AI Insights

2 Artificial Intelligence (AI) Stocks That Could Soar in the Second Half of 2025

The first half of 2025 is officially in the books, and despite the S&P 500 (^GSPC 0.83%) logging a gain of around 5% for the period, it certainly wasn’t smooth sailing for investors. The index was sitting on a year-to-date loss of 15% at its low point in April, after President Donald Trump announced plans to impose tariffs on imported goods from all of America’s trading partners.

Even though the broader market has recovered, some growth stocks like SentinelOne (S 1.74%) and Alphabet (GOOG 0.51%) (GOOGL 0.54%) are still trading in the red for the year. However, a rebound might be in the cards for those two names during the second half of 2025, given the strength of their underlying businesses and their leadership positions in areas like artificial intelligence (AI).

Here’s why SentinelOne and Alphabet might be two great stocks to own in the final six months of this year.

Image source: Getty Images.

The case for SentinelOne

SentinelOne developed an AI-powered cybersecurity platform called Singularity, which offers comprehensive protection for cloud networks, employee identities, endpoints (computers and devices), and more. It autonomously tracks and eliminates threats, and it can even produce detailed summaries of each incident to save human managers from completing hours of manual investigative work.

Purple AI is SentinelOne’s AI-powered virtual assistant that is embedded in Singularity to help employees speed up cybersecurity workflows. But in April, the company launched a new version called Purple AI Athena with expanded capabilities. It’s an AI agent designed to think and reason like a highly experienced human, but at machine speed so it’s far more effective. It learns from security incidents and helps managers set up automated workflows that allow it to remediate similar events in the future.

SentinelOne generated $229 million in total revenue during its fiscal 2026 first quarter (ended April 30). It was a 23% increase from the year-ago period, which was a solid growth rate at face value, except it represented a deceleration from the 29% growth the company delivered in the previous quarter three months earlier. Plus, management actually reduced its full-year forecast for fiscal 2026 by around 1%, to $998.5 million (at the midpoint of the guidance range).

Management cited macroeconomic uncertainties for the downward revision, even though SentinelOne isn’t directly affected by the recent global trade turmoil because it sells digital software products, and penalties like tariffs primarily affect physical imports. However, its customers come from many different industries and if their businesses suffer a slowdown, they might cut their cybersecurity spending.

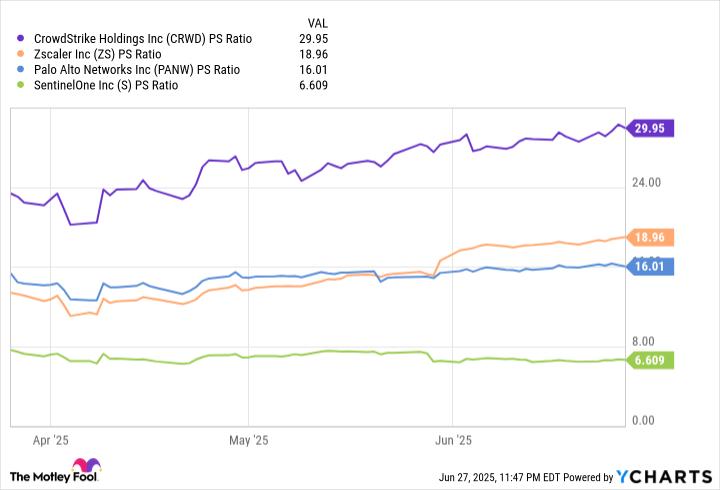

Fortunately, the majority of Trump’s most aggressive tariffs were rolled back after April, so this might be less of a concern for SentinelOne in the coming quarters. That presents investors with an interesting opportunity, because its stock is still down by 20% this year. Moreover, it’s significantly cheaper than its rivals in the AI-powered cybersecurity space, based on its price-to-sales (P/S) ratio of 6.6:

CRWD PS Ratio data by YCharts

As a result, I think the setup looks great for a potential rebound in SentinelOne stock in the second half of 2025.

The case for Alphabet (Google)

Alphabet is the parent company of Google, YouTube, DeepMind, and self-driving car powerhouse Waymo. The majority of the conglomerate’s revenue comes from the advertising dollars generated by Google Search, but this valuable income stream remains under threat by the growing adoption of AI chatbots, which are stealing traffic from traditional internet search engines.

To combat this, Alphabet launched AI Overviews, which appear above the traditional Google Search results. They combine text, images, and links to third-party sources to answer users’ queries, saving them from having to sift through web pages to find the information they need. Alphabet is hoping this creates enough convenience to stop people from abandoning Google Search, and it seems to be working as planned because at the end of the first quarter of 2025, the company said 1.5 billion people were using Overviews every month.

But Alphabet also used its Gemini family of large language models (LLMs) to launch its own AI chatbot of the same name, so it’s competing with the likes of OpenAI for the attention of users who prefer these tools over traditional search engines. Plus, Alphabet has embedded Gemini into Google Workspace applications like Docs, Sheets, and Gmail, which should prevent users from venturing outside its ecosystem in the hunt for information.

Finally, Google Cloud deserves a special mention because it’s regularly the fastest growing piece of the entire Alphabet conglomerate. Google Cloud operates state-of-the-art data centers filled with AI chips from leading suppliers like Nvidia, and leases the computing capacity to businesses for profit. Plus, its Vertex AI platform offers developers access to more than 200 foundation models (like Gemini) which they can use to accelerate their AI software projects.

Alphabet generated $90.2 billion in total revenue in the first quarter of 2025, which was up 12% from the year-ago period. That included $50.7 billion in Google Search revenue, which grew by 10%, and $12.2 billion in Google Cloud revenue, which was up 28%. The company also delivered $2.81 in earnings per share (EPS), which takes its trailing-12-month EPS to $8.97.

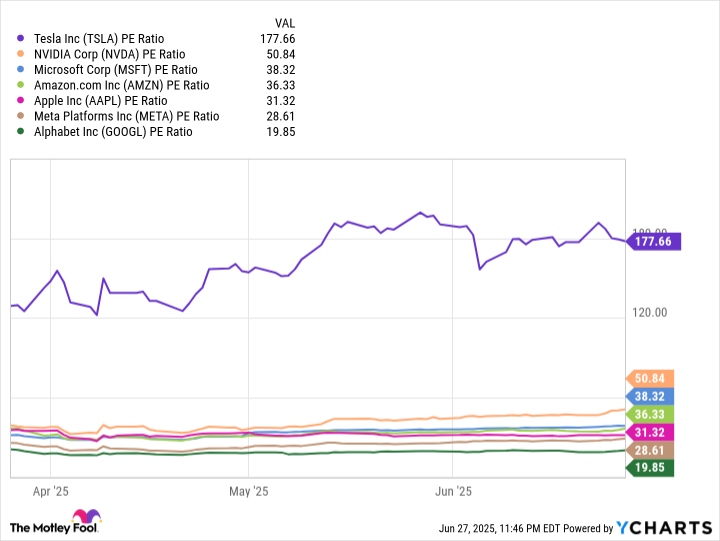

Based on that trailing EPS figure, Alphabet stock is trading at a price-to-earnings (P/E) ratio of just 19.8 as of this writing (June 28), which makes it the cheapest member of an elite group known as the “Magnificent Seven.” These seven companies are at the cutting edge of most segments of the tech industry, including AI:

Alphabet stock is trading at a discount right now because of its ongoing legal battle with the Department of Justice (DOJ), which won a verdict that the conglomerate engages in monopolistic practices. Investors are waiting for the judge to hand down a formal punishment, but the case could be tied up in court for several more years while the appeals process plays out.

However, AI could be the biggest opportunity in Alphabet’s history, so services like Google Cloud and Gemini could be more important to the company’s financial success from here than legacy businesses like Google Search (which is the subject of its legal woes). I think Alphabet’s attractive valuation sets the stage for a strong second half of 2025, as investors turn more of their attention to the success of its AI products and services.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, CrowdStrike, Meta Platforms, Microsoft, Nvidia, Tesla, and Zscaler. The Motley Fool recommends Palo Alto Networks and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AI Insights

General Counsel’s Job Changing as More Companies Adopt AI

The general counsel’s role is evolving to include more conversations around policy and business direction, as more companies deploy artificial intelligence, panelists at a University of California Berkeley conference said Thursday.

“We are not just lawyers anymore. We are driving a lot of the policy conversations, the business conversations, because of the geopolitical issues going on and because of the regulatory, or lack thereof, framework for products and services,” said Lauren Lennon, general counsel at Scale AI, a company that uses data to train AI systems.

Scattered regulation and fraying international alliances are also redefining the general counsel’s job, panelists …

AI Insights

AI a 'Game Changer' for Assistance, Q&As in NJ Classrooms – GovTech

AI Insights

Analysis on expected use of artificial intelligence by businesses in Canada, third quarter of 2025

As artificial intelligence (AI) continues to expand its role in business operations across Canada, questions about its future use and influence have gained attention. What was once considered an emerging technology limited to select sectors is now being increasingly integrated into a range of industries. According to data from the Canadian Survey on Business Conditions, in the second quarter of 2025, 12.2%Note of businesses reported using AI to produce goods or deliver services over the last 12 months, up from 6.1%Note in the same period a year earlier.

This article presents data on how businesses in Canada expect to use AI over the next 12 months for producing goods and delivering services. While both the second quarters of 2024 and 2025 focused on AI use over that previous year, the current release revisits forward looking questions, first introduced in the third quarter of 2024. It explores the types of AI applications businesses intend to adopt, anticipated impacts on employment and operations, and reasons businesses provided for not planning to use AI.

The Canadian Survey on Business Conditions was conducted between July 2 and August 6, 2025, to collect information on the environment businesses are currently operating in and their expectations moving forward, including expectations for AI use in the year ahead.Note The proportion of businesses planning to adopt AI over the next 12 months has grown since last year’s third quarter, with 14.5% of businesses now reporting plans to use the technology, up from the 10.6%Note in the third quarter of 2024. This reflects a gradual increase for interest in AI’s long-term potential to reshape operations.

Most businesses still do not plan to use artificial intelligence in the next 12 months

While growth has been observed, adoption of AI among businesses in Canada remains limited. In the third quarter of 2025, 14.5% of businesses reported plans to use AI over the next 12 months, while two-thirds (66.7%) of businesses reported no plans and 18.9% were uncertain. These findings are consistent with results from the third quarter of 2024, where 71.8% of businesses reported no plans to implement AI in their operations.

Among businesses not planning to adopt AI over the next 12 months, 78.1% reported that AI was not relevant to the goods or services they currently provide. Other reported reasons included a lack of knowledge about AI capabilities (11.3%), concerns about privacy and security (8.1%), and the view that AI is not yet a mature enough technology (7.6%). These findings are similar to those from the third quarter of 2024, when 74.2% of businesses reported lack of relevance as the main reason, followed by a lack of knowledge on AI capabilities (9.3%).

| Third quarter of 2025 | Third quarter of 2024 | |

|---|---|---|

| percent of businesses | ||

| Notes: The results in this table are based on the survey that was in collection from July 2 to August 6 2025 and from July 2 to August 6, 2024, and respondents were asked what their expectations would be over the next 12-month period. As a result, those 12 months could range from July 2 to August 6 2025 and from July 2 to August 6, 2024, depending on when the business responded. Source: Canadian Survey on Business Conditions, third quarter of 2025 (Table 33-10-1046-01) and third quarter of 2024 (Table 33-10-0879-01). |

||

| Lack of knowledge on the capabilities of AI | 11.3 | 9.3 |

| Concerns about privacy or security | 8.1 | 6.8 |

| AI is not a mature enough technology yet | 7.6 | 8.8 |

| Too expensive | 4.7 | 6.1 |

| Lack of skilled workforce | 4.6 | 2.3 |

| Concerns about bias | 3.2 | 1.7 |

| Lack of required data | 3.0 | 1.6 |

| Laws and regulations prevent or restrict use of AI | 2.2 | 1.4 |

| Previous or current use of AI did not meet expectations | 1.5 | 1.0 |

| Other reason | 1.7 | 3.8 |

| AI is not relevant to the goods produced or services delivered | 78.1 | 74.2 |

Businesses in information and cultural industries continue to lead in expected artificial intelligence adoption

Of the businesses planning to use AI over the next year (14.5%), those in information and cultural industries were most likely to report this, at 38.6%. This was followed by businesses in finance and insurance (31.5%), and professional, scientific and technical services (26.3%). These findings are similar with results from the third quarter of 2024, when businesses in information and culture industries (29.7%) were also the most likely to report plans to use AI in that coming year.

These forward-looking expectations by industry align with past reported AI use. In the second quarter of 2025, 35.6% of businesses in information and cultural industries reported having used AI in the previous year, followed by 31.7% in professional, scientific and technical services and 30.6% in finance and insurance. Businesses in these industries also reported the highest usage rates in the second quarter of 2024, at 20.9% for information and cultural industries, 13.7% for professional, scientific and technical services and 10.9% for finance and insurance.

Between the third quarter of 2024 and the third quarter of 2025, expected AI usage varied by industry. Businesses in finance and insurance had the largest increase in expected AI usage, growing from 17.9% to 31.5% between the third quarter of 2024 and third quarter of 2025. The proportion of businesses in health care and social assistance expecting to use AI also grew from 11.4% to 23.2% over the same period. In contrast, manufacturing experienced the largest decline, falling from 13.1% in third quarter of 2024 to 7.2% in third quarter of 2025.

| Third quarter of 2025 | Third quarter of 2024 | |

|---|---|---|

| percent of businesses | ||

| Notes: The results in this table are based on the survey that was in collection from July 2 to August 6 2025 and from July 2 to August 6, 2024, and respondents were asked what their expectations would be over the next 12-month period. As a result, those 12 months could range from July 2 to August 6 2025 and from July 2 to August 6, 2024, depending on when the business responded. Source: Canadian Survey on Business Conditions, third quarter of 2025 (Table 33-10-1045-01) and third quarter of 2024 (Table 33-10-0878-01). |

||

| All businesses | 14.5 | 10.6 |

| Agriculture, forestry, fishing and hunting | 4.9 | 4.8 |

| Mining, quarrying, and oil and gas extraction | 3.4 | 4.6 |

| Construction | 9.2 | 3.2 |

| Manufacturing | 7.2 | 13.1 |

| Wholesale trade | 7.8 | 12.2 |

| Retail trade | 5.7 | 5.1 |

| Transportation and warehousing | 6.6 | 4.2 |

| Information and cultural industries | 38.6 | 29.7 |

| Finance and insurance | 31.5 | 17.9 |

| Real estate and rental and leasing | 24.4 | 13.0 |

| Professional, scientific and technical services | 26.3 | 24.6 |

| Administrative and support, waste management and remediation services | 11.6 | 12.7 |

| Health care and social assistance | 23.2 | 11.4 |

| Arts, entertainment and recreation | 15.2 | 18.5 |

| Accommodation and food services | 14.8 | 6.0 |

| Other services (except public administration) | 8.7 | 6.5 |

Virtual agents or chatbots most expected artificial intelligence application

Of the businesses planning to use AI over the next 12 months (14.5%), the most common applications reported were virtual agents or chatbots (34.8%) and data analytics (32.9%). The proportion of businesses planning to use virtual agents or chatbots increased from 18.7% in the third quarter of 2024, to 34.8% in 2025, indicating an increase in customer facing applications. Other reported applications included text analytics (28.5%), marketing automation (25.6%) and natural language processing (20.9%).

| Third quarter of 2025 | Third quarter of 2024 | |

|---|---|---|

| percent of businesses | ||

| Notes: The results in this table are based on the survey that was in collection from July 2 to August 6 2025 and from July 2 to August 6, 2024, and respondents were asked what their expectations would be over the next 12-month period. As a result, those 12 months could range from July 2 to August 6 2025 and from July 2 to August 6, 2024, depending on when the business responded. Source: Canadian Survey on Business Conditions, third quarter of 2025 (Table 33-10-1045-01) and third quarter of 2024 (Table 33-10-0878-01). |

||

| AI use planned in producing goods or delivering services | 14.5 | 10.6 |

| Virtual agents or chatbots | 34.8 | 18.7 |

| Data analytics using AI | 32.9 | 26.7 |

| Text analytics using AI | 28.5 | 27.2 |

| Marketing automation using AI | 25.6 | 19.4 |

| Natural language processing | 20.9 | 15.4 |

| Speech or voice recognition using AI | 20.2 | 11.9 |

| Large language models | 19.9 | 9.3 |

| Machine learning | 18.4 | 18.8 |

| Recommendation systems using AI | 14.0 | 11.7 |

| Decision making systems based on AI | 13.1 | 6.3 |

| Deep learning | 8.9 | 5.3 |

| Image or pattern recognition | 7.6 | 7.5 |

| Machine or computer vision | 3.2 | 3.2 |

| Robotics process automation | 3.2 | 6.2 |

| Neural networks | 2.2 | 2.6 |

| Augmented reality | 2.0 | 1.3 |

| Biometrics | 1.6 | 1.9 |

| Other | 7.3 | 6.2 |

Among businesses in information and cultural industries who plan to use AI over the next year (38.6%), the most common intended uses are virtual agents or chatbots (51.2%), followed by text analytics (49.9%) and large language models (48.1%). Meanwhile, among businesses in finance and insurance planning to use AI (31.5%), the most common expected use is data analytics (57.3%), followed by virtual agents or chatbots (35.1%). Of the businesses in professional, scientific and technical services planning to use AI (26.3%), nearly half (45.3%) reported plans to use data analytics, followed by 39.9% planning to use large language models.

Plans to adopt artificial intelligence over the next 12 months vary by business size

While 14.5% of all businesses plan to use AI over the next 12 months to produce goods or deliver services, those with 100 or more employees were more likely to report such plans (20.5%), compared with 15.0% of businesses with 20 to 99 employees, 14.4% of businesses with 5 to 19 employees and 14.2% of those with 1 to 4 employees.

While adoption rates of AI varied by business size, the intended applications presented similar characteristics. Among larger businesses with 100 or more employees that plan to use AI in producing goods or delivering services over the next year, nearly half (48.0%) plan to use AI for data analytics, followed by text analytics (32.0%) and virtual agents or chatbots (20.7%). Similarly, among smaller businesses with 1 to 4 employees that plan to use AI, nearly one-third (31.8%) reported plans to use data analytics, followed by virtual agents or chatbots (29.8%), and text analytics (29.4%).

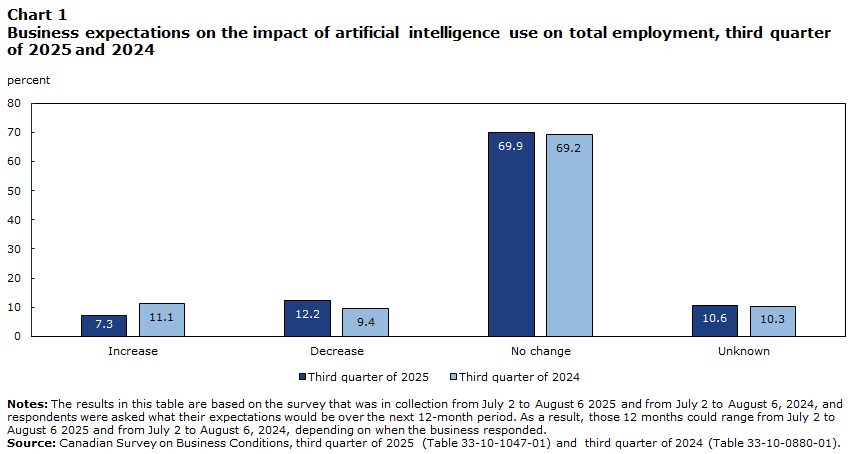

Most businesses still expect no change to employment levels after artificial intelligence adoption

Businesses in Canada continue to report limited expectations of employment change resulting from AI adoption. In the third quarter of 2025, among businesses planning to implement AI over the next 12 months (14.5%), 69.9% expected no change in employment levels. This is consistent with the third quarter of 2024, where 69.2% of the businesses planning to adopt AI that coming year (10.6%) reported they expected no employment changes.

At the same time, the proportion of businesses expecting employment decreases rose from 9.4% in the second quarter of 2024, to 12.2% in the second quarter of 2025. Meanwhile, businesses expecting employment gains went down from 11.1% to 7.3% over the same period.

Data table for Chart 1

| Increase | Decrease | No change | Unknown | |

|---|---|---|---|---|

| percent | ||||

| Notes: The results in this table are based on the survey that was in collection from July 2 to August 6 2025 and from July 2 to August 6, 2024, and respondents were asked what their expectations would be over the next 12-month period. As a result, those 12 months could range from July 2 to August 6 2025 and from July 2 to August 6, 2024, depending on when the business responded. Source: Canadian Survey on Business Conditions, third quarter of 2025 (Table 33-10-1047-01) and third quarter of 2024 (Table 33-10-0880-01). |

||||

| Third quarter of 2025 | 7.3 | 12.2 | 69.9 | 10.6 |

| Third quarter of 2024 | 11.1 | 9.4 | 69.2 | 10.3 |

These employment expectations correspond to the experiences of businesses already using AI to produce goods or deliver services. Of the businesses using AI in the second quarter of 2025 (12.2%), a vast majority (89.4%) reported no change in their employment levels, while 6.3% reported a decrease and 4.3% reported an increase. Similar results were observed in the second quarter of 2024, when 84.9% of the businesses using AI over the previous 12 months reported no change to their employment, while 6.3% reported a decrease and 8.8% reported an increase.

Training staff remains the most common operational response to artificial intelligence

Among businesses planning to use AI over the next 12 months to produce goods or deliver services (14.5%), the most anticipated operational change is training existing employees to use AI. About half (49.8%) of businesses reported plans to provide staff with AI training once new systems are implemented. This is consistent with third quarter of 2024 results, where among businesses who planned to use AI over that year (10.6%), nearly half (48.7%) reported plans to provide staff with AI training after implementation.

Other expected changes by businesses after AI adoption in the third quarter of 2025 include the development of new workflows (41.9%), purchasing cloud services or storage (27.0%) and changing data collection or data management practices (25.6%).

These results align with the operational changes already put in place by businesses currently using AI. Among businesses using AI in the second quarter of 2025 (12.2%), the most reported operational changes in the previous 12 months were developing new workflows (40.1%), training current staff to use AI (38.9%) and purchasing cloud services or storage (25.7%).

Meanwhile, hiring new staff trained in AI remained relatively uncommon for businesses after adopting AI. It was the least reported change expected in the third quarter of 2025, at 12.6%, up from 10.2% in the third quarter of 2024. Furthermore, purchasing computing power or specialized equipment was also less common, reported by 14.2% of businesses in third quarter of 2025, down from 18.6% in third quarter of 2024.

| Third quarter of 2025 | Third quarter of 2024 | |

|---|---|---|

| percent of businesses | ||

| Notes: The results in this table are based on the survey that was in collection from July 2 to August 6 2025 and from July 2 to August 6, 2024, and respondents were asked what their expectations would be over the next 12-month period. As a result, those 12 months could range from July 2 to August 6 2025 and from July 2 to August 6, 2024, depending on when the business responded. Source: Canadian Survey on Business Conditions, third quarter of 2025 (Table 33-10-1048-01) and third quarter of 2024 (Table 33-10-0881-01). |

||

| Train current staff to use AI | 49.8 | 48.7 |

| Develop new workflows | 41.9 | 43.7 |

| Purchase cloud services or cloud storage | 27.0 | 25.2 |

| Change data collection or data management practices | 25.6 | 17.6 |

| Use vendors or consulting services to install or integrate AI | 16.0 | 16.2 |

| Purchase computing power or specialized equipment | 14.2 | 18.6 |

| Hire staff trained in AI | 12.6 | 10.2 |

| Other change | 0.2 | 1.0 |

| Unknown | 14.0 | 16.1 |

| None | 12.3 | 9.3 |

Methodology

From July 2 to August 6, 2025, representatives from businesses across Canada were invited to complete an online questionnaire about business conditions and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector and size. Proportions are estimated using survey weights ensuring that the survey results are representative of all employer businesses in Canada. The total sample size for this iteration of the survey was 21,406, and results are based on responses from a total of 9,494 businesses or organizations.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi