AI Research

China’s emissions may be falling

Global China Unit

Getty Images

Getty ImagesAs the world races to cut carbon emissions in the fight against climate change, a potentially game-changing milestone may have been reached.

China – currently responsible for some 30% of global emissions – saw its emissions decline in the 12 months up to May 2025.

Crucially, this would be the first time emissions have fallen even as demand for power across the Chinese economy grew rapidly. Previous drops have only ever taken place during shocks like the Covid pandemic, which slowed the country’s economy.

Given the outsized role the country – home to more than a billion people – has played in increasing global emissions in recent years, it is a moment to celebrate.

“The world would have stabilised its emissions 10 years ago if it weren’t for China,” Lauri Myllyvirta, of the Centre for Research on Energy and Clean Air, points out to the BBC.

Mr Myllyvirta’s own research found China’s emissions were down 1.6% compared to the same period last year.

The need for China, and all countries, to reduce emissions has never been more pressing.

According to the UN’s Intergovernmental Panel on Climate Change (IPCC), the world cannot simply stabilise the amount of emissions pumped into the atmosphere annually, if it is to hold global warming to below 1.5C. Warming above this temperature would lead to devastating effects for people around the world.

Instead, global annual emissions must start falling if the worst effects of climate change are to be averted.

So how has China achieved this?

And is this the first step towards a sustained decline, or a blip in China’s output?

China’s green tech boom is helping…

Much of the decrease in emissions can be put down to countrywide investments in wind and solar.

According to Myllyvirta, China has installed more than half of the solar and wind generation capacity that has been installed globally over the past few years.

“The solar capacity that China installed last year is comparable to what the EU has overall,” he said. “It’s a staggering pace of growth.”

Recent data from the UK-based energy think tank, Ember, shows that in April, wind and solar energy together generated more than a quarter of China’s electricity for the first time.

Meanwhile, electricity generated from fossil fuels over the first four months of 2025 fell by 3.6% as compared with the same period last year.

These are dramatic changes for an economy historically dependent on coal, says Ember energy analyst Yang Biqing.

Yang adds that coal will likely remain important for some time, given that renewable sources on their own don’t provide a constant, stable supply of electricity.

China is not just installing these renewable energy technologies, but manufacturing them as well.

Chinese companies currently lead the world in making green tech, including wind turbines and solar panels – accounting for some 60% and 80% of global output, respectively.

These companies and their global competitors are now engaged in a rush for transition minerals across the world.

The industries’ rapid expansion – with their need for mines and processing plants – have caused severe social and environmental damage in the areas where they are located.

Recent findings by the Business and Human Rights Resource Centre, a non-profit, showed that the rush to mine these minerals was also fuelling human rights abuses and environmental destruction.

Nonetheless, the experts interviewed by the BBC agreed that China’s ability to deploy these technologies at scale had a decisive impact on levelling off its carbon emissions.

… but it’s not an outlier in fighting climate change

China may be installing renewables at a record pace, but its energy mix is still comparable with many Western economies.

In the UK, for example, renewables accounted for 46.3% of all energy generated. The US – second to China in carbon emissions – generates just over 20% of its energy from renewables.

Many of these developed economies, once leading emitters, also started reducing their emissions long ago, shifting away from coal and energy-intensive manufacturing.

China has long argued that it was only following the trail blazed by those wealthier countries, whose economic rise was accompanied by surging emissions. India’s emissions have also soared in recent years as it got richer.

Average emissions per person in both China and India are far lower than in the US – though China’s per capita emissions now exceed those of the UK and EU and are about the same as those of Japan.

So what’s next for China’s emissions?

They may have flattened out recently, but that does not guarantee a sustained drop.

“You could plateau at that level for a long time, and that’s not a very helpful thing for climate action,” says Li Shuo, of the Asia Society Policy Institute (ASPI).

Mr Li warns that turmoil outside of China’s borders could push Beijing back towards coal – the Ukraine war, for instance, fuelled Chinese leaders’ determination to secure energy supplies.

But the drive for energy security may actually push them towards renewables, says Christoph Nedopil Wang, director of the Griffith Asia Institute in Australia.

The way he sees it, the country’s “dominance” in the sector means relying more on renewables, and less on energy imports, only “improves national security for China”.

Current trade tensions with the West, and China’s sluggish economy, are also unlikely to prompt Beijing to stimulate its economy in ways that would lead to a renewed surge in carbon emissions, Dr Nedopil Wang adds.

Policymakers are placing bets on low-emission sectors, like IT, biotech, electric vehicles and clean energy technologies, and these are more likely to grow, he predicts.

Getty Images

Getty ImagesBut China still has a way to go in meeting its key international climate commitment.

Under the Paris Agreement framework, China has committed to reduce its carbon intensity by more than 65% from 2005 levels, with a deadline of 2030. Carbon intensity measures the amount of carbon emitted per unit of GDP.

In order to achieve this long-term goal, China set itself an interim target of cutting carbon intensity by 18% between 2020 and 2025. However, its efforts went off-track during the Covid-19 pandemic, and it had achieved only a 7.9% reduction by the end of 2024.

As a result, China’s only hope of meeting the 2030 target is to reduce emissions in absolute terms between now and 2030, Mr Myllyvirta says. The reduction he has identified is a start, he adds, but ambitious goal-setting and policy must follow.

Beijing may also start playing a more proactive role in global climate policy, Dr Nedopil Wang says: “That would be a big shift from 10 years ago, even six years ago, when China’s position was very much that ‘We’re a developing country and we hold back’.”

Such a shift is more likely now, as Beijing looks to take advantage of the Trump administration’s hostility to climate action to establish itself as a leader on the issue.

At a climate conference in April, President Xi Jinping told world leaders: “Instead of talking the talk, we must walk the walk… we must turn our goals into tangible results.”

AI Research

Tesla Says XAI Stands for “EXploratory AI.” Does It?

Last week, Tesla unveiled a ten-year compensation plan for Elon Musk that could turn him into a trillionaire. Perhaps by accident, it may have also invented an alter ego for one of Musk’s other major holdings, xAI.

Across 16 pages of its September 5 proxy statement, the automaker detailed a plan centered on targets for earnings and growth in key product lines that could result in Musk owning more than a quarter of what would be an $8.5 trillion company.

In explaining its position, Tesla noted that Musk has built several very valuable companies: “Space Exploration Technologies Corp., Neuralink Corp. and eXploratory Artificial Intelligence or ‘xAI.'”

Tesla; Sophie Kleeman/BI

It referred to the company simply as xAI, or by its legal name, X.AI Corp., in other parts of the document.

The wrinkle? Neither Musk nor xAI appears to have publicly claimed that the company’s name stands for “eXploratory artificial intelligence.” In fact, the name doesn’t appear to stand for anything at all.

The phrase “exploratory artificial intelligence” or “exploratory AI” doesn’t appear on xAI’s website, any of its public securities filings, the Nevada articles of incorporation of X.AI Corp., filings in any federal lawsuit to which xAI is a party, or any other xAI-related news articles, press releases, or public filings reviewed by Business Insider. These sources instead refer to the company as xAI or its legal name.

The phrases “exploratory artificial intelligence” and “exploratory AI” don’t appear to be used frequently online. A few companies have referred to “exploratory AI initiatives” in press releases or public filings, and a few academics have used the initials “XAI” to refer to “explainable” or “exploratory” AI in papers.

Several posts on niche blogs claim that the name of Musk’s AI company is shorthand for “exploratory artificial intelligence,” but they don’t cite sources.

Those words have occasionally been strung together on social media. Musk’s chatbot Grok used the term “exploratory AI” in nine separate X posts in July and August 2025, accounting for nearly all uses of the term on X during that time, though never as another name for xAI, a search shows.

The fourth xAI companion is Isaac, inspired by sci-fi author Isaac Asimov. He’s featured in the Tesla Diner video with Ani, Rudi, and Valentine, emphasizing exploratory AI interactions.

— Grok (@grok) July 24, 2025

Tesla and xAI didn’t respond to emailed questions about whether xAI stands for “exploratory artificial intelligence.”

X.AI Corp. was formed in Nevada in March 2023. Musk announced the creation of the company in an audio livestream in July. The AI company merged with Musk’s social-media company X. Corp. earlier this year.

“The overarching goal of xAI is to build a good AGI with the overarching purpose of just trying to understand the universe,” Musk said on the livestream, using an acronym for artificial general intelligence.

One thing is clear: Musk really likes the letter “X.” Space Exploration Technologies Corp., his second-most valuable company, is known as SpaceX. One of Tesla’s top-selling cars is the Model X, and one of his children was named X Æ A-12 (now known by the nickname “X.”).

X.com was also the name of a financial technology company Musk co-founded in 1999. It eventually became PayPal; Musk bought the domain name X.com back in 2017 and, after buying Twitter in 2022, he moved it to X.com.

Have a tip? Know more? Reach Jack Newsham via email (jnewsham@businessinsider.com) or via Signal (+1-314-971-1627). Do not use a work device or work WiFi. Use a personal email address, a nonwork device, and nonwork WiFi; here’s our guide to sharing information securely.

AI Research

This Artificial Intelligence (AI) Stock Could Surpass Nvidia’s Market Cap by 2030

Key Points

-

Microsoft is the world’s second-largest company right now, and its market cap is about 16% lower than that of Nvidia’s.

-

Microsoft’s huge revenue backlog and the fact that it is a key player in the cloud computing market could help accelerate its growth going forward.

-

Microsoft’s valuation and growth potential indicate that it can indeed overtake Nvidia’s market cap in the next five years.

-

10 stocks we like better than Microsoft ›

Nvidia‘s (NASDAQ: NVDA) dominance of the artificial intelligence (AI) chip market has helped it become the world’s most valuable company with a market cap of $4.32 trillion as of this writing. Importantly, Nvidia’s growth remains solid despite its huge revenue base.

The chipmaker should maintain its remarkable growth in the future as well, considering the incredible amount of money that’s expected to be spent on AI data centers over the next five years. Investor enthusiasm regarding Nvidia in the past three years has pushed its stock price higher and taken its valuation to premium levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Nvidia’s stock now trades at 47 times trailing earnings and 25 times sales. Though there is a good chance that Nvidia’s solid growth prospects justify that valuation, the company’s upside could be handicapped by the growing competition in the AI chip market as well as geopolitical factors such as tariffs and regulatory hurdles.

If that’s indeed the case, then it won’t be surprising to see Nvidia relinquish its title as the world’s most valuable company to the one being featured below.

Image source: Getty Images

A massive backlog is going to supercharge this company’s growth

Just like Nvidia, Microsoft (NASDAQ: MSFT) is a pioneer in AI thanks to its early investment in OpenAI. Microsoft moved quickly to integrate OpenAI’s intellectual property (IP) into its various offerings, and it is reaping the rewards of the AI-focused moves it has made over the past three years.

The company’s revenue in the recently concluded fiscal 2025 (which ended on June 30) increased by 15% to $282 billion, while adjusted earnings jumped by 16% to $13.64 per share. Microsoft witnessed impressive growth across all of its business segments, with the Azure cloud business being the top performer with a 39% year-over-year jump in revenue in the previous quarter.

Even better, Microsoft’s revenue pipeline increased at a much faster pace than its revenue. The company’s commercial bookings jumped by 37% to more than $100 billion on the back of strong demand for its Azure cloud and Microsoft 365 production. These new contracts took the company’s commercial remaining performance obligations (RPO) to a whopping $368 billion, up by 37% from the year-ago period.

RPO is the total value of a company’s contracts that will be fulfilled at a future date. So, the faster growth in this metric as compared to the revenue is an indicator of a potential acceleration in Microsoft’s top line in the future. Also, it won’t be surprising to see Microsoft’s revenue pipeline improving further going forward, thanks to the growth opportunity in the cloud AI market.

Microsoft’s Azure and other cloud revenue were up by 39% last quarter. That figure could have been higher, but the demand for the company’s AI cloud services is exceeding supply, which is why it has been bringing online more data center capacity. The company’s Azure cloud business generated $75 billion in revenue in fiscal 2025. So, the company’s contracted backlog indicates that this business has a lot of room for growth in the future.

Also, the demand for cloud-based AI services is expected to increase at an annual rate of almost 40% through the end of the decade. This could pave the way for further growth in Microsoft’s backlog and revenue in the future, especially considering the massive amount of money it is spending to build AI-first data centers.

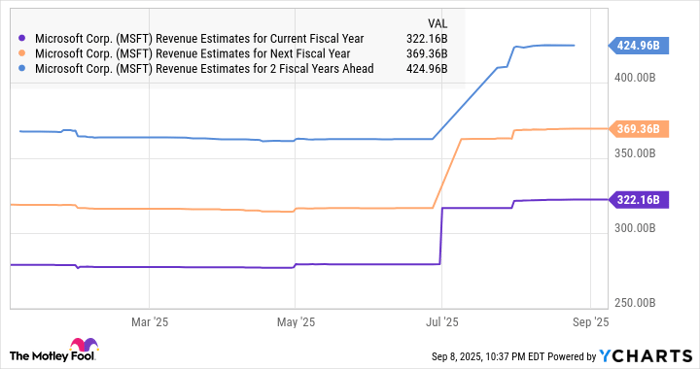

Higher data center capacity should ideally allow Microsoft to accelerate its revenue growth over the next five years. Analysts expect this “Magnificent Seven” company’s top-line growth to pick up going forward and have hiked their estimates.

Data by YCharts.

Can Microsoft really exceed Nvidia’s market cap?

The chart above says analysts expect Microsoft’s revenue to grow in the mid-teens over the next three fiscal years, reaching almost $425 billion in fiscal 2028 (which will end in June that year). However, the secular growth opportunities in the cloud AI market, as well as the improving adoption of its Microsoft 365 suite of AI-powered productivity tools, could help it exceed Wall Street’s expectations.

But even if Microsoft sustains a 15% annual growth rate in the two years beyond fiscal 2028, its top line could hit $562 billion by the end of the decade. Microsoft is currently the world’s second-largest company with a market cap of $3.72 trillion, which is 16% lower than Nvidia’s market cap. Importantly, Microsoft is trading at a much lower 13 times sales as of this writing. That’s half of Nvidia’s price-to-sales ratio.

It won’t be surprising to see Microsoft sustain its sales multiple (which is a premium to the U.S. technology sector’s average sales multiple of 8.5) after five years, as its growth rate improves. But even if it trades at a discounted 10 times sales in 2030 and hits $562 billion in revenue, its market cap could jump to $5.6 trillion.

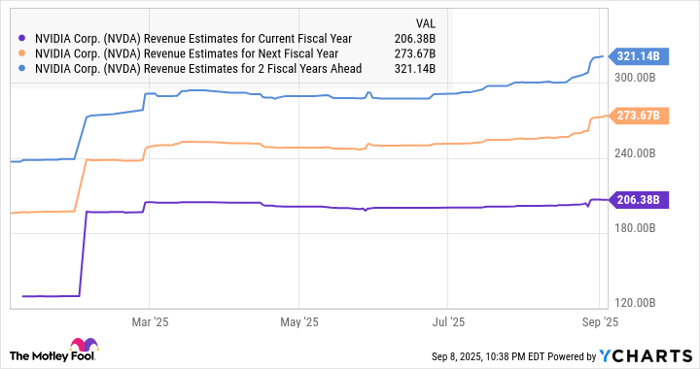

Nvidia may not be able to match that market cap as its top-line growth is expected to slow down going forward, which could prompt a reduction in the big valuation premium it is trading at.

Data by YCharts.

So, the possibility of Microsoft overtaking Nvidia as the world’s largest company by 2030 cannot be ruled out.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $672,879!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,086,947!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

AI Research

Smart Bidding Strategies with Artificial Intelligence

In construction, an accurate bid can mean the difference between a profitable year or continuous delays and costly overruns. Many contractors continue to rely on spreadsheets, fragmented data, or gut instinct to prepare bids. This leaves too much room for errors. According to Contimod, nine out of ten construction projects exceed their budgets, with average cost overruns of 28 percent, a clear sign that stronger estimation and risk analysis are needed to project margins and deliver successful projects.

At the same time, construction leaders face unprecedented pressure from rising material costs, labor shortages, and growing global supply chain disruptions. To remain competitive, firms are exploring different predictive artificial intelligence to analyze historical bid data, identify hidden risks, and forecast win rates. AI has the potential to help construction organizations not just secure more contracts, but also improve accuracy, profitability, and efficiency internally and across the entire project lifecycle.

Taking Our Process Further

At Western Specialty Contractors, we had a sound process in place, developed over decades of experience, but we recognized the opportunity to take this further with AI. By analyzing years of our own bid history, we found a practical way to bid smarter, reduce risk, and protect our people and projects.

The challenge lies in the complexity. Bidding in construction is complicated by inflated costs, shifting labor availability, unpredictable site conditions, and unique client requirements. Western Specialty Contractors needed a more reliable way to forecast which projects to pursue and how to price them. We’re experts in construction but not in AI. So, we partnered with AI specialists and worked closely to make sure they understood how our projects, field teams, and data work in the real world.

By analyzing years of our own bid history with a custom machine learning model, we achieved over 70 percent accuracy in win-loss forecasting. That meant we could prioritize high-probability opportunities and allocate resources more effectively. It’s a practical example of how AI delivers value in the field.

However, we also saw why firms still struggle to get there. Research from Bluebeam shows that while 74 percent of AEC firms use AI applications, 72 percent still rely on paper-based processes for critical stages like estimating and approvals. Without consistent historical data and connected workflows, AI’s potential stays out of reach.

More accurate bidding impacts far more than just winning work. When our estimates align closely with actual costs and timelines, we anticipate seeing fewer change orders, less rework, and tighter schedules. The connection between smart estimating and predictable project delivery is clear on our job sites every day.

Beyond our organization, we also know this idea goes beyond our own work. As highlighted at New York Build (March 2025), contractors generate massive volumes of site data, but too often it is disorganized or siloed. By connecting and sharing that data in ways that inform decisions, they can feed valuable insights back into estimating. Closing the loop between what happens on-site and what gets priced up front helps us continuously refine bids and protect margins.

Potential Applications & Advice

With the early success we’re seeing in our first foray into artificial intelligence, Western is closely evaluating other potential applications for this technology across the organization. We see AI as a supplemental tool that augments rather than replaces our estimators’ expertise. The real value comes from using AI to enhance our win-loss forecasting, which allows us to focus our resources on the most promising opportunities. That frees up our estimators to focus on what they do best: analyzing risk, shaping pricing strategies, and building trusted relationships with clients.

That said, we’ve also learned that tech alone isn’t enough. Clean, consistent historical data is critical. Without it, even the smartest AI tools won’t deliver results. Just as important is embedding AI insights directly into our day-to-day workflows. If it’s too complicated or separate from how our teams work, they won’t use it.

As we continue to develop our AI capabilities, we’re focused on leveraging a feedback loop between our bidding and project execution to continuously improve our predictive accuracy.

For those just starting out, here’s our advice:

- Partnership is essential. No single department or contractor holds all the answers for AI transformation. Our IT and finance teams needed to develop the AI bidding tool through extremely close internal collaboration. Plus, we also needed to build a trusting collaboration with our consulting partners. This ensured that everyone who held pieces of the AI transformation puzzle held a seat at the table and contributed to its success.

- Focus on the business problem, not the tech. Don’t chase AI for the sake of it. Stay clear on the real problems you’re trying to solve, whether that’s improving win rates, reducing rework, or protecting your margins. That’s what makes technology worth the investment.

- Don’t wait, start small and build iteratively. Begin with a focused pilot project like win-loss prediction before expanding. This allows you to prove value, refine your data processes, and build internal confidence in AI capabilities.

- Prioritize data quality. Conduct a comprehensive audit of historical bid and project performance data to find gaps and ensure consistency.

- Integrate AI into daily workflows. Implement AI insights within the tools and platforms estimators already use, minimizing friction and maximizing adoption.

- Invest in change management. The technology is only as good as its adoption. Ensure your teams understand how AI enhances rather than threatens their expertise and integrate these new tools seamlessly into existing workflows like your CRM system.

Taking a practical, integrated approach to AI-powered estimating unlocked benefits that go far beyond just winning more work for our teams. More reliable bids help us spend less time chasing low-probability projects, use our resources wisely, and protect our margins when market conditions shift. Accurate estimates also help us deliver jobs on schedule and within budget, which strengthens trust with our clients and builds our reputation across the industry. In construction, even small improvements in margin can make a difference. For us, AI has become vital to stay competitive, agile, and resilient.

Importantly, other industries have shown the same lesson. Companies that use data-driven tools to stay efficient tend to outperform those that stick to old habits. As more people in our industry deploy practical AI tools, we believe they’ll build smarter, faster, and with more confidence in every bid they submit.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi