AI Insights

Better Buy in 2025: SoundHound AI, or This Other Magnificent Artificial Intelligence Stock?

SoundHound AI (SOUN 11.99%) is a leading developer of conversational artificial intelligence (AI) software, and its revenue is growing at a lightning-fast pace. Its stock soared by 835% in 2024 after Nvidia revealed a small stake in the company, although the chip giant has since sold its entire position.

DigitalOcean (DOCN 2.03%) is another up-and-coming AI company. It operates a cloud computing platform designed specifically for small and mid-sized businesses (SMBs), which features a growing portfolio of AI services, including data center infrastructure and a new tool that allows them to build custom AI agents.

With the second half of 2025 officially underway, which stock is the better buy between SoundHound AI and DigitalOcean?

Image source: Getty Images.

The case for SoundHound AI

SoundHound AI amassed an impressive customer list that includes automotive giants like Hyundai and Kia and quick-service restaurant chains like Chipotle and Papa John’s. All of them use SoundHound’s conversational AI software to deliver new and unique experiences for their customers.

Automotive manufacturers are integrating SoundHound’s Chat AI product into their new vehicles, where it can teach drivers how to use different features or answer questions about gas mileage and even the weather. Manufacturers can customize Chat AI’s personality to suit their brand, which differentiates the user experience from the competition.

Restaurant chains use SoundHound’s software to autonomously take customer orders in-store, over the phone, and in the drive-thru. They also use the company’s voice-activated virtual assistant tool called Employee Assist, which workers can consult whenever they need instructions for preparing a menu item or help understanding store policies.

SoundHound generated $84.7 million in revenue during 2024, which was an 85% increase from the previous year. However, management’s latest guidance suggests the company could deliver $167 million in revenue during 2025, which would represent accelerated growth of 97%. SoundHound also has an order backlog worth over $1.2 billion, which it expects to convert into revenue over the next six years, so that will support further growth.

But there are a couple of caveats. First, SoundHound continues to lose money at the bottom line. It burned through $69.1 million on a non-GAAP (adjusted) basis in 2024 and a further $22.3 million in the first quarter of 2025 (ended March 31). The company only has $246 million in cash on hand, so it can’t afford to keep losing money at this pace forever — eventually, it will have to cut costs and sacrifice some of its revenue growth to achieve profitability.

The second caveat is SoundHound’s valuation, which we’ll explore further in a moment.

The case for DigitalOcean

The cloud computing industry is dominated by trillion-dollar tech giants like Amazon and Microsoft, but they mostly design their services for large organizations with deep pockets. SMB customers don’t really move the needle for them, but that leaves an enormous gap in the cloud market for other players like DigitalOcean.

DigitalOcean offers clear and transparent pricing, attentive customer service, and a simple dashboard, which is a great set of features for small- and mid-sized businesses with limited resources. The company is now helping those customers tap into the AI revolution in a cost-efficient way with a growing portfolio of services.

DigitalOcean operates data centers filled with graphics processing units (GPUs) from leading suppliers like Nvidia and Advanced Micro Devices, and it offers fractional capacity, which means its customers can access between one and eight chips. This is ideal for small workloads like deploying an AI customer service chatbot on a website.

Earlier this year, DigitalOcean launched a new platform called GenAI, where its clients can create and deploy custom AI agents. These agents can do almost anything, whether an SMB needs them to analyze documents, detect fraud, or even autonomously onboard new employees. The agents are built on the latest third-party large language models from leading developers like OpenAI and Meta Platforms, so SMBs know they are getting the same technology as some of their largest competitors.

DigitalOcean expects to generate $880 million in total revenue during 2025, which would represent a modest growth of 13% compared to the prior year. However, during the first quarter, the company said its AI revenue surged by an eye-popping 160%. Management doesn’t disclose exactly how much revenue is attributable to its AI services, but it says demand for GPU capacity continues to outstrip supply, which means the significant growth is likely to continue for now.

Unlike SoundHound AI, DigitalOcean is highly profitable. It generated $84.5 million in generally accepted accounting principles (GAAP) net income during 2024, which was up by a whopping 335% from the previous year. It carried that momentum into 2025, with its first-quarter net income soaring by 171% to $38.2 million.

The verdict

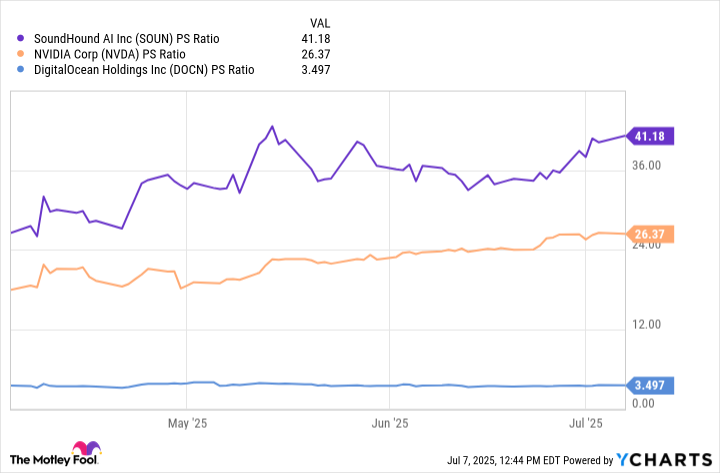

For me, the choice between SoundHound AI and DigitalOcean mostly comes down to valuation. SoundHound AI stock is trading at a sky-high price-to-sales (P/S) ratio of 41.4, making it even more expensive than Nvidia, which is one of the highest-quality companies in the world. DigitalOcean stock, on the other hand, trades at a very modest P/S ratio of just 3.5, which is actually near the cheapest level since the company went public in 2021.

SOUN PS Ratio data by YCharts

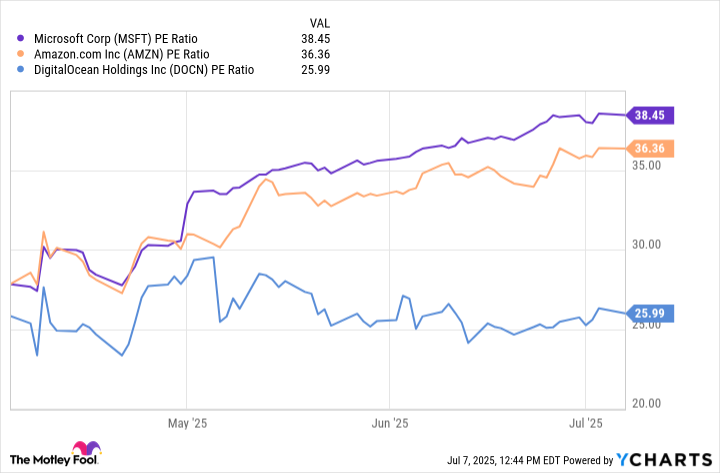

We can also value DigitalOcean based on its earnings, which can’t be said for SoundHound because the company isn’t profitable. DigitalOcean stock is trading at a price-to-earnings (P/E) ratio of 26.2, which makes it much cheaper than larger cloud providers like Amazon and Microsoft (although they also operate a host of other businesses):

MSFT PE Ratio data by YCharts

SoundHound’s rich valuation might limit further upside in the near term. When we combine that with the company’s steep losses at the bottom line, its stock simply doesn’t look very attractive right now, which might be why Nvidia sold it. DigitalOcean stock looks like a bargain in comparison, and it has legitimate potential for upside from here thanks to the company’s surging AI revenue and highly profitable business.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Chipotle Mexican Grill, DigitalOcean, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short June 2025 $55 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

AI Insights

Answering the question of which AI tools deliver measurable value

Silicon Valley kingmakers

Meanwhile, the investor lineup reads like a who’s who of Silicon Valley’s kingmakers. Sequoia’s Roelof Botha and “solo GP” Elad Gil represent the kind of money that moves markets and shapes entire industries. Dramatic as it may sound, their funding decisions often preview which technologies will dominate enterprise conversations within two years, making their perspectives essential intelligence for anyone planning technology strategy.

The programming extends well beyond AI and public markets. The CEO of Waymo will showcase how autonomous systems are reshaping transportation, while Netflix’s CTO will provide a rare glimpse into the streaming infrastructure that powers global entertainment. Perhaps most intriguingly, Kevin Rose—who founded Digg, sold it, then recently rescued it from corporate ownership—will discuss the art of platform resurrection in an era of constant digital disruption.

Disrupt takes place as both TechCrunch and San Francisco reassert their respective primacies — the publication as tech journalism’s defining voice, the city as technology’s undisputed capital. It also promises to be entertaining, as these events always are.

AI Insights

AI accurately identifies questionable open-access journals by analysing websites and content, matching expert human assessment

Artificial intelligence (AI) could be a useful tool to find ‘questionable’ open-access journals, by analysing features such as website design and content, new research has found.

The researchers set out to evaluate the extent to which AI techniques could replicate the expertise of human reviewers in identifying questionable journals and determining key predictive factors. ‘Questionable’ journals were defined as journals violating the best practices outlined in the Directory of Open Access Journals (DOAJ) – an index of open access journals managed by the DOAF foundation based in Denmark – and showing indicators of low editorial standards. Legitimate journals were those that followed DOAJ best practice standards and classed as ‘whitelisted’.

The AI model was designed to transform journal websites into machine-readable information, according to DOAJ criteria, such as editorial board expertise and publication ethics. To train the questionable journal classifier, they compiled a list of around 12,800 whitelisted journals and 2500 unwhitelisted, and then extracted three kinds of features to help distinguish them from each other: website content, website design and bibliometrics-based classifiers.

The model was then used to predict questionable journals from a list of just over 15,000 open-access journals housed by the open database, Unpaywall. Overall, it flagged 1437 suspect journals of which about 1092 were expected to be genuinely questionable. The researchers said these journals had hundreds of thousands of articles, millions of citations, acknowledged funding from major agencies and attracted authors from developing countries.

There were around 345 false positives among those identified, which the researchers said shared a few patterns, for example they had sites that were unreachable or had been formally discontinued, or referred to a book series or conference with titles similar to that of a journal. They also said there was likely around 1780 problematic journals that had remained undetected.

Overall, they concluded that AI could accurately discern questionable journals with high agreement with expert human assessments, although they pointed out that existing AI models would need to be continuously updated to track evolving trends.

‘Future work should explore ways to incorporate real-time web crawling and community feedback into AI-driven screening tools to create a dynamic and adaptable system for monitoring research integrity,’ they said.

AI Insights

Should You Forget BigBear.ai and Buy 3 Artificial Intelligence (AI) Stocks Right Now?

BigBear.ai has big problems scaling its AI business.

There’s little doubt that Palantir Technologies (PLTR -0.19%) is one of the most significant stock market stories of the decade, so far. The data mining company unveiled its Artificial Intelligence Platform (AIP) in 2023 and since has been climbing fast.

Palantir jumped 340% in 2024, making it the best-performing stock in the S&P 500, and its 118% gain so far this year puts it at a close second to Seagate Technology for 2025. An investment in Palantir of just $1,000 three years ago would have given you $21,000 today.

Undoubtedly, people are looking for the next Palantir, and for many, BigBear.ai (BBAI 0.59%) is a contender. Like Palantir, BigBear.ai is a government contractor that is using artificial intelligence (AI) to develop solutions for defense and intelligence agencies.

Image source: Getty Images.

But if you’re hoping BigBear.ai can match Palantir, I think you’ll be mistaken. There are three other names you should consider instead to play the AI space.

BigBear.ai isn’t another Palantir

Palantir is growing so fast because it’s reeling in contracts hand over fist. It closed $2.27 billion in total contract value sales in the second quarter, up 140% from last year. Its customer count grew 43% for the quarter. That’s why the company’s revenue growth is so steep — it’s gone from about $460 million per quarter to $1 billion a quarter in just three years.

BigBear.ai, however, had revenue of just $32.4 million in the second quarter, down 18% from a year ago. Management said the drop was because of lower volume of U.S. Army programs, but that also shines a spotlight on the company’s biggest problem. BigBear.ai’s biggest contract is with the Army, a $165 million deal to modernize and incorporate AI into its platforms. If the Army slows down its work for any reason, then BigBear.ai and its stock suffer.

So, what AI companies are a better play than BigBear.ai now?

Palantir Technologies

I completely understand wanting to get in on the next Palantir, but I also see a lot of value in investing in the original. While BigBear.ai has to create new platforms and new products for each of its clients, Palantir’s AIP is designed to work with multiple government agencies and commercial businesses.

Palantir rolls out AIP in boot camps so potential customers can try it out, and the results speak for themselves — the company closed 157 deals in the second quarter that were valued at $1 million or more. Sixty-six of those were more than $5 million in value and 42 were more than $10 million. BigBear.ai can’t do that.

International Business Machines

International Business Machines (IBM 1.15%) wins my vote in the AI space because of a bet that Big Blue made six years ago. The venerable computing company that was perhaps best known for its work in personal computing spent $34 billion in 2019 to purchase Red Hat, an open-source enterprise software company, in order to develop its hybrid cloud offerings. The hybrid cloud combines public cloud, private cloud, and on-premises infrastructure, which gives customers flexibility to keep parts of their data secure while utilizing cloud services.

IBM layers its hybrid cloud with its Watsonx, which is its portfolio of artificial intelligence products, which includes a studio to build AI solutions, virtual agents, and code assistants powered by generative AI.

IBM saw software revenue of $7.4 billion in its second quarter, with the hybrid cloud revenue up 16% from a year ago.

“Our strategy remains focused: hybrid cloud and artificial intelligence,” CEO Arvind Krishna said on the Q2 earnings call. “This strategy is built on five reinforcing elements — client trust, flexible and open platforms, sustained innovation, deep domain expertise, and a broad ecosystem.”

Amazon

I love Amazon (AMZN 1.44%) — not because I get packages delivered to my house every week (its e-commerce division makes shopping incredibly convenient), but because of Amazon Web Services (AWS).

AWS holds first place in global market share for cloud computing, with a 30% share. Its Amazon Bedrock platform allows customers to use generative AI to build and experiment with AI-powered products. And because it operates on Amazon’s powerful cloud, users don’t need to invest in expensive graphics processing units (GPUs) or data centers of their own.

AWS was responsible for $30.87 billion in revenue and $10.16 billion in operating income. That profit margin is hugely important, as Amazon’s net income for the quarter was just $18.16 billion — AWS accounts for more than half of the company’s profit despite being responsible for just 18% of the company’s revenue.

In addition, Amazon’s advertising business is growing in importance. It’s using machine learning to deliver targeted product ads, making it one of Amazon’s most profitable efforts. Advertising services revenue jumped to $15.6 billion in the second quarter, up 22% from a year ago.

E-commerce is where Amazon made its mark, but AI is where Amazon will carve its future.

The bottom line

AI is going to shape our future for years to come. While BigBear.ai is making efforts, not everyone can be a winner. Pass on BigBear.ai for now and focus on established companies that are not only proven winners, but also have a broad runway for growth.

-

Business3 weeks ago

Business3 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers3 months ago

Jobs & Careers3 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education3 months ago

Education3 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business3 months ago

Funding & Business3 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries