AI Research

5 Artificial Intelligence Stocks You Can Buy and Hold for the Next Decade

AI remains a potential game-changing technology that is still in its early innings.

Artificial intelligence (AI) is rewriting the playbook for nearly every major tech company. Because the AI development game is still in its early innings, there remain plenty of opportunities to rack up points. And it’s a perfect time to jump into some of the leaders in the space.

Here are five names that are already shaping the future of AI that investors might want to consider buying for the long haul.

Image source: Getty Images.

1. Nvidia

Nvidia (NVDA -0.83%) is still the clear leader in AI hardware. Its graphics processing units (GPUs) run the majority of the world’s AI workloads, and its market share for GPUs in Q1 was a staggering 92%.

Its chips are only part of the story, though. Years before AI went mainstream, Nvidia seeded its CUDA software into research labs and universities for free. That early push trained a generation of developers on its platform and encouraged the creation of tools and libraries that make its chips perform even better.

The result is an ecosystem that’s hard to dislodge. Competitors can match the performance of its chips on paper, but they’re still years behind on the software side. Nvidia’s move to release new chips every year should also keep it in the lead. Overall, AI infrastructure should continue to be a huge growth driver for the company moving forward.

2. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (TSM -1.17%) is the unsung hero of the AI boom. It doesn’t design chips, but it builds the most advanced ones for nearly every major player, including Nvidia. That means it wins no matter who comes out on top. High-performance computing now accounts for 60% of its revenue, up from 52% a year ago, and demand keeps climbing.

The company’s lead in advanced manufacturing is unmatched. Last quarter, chips built on 7-nanometer and smaller nodes made up nearly three-quarters of revenue, with 3nm already representing almost a quarter. Meanwhile, competitors continue to struggle, with both Intel and Samsung reportedly having major production yield issues at smaller nodes.

As AI adoption spreads into new markets like robotics and autonomous vehicles, TSMC’s vital role at the heart of the semiconductor supply chain makes it a long-term winner.

3. Alphabet

Once viewed as a potential AI loser, Alphabet (GOOGL -0.67%) (GOOG -0.54%) has turned AI into a tailwind for its core business. Google Search traffic is growing, helped by AI Overviews that are now used by billions of people each month. Search revenue rose 12% last quarter, showing the strategy is paying off. The Gemini app and its new AI Mode are just starting to ramp up, opening more growth opportunities.

Alphabet’s cloud computing business, Google Cloud, is another bright spot. Revenue jumped 32% last quarter, and operating income more than doubled as more customers use Google’s Vertex platform to build and deploy AI models and apps. Capacity remains tight, which is why Alphabet plans to pour billions into expanding its data center infrastructure. Not to be overlooked, the company’s custom AI chips give it a cost advantage and are gaining momentum with customers.

Alphabet is beginning to change the narrative on AI, and it looks like it will be a long-term AI winner.

4. Meta Platforms

Meta Platforms (META -1.21%) is using AI to strengthen its already dominant social media platforms. Its Llama models are keeping users on Facebook and Instagram longer by improving content recommendations. That extra engagement creates more ad opportunities, and new AI-powered tools are helping advertisers target consumers more effectively. As a result, advertisers are getting better returns, which is leading to higher prices.

Meanwhile, WhatsApp and Threads could be the company’s next growth engines. WhatsApp has over 3 billion users, and Threads is already at 350 million, yet both are only beginning to run ads. AI, meanwhile, should help speed up monetization.

However, the company has even bigger goals in mind when it comes to AI. CEO Mark Zuckerberg has been clear about his goal of building “personal superintelligence,” and he’s spending heavily to hire the people who can make it happen. That makes Meta an AI stock that investors should own over the long haul.

5. Microsoft

Microsoft‘s (MSFT -1.61%) businesses keep delivering, with AI helping drive its growth. Its cloud computing unit, Azure, has posted revenue growth of 30% or more for eight straight quarters, with AI responsible for nearly half of that increase. Its partnership with OpenAI gave it an early lead, as customers like having direct access to powerful AI models through Azure.

AI is now embedded across Microsoft’s product lines. Enterprise customers continue to embrace Microsoft 365 AI Copilot assistants, while its GitHub Copilot is seeing rapid adoption among developers. The company is investing heavily in GPUs and servers to relieve capacity bottlenecks, and it’s exploring quantum computing as another potential technology breakthrough.

Let’s also not forget that the company has a large stake in OpenAI that entitles it to 49% of OpenAI Global’s profits up to a tenfold return on its investment. With its enterprise relationships, cloud strength, early AI push, and stake in OpenAI, Microsoft is set to benefit as AI adoption accelerates worldwide.

Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Intel, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short August 2025 $24 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AI Research

GAO Review Finds 94 Federal AI Adoption Requirements

AI Research

South Korea Looks to Canadian Energy to Fuel its AI Ambitions

Artificial intelligence (AI) and clean energy technologies have emerged as central policy pillars of the new Lee Jae Myung government in South Korea, as part of his administration’s strategy to revitalize the economy.

Recognizing that the country has lagged behind global leaders such as the U.S. and China, both of which have adopted robust industrial policies, Lee’s government plans to introduce a South Korean version of the Inflation Reduction Act, a massive government investment plan to promote key strategic sectors. Similar to the U.S. act, Lee’s initiative aims to provide large-scale subsidies and targeted government financing to accelerate growth in strategic sectors, with AI and clean energy at the forefront.

Within this broader policy shift, the nexus between AI and energy has gained prominence. The rapid scaling up of energy-intensive AI infrastructure has sent energy demand soaring. As a result, South Korea needs to ensure a sustainable and resilient power supply for the digital economy. South Korea is one of the countries leading efforts to integrate energy policy and AI strategy in a way that both promotes innovation and strengthens energy security.

The evolution of South Korea’s AI governance

South Korea laid a foundation for AI governance in its 2024 Framework Act on Artificial Intelligence, one of the world’s first comprehensive national AI laws. Enacted under Lee’s predecessor, Yoon Suk Yeol, the act was designed to foster innovation while ensuring transparency, safety, and public accountability.

Shortly after assuming the presidency in early June, Lee elevated AI to a central role in South Korea’s national growth agenda. His administration’s blueprint aims to position the country among the world’s top three AI powers. Adopting a ‘develop-first, regulate-later’ philosophy, the plan emphasizes ecosystem expansion, including C$97 billion (100 trillion South Korean won) in AI investments, the designation of data centres as critical infrastructure, and the rollout of an “AI Highway” to connect regional tech clusters. Simultaneously, the administration is continuing to build on the AI Framework Act, working to implement its provisions early in Lee’s five-year term to ensure legal stability and time to build public trust, particularly around issues such as data privacy and algorithmic bias.

A notable feature of this approach is integrating the country’s tech-sector leaders into policy roles. For example, the head of Naver’s AI Center was appointed presidential secretary for AI policy, and the president of LG AI Research now serves as minister of science and Information and Communications Technology. In addition, a centralized AI governance body within the presidential office now co-ordinates interministerial initiatives and accelerates regulatory reforms in close dialogue with the private sector.

To ensure that the strategy is well resourced, the government has earmarked C$970 million (1 trillion won) in public investment for AI research and development (R&D), in addition to a C$330-billion (340 trillion won) investment in three ‘game-changing’ technologies: AI semiconductors, advanced biotechnology, and quantum technology. Additionally, a national AI computing centre, costing C$2 billion (2 trillion won), is expected to open by 2027. These developments reflect a national effort to accelerate AI innovation to give South Korea the upper hand in technologies that are indispensable within the global value chain.

Key challenges in the AI–energy nexus

As South Korea pushes forward with its AI agenda, one of its most pressing challenges is building a sufficient and reliable energy supply. The explosive growth of AI infrastructure is substantially increasing demand on South Korea’s energy grid, with wide-ranging implications for both industrial competitiveness and climate goals.

The expansion of AI computing, especially through hyperscale data centres, is driving this steep growth in demand. A landmark 3 gigawatt data centre project in Jeollanam-do Province is expected to go online by 2028 to accommodate the compute intensity of next-generation AI applications. National electricity demand is projected to double by 2030 relative to 2022 levels, driven largely by data centres and semiconductor fabrication plants — two sectors at the heart of South Korea’s digital strategy.

Already, the country’s aging power grid is struggling to keep pace with this growth. Approximately 78 per cent of existing data centre power use is concentrated in the Seoul metropolitan area, straining the city’s local infrastructure. Although the government has pushed to relocate the data centre to other provinces through the Special Act on Distributed Energy (which came into effect in June 2024), to date, no such news of this relocation has been reported. Experts warn that without rapid modernization, grid bottlenecks could compromise supply stability and industrial growth. In response, the government enacted the Power Grid Act in February 2025 to expedite grid expansion, including provisions for enhanced compensation to communities affected by new transmission lines. The act also encourages public-private investment and regulatory reforms to streamline power purchase agreements and other procedures related to utilities.

To support its expanding AI infrastructure and meet AI-driven energy demands, South Korea is turning to liquefied natural gas (LNG) and nuclear power as its main sources of reliable electricity. Plans are underway to convert 28 aging coal-fired plants to run on LNG and to build two new nuclear reactors by 2038, supplementing the four already under construction. In contrast to former president Moon Jae-in’s (2017-22) nuclear phase-out policy, recent developments — including a speech by Lee during the recent election campaign and the appointment of Kim Jeong-gwan, president of Doosan Enerbility (a major national conglomerate deeply engaged in nuclear energy development), as minister of trade, industry and energy — suggest that the current administration recognizes the challenges of relying solely on renewables and the necessity of re-introducing nuclear energy. These signals indicate a pragmatic approach to building a renewables-centred energy system while maintaining energy security.

In the same vein, Seoul also sees small modular reactors (SMRs) as a promising long-term solution for powering AI infrastructure and carbon neutrality. The first 0.7-gigawatt SMR is expected to be deployed by 2036. Meanwhile, Korea Hydro & Nuclear Power (KHNP), one of the Korea Electric Power Corporation’s subsidiaries operating nuclear and hydroelectric plants, is advancing its innovative SMR design, aiming to finalize the standard design by the end of 2025. SMRs are increasingly favoured as a go-to solution to meet soaring AI-driven energy demand, not just in South Korea but elsewhere. For example, large tech companies such as Amazon and Google have pledged to increase their nuclear-power capacity by 2050, paying particular attention to SMRs for their potential to provide localized, carbon-free power generation for data centre clusters and industrial complexes.

Canada–South Korea co-operation: a strategic convergence

No country can achieve the dual goals of securing sustainable energy and fuelling the AI boom on its own. As South Korea bolsters its AI-energy strategy, cross-border collaboration will become indispensable. Canada has emerged as a key partner in this space.

Stable access to critical minerals and nuclear fuel is essential to South Korea’s energy security and growing AI infrastructure. In 2024, 48 per cent of the country’s enriched uranium imports (by value) came from Russia. However, amid heightened geopolitical risk, South Korea is shifting to more secure suppliers. Canada, the world’s second-largest supplier, with an 18 per cent global share in 2024, is expected to play an increasingly vital role. This diversification strategy not only reduces South Korea’s dependence on Russia but also boosts the long-term sustainability of its nuclear power fleet.

Nuclear technology and fuel have long been central to Canada–South Korea technology co-operation. Canada’s CANDU heavy-water reactors form a key part of South Korea’s nuclear infrastructure, with four CANDU reactors currently in operation at Wolsong. The bilateral nuclear co-operation has been well exemplified in the recent memoranda. In 2023, the Korea Atomic Energy Research Institute (KAERI) signed a memorandum of understanding (MOU) with Alberta’s provincial government to explore deploying the South Korea-designed SMART SMRs in Alberta, targeting applications such as oil sand steam generation. In the same year, KAERI and Canada’s Atomic Energy of Canada Limited signed a nuclear R&D MOU focusing on placing South Korean SMR designs into global markets, with an emphasis on collaboration with Canada. In May 2024, KHNP, Canada’s SMR developer, ARC Clean Technology, and New Brunswick Power signed a trilateral agreement to co-develop and deploy the ARC-100 advanced SMR, including mass deployment plans, starting with a demonstration at Point Lepreau, New Brunswick.

Bilateral AI collaboration is also in the works. In June 2024, the National Research Council of Canada and South Korea’s National Research Council of Science and Technology renewed their MOU, reaffirming joint R&D co-operation in AI and digital technologies. The agreement supports exchanges of researchers, joint innovation projects, and the development of collaborative infrastructure.

Finally, ethical AI governance — specifically South Korea’s AI Framework Act — can serve as a valuable reference point for Canada as it develops its own regulatory framework. Both countries emphasize transparency, safety, and accountability in AI, and their joint participation in forums such as the OECD and the Global Partnership on AI offers meaningful avenues for co-ordination. Collaborative efforts in this space would not only promote responsible innovation but also contribute to shaping global norms grounded in democratic values.

As South Korea accelerates its AI ambitions, the question of energy resilience has become inseparable from digital innovation. The AI-energy nexus is now a strategic domain where governance, infrastructure, and international partnerships converge. Canada, with its deep expertise in nuclear technology and growing AI ecosystem, is uniquely positioned to collaborate with South Korea in building a secure, ethical, and sustainable digital future.

• Edited by Jeehye Kim, Senior Program Manager, Northeast Asia, Vina Nadjibulla, Vice-President Research & Strategy, and Ted Fraser, Senior Editor, APF Canada

AI Research

Equipping artificial intelligence with the lens of evolution

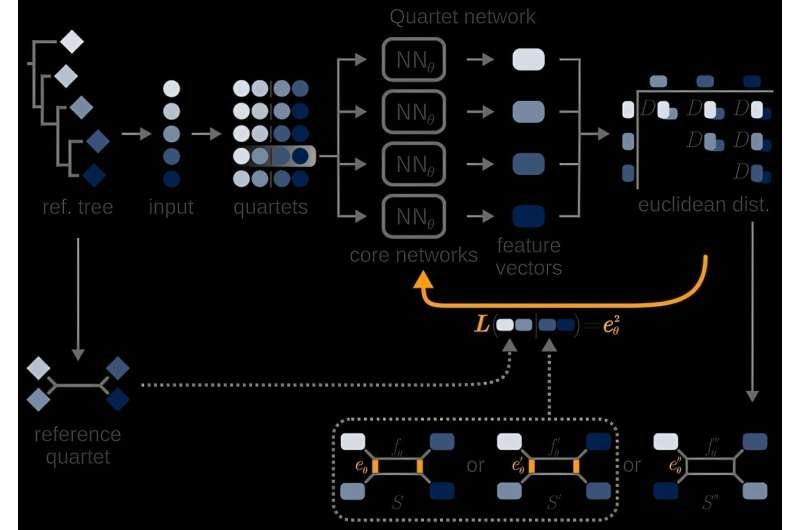

Artificial intelligence is now better than humans at identifying many patterns, but evolutionary relationships have always been difficult for the technology to decipher. A team from the Bioinformatics Department at Ruhr University Bochum, Germany, working under Professor Axel Mosig has trained a neural network to tackle this issue.

The AI can relate any data from different species in an evolutionary relationship and identify which characteristics have developed in what manner throughout the course of evolution.

“Our approach lets artificial intelligence look at data through the lens of evolution, in a way,” explains Vivian Brandenburg, lead author of the report published in the Computational and Structural Biotechnology Journal on August 22, 2025.

Providing prior knowledge about the ancestry tree

“Most previous AI algorithms have a hard time analyzing biological data through an evolutionary lens, because they don’t know what to look for and get confused by random patterns,” says Mosig. The team has provided its AI with prior knowledge of the phylogenetic trees of the species being analyzed.

This approach is based on classifying groups of four species into the presumably correct ancestry tree when training the AI. The tree contains information about close and distant relationships. “If all groups of four are correctly arranged, the entire ancestry tree can come into place like a puzzle,” explains Luis Hack, who also worked on the study. “The AI can then look in the sequences to identify patterns that have evolved throughout this tree.”

The kicker: This method works not only for genetic sequence data, but also for any other type of data, such as image data or structural patterns of biomolecules from various species. After the bioinformaticists from RUB initially established the approach for DNA sequence data as part of their current work, they are already exploring its applicability for image data.

“For example, you could reconstruct hypothetical images of evolutionary predecessor species,” says Hack, explaining the method’s potential for future projects.

More information:

Vivian B. Brandenburg et al, A quartet-based approach for inferring phylogenetically informative features from genomic and phenomic data, Computational and Structural Biotechnology Journal (2025). DOI: 10.1016/j.csbj.2025.08.015

Provided by

Ruhr University Bochum

Citation:

Equipping artificial intelligence with the lens of evolution (2025, September 10)

retrieved 10 September 2025

from https://phys.org/news/2025-09-equipping-artificial-intelligence-lens-evolution.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi