AI Research

3 Reasons to Hold AMZN Stock as AWS & AI Drive 31% Growth in 3 Months

AmazonAMZN has demonstrated remarkable resilience and growth potential, surging 30.9% over the past three months, outperforming the broader Zacks Retail-Wholesale sector and the S&P 500’s return of 21.4% and 26%, respectively.

Combined, AWS, MicrosoftMSFT Azure and AlphabetGOOGL-owned Google Cloud achieved a 63% share of total enterprise spending on cloud infrastructure services during the first quarter of 2025. AWS ranked No. 1 in market share by winning 29.1% share of the market, followed by Microsoft’s 40.7% and Google’s 24.1%. China’s largest and most dominant cloud company, Alibaba BABA, achieved 9.4% global cloud market share.

Investors have recognized the transformative power of Amazon’s cloud computing and artificial intelligence (AI) initiatives in driving future growth.

3-Month Performance

Image Source: Zacks Investment Research

AWS Revenue Growth Maintains Strong Momentum

AWS continues to serve as the company’s primary profit engine, generating $29.3 billion in first-quarter revenues with impressive 16.9% year-over-year growth. This performance translates to an annualized run rate of $117 billion, cementing AWS’ position as the dominant force in enterprise cloud computing. The segment’s operating margins expanded to 39.5%, demonstrating exceptional scalability and pricing power as organizations accelerate their digital transformation initiatives.

AWS also maintains a substantial backlog of $189 billion with a 4.1-year weighted average life, providing unprecedented revenue visibility and supporting long-term growth projections. This committed pipeline reflects enterprise customers’ confidence in AWS’ capabilities and suggests sustained demand for cloud services throughout 2025 and beyond. Recent customer acquisitions spanning diverse industries, including Adobe, Uber, and Nasdaq, demonstrate AWS’ ability to capture market share across various sectors while expanding its total addressable market.

Management has indicated that supply constraints currently limit AWS’ ability to capture additional AI-driven demand, suggesting that faster capacity deployment could drive even higher revenue growth rates. This bottleneck represents both a near-term challenge and a significant opportunity, as infrastructure expansion throughout 2025 could unlock accelerated performance in subsequent quarters.

AI Innovation Positions Amazon for Future Dominance

Amazon’s AI business has achieved a multi-billion-dollar annual run rate with triple-digit growth rates, positioning Amazon advantageously in the generative AI transformation sweeping through enterprise technology.

Recent AWS developments demonstrate the company’s commitment to AI leadership. The introduction of Amazon Nova Canvas with AI-powered image generation capabilities, the availability of Anthropic Claude 4 models, including Opus 4 and Sonnet 4 through Amazon Bedrock, and the launch of DeepSeek-R1 models showcase Amazon’s ability to integrate cutting-edge AI technologies into its platform. These innovations provide customers with comprehensive AI solutions while creating additional revenue streams for Amazon.

Project Rainier represents Amazon’s ambitious infrastructure investment in AI compute capabilities, designed to train next-generation AI models through powerful Trainium2 chip clusters. This initiative demonstrates Amazon’s willingness to invest heavily in foundational AI infrastructure, potentially creating significant barriers to entry for competitors while establishing AWS as the preferred platform for AI workload deployment.

The enhanced Amazon Q Developer experience, now featuring cost optimization capabilities and Claude Sonnet 4 integration within the CLI, illustrates how Amazon leverages AI to improve customer productivity while driving platform adoption. These developments suggest that AI will continue serving as both a direct revenue generator and a catalyst for broader AWS growth.

Strong Financial Performance Supports Investment Thesis

Amazon’s first-quarter financial results demonstrate the company’s operational efficiency and margin expansion capabilities. Net income increased 64.4% year over year to $17.1 billion, while operating income rose 20.2% to $18.4 billion, representing 11.8% of revenues compared to 10.7% in the prior year. This margin expansion across a $155.7 billion revenue base reflects management’s ability to scale operations effectively while maintaining growth momentum.

The company’s balance sheet remains robust with $66.2 billion in cash and equivalents, providing substantial financial flexibility for continued AI infrastructure investments and strategic initiatives. Operating cash flow of $113.9 billion for the trailing 12 months, despite a decline in free cash flow to $25.9 billion, reflects the capital-intensive nature of Amazon’s current growth investments.

The Zacks Consensus Estimate for 2025 net sales is pegged at $694.49 billion, indicating growth of 8.86% from the prior-year reported figure. The Zacks Consensus Estimate for 2025 earnings is pegged at $6.22 per share, which indicates a jump of 0.5% from the year-ago period.

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

However, new investors should exercise patience given Amazon’s forward 12-month price-to-sales ratio of 3.25X, significantly above the Zacks Internet – Commerce industry average of 2.17X. This valuation premium suggests the stock may be fully valued at current levels, warranting a more strategic entry point during potential market corrections or company-specific volatility.

AMZN’s P/S F12M Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

Investment Recommendation

Current Amazon shareholders should maintain their positions as AWS and AI initiatives drive fundamental business transformation. The combination of sustained cloud growth, expanding AI capabilities, and improving operational efficiency supports the stock’s recent 30.9% appreciation while indicating continued upside potential throughout 2025. AMZN currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

AI Research

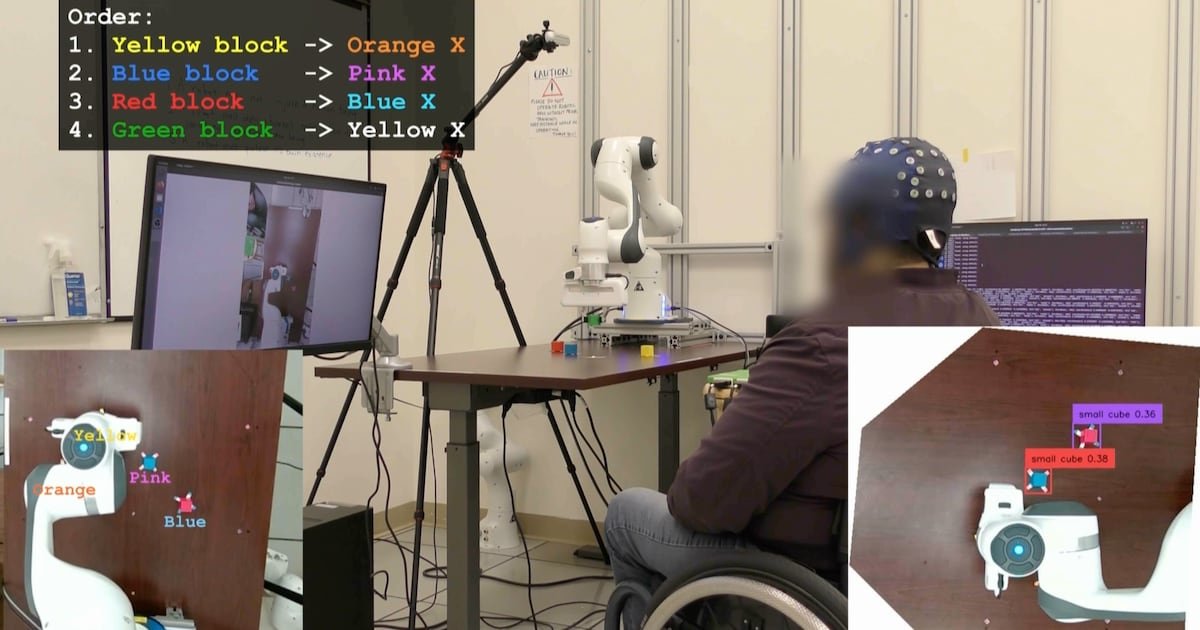

UCLA Researchers Enable Paralyzed Patients to Control Robots with Thoughts Using AI – CHOSUNBIZ – Chosun Biz

AI Research

Hackers exploit hidden prompts in AI images, researchers warn

Cybersecurity firm Trail of Bits has revealed a technique that embeds malicious prompts into images processed by large language models (LLMs). The method exploits how AI platforms compress and downscale images for efficiency. While the original files appear harmless, the resizing process introduces visual artifacts that expose concealed instructions, which the model interprets as legitimate user input.

In tests, the researchers demonstrated that such manipulated images could direct AI systems to perform unauthorized actions. One example showed Google Calendar data being siphoned to an external email address without the user’s knowledge. Platforms affected in the trials included Google’s Gemini CLI, Vertex AI Studio, Google Assistant on Android, and Gemini’s web interface.

Read More: Meta curbs AI flirty chats, self-harm talk with teens

The approach builds on earlier academic work from TU Braunschweig in Germany, which identified image scaling as a potential attack surface in machine learning. Trail of Bits expanded on this research, creating “Anamorpher,” an open-source tool that generates malicious images using interpolation techniques such as nearest neighbor, bilinear, and bicubic resampling.

From the user’s perspective, nothing unusual occurs when such an image is uploaded. Yet behind the scenes, the AI system executes hidden commands alongside normal prompts, raising serious concerns about data security and identity theft. Because multimodal models often integrate with calendars, messaging, and workflow tools, the risks extend into sensitive personal and professional domains.

Also Read: Nvidia CEO Jensen Huang says AI boom far from over

Traditional defenses such as firewalls cannot easily detect this type of manipulation. The researchers recommend a combination of layered security, previewing downscaled images, restricting input dimensions, and requiring explicit confirmation for sensitive operations.

“The strongest defense is to implement secure design patterns and systematic safeguards that limit prompt injection, including multimodal attacks,” the Trail of Bits team concluded.

AI Research

When AI Freezes Over | Psychology Today

A phrase I’ve often clung to regarding artificial intelligence is one that is also cloaked in a bit of techno-mystery. And I bet you’ve heard it as part of the lexicon of technology and imagination: “emergent abilities.” It’s common to hear that large language models (LLMs) have these curious “emergent” behaviors that are often coupled with linguistic partners like scaling and complexity. And yes, I’m guilty too.

In AI research, this phrase first took off after a 2022 paper that described how abilities seem to appear suddenly as models scale and tasks that a small model fails at completely, a larger model suddenly handles with ease. One day a model can’t solve math problems, the next day it can. It’s an irresistible story as machines have their own little Archimedean “eureka!” moments. It’s almost as if “intelligence” has suddenly switched on.

But I’m not buying into the sensation, at least not yet. A newer 2025 study suggests we should be more careful. Instead of magical leaps, what we’re seeing looks a lot more like the physics of phase changes.

Ice, Water, and Math

Think about water. At one temperature it’s liquid, at another it’s ice. The molecules don’t become something new—they’re always two hydrogens and an oxygen—but the way they organize shifts dramatically. At the freezing point, hydrogen bonds “loosely set” into a lattice, driven by those fleeting electrical charges on the hydrogen atoms. The result is ice, the same ingredients reorganized into a solid that’s curiously less dense than liquid water. And, yes, there’s even a touch of magic in the science as ice floats. But that magic melts when you learn about Van der Waals forces.

The same kind of shift shows up in LLMs and is often mislabeled as “emergence.” In small models, the easiest strategy is positional, where computation leans on word order and simple statistical shortcuts. It’s an easy trick that works just enough to reduce error. But scale things up by using more parameters and data, and the system reorganizes. The 2025 study by Cui shows that, at a critical threshold, the model shifts into semantic mode and relies on the geometry of meaning in its high-dimensional vector space. It isn’t magic, it’s optimization. Just as water molecules align into a lattice, the model settles into a more stable solution in its mathematical landscape.

The Mirage of “Emergence”

That 2022 paper called these shifts emergent abilities. And yes, tasks like arithmetic or multi-step reasoning can look as though they “switch on.” But the model hasn’t suddenly “understood” arithmetic. What’s happening is that semantic generalization finally outperforms positional shortcuts once scale crosses a threshold. Yes, it’s a mouthful. But happening here is the computational process that is shifting from a simple “word position” in a prompt (like, the cat in the _____) to a complex, hyperdimensional matrix where semantic associations across thousands of dimensions create amazing strength to the computation.

And those sudden jumps? They’re often illusions. On simple pass/fail tests, a model can look stuck at zero until it finally tips over the line and then it seems to leap forward. In reality, it was improving step by step all along. The so-called “light-bulb moment” is really just a quirk of how we measure progress. No emergence, just math.

Why “Emergence” Is So Seductive

Why does the language of “emergence” stick? Because it borrows from biology and philosophy. Life “emerges” from chemistry as consciousness “emerges” from neurons. It makes LLMs sound like they’re undergoing cognitive leaps. Some argue emergence is a hallmark of complex systems, and there’s truth to that. So, to a degree, it does capture the idea of surprising shifts.

But we need to be careful. What’s happening here is still math, not mind. Calling it emergence risks sliding into anthropomorphism, where sudden performance shifts are mistaken for genuine understanding. And it happens all the time.

A Useful Imitation

The 2022 paper gave us the language of “emergence.” The 2025 paper shows that what looks like emergence is really closer to a high-complexity phase change. It’s the same math and the same machinery. At small scales, positional tricks (word sequence) dominate. At large scales, semantic structures (multidimensional linguistic analysis) win out.

No insight, no spark of consciousness. It’s just a system reorganizing under new constraints. And this supports my larger thesis: What we’re witnessing isn’t intelligence at all, but anti-intelligence, a powerful, useful imitation that mimics the surface of cognition without the interior substance that only a human mind offers.

Artificial Intelligence Essential Reads

So the next time you hear about an LLM with “emergent ability,” don’t imagine Archimedes leaping from his bath. Picture water freezing. The same molecules, new structure. The same math, new mode. What looks like insight is just another phase of anti-intelligence that is complex, fascinating, even beautiful in its way, but not to be mistaken for a mind.

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies