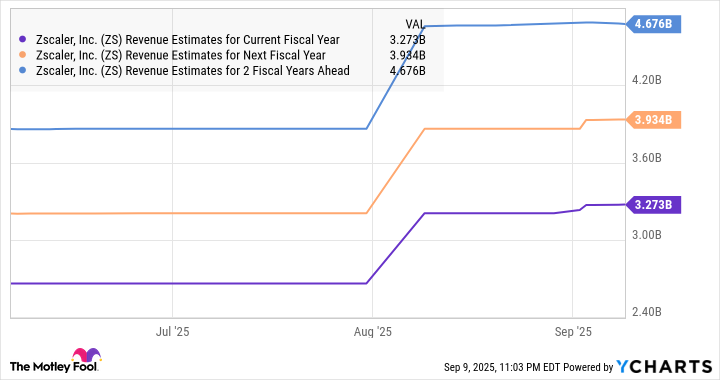

Though analysts are expecting Zscaler to deliver robust double-digit growth over the next three fiscal years, they are expecting a relatively slower pace of growth compared to its fiscal 2025 performance.

ZS Revenue Estimates for Current Fiscal Year data by YCharts

But what’s worth noting is that Zscaler’s consensus revenue estimates have moved higher of late. That’s not surprising considering the improvement in the company’s RPO. Moreover, the outstanding growth opportunity in the AI-focused cybersecurity niches in the long run is likely to help Zscaler deliver much stronger growth than what analysts are expecting.

That’s why it makes sense to buy Zscaler while it is trading at 16 times sales. Though that’s not exactly cheap considering the U.S. technology sector’s average sales multiple of 8.5, it is much lower than Nvidia’s price-to-sales ratio of 25. What’s more, Zscaler’s growth after a couple of years is expected to be higher than that of Nvidia’s, as the latter’s growth could taper off thanks to its high revenue base.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

That’s why investors looking for a reasonably valued AI stock that has the potential to deliver robust gains in the long run can consider going long Zscaler even after the healthy gains that it has clocked this year.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Zscaler. The Motley Fool has a disclosure policy.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi