AI Insights

2 Artificial Intelligence (AI) Stocks That Could Help Make You a Millionaire

The cat is out of the bag with artificial intelligence (AI). Trillions of dollars in value have been added to stock portfolios on the backs of the AI revolution in just a few years. Nvidia is knocking on the door of a $4 trillion market capitalization. It is difficult to find undervalued AI stocks right now.

But it is not impossible. Here are two AI stocks — ASML (ASML -0.73%) and Alphabet (GOOG 0.51%) — that look undervalued and can help investors become millionaires if they buy and hold for the long term.

Image source: Getty Images.

Helping build advanced computer chips

ASML is the leading seller of lithography equipment for making advanced semiconductors. In some cases, it is the only provider on the market. Lithography in this case is the use of lights and lasers to print tiny patterns on objects such as semiconductors. Advanced semiconductors require intricate designs over microscopic areas, which helps them generate more efficient computing power for AI applications.

With its advanced extreme ultraviolet lithography systems (EUV), ASML is the only provider of machines that help make advanced semiconductors for the likes of Nvidia. This makes it a vital point in the semiconductor supply chain and a monopoly seller of its equipment today. Not a bad place to be in when semiconductor demand is soaring because of the insatiable need for more AI computer chips.

Over the past 12 months, ASML generated $33 billion in revenue, which has grown a cumulative 353% in the last 10 years. Operating income has grown 551% to $11 billion. The company’s growth is not linear because of lumpy equipment sales to large factories and the cyclicality of the semiconductor industry, but over the long term, demand prospects look fantastic. Manufacturers are planning hundreds of billions of dollars in capital expenditures to build new semiconductor factories. These factories will be stuffed with ASML lithography equipment.

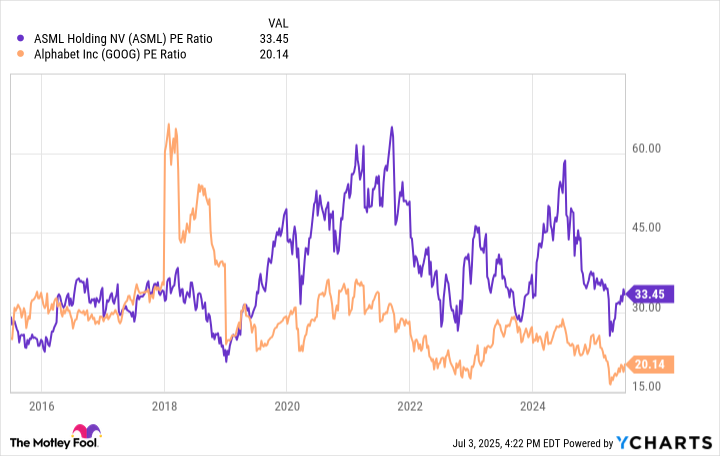

ASML has a trailing price-to-earnings (P/E) ratio of 33. This is not dirt cheap in a vacuum, but I believe it makes the stock undervalued because of its future growth prospects, which will bring this P/E ratio down to a much more reasonable level. Buy ASML stock today and hold on tight for the long term.

ASML PE Ratio data by YCharts

AI for consumers and enterprises

One of the reasons for the increased demand for computer chips and ASML equipment — perhaps the largest reason — is Alphabet. The owner of Google, Google Cloud, YouTube, Waymo, and Gemini keeps doubling down on AI.

The big technology company can win in AI by playing two fronts: consumer and enterprise applications. With everyday users it is adding new AI tools to Google Search while building out advanced conversational AI with the Gemini application. Gemini now has an estimated 350 million active users and is growing rapidly, although it is still smaller than OpenAI’s ChatGPT.

With immense scale and resources, Alphabet will be able to deploy AI tools across its applications that are used by billions of people around the globe.

On the enterprise side, Google Cloud is one of the leading AI cloud companies due to its advanced computing infrastructure. Google Cloud revenue grew 28% year over year last quarter to $12.3 billion, making it the fastest-growing segment for Alphabet. The division has invested heavily in its own computer chips called Tensor Processing Units (TPUs), which make it more efficient to build AI software applications on Google Cloud.

There is expected to be hundreds of billions of dollars spent on AI cloud workloads in the coming years, which will help Google Cloud keep growing as a bigger piece of the Alphabet pie.

Overall, Alphabet generated a whopping $360 billion in revenue over the past 12 months and $117.5 billion in operating income. Investors were previously worried about saturation of usage at Google Search, which has now proliferated around the globe. However, with the rise of AI applications, Alphabet looks to have increased its addressable market in organizing the world’s information, the company’s famous slogan. This will help revenue and earnings keep growing over the next decade.

Today, you can buy Alphabet stock at a measly P/E ratio of 20. This makes the stock undervalued if you plan on holding for many years into the future.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends ASML, Alphabet, and Nvidia. The Motley Fool has a disclosure policy.

AI Insights

Oracle (ORCL) Stock Soars 40% on AI Boom and $455B Cloud Backlog While Going Green

Oracle Corporation (NASDAQ: ORCL) surprised the markets today with a dramatic stock rally. Its shares jumped more than 40%, reaching record highs and placing the company near the trillion-dollar club. This sharp increase was powered by huge demand for Oracle’s cloud services, especially for artificial intelligence (AI) and big partnerships.

Wall Street focused on the financial side, but Oracle also highlighted something else: its environmental goals. The company wants to show that fast growth can go hand in hand with sustainability. By investing in both AI and green programs, Oracle is shaping an image as a modern tech leader that balances profit with responsibility.

Record-Breaking Rally: Oracle’s Biggest Jump in Decades

The jump in Oracle’s stock was its largest in more than 30 years. Investors reacted to news that Oracle signed multiple multi-billion-dollar contracts with tech giants such as OpenAI, Meta, and NVIDIA.

These contracts are tied to AI cloud services and pushed Oracle’s contract backlog to around $455 billion, a sharp rise from $130 billion just a quarter earlier.

This backlog shows how fast demand for Oracle Cloud Infrastructure (OCI) is growing. The company responded by raising its forecast for OCI revenue. It now expects 77% growth this fiscal year, higher than its earlier estimate of 70%. The company also predicts $18 billion in cloud revenue in 2025 and has set a long-term target of $144 billion by 2030.

The growth reflects the global rush to build AI systems. Oracle has placed itself at the center of this movement, partnering in major projects such as the Stargate initiative led by SoftBank and OpenAI. These deals highlight Oracle’s role in powering the next generation of AI.

Recent Developments Strengthening Oracle’s Position

On top of these strong results, Oracle has made headlines with two new announcements that underline its growing role in AI.

The first is a massive deal with OpenAI. Beginning in 2027, OpenAI will purchase at least $300 billion worth of computing power from Oracle over five years. This is one of the largest cloud agreements in history, and it shows how central Oracle has become to advanced AI systems. For Oracle, it marks a major vote of confidence from one of the most important AI companies in the world.

Oracle’s stock surged to a record high. This boosted the company’s market value to nearly $1 trillion. The rally also made headlines for another reason: it boosted co-founder Larry Ellison’s wealth by more than $100 billion in a single day, making him the world’s richest person.

Greener Growth: Oracle’s Path to Net Zero

Amid the AI excitement and stock rally, Oracle is pushing its green message. The company has promised to be carbon neutral by 2050. It also set a nearer goal to cut greenhouse gas emissions in half by 2030, using 2020 as its baseline year. These goals cover its offices, data centers, and cloud services.

Oracle has already achieved some key milestones:

- Renewable power: 86% of OCI’s global energy came from renewables in 2023.

- Regional progress: Europe and Latin America already run on 100% renewable power.

- Global ambition: Oracle plans to hit 100% renewable energy worldwide by 2025.

- Water and waste: Since 2020, water use has dropped by almost 25% and landfill waste by more than 35%.

- Travel impact: Employee air travel emissions have been cut by 38% thanks to more virtual meetings.

These achievements prove Oracle is not only talking about sustainability but also acting on it. For a company scaling up fast in cloud and AI, these steps are important. They show Oracle is trying to balance expansion with its responsibility to the planet.

Pushing Green Standards Across the Supply Chain

Oracle knows its environmental impact extends beyond its own walls. A big part of its footprint comes from suppliers. That’s why the company is pushing its partners to meet strict environmental standards.

Here are some of the key steps:

- Supplier programs: All major suppliers must have environmental programs.

- Emission targets: At least 80% of suppliers are expected to set formal climate goals.

- Progress: More than four in five suppliers already meet these expectations.

- Broader impact: By setting these standards, Oracle ensures its ESG efforts reach across its global supply chain.

This approach boosts Oracle’s credibility. It tells investors and clients that the company’s sustainability commitments are not limited to its own operations. Instead, they cover the full ecosystem of partners that make its technology possible.

AI-Powered Tools for Climate Accountability

Oracle is also building tools to help other companies meet their climate goals. One of these is Fusion Cloud Enterprise Performance Management (EPM) for ESG. This platform allows organizations to automate sustainability reporting, integrate emissions data with financial information, and align with global standards.

The system uses AI to make reporting easier and more accurate. This is important as regulators push companies to disclose their environmental impacts in more detail.

-

It combines Scope 1, 2, and 3 emissions data based on the GHG Protocol Corporate Standard. This links emissions to financial and operational data, helping with better ESG management.

-

Oracle improved its ESG reporting with this platform. They cut reporting timelines by 30% using automation and AI-driven process management.

-

The platform collects unique identifiers from source documents. This ensures clear data tracking and auditability. It boosts transparency and lowers compliance risks.

-

It supports global reporting standards like IFRS, ESRS (CSRD), and GRI. This helps organizations align their disclosures with changing regulations easily.

Oracle has also introduced features in its cloud infrastructure that estimate emissions from customer workloads. This means clients can see how much carbon their computing generates and adjust operations to stay on track with their own sustainability commitments. By doing this, Oracle is not only greening its own business but also helping others.

The Tough Road Ahead: Energy Demands vs. Climate Goals

Still, Oracle faces challenges in meeting its promises. Reaching 100% renewable energy worldwide is difficult, especially in regions where clean energy options are limited. Ensuring suppliers stick to emissions goals is also complex, given the size of Oracle’s global network.

Another challenge is the massive energy demand of AI. As Oracle expands its role in AI infrastructure, its energy use will rise. Balancing this growth with its climate goals will require new investment in efficient data centers, renewable sourcing, and innovations in green computing.

Oracle’s record-breaking stock surge highlights its importance in the AI and cloud industry. But what makes its story more powerful is the balance it is trying to strike between growth and sustainability. By pledging net zero emissions by 2050, setting ambitious near-term targets, and building tools for others to track emissions, Oracle is showing that technology and responsibility can go together.

For investors, Oracle now offers both a high-growth AI story and a strong ESG narrative. For customers, it provides powerful cloud services backed by renewable energy and transparent carbon data.

As Oracle continues to grow, its ability to deliver on both financial and environmental goals may define its future as one of the world’s most influential technology leaders.

AI Insights

Loneliness Is Reshaping Your Workplace

As a seasoned senior vice president at a global tech firm, Sharon wasn’t expecting to feel emotional while listening to a keynote. But as former U.S. Surgeon General Dr. Vivek Murthy spoke, describing how loneliness has become a public health crisis, something clicked. “It wasn’t that the information was new,” she told us. “It was that I suddenly saw the evidence everywhere—in my team, in our culture, even in myself.”

AI Insights

Procure IT Names Corey Whiting as Chief Artificial Intelligence Officer

In addition to his role as CAIO, Whiting joins Andrew Laughter, CEO Randy Jeter and CIO Phil Ben-Joseph as a Partner in Procure IT. He will work with Laughter at the company’s Winter Park, Fla., office.

Corey Whiting: A Career Built on Data and Intelligence

Whiting brings 26 years of software engineering and data innovation to Procure IT. He has a Bachelor of Science and a Master of Science in Computer Science, and a career defined by turning data into insights that drive business outcomes.

He began his career at Stats Perform, where he developed algorithms and analytics from sports data sets. Building on that experience, he went on to found BaseballCloud, a platform delivering data-driven scouting and player development insights. Later, he co-founded RoyFi, a fintech company that leveraged music streaming data to accurately project music royalties and provide funding for artists, combining predictive analytics with financial impact.

“My role at Procure IT is about embedding intelligence everywhere, taking the data we have and turning it into insights that drive better, faster IT business decisions,” said Whiting. “The opportunity here is huge to turn all this data into managed intelligence so that companies can make smarter decisions at scale.”

Accelerating AI-Driven Decisions

Whiting will oversee the continued development of Procure IT’s Managed Intelligence Platform, including integration and application of the company’s AI Virtual Assistant (AVA). AVA gives enterprises instant, conversational access to insights across their entire IT stack — from usage and licenses to contracts, financials and performance metrics — shifting from static dashboards to real-time, actionable intelligence.

“Dashboards are dead,” said Whiting. “Organizations don’t want to dig through data — they want answers. Procure IT’s Managed Intelligence Platform gives them those answers instantly, in context and ready to act on.”

With Whiting leading the company’s AI strategy, Procure IT is doubling down on embedding intelligence throughout the platform, a move CIO Ben-Joseph says positions the company to be the leading Managed Intelligence Platform for Technology Advisors, Value Added Resellers (VARs) and Managed Service Providers (MSPs).

“Agentic AI is going to reshape how IT environments are managed,” said Ben-Joseph. “We’re building Procure IT’s platform to make sure enterprises are ready for that shift, helping them understand, control and optimize their data like never before.”

Our Channel-First Approach

Procure IT goes to market exclusively through a global network of technology advisors, MSPs, VARs and solution providers who use the Procure IT Managed Intelligence Platform to audit and optimize client IT environments while tapping recurring revenue opportunities through commissions, license-funded engagement models and advisory services.

With Procure IT, partners can deliver real-time intelligence across their clients’ entire IT stack — from spend and contracts to usage and performance analytics. Built-in AI insights, benchmarking and automated reporting allow partners to provide strategic, data-driven recommendations that drive cost savings, efficiency and long-term business value.

More Information

To learn more about leveraging the Procure IT Managed Intelligence Platform to simplify and optimize your company’s IT environment, visit www.procureit.com. To speak to a Procure IT procurement expert, visit www.procureit.com/contact or email [email protected].

Partners interested in learning more about becoming a Procure IT partner can contact Procure IT at [email protected].

About Procure IT

Procure IT is transforming IT decisions with its Managed Intelligence Platform by enabling companies to optimize their own data to make informed and intelligent business decisions. Our flagship AI-driven SaaS platform streamlines sourcing, spend management and vendor oversight through a single-pane-of-glass experience designed for midmarket and enterprise businesses. Procure IT goes to market exclusively through a network of technology advisors, MSPs, VARs and solution providers, empowering partners to deliver real-time intelligence and strategic insights across their business clients’ IT environments.

With core modules spanning Cloud FinOps, SaaS FinOps, Technology Expense Management, Contract Management, Supplier Insights and Supplier Analytics, the platform delivers the tools and intelligence enterprises need to manage technology spend and performance at scale. Using built-in AI, benchmarking and automated reporting, Procure IT enables partners and their clients to reduce costs, minimize risk and achieve better outcomes across the entire IT lifecycle. For more information, visit www.procureit.com or engage with us on LinkedIn.

Media Contact

Randy Jeter, Procure IT, 1 949.245.2978, [email protected], www.procureit.com

Khali Henderson, BuzzTheory (for Procure IT), 1 480.848.6726, [email protected], www.buzztheory.com

SOURCE Procure IT

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi