AI Insights

3 Top Artificial Intelligence (AI) Stocks to Buy Not Named Nvidia – July 1, 2025

Key Takeaways

- It’s time to buy digital infrastructure and Nvidia partner Vertiv stock.

- Why chip maker Taiwan Semi is an all-encompassing tech investment across AI and beyond.

- Buy electric construction stock MYRG for the AI infrastructure boom.

Wall Street bulls pushed the stock market to new all-time highs to end June, as investors bet on a cease-fire deal in the Middle East. The strong end to the second quarter capped off a historic rebound from the early April lows.

The Nasdaq soared over 33% since April 8, driven by mouth-watering gains from Nvidia and other growth stocks benefiting from the artificial intelligence revolution.

The market might face some near-term selling pressure and volatility in the coming weeks. Still, the combination of trade deals, cooling inflation, and strong earnings growth expectations provide a bullish launching pad for stocks in the second half. The S&P 500 has also posted a positive July for 10 straight years.

Let’s dive into three highly-ranked Zacks stocks benefiting directly from the artificial intelligence spending boom to consider buying in July.

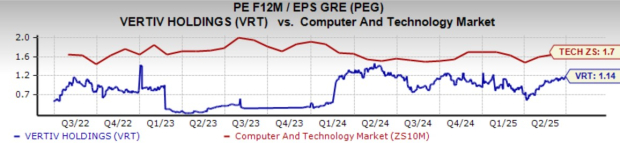

Buy Picks-and-Shovels AI Stock Vertiv Now and Hold

Behind-the-scenes technology stock Vertiv ((VRT – Free Report) ) soared1,445% in the past three years to outclimb AI chip powerhouse Nvidia’s 990% charge. The digital infrastructure and continuity solutions company is poised to benefit from the AI spending boom and become a long-term AI winner no matter who commercializes artificial intelligence and which AI hyperscalers gain the largest market share.

Image Source: Zacks Investment Research

Vertiv’s hardware, software, analytics, and ongoing services portfolio is focused on power, cooling, and IT infrastructure, operating across AI data centers, communication networks, and commercial/industrial environments. The Ohio-based firm’s growing portfolio helps make sure the high-density computing power that drives technological innovation and the economy runs as smoothly as possible 24/7.

VRT, which has partnered with Nvidia ((NVDA – Free Report) ) to help solve critical AI challenges such as cooling, averaged 16% revenue growth in the past four years.

“We continue to see accelerated scaling of AI deployments across the data center market, with strong demand signals reinforcing both our near- and long-term growth outlook… Our partnership with NVIDIA and our reference designs for their GB200 and GB300 NVL72 platforms position Vertiv at the forefront of AI factory deployment at industrial scale,” CEO Giordano Albertazzi said in prepared remarks last quarter.

Image Source: Zacks Investment Research

Vertiv is projected to grow its revenue by 19% in 2025 and 14% next year to $10.87 billion—double its 2021 total. The soaring tech company is expected to boost its adjusted earnings by 25% and 24%, respectively, following 60% growth in 2024 and 236% in 2023. VRT reaffirmed its 2025 outlook in late May, and its upbeat EPS revisions earn it a Zacks Rank #2 (Buy).

Wall Street loves the dividend-paying AI stock, with 15 of the 19 brokerage recommendations we have at “Strong Buys.” Despite its Nvidia-beating run over the past three years, VRT trades 16% below its highs and it’s on the verge of completing the bullish golden cross where the shorter-dated 50-day moving average climbs above the 200-day.

Image Source: Zacks Investment Research

Vertiv trades at a 30% discount to its highs at 32.1X forward 12-month earnings. Its strong longer-term earnings growth outlook helps the stock trade at a 33% discount to Tech, even though VRT has crushed the sector over the past five years.

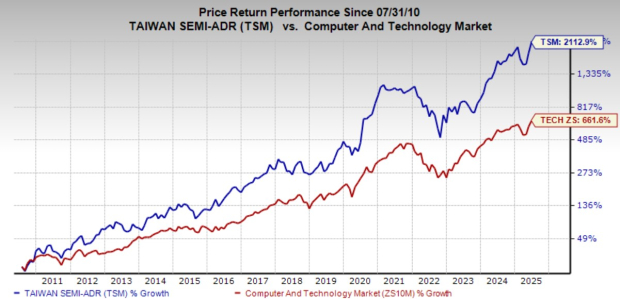

TSMC is One of the Best AI Tech Stocks to Buy for the Next Decade

Physically building the most complex, cutting-edge semiconductors in the world makes Taiwan Semiconductor Manufacturing Co. ((TSM – Free Report) ) a straightforward, all-encompassing tech investment across AI, electronics, and future tech innovations.

Taiwan Semi’s foundry-only model slowly transformed it into one of the only games in town for semiconductor manufacturing, especially at the bleeding edge. This backdrop is why TSM stock has skyrocketed 2,600% over the past 20 years, more than tripling the Tech sector’s performance.

Taiwan Semi reportedly holds a roughly 60% share of the entire foundry market and 90% of advanced chip manufacturing, boasting Apple and other tech titans as key clients. Nvidia’s massive AI expansion likely wouldn’t be possible without TSMC.

Image Source: Zacks Investment Research

TSMC is also critically addressing its geopolitical fears by expanding its manufacturing footprint outside Taiwan into Japan and the U.S. Taiwan Semi pays a dividend, and its balance sheet is solid.

Taiwan Semi is boosting its industry-leading 3-nanometer production, fueled by demand from AI chip companies Nvidia and AMD. The pure-play foundry company said 3nm chips accounted for 22% of total wafer revenue in the first quarter of 2025, up from 9% in the year-ago period, with advanced technologies accounting for 73%.

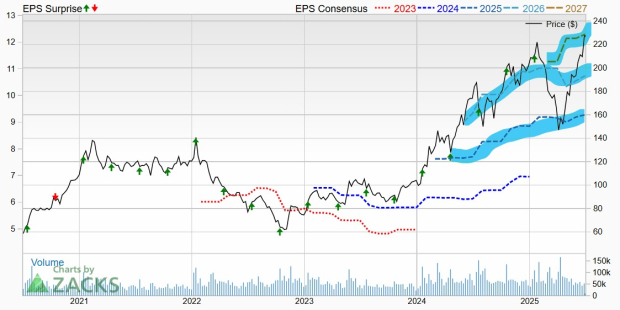

Image Source: Zacks Investment Research

TSMC is projected to grow its revenue by 29% in FY25 and 17% in FY26 (following a 25% expansion last year) to surge from $90 billion in 2024 to $137 billion in 2026. Taiwan Semi is projected to grow its adjusted earnings by 32% in FY25 and 16% next year.

The company’s recent positive earnings revisions earn it a Zacks Rank #2 (Buy) and extend its stretch of improving, AI-boosted earnings growth. And TSMC has topped our estimates for nearly five years running.

Taiwan Semi stock might be a little overheated from a technical standpoint after its massive rally saw it hit new highs at the end of June alongside Nvidia and other tech standouts. That said, TSMC still trades at a 33% discount to its highs and 18% below Tech at 22.6X forward 12-month earnings.

Image Source: Zacks Investment Research

Any pullback to its 21-day or 50-day moving averages could represent a more enticing buying opportunity. Others might want to wait for its second-quarter earnings release on July 17. Long-term investors might avoid the market timing game and buy TSMC now.

Buy Under the Radar MYRG Stock for the AI Infrastructure Boom

MYR Group Inc. (MYRG – Free Report) is a U.S.-based specialty contractor that builds and maintains electrical infrastructure, such as power lines and substations, for utilities, renewable energy projects, and beyond.

The electric construction firm’s growth outlook is stellar. MYR Group is set to ride the massive energy and electrification infrastructure spending boom that’s just kicking off due to soaring AI energy demand and decades of underspending on critical energy infrastructure.

Image Source: Zacks Investment Research

MYRG’s Transmission and Distribution segment focuses on electric transmission lines, distribution networks, substations, clean energy projects, EV charging infrastructure, and much more for utilities and developers.

MYR Group’s Commercial and Industrial unit provides electrical wiring, maintenance, and repair services for a diverse range of facilities, including airports, hospitals, AI data centers, industrial plants, as well as clean energy infrastructure.

Image Source: Zacks Investment Research

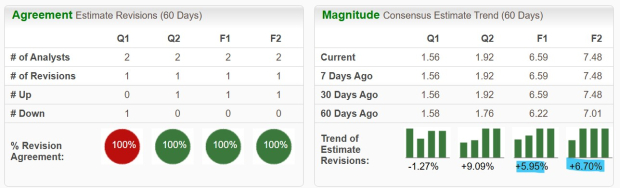

MYR Group went on a massive run between 2017 and 2023, before facing short-term setbacks in 2024, driven by project delays, cost overruns in clean energy contracts, and more. MYRG’s beat-and-raise first quarter helps it earn a Zacks Rank #1 (Strong Buy).

Its backlog jumped 8% YoY in Q1 to $2.43 billion. MYRG is projected to grow its revenue by 3% and 6%, respectively, in 2025 and 2026. Better yet, its earnings are expected to bounce back massively after a rough 2024 to the tune of 260% growth in 2025 and 14% next year to reach $7.48 a share, blowing away its previous 2023 record of $5.42 a share.

Image Source: Zacks Investment Research

The electric construction stock climbed 960% in the past 15 years, crushing the Utilities sector’s 45% and the S&P 500’s 480%, including a 450% surge in the past five years. MYR Group recently broke out to new all-time highs. Yet, MYRG trades at a 20% discount to its highs at 25.8X forward 12-month earnings.

AI Insights

why the success of AI depends on good data – Physics World

Copyright © 2025 by IOP Publishing Ltd and individual contributors

AI Insights

Artificial Intelligence Stocks To Follow Now – August 30th – MarketBeat

AI Insights

Detects heart disease in 15 seconds: AI-powered stethoscope developed in Britain

A team of researchers confirms the potential of a new type of stethoscope; specialists say that the new device, with the help of artificial intelligence, can save more lives. This is reported by UNN with reference to Euronews and Spiegel.

Details

Artificial intelligence is increasingly penetrating various sectors and changing what previously seemed untouchable. A classic situation, unshakable for many decades during a patient’s visit to the doctor: the doctor holds a stethoscope to the patient’s chest and listens, among other things, to the heartbeat.

For reference

The hearing aid, invented in 1816 by the French physician René Laennec, has been a symbol of medicine for centuries. Always around the neck, this “simple” instrument has accompanied generations of doctors, performing the indispensable mission of examining the heart and lungs.

With the help of an AI-stethoscope, everything is probably better now… Or faster

According to new data, researchers from the United Kingdom have developed an artificial intelligence (AI)-based stethoscope. The new device, according to scientists, can detect three heart diseases in just 15 seconds.

Note:

- smart stethoscopes (which transmit body sounds to software) are relatively new;

- researchers are now exploring the potential of such devices.

And now a wonderful new update has been announced, which, by the way, was recently presented at the annual congress of the European Society of Cardiology in Madrid.

How the examination was conducted using the new technology

The study was conducted by Imperial College London and Imperial College Healthcare NHS Trust.

The goal is to confirm that innovative stethoscopes can detect heart failure, heart valve disease, and cardiac arrhythmias significantly better than traditional methods.

For the study, over 12,000 patients from 96 medical facilities were examined using AI stethoscopes from the American company Eko Health. Their data was then compared with data from patients from 109 medical facilities where this technology was not used.

“Doctor in your pocket”: UK launches AI-powered medical chatbot25.06.25, 21:14 • 3852 views

According to the study, people with heart failure were 2.33 times more likely to be diagnosed with the disease within the next twelve months than those in the control group.

- atrial fibrillation, which can increase the risk of stroke, was detected in the AI-assisted group even 3.5 times more often;

- heart valve diseases were detected 1.9 times more often within twelve months.

Comment

Our study shows that it is now possible to detect three heart diseases in one session

Addition

The possibility of an undesirable effect in unfortunate circumstances cannot be ruled out.

Healthy people, for example, may be mistakenly diagnosed with heart problems.

Researchers emphasize:

The AI-based stethoscope should not be used for routine examinations, but only for patients who already have a suspected heart condition.

Recall

Researchers at Cambridge University have found that common aspirin can enhance the immune system’s ability to fight cancer spread.

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi